This isn’t my first review of PLAN, but wow has it been a while. My first and only review of Progressive Planet came way back in November of 2022. They were just starting to hit some paydirt on the top line, but were still burning some cash and it looked like one to potentially watch. It was a $26M market cap then, and today sits at $16M. At the time I awarded them an encouraging watchlist worthy three stars but they have never seen any of my investing dollars. I’ve been on their investor email list ever since as is the case with dozens of not hundreds of other small and microcap companies. We all have our limits of what we can read and research and as a result they have just fallen off my radar.

There are some small cap investors whose ideas I follow more than others and one of those is Mathieu, who writes Stocks & Stones and he recently wrote about PLAN in his monthly piece which is always a must read. Link below.

While Mathieu isn’t invested in Progressive Planet, it was a trigger for me and I had an “Oh yeah, those guys - I wonder what they’re up to” moment.

Let’s find out.

Balance Sheet:

PLAN has a relatively strong and improving balance sheet. An overall current ratio of 2.4, but with their deferred grant removed becomes even stronger at 3.9. That consists of $4.8M in cash, $1.6M in receivables, $2.6M worth of inventory and $240k in prepaids against just $2.4M in short term liability commitments. The cash position alone at 2x their pre committed cash outflows over the next twelve months puts them in tremendous shape.

Progressive has $6.24M worth of debt, which may sound high for a company with such a small market cap, but that is over a 25 year period with BMO at an attractive prime + .75% rate.

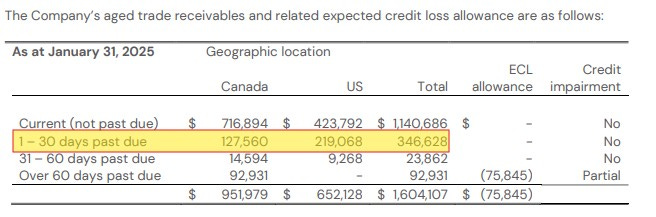

Receivables look ok but that 1-30 line is something to monitor when the company produces their annuals, particularly since the company wrote off some receivables in Q3 due to a customer bankruptcy.

Cash Flow:

Progressive’s operational cash flow is very strong through three quarters with $3.66M generated vs $790k at this stage of last year. the near 5x improvement did come with some assists from working capital variances YoY, but that doesn’t take away from the fact that this is directionally quite strong.

They had a net gain of cash inflows of nearly $500k from investing activities due to selling off more assets than acquired. They made $550k of loan payments through nine months and have also repurchased $290k worth of stock.

Overall they have improved the company’s cash position by 2.9x through their first three quarters.

Share Capital:

109.8M shares outstanding, slightly less than where the float stood nine quarters ago with their share buy backs this year more than the shares used to acquire APL in 2023

8.6M options, all currently out of the money

0 warrants now outstanding with over 31M expiring unexercised in the last two years

30% insider ownership per YF

Some minor insider buying in the open market back in October but nothing I would consider significant

2.7M shares bought back YTD and strategically did so at share price lows of an average of 10.5 cents between June & October

Income Statement:

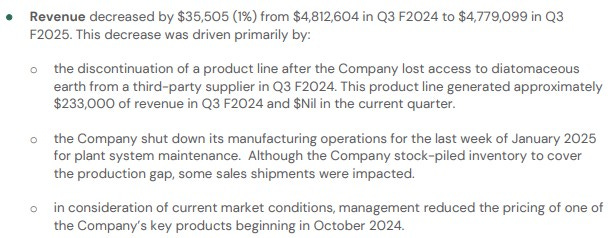

Mixed results throughout their P&L between the individual quarter and their year to date numbers but the one constant has been their stagnant revenue to last year with .7% sales erosion in the quarter and 1.7% erosion through their first nine months.

Q3 gross profit was over 400 basis points less at 28.4%, Selling costs were up 10% and G&A costs up 11% and those combination of numbers put a significant dent into the company’s profitability in the quarter, declining by $234k or 67%.

The YTD results look more encouraging if you overlook their flat top line. Margins are up over 400 basis points, Selling costs down 9%, G&A costs way down by over 20% and all of that translates to a $1.1M net income through three quarters, compared to a loss of $320k.

A very mixed bag indeed.

Overall:

The company did have a few things not go their way in Q3 including a discontinued product line, one week of lost production impacting the top line, and one time bad debt expense due to a bankruptcy with a customer explained earlier.

In their MD&A, the company also spoke to a reduction in pricing for one of their lines to be more competitive and a 9% increase in transportation costs. These ones are a little more concerning as they could impact future quarters.

Recent news includes spending a half million on plant automation through robotics investments which will improve plant efficiencies, but those will not bear any fruit for about a year. Nearly $6M in federal and provincial non-dilutive funding was announced in March. These dollars will be used to support the construction of a new pilot plant where they will manufacture their patented PozGlass which involves recycling glass into low carbon cement. These initiatives are being done in partnership with Lafarge Canada, who is committed to purchasing all product from the pilot plant.

If you’re also a follower of Northstar Technologies (ROOF), it is a similar type of play with an initial pilot plant, then scale additional plants and then move into a licensing and royalty model. It’s also similar with one of their main partners committed to being a future buyer of the end product.

Timelines however are a little fuzzy. Unfortunately the company’s investor deck is close to eighteen months old and based on this information they would be behind where they thought they would be today. Perhaps newer timelines are available to the investing public, but I was unable to find them. Unfortunately after watching the latest video with Radius Research and the CEO on Q3 financials, I’m not prepared to watch any more of that undynamic duo.

Typically if an investor were to consider investing in a company such as this, it would be in a pre revenue stock. This is what is most interesting to me when it comes to Progressive Planet as they already have a positive cash flow producing and profitable $20M business in their other product lines.

PLAN went from little to no revenue to $20M in 2022 and it appears their revenue will remain flattish to finish out this year. But what they have been able to do is go from losing $1.1M in 2022 to close to $1.5M of positive net income this year. They are also on the receiving end of non-dilutive government grants and have a pretty good recent history of share capital management.

Therefore I would argue that the stock is much more attractive today at 14.5 cents a share than it was in the 25-30 cent range when I first reviewed the stock nearly two and a half years ago. At this valuation and assuming an average fourth quarter would put them in an 11x earnings and somewhere under 6 EV/EBITDA plus you would be getting improved efficiencies in current business lines and a larger undefined potential in their PozGlass business.

There are worse bets out there. I’m interested but not 100% sold on them yet, therefore I will be performing additional due diligence.

3.25 stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Nice write up. I toured their facility in Feb. Interesting mix of products...they have an onsite lab where they test the clumping of cat litter! But...significant sales are into US and a decent amount of sales into the commercial poultry industry...lining for those large indoor yarding houses. On my watch list but want to see a few more quarters to see how they sort out product mix and what happens to margin with whatever happens with the tariffs chaos.

An updated deck would be helpful; curious as to why revenue stagnated but if we consider a customer bankruptcy, could be simply they have a better book now than they did before. Capital allocation also sounds good. The catalysts up aren't clear either. Thanks for this.