My last review of PLAN came back in April where I gave them an encouraging 3.25 stars but felt they were still a bit of a dice roll. That review was initially behind a paywall, but I’ve since opened it up for everyone (attached below).

Progressive Planet ($PLAN.V) FINS Review

This isn’t my first review of PLAN, but wow has it been a while. My first and only review of Progressive Planet came way back in November of 2022. They were just starting to hit some paydirt on the t…

Had you rolled the dice it would have turned out better than most bets in Vegas as the stock is up 93% from that review, gapping up after releasing their financials late last week.

With a quick review of their metrics, it suggests that their could be some more upside room based on this pretty solid start to their 2026 fiscal year. Let’s find out if that is indeed the case or if investors are about to roll snake eyes.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Their balance sheet and overall liquidity look good with a current ratio of 2.7 and quick ratio of 1.7. That consists of $4.7M in cash, $1.5M of receivables $2.5M worth of inventory and $1.1 in prepaids and other short term assets against just $3.6M in short term liabilities and $1.4M of those consist of deferred grant income (more on that later).

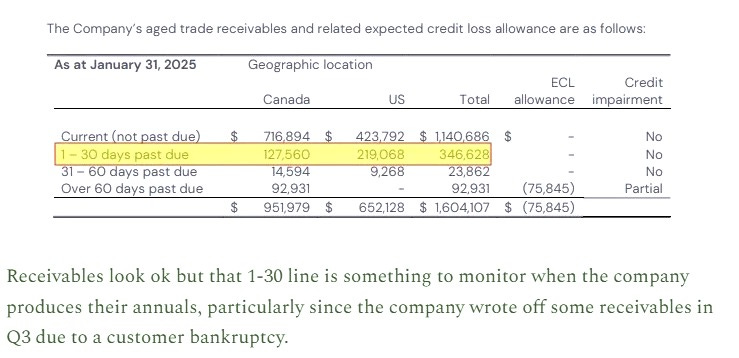

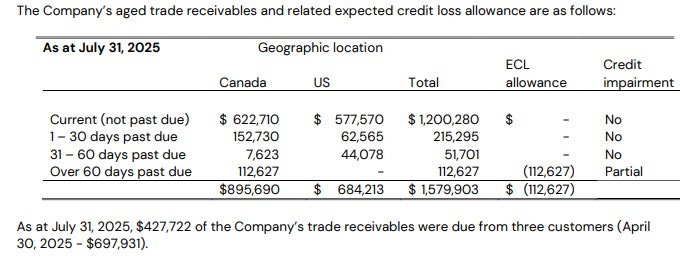

Back in my April review I suggested it was a good idea to monitor their receivables to see if their past due amounts would continue to age. While more did slip down to potential write offs, the overall state of their aging report improved marginally.

Progressive has $5.7M of debt, the vast majority under a 23 year mortgage with BDC at 5.05% interest. This was recently replaced from a BMO revolving demand loan therefore this change offers them more flexibility.

Part of their long term assets include investments in private and public companies (more on that later as well).

Cash Flow:

During their first quarter, PLAN achieved $501k in operational cash flow, up 15% from the same quarter last year. They also spent $656k in multiple asset purchases and reduced their debt load by nearly a half million dollars.

Overall the company’s cash position was depleted by 13% in Q1.

Share Capital:

109.8M shares outstanding. 2.7M less shares than a year ago due to share buy backs

All of those buy backs occurred in mid 2024 when the stock was in the ten cent range. Not have happened since and I don’t believe they have an outstanding NCIB

8.9M options outstanding. All were out of the money when I last reviewed. With 3.7M expiring worthless in the past year and 2.9M granted at 18 cents, all but 600k are now ITM.

8.3M warrants expired unexercised last year at 36 cents - none remain outstanding

30% insider ownership (per Yahoo Finance)

Small dabbling in the open market from insiders early in 2024 but nothing I would consider substantial

Income Statement:

Strong revenue to kickstart their year at $5.9M, 27% up from the $4.67M from a year ago. Gross profit came in 500 basis points higher as well going from 33.5% to 38.5% which resulted in 46% more dollars delivered to the GP line.

Expense conversion was not as good with total expenses up by 51% including G&A costs which rose by 66%, significantly greater than their revenue and GP gains. However if you exclude $225k in non cash SBC which they did not have last year in addition to $100k in fees related to renegotiating their debt, it is a much more reasonable 20% more in opex over last year.

After $92k in finance costs (savings of $62k vs last year) $450k in grant income and $470k in deferred tax breaks, PLAN delivered $1.6M of net income, over 4x more than the $373k from Q1 of last year.

Overall:

Big improvements in revenue, margin and the bottom line, but the question I have is on their 27% net income as a ratio of sales and how sustainable that really is. If one would simply annualize this quarterly net income they would get to $6.4M which would then drive a P/E of 4.8. But that would also be a mistake due to more than half of their profitability coming from tax recoveries and grant income. The good news is the tax recovery is slated to continue for quite some time as they have approx $14M in future deferred tax benefits.

The company has over $1.55M left in grant income. That will be recognized over time and be relative to how much the company spends on capex for their PozGlass pilot plant.

If you normalize their quarterly earnings here, I come up with a figure of roughly $800k for the quarter which then annualizes out to $3.2M and using that NNI figure gives you a P/E of 9.6 - still on the attractive side.

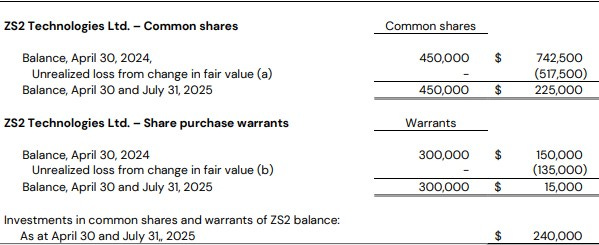

I can’t say I enjoy seeing microcap companies using precious funds to invest in other company’s, and Progressive Planet is invested in two of them. Once public and one private company and they added $77k to their position of the public company in the first quarter.

If they were good at this it would be one thing but since they have $650k in unrealized losses (down 73% from book value) from their investment in ZS2, maybe they should leave the shitco investing to me. Run the fuckin business.

Other than a couple of small concerns things appear to be progressing well here. As I mentioned in my last review this has a very similar vibe as ROOF (NorthStar Clean) with the added benefit of PLAN having an existing profitable business outside of their larger initiative (PozGlass). Those existing legacy business lines will continue to help fund the new ones which is also assisted through government funding. There future capital needs and potential dilutionary measures are also a stark advantage over NorthStar.

With an already attractive legacy business going along with the potential of their PozGlass, for whom they already have a committed buyer of 3500 tons a year, I like the upside enough that I started a position.

In a bit of an unusual move, the company is hosting an earnings call the week after it released financials and that occurs tomorrow. I’m looking forward to that.

The Wolf is rolling the dice on this one. Upgrade to 3.5 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.