Four straight three star reviews going back to mid November of last year when I downgraded them from 3.5 stars.

I have purchased, held and sold Well twice now, but exited the most recent position while on my Scottish golf vacation after their Q2 financials dropped back in August. I’ve written much about my frustrations with the company, and while I won’t reiterate all of it, I just feel that while they have done a pretty darn good job on the acquisition phase, I haven’t seen enough progress on the profitability side of the business which hasn’t translated to increased shareholder value.

After a quick glance at their financials yesterday morning, I didn’t immediately see anything that changed my mind. Investors certainly disagreed with that as the stock soared by a little over 9% to close at $4.93 and tested the $5.03 resistance area multiple times. Did I miss something significant? Feels doubtful but anything is possible. The stock also has a pretty good history of significant volume on days financials are released and there is also a pretty good trend of a bounce, followed by a significant dip which you can clearly see in the above chart (note the earning dates with the small “E’s” at the very bottom of the chart).

What will the next few trading sessions look like, and will these financials change my opinion of a promising company who continues to fall short change at at all?

Balance Sheet:

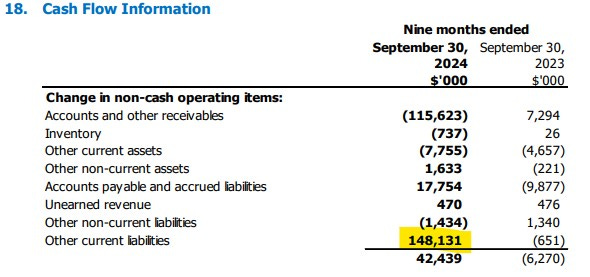

We start with a current ratio of 1.13, a little better than acceptable which consists of $66.1M in cash, $217M of receivables, $29M of prepaids and $2.7M of other short term assets against $277M in current liabilities. Unfortunately due to the ongoing issues with CRH’s payment processor, both sides of the balance sheet here are overstated with receivables and “Other Liabilities”. Since this was an issue last quarter to see it still be an issue is a bit of a surprise. There is no reason to fault Well here as far as I understand it, and the good news is they are receiving advances from the payment processor so they will not experience cash flow issues arising from it. Some good news with their cash position improving from the beginning of the year, but on the flip side their A/P and accruals have risen by a similar amount. Let’s hope this is cleared up by year end.

The company has $260.6M of debt, down just under $30M from where they began the year. The bulk of that debt, $253M isn’t due until 2027. They also have $54.6M of convertible debentures including $7.1M interest accretion from the start of the year, $13.1M of deferred acquisition commitments and $10.6M due to the tax man.

Cash Flow:

Due to the issues with CRH’s payment processor, that messiness trickles down to the cash flow statement. Through nine months the company has generated $112M of operational cash flow, more than doubling what they achieved at the same stage last year.

Included in that $112M is a $42M birdie in working capital adjustments. There are $143M in advances from the billing company which will need to be re-paid, so you would have to assume an offsetting bogey will come once this issue is resolved. So while their OCF has undoubtedly improved, I don’t think investors should bank on it trending as good as it appears here.

YTD, the company has utilized $17M in new and deferred acquisitions, paid down a net of $37M in debt excluding interest accretion and paid out $22M to non controlling interest. Overall they have improved their cash position by 51% from the start of their fiscal year.

Share Capital:

Just shy of 249M shares outstanding, with just over 4% dilution occurring in the previous twelve month primarily via RSU/PSU’s and deferred acquisitions

400k ITM options

3.5 RSU’s and 2.6M PSU’s

Future dilutive measures to come from $55M in convertible debentures and shrinking future deferred acquisition costs

21% insider ownership and 6% tutes (per Yahoo Finance)

Insiders have been allergic to purchasing in the open market but a few have sold, including the CEO, selling 1M shares at the end of June.

Despite the above, the CEO still owes the company $7.1M with the CFO and COO owing another $4.7M from payroll taxes resulting from SBC. These amounts have been outstanding for some time

I almost forgot about their NCIB, as they bought back 294k shares YTD. (insert eyeroll emoji here)

Income Statement:

Now we get into the section that I’ve had the most historical problems with, the most important - the P&L.

Due to their acquisition successes the top line has never been an issue and this quarter is no different with $251.7M in revenue in Q3, a 23% improvement to a year ago. Through nine months the company has now achieved $726M, 33% up from the prior year.

Gross margin has suffered in recent quarters and it continues in Q3 with a 150bp decrease to 44.3%. The decline in Q3 is much better than the 450bp erosion from 49.8% to 44.3%. That 44.3% is a pretty consistent number now so it looks like that stabilized number is one investors can target as a new baseline moving forward. That 450 basis points on their revenue is a significant $33M miss to last year however.

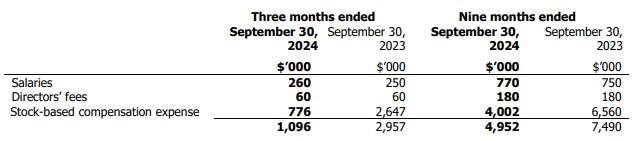

G&A costs which are their sole cash burning expense rose by 19%. While revenue rose by 23%, after the margin erosion their GP dollars rose by 19%, so in reality and consistent with recent trends, they continue to fail to convert on their increased revenues. Their operating income did double, from $7.1M to nearly $15M, but 62% of that improvement came from a reduction in share based compensation.

You may be thinking that management has told us that they were moving from dilutionary measures to cash based compensation. The problem is they haven’t hit the 2024 P&L with any cash bonuses yet. One would have to assume that will occur in Q4 and would erase even the small improvements they have made in Operating income in this quarter. It also makes up for all the YTD improvement.

Below the operating income is messy and more complex due to the impact the volatility in the share price of AIDX has had. After two enormous gains in the first two quarters of the year, the company took a massive hit in Q3. I’ve spoken at length about this previously and while the negative impact here was expected, to properly evaluate Well’s performance these items need to be parsed out for both quarterly and YTD performance, so the numbers I will speak from now forward will exclude them.

After interest expense which is relatively comparable in the quarter and $3.8M more YTD and income tax expense, net income is $1.34M vs a loss of $3.69M for the quarter, and a net loss of $3.7M vs a $17.1M loss through nine months. Foreign exchange resulted in a $18.5M bogey in the quarter and an $11.8M birdie YTD. Net comprehensive income in the quarter is therefore a loss of $7M, but takes their YTD into the black for comprehensive income of $6.7M. Confused yet?

Overall:

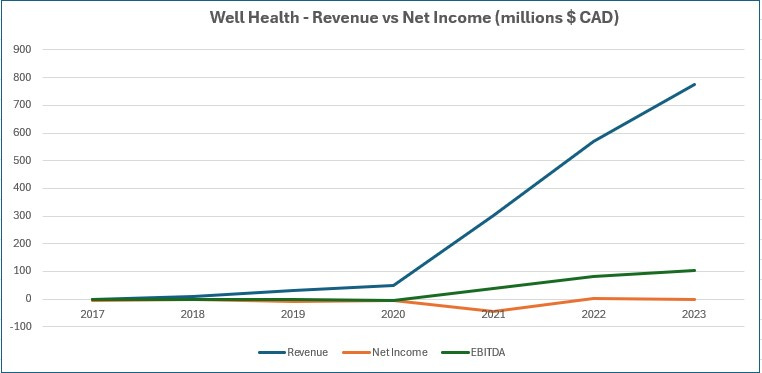

The big takeaway for me is if you exclude the share price of AIDX and foreign exchange, two things out of Well Health’s control, they had a breakeven quarter and are unprofitable YTD after driving $182M more in revenue thus far in 2024 over last year. Once again, the conversion is just not there.

One of my favourite things to do for a Well review is to go through their presentation deck for their master class on PowerPoint magic. You will see numerous slides on the growth of “Adjusted” numbers and a fancy never before seen metric on free cash flow, but these will never be coupled with EPS. If you added EPS, net income or even EBITDA to the graph below you would see a straight line hovering around zero. I know this because I’ve made one before for a previous write up (second image below).

That gap between the revenue and profitability metrics is a sign of lack of converting revenue into profitability, and remains the sore spot and the company’s biggest opportunity.

Lastly I just want to touch on the company statements of organic growth. They state 23% organic growth which is a little hard to buy since their overall growth was 23% and even 27% with the removal of assets sold off.

Canadian clinics are performing extremely well but the clinic count has also risen pretty substantially from last year. Are they using 23% on the clinic number from last year, as that would actually be organic growth. We’ll likely never know how they arrive at that number.

With 23% organic growth, their guidance should take them well over $1B for fiscal 2024. Using their mid range of $990M, they are projecting 16% growth in Q4. Sandbagging? Probably.

Lots of opportunity on the table for Well Health. I love the recent move to acquire the failing JNH clinics, especially for the bargain basement price they got it for and the company is also doing a number of other very good things. Totally happy for the bulls on the little run here, up another 5% this morning hitting a 52 week high as I write. Overall though these financials look awfully similar to the last few - nice top line with little to no conversion to profitability and I don’t see where that begins to change yet. As a result I’m maintaining my three star rating.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.