Well Health Technologies ($WELL.TO) FINS Review

2024 Q4 and Annual Filings (3 / 5 stars - unchanged)

A two a.m. financials drop under the cover of darkness does not typically go well but that is what we have today with Well Health dropping their annuals while most of us slept.

After announcing that their financials would be delayed due to an issue with Circle Medical (CM), it was a bit of a pleasant surprise to see the company announce they were going to announce a date for their release just eleven days later. Many, including myself likely assumed that the issue with their subsidiary was resolved. Apparently that isn’t the case, and issues extended beyond just the CM news as a $81M negative impact to revenue also includes $24.5M related to the earlier cyberattack on their payment vendor. While Well Health believes they will capture the CM revenue in their 2025 revenue numbers, the $25M may not be recoverable.

I’ve lost count of the number of reviews I have completed for Well, but the latest couple have not been my most positive receiving three stars. I also exited my position in the summer.

Of course that meant missing that incredible run up at the end of the year into early January. But with the stock down 45% since those highs in early January the HODL strategy certainly hasn’t worked out for that crowd.

Some may think I have a love-hate relationship with the company, but I would argue it’s more of a love-disappointment one. While the company has executed their acquisition strategy quite solidly to grow the top line, they have shown very little ability to take any of that top line growth to the bottom line. At the same time management has been rewarded handsomely including some significant SBC and as of my last writing still owed the company several millions of dollars.

With the new Healwell AI ownership, and other potential plans to sell off other parts of the company, the stock now becomes a much more complex one to evaluate and determine a fair value. I think the recent share price action since the beginning of the year proves that out. If you want to see what I had to say about them after their Q3, click below.

Balance Sheet:

We begin with a continually weakening current ratio, now down to 1.07 and that is with deferred revenue removed from their current liabilities. That includes a strong cash position of $131.7M, $184.5M worth of receivables and an additional $30M of other short term assets against over $322M in liabilities due over the course of the next twelve months.

The A/R is a bit of a complex mess to put it mildly. The overall amount is down by $32M from Q3, all related to a drop in A/R relating to the issues with CRH. What I find interesting is the Advances payable related to the problem rose by $22M. According to the financial notes from Q3 these advances were to be paid back upon receipt of those receivables. With that spread between those advances growing from approximately $12M to about $65M over those three months, one would expect that to negatively impact future cash flows, and in theory artificially inflate the cash flow numbers we’re looking at today. Note, $35.6M of those advances were paid post financials.

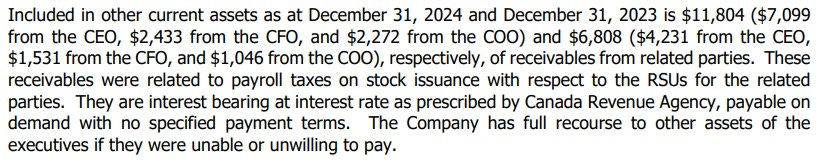

Amounts owing to the company from the C suite from payroll taxes grew from $6.6M to $11.8M in 2025. Interesting verbiage in the last sentence which is new to the financials notes.

Well Health has a little more than $300M in long term debt which includes $16M of deferred acquisition costs. The remaining amounts are primarily split between facilities with JP Morgan and RBC. In total these amounts are $5.4M lower than at the end of 2023.

Cash Flow:

Big dip in operational cash flow (OCF) YoY to just $9.5M in 2024 compared to $66.4M in 2023, a drop of 86%. That all stems from burning $102M in Q4. In my previous review I mentioned that their working capital adjustments made their previous numbers look better than they did, and Q4’s burn rate was exacerbated by the net income loss due to revenue removal of Circle Medical while still having to record COGS and underlying expenses.

The company also utilized $60.2M through investing activities, the majority of which were for newly acquired companies and assets with $7.5M used to settle prior year acquisitions. During 2024 they received $165M in advances as already mentioned, paid $31.6M of debt payments not including interest charges and received $3.2M via exercise of options. Well Health also received $47.6M (gross $50.4M) through proceeds from redeemable preferred shares as part of the transactions announced in December related to WellStar. When WellStar IPO’s these preferred shares will automatically convert to subordinate voting shares of the newly formed company. The initial planned date of the IPO occurring in 2025 appears to be pushed into 2026 per the company’s recent comments. Note, insiders participated for approximately $5M with the balance coming from institutional investors.

While the company touted an increase in their modified FCFA2S of 16%, their actual Free Cash Flow was -$10M for 2024. Given the delta between their advances and receivables due from Circle Medical has grown, I would expect Q1’s cash flow could be impacted negatively as well.

During 2024 the company’s cash position just about tripled from $43.4M to $131.7M. But when you consider Well Health received $65M more in advances than receivables and another $47M for a future spin-out, I’m not sure how much of a success story that really is.

Share Capital:

249.1M shares outstanding, 3.2% dilution during the year with about half coming from RSU/PSU awards and the balance between deferred acquisition costs and stock options exercised.

365k options remaining all ITM

3.37M RSU’s (1.6M granted in 2024) and 2.46M PSU’s (800k granted) outstanding

127k shares purchased under their now cancelled NCIB

$55M of convertible debentures outstanding at scheduled conversion of $9.23/share

21% insider and 7% institutional ownership

No recent purchases in the open market, but a continuing trend of partly exercising RSU/DSU awards for cash

Income Statement:

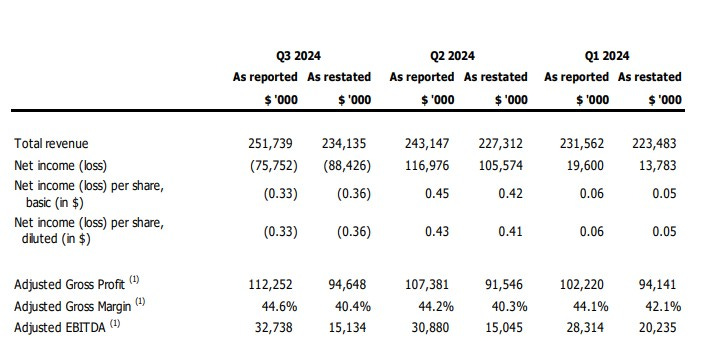

Total revenue for 2024 came in at $919.7M, 18.5% greater than 2023. Overall margin numbers look very weak due to the impacts of Circle Medical whereby all the COGS have been recognized with $56M pushed into deferred revenue. The overall margin rate YoY therefore decreased by nearly 2000 basis points from 48% in 2023 all the way down to 29.5%. I will attempt to reconcile this later on. G&A costs increased by 22% and even with $10M less in share based compensation costs, the company was into the negative on the operating income line by $30.2M compared to $35.2M of positive operating income a year ago.

The overall net income line looks better with $29.1M in 2024 compared to $16.6M in 2023. When the impact of Healwell AI ownership is removed, Well Health would have had a net income loss of $84.2M in 2024 compared to a net income loss of $27.5M in 2023.

Looking at Q4 alone is exceptionally hard to do given the revisions and the lack of information provided. The important thing to note is the $56M revision to the revenue moved to deferred occurred across all four quarters of Well’s business in 2024 and the revised numbers shown above.

Overall:

If we were generous and included all of the revenue impacts including the $23.8 from CRH which may never be recovered, Well Health would have just eclipsed the $1B mark during 2024.

If all of that revenue was included in their top line, their gross profit would have been trending where it has all year, about 400 basis points lower than 2023, and the bottom line excluding Healwell AI’s share price impact would put Well Health at pretty much at a break even business on the Net Income line.

The good news moving into 2025 is when they do recognize the revenue from CM and if things change with CRH, there will be no COGS or expenses related to that revenue so it will all be gravy to the bottom line. On the flip side that will artificially inflate margins and make it more difficult to forecast. That $56M is also only 4% of their new guidance of $1.4B.

The next 12-18 months are going to have a lot of activity. First in Q3 we will see Healwell AI’s financials included within Well Health. I believe Healwell is a bloated, cash burning overpriced pig, so I don’t see this as a positive. I reviewed them two weeks ago which you can read below. I see them as being a profitability drain on the company through 2026.

They will also spin out WellStar likely within the next four quarters. On the surface this may be the most attractive of the businesses with 80% margins. While I don’t love Adjusted EBITDA you would think 29% would translate into some pretty respectable “actual” earnings.

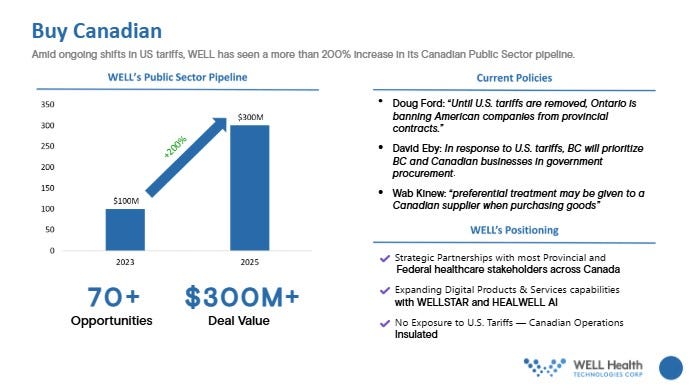

Then you have the “strategic alternatives” for Circle Medical and WISP which the company hopes to achieve a sale of those two entities. It remains to be seen just what kind of valuation these two businesses can garner. In total they are approximately a $230M in revenue, but in terms of Adjusted EBITDA are also the two worst performing segments, barely breaking even on the Adjusted EBITDA line suggesting they are very likely significant Net Income drainers. WISP for example drives decent margins but more they spend 52 cents of every revenue dollar on marketing costs. I have the sneaking suspicion based on language from leadership that they are likely overvaluing these plays, but one would expect that language on something that is for sale. If they could get a reasonable valuation for these businesses, it could free up some significant capital for acquisitions on segments of the business they want to focus on - which seems to be Canadian clinics.

My biggest overall concern with Well is the theme of significant CAGR top line but taking none of that to the bottom line. At some stage you want to see profitability growing at least as fast as revenue. That even shows up in their adjusted metrics and if there is one thing that Well Health is good at, it’s creating their own metrics to announce to the world. Interestingly I didn’t see FCFA2S metrics for 2025 which was one of my favourites.

With Healwell AI not included in the reporting until Q2, their first quarter scheduled to report in about a month’s time may be less meaningful to look at as a whole.

The company is more and more becoming a tougher company to evaluate. I will say if you liked the company projecting $1B in revenue in 2024, I don’t see how you wouldn’t like it with guidance $1.4B in 2025, as it is basically trading around the same market cap just shy of $1B. It’s trading at .7 P/S if you like that metric but has very weak profitability metrics.

Despite all of those question marks, the closer this gets to $3.72 the more I get tempted when you consider it was trading in this range 26 months ago, not to mention that 50 cent gap above $4.40. At that time it just came off delivering $570M in revenue in 2022, and stands to be a $1.4B revenue producer by the end of this year.

A lot of food for thought here, but too many question marks ahead for me to change my overall rating of 3 stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Agree with fishsmell. It's like you're reviewing multiple companies at the same time.

I,ll have to re read this a few times to get my head around it....thanks wolf, great as always