Rubicon Organics ($ROMJ.V) FINS Review

August 20th Mystery stock revealed (3.25 / 5 stars)

A couple of weeks ago I thought I would do something different and announce a mystery review of a stock I had purchased the previous day. I don’t think I will be making a habit out of mystery reviews, but it sounded like fun at the time. It was also the day I announced my exit had begun out of Simply Solventless (HASH.V). Since then HASH has announced some encouraging earnings for bulls and is up 1.4% since.

Rubicon has performed slightly better, bouncing out of the bottom of my buy zone (a short lived one) by 35% (30% from my entry at .54).

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Below is a cut & paste of the Aug 20 article with the portion regarding Rubicon. If you want to read the whole piece including what I had to say about HASH, the full article with the paywall removed can be viewed below:

I gotta tell you, for a guy who swore off this sector a couple of years ago, I sure have reviewed quite a number of encouraging weed stocks in the past year and a growing percentage of my portfolio is now in this sector as well.

This will be my first formal review of Rubicon Organics.

The chart doesn’t exactly jump off the page with just a 10% gain over the past twelve months. If you read my WWW article a couple of weeks ago then you know I had some concerns coming into their Q2 earnings here. Judging by an initial glance of what they reported on Friday perhaps those concerns were unfounded.

Let’s cross the Rubicon once and for all with a deep dive to find out.

Balance Sheet:

Rubicon has a pretty stellar looking balance sheet overall and it starts with a current ratio of 2.9. That consists of $7.3M in cash, $6.6M of receivables, $16.1M worth of inventory (including plants) and $2.4M worth of prepaid expenses. All of this over top of just $11.3M of current liabilities.

The company’s cash position is just 22.5% of their total current assets and only covers two thirds of their twelve month liability commitments so in these cases investors want to take a look at the health of their accounts receivable, and monitor their operational cash flow.

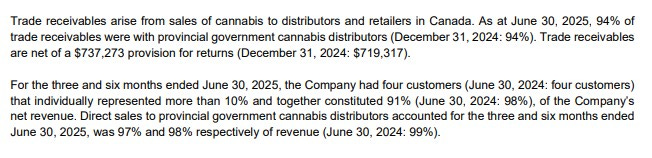

Normally, I would like to see an aging report but alas, the company does not provide one. And normally a 94% concentration of receivables with four customers might be a concern but since these customers are provincial distributors like the OSCR, we can safely assume they are good for it.

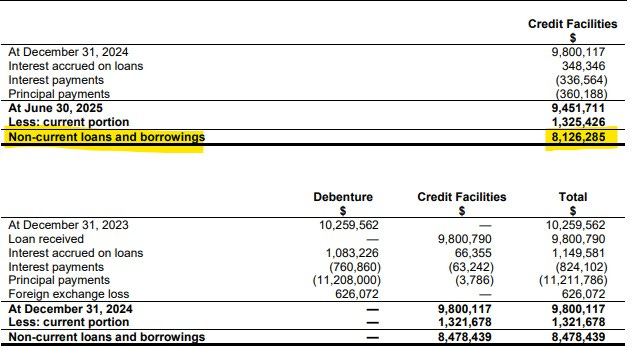

The company pulls a bit of a boner here on the balance sheet by misstating their largest liability. The highlighted item above is actually long term debt, a loan that they entered into in November of last year to settle up with old debenture holders. a very unusual error to see.

Cash Flow:

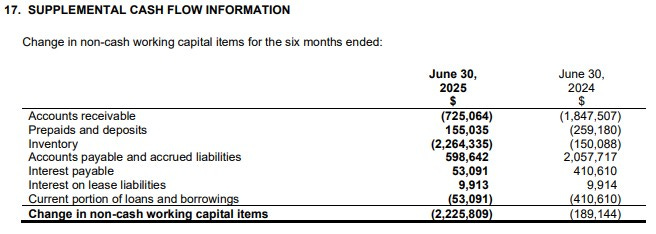

Rubicon is just on the wrong side of cash flow neutral YTD with operational cash burn of $186k vs positive operational flow off $191k last year.

That may initially look like a small set back comparatively but without large investments in inventory so far in 2024 this looks much better. As long as the company gets more efficiencies out of this additional inventory, this operational cash flow should look better as the year moves on. It’s also very notable that their OCF was positive in Q2 with $776k generated.

Seldom does the largest news item for a company occur within their cash flow statement, but in this case that argument can be made as Rubicon purchased a new indoor cultivation facility in Hope, B.C. during the quarter. In total, the company has spent $5.8M through investing activities year to date.

To help fund that Hope facility purchase the company raised a net $4.2M prior to that deal closing. The company also paid down their debt by $360k and made interest payments of $340k so far during the year.

Overall Rubicon’s cash position has depleted by 26% from the beginning of the year.

Share Capital:

67.2M shares outstanding, 19% dilution YTD due to the LIFE PP back in May.

2.05M options outstanding, all well out of the money with about a quarter of the total set to expire at year end

6.2M warrants outstanding. 880k will surely expire unexercised at year end at $1.34. The balance are at $.70 expiring in May of 2027 related to the recent raise where 1/2 warrants were issued.

5.2M combined RSU/DSU/PSU’s

Per Yahoo Finance, 42.5% insider ownership with 3% owned by institutions.

Minor insider activity on the open market, but of that $4.5M LIFE raise back in May, insiders stepped up for $1.5M or 1/3rd of the raise, including this guy for a cool milly

Income Statement:

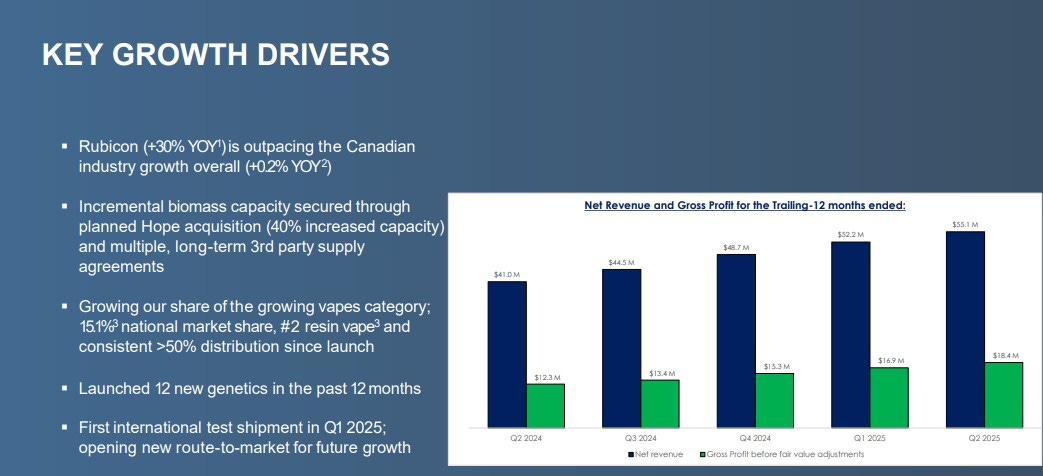

In Q2, Rubicon delivered just shy of $15M in net revenue after excise taxes, 24% better than the comparable quarter. Their gross profit rate also surged by 570 basis points from 33.5% last year to 39.2% here. I’m always a little bit leery of GP rates in this sector as they can be influenced heavily by FVA’s (fair value adjustments) as sometimes they can go the other way and be quarter killers. The good news here is their GP rate also went up by 400 basis points prior to these adjustments. Therefore on 24% more business ROMJ delivered 45% more gross profit dollars.

Operating expenses grew at the same rate of revenue (24.6%), thereby just missing out on a Wolf Trifecta. If you remove non cash burning expenses such as SBC and Depreciation, it’s actually slightly worse at 27% more than last year. By bucket, Payroll and consulting rose by 15%, G&A by 32% and Sales and Marketing by a considerable 61%.

The company does not breakdown any of these large buckets into sub accounts within their financial notes, and their explanations within the MD&A are somewhat lacking in my opinion. While it is still early to fully judge, I’d want a better than 24% revenue increase on 61% more in marketing spend.

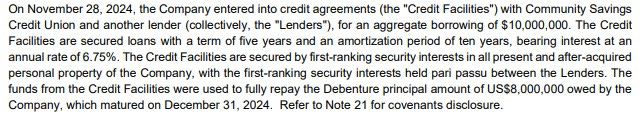

Entering into the credit facility to pay off their outstanding debentures at the end of last year was an excellent move, as it will result in nearly a half million in interest cost savings which go right to the bottom line. After a $235k birdie within foreign exchange the company posted their first profitable quarter of their last six with $773k of net income vs a loss of $454k last year.

At the mid way point of the year, Rubicon now has $27.4M of revenue, a 32% increase above the $21M achieved last year. Gross profit has improved by over 600 basis points to 36.9% which has resulted in generating 58% more GP dollars.

On a YTD basis, I would award them the Wolf Trifecta as they converted much better through six months with only 15% expense growth on 32% more business. The total net income turnaround from last year is a very impressive $2.8M going from a loss of $2.35M to $450k of profitability YTD.

Overall:

What I like about Rubicon is they appear to be at a key inflection point towards generating consistent cash flow and profitability. They have taken the business from $9M in revenue in 2020 to $49M last year and $55M on a TTM basis.

When I see growth like the above, my typical question would ask how they intend to keep up that momentum. For starters their new Hope facility will increase their growing production capacity by 40% (you can take “planned” out of your slide now). They are continually adding new products and have already achieved #2 market share shortly after introducing resin vapes.

The company also has certifications for international exports and had their first test shipment in Q1. While the company hasn’t provided a specific (that I’ve seen at least) roadmap to best capitalize outside of Canada, they have a unique competitive advantage over others in this space.

For a bit of a DD primer, I invite you to watch the following presentation from the CEO from the end of May presented at an event from Rivemont Capital hosted by Mathieu Martin (Stocks & Stones) who has also done a great job in covering the company.

I find Rubicon’s $36M market cap valuation quite interesting as they have a book value of $42M. Often a company’s book value is inflated with excess goodwill and intangibles, but not in this case as the company has $60M worth of legitimate and tangible assets on the books.

After this recent quarter Rubicon would be on a $60M run rate revenue pace with an 11 P/E if you extrapolate what they delivered in net income, although I concede extrapolating a three month run is a bit of a stretch.

Now the company does plan to spend an additional $1-2M on additional capex on the Hope facility for the remainder of 2025, and that won’t be revenue generating until they enter into 2026, so there is the potential of perhaps being too early here with rewards further down the road.

I’ve identified a 52-55 cent buy zone throughout the next few months leading into their next earnings period. I only took a smallish starter position here as there is that gap fill possibility down to 42 cents does exist.

If that 42 cent opportunity is there later in the year it would certainly be on the early radar as a potential 2026 Wolf Pick with the future initiatives they have.

Initial rating of 3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.