We have an interesting predicament, or at least I do. I released my 2026 Wolf Picks last Wednesday. Due to the volume and attention they received, a couple leaked through various message boards but one probably even more so.

I also don’t believe I’ve ever had a Wolf Pick announcement match up with their financial reporting calendar in quite this way either. If you haven’t guessed by now you’re likely a few bricks shy of a full load - Progressive Planet was one of the stocks I announced as a 2026 pick on Dec 17th. Their Q2 dropped the following day, and I wasn’t sure how I was going to write this article while avoiding the obvious to the majority of people reading this. So let this be your confirmation of the leak. You will still have to wait until New Years Day to read the full article for the pick rationale however.

Progressive Planet has been on a nice run, up 116% in the past year, and the stock is up 19% in the past week from when my 2026 pick selections were released. In the past five years, PLAN has had 4 days where it has traded over 1M shares and two of them have been in the last five trading sessions. Coincidence? You can decide.

I’ve been covering the stock for over three years now. The inclusion of the Wolf Pick likely came as little surprise to paid subscribers , as I wrote a favourable review in September (below), and have announced multiple additions to my position since within the Wolf Den Discord.

Progressive Planet ($PLAN.V) FINS Review:

My last review of PLAN came back in April where I gave them an encouraging 3.25 stars but felt they were still a bit of a dice roll. That review was initially behind a paywall, but I’ve since opened …

It’s Christmas Eve and we’re all likely busy, so let’s get into the review and I’ll try to keep most of my comments related to the numbers themselves.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Both the current ratio and liquidity situation are quite solid. They have a current ratio of over 2.5 that consists of $2.8M in cash, $1.2M of receivables. $2.6M worth of inventory and $330k in prepaids overtop of just $2.75M in short term liability commitments.

Their cash position alone covers their next twelve months of current financial commitments.

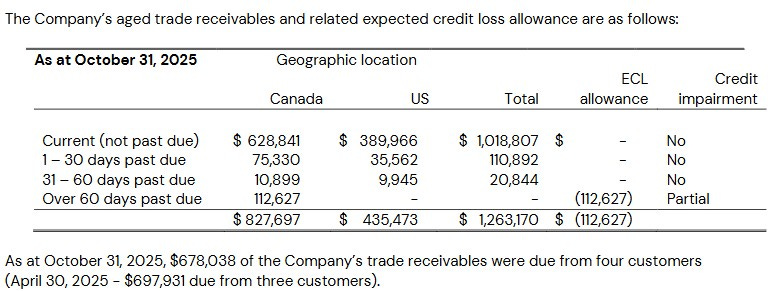

The company has written off $113k YTD in receivables due to a customer bankruptcy. Outside of that their aging report looks much better than it did at their year end with 87% of A/R marked as current.

Progressive Planet has $5.7M of debt, the vast majority under a 23 year mortgage with BDC at 5.05% interest. This was replaced from a BMO revolving demand loan therefore this change offers them more flexibility.

Cash Flow:

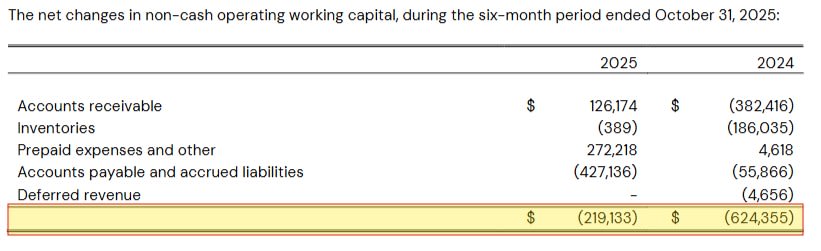

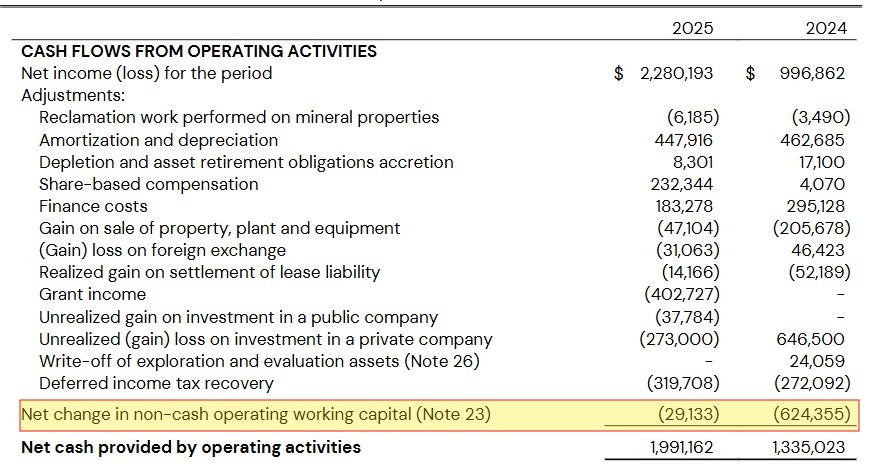

Halfway through their fiscal year, PLAN has delivered just shy of $2M in operational cash flow, up 49% on that metric compared to last year. The company did fumble note 23 within their financial notes related to working capital adjustments however as you can see below.

YTD, the company has spent $3.2M investing in new automated equipment for their legacy business and new equipment and building improvements for their pilot plant for PozGlass. They also spent $260k on mineral property additions and exploration costs, and utilized $570k in purchases of public company. Combined with their investment in partner and private company ZS2 Technologies I have very mixed feelings on this to say the least given their valuation swings.

After reducing their debt load by $560k from the beginning of the year, they company has depleted nearly half of the cash position they started the year with $2.78M vs $5.43M.

Share Capital:

109.8M shares outstanding. 2.7M less shares than 18 months ago due to share buy backs - all of which occurred in their previous fiscal year with the stock in the ten cent range

8.9M options outstanding. All but 600k currently ITM but those are only .5 out of the money as of this writing. Approx 2M ITM options at 27.5 cents are set to expire in June.

8.3M warrants expired unexercised last year at 36 cents - none remain outstanding

30% insider ownership (per Yahoo Finance)

Nothing substantial worth noting in terms of insider activity on the open market

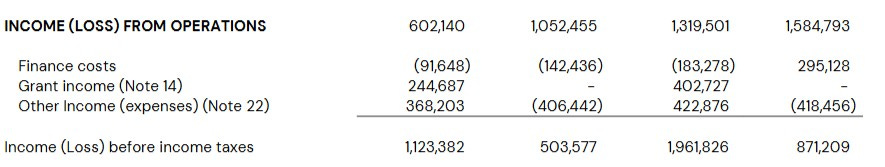

Income Statement:

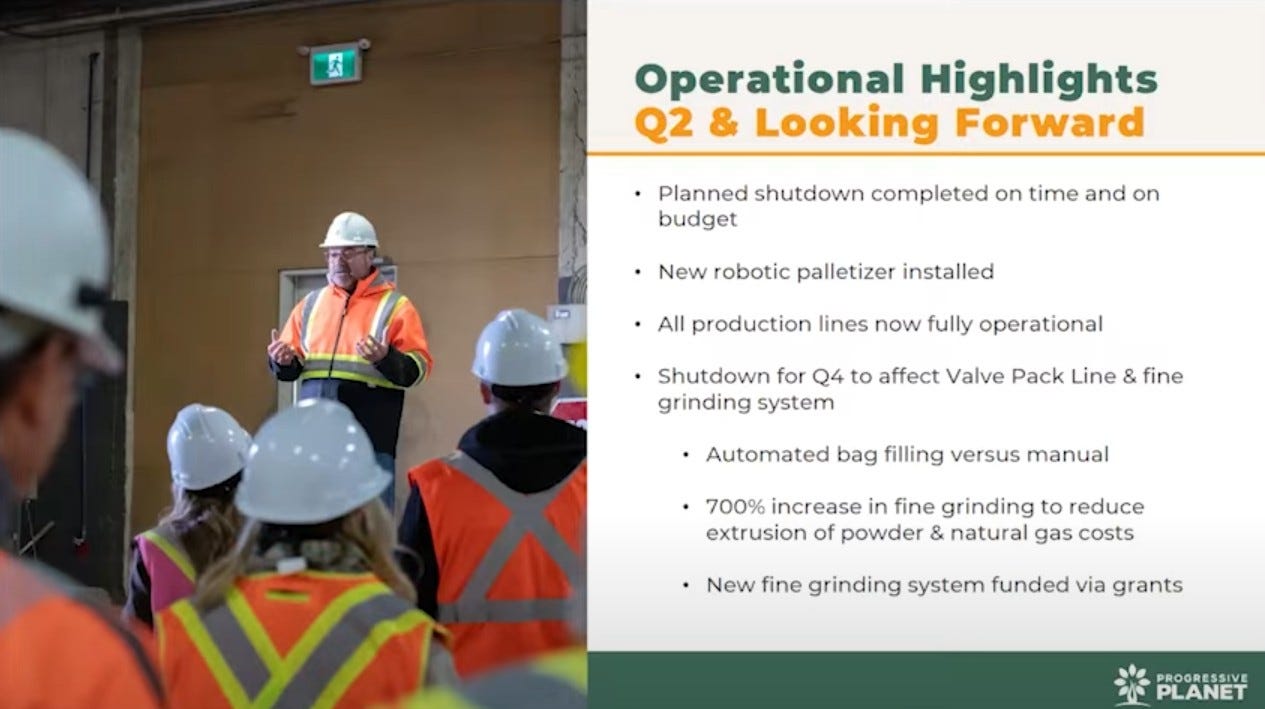

Revenues were soft in the quarter, down 9.2% to $4.96M vs $5.47M. Much of that decline can be tied back to temporarily shutting down three of their four production lines for upgrades and to prepare for new sku’s. This was well communicated back in October and is likely the reason the market appeared to shrug off the seemingly one time hit.

Margin was off by 50 basis point in the quarter as a result of lower volumes to 38.1% which resulted in 10.3% less GP dollars.

Total expenses rose by 22% giving them the never desired “Reverse Wolf Trifecta”, but there is more to that story as R&D costs not a lack of operational leverage as the culprit.

R&D costs were $308k vs only $39k in the comparable quarter related to their new pilot plant. With R&D excluded, total operating costs declined by 3.6%.

There is a significant variance between their operating results and net income due to one time items, and this will be a factor which will plague their Q3 results as well. The company had $244k in grant income recognized during the quarter and with additional grants awarded post financials, their net income will be buoyed by future grants as well. The most dramatic variance to last year comes in their other income and the vast majority of this is due to the valuations within their investments mentioned earlier.

I’ll be honest, these situations are not my favourite, and the $919k birdie to last year in their unrealized gain/loss to last year is a big reason why. Z2S is a private company, and their public company investments is an undisclosed ticker and not one that I can reliably evaluate in the same manner as Progressive Planet. When these two’s combined valuation can fluctuate as much as it has and impact PLAN’s net income to the extent it has, it makes me uncomfortable as an investor. As much as I’m a fan of Progressive Planet in taking a position and also choosing them as a Wolf Pick, I would likely take a much larger position if this relationship didn’t exist. It just adds risk.

On a YTD basis (six months), their results are much better as follows:

Revenue up by 7.3% to $10.9M

Gross margin up by 280 basis points to 39% with GP dollars up by 15.4%

Total expenses up by 40%. Non R&D spending up by 23%

Income from operations down 16.7%

Net income up 129% with heavy assists from grant income and other income described above

Overall:

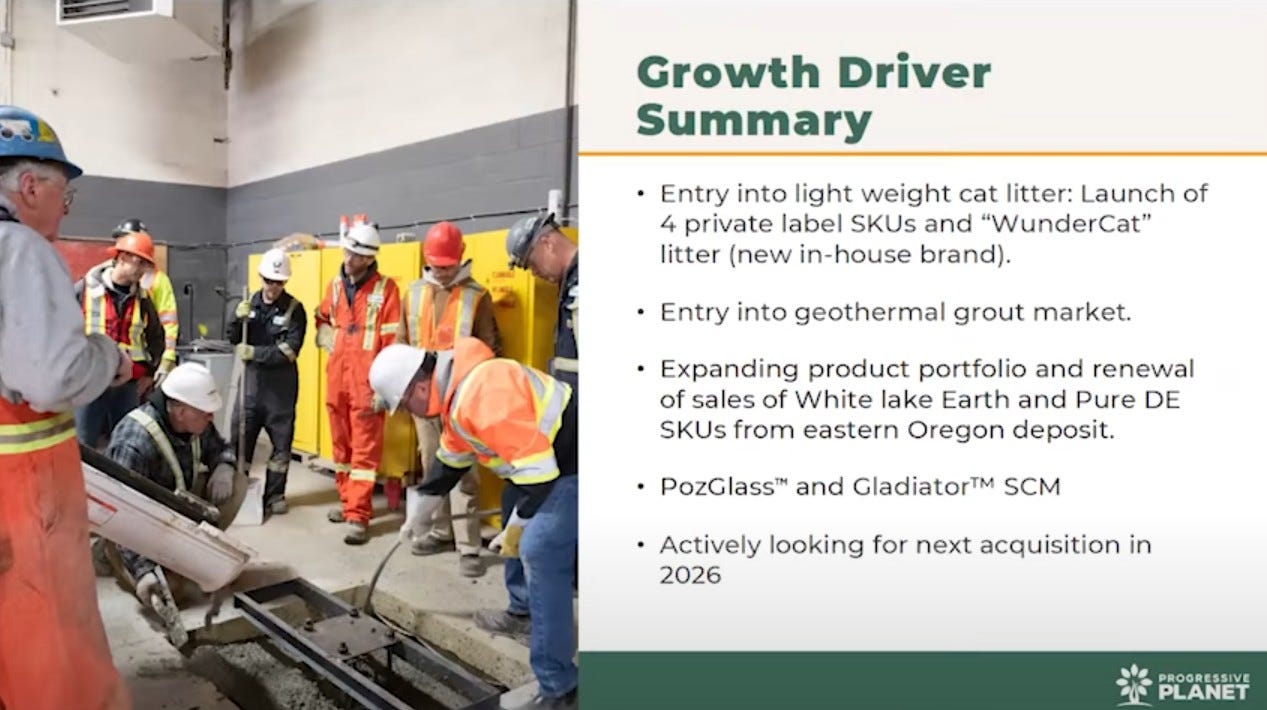

I’d say very good results overall, particularly given the planned October plan shut down. Record purchase orders were received in the final month of Q2 and with new sku’s coming, Q3’s results look to more than offset the revenue hit experienced in this recent quarter.

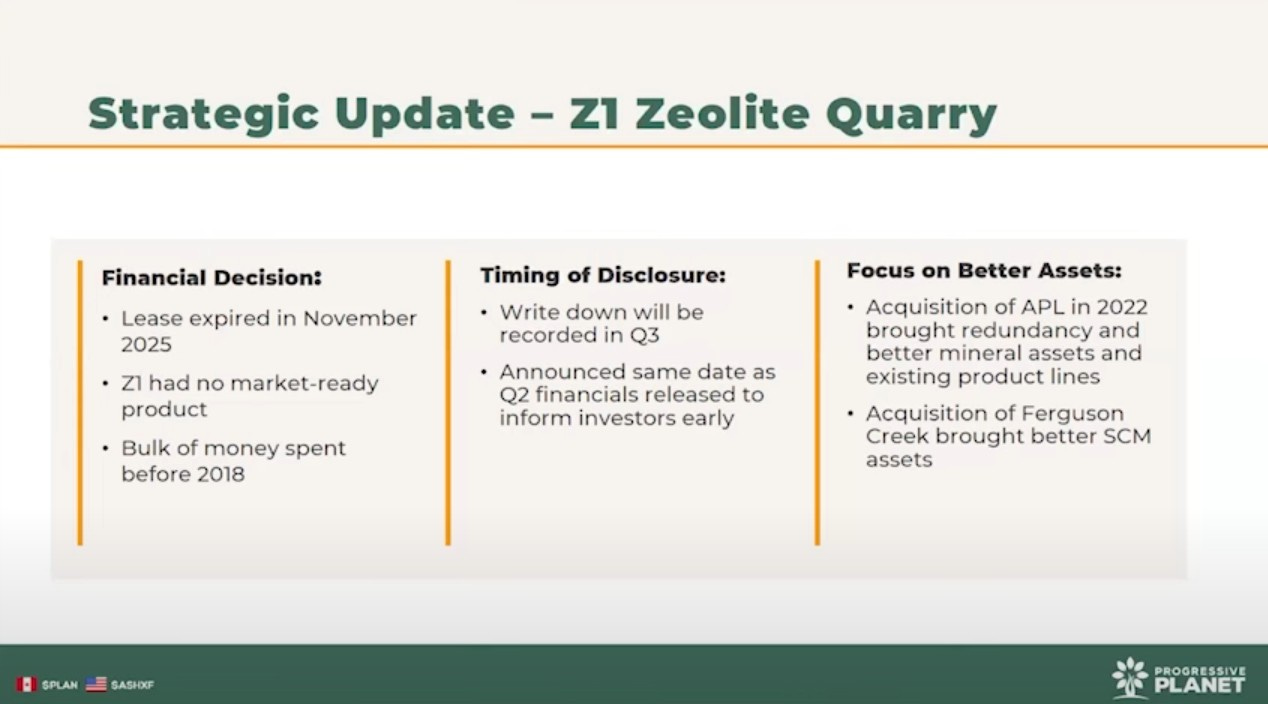

There are some things to highlight which will also impact upcoming quarters. The most significant will be the write down impacting next quarter to the tune of $1.2M.

There will also be another line shutdown of the company’s second largest line in Q4, although long term will have significant productivity and efficiency benefits.

Plenty of growth drivers are in place to help offset the negative impacts of the two items mentioned above.

The above slides were taken from the company’s recent interview with CEO Stephen Harpur with Radius Research. For more details and for a intro into Progressive Planet, it’s certainly worth the watch.

I’m not seeing anything either way to adjust my 3.5 star rating up or down based on these Q2 results. Due to these one time items here and in upcoming quarters, I think it is really important for investors to normalize the company’s earnings when determining their valuations.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. Even with the Reverse Trifecta the company seems solid. Hopefully will see better numbers in 2026.

Too many growth levers to ignore. Still flying under the radar