It’s been a minute since we last took a look at our friend Plurilock. One of my most read articles early on after making the move to Substack wasn’t an actual FINS review, but a special blog discussing the company’s meteoric rise from 20 cents to $2.75, and successfully predicting their inevitable downfall.

While I’ve attached the article above, my piece predicted the demise of the share price in August due to two factors. First, their historically poor financials would be dropping then, and second was the enormous amount of cheap paper that was coming free after their four month lock up period. In the chart below it’s not very difficult to see match up where those two things occurred and the end result.

The stock is down 90% from those highs and predictions.

Since then the company has admittedly put out several news released with new contracts, something promising that each small cap investor likes to see. The company’s historical problems have been their low margins and an expense structure way too rich to ever look like they could turn a profit. I haven’t looked at a set of their financials since the end of August. Has anything changed or are they still the perennial sheeetco that they have always been?

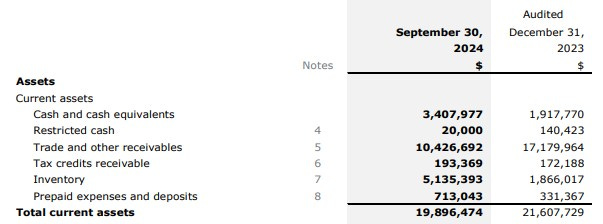

Balance Sheet:

With unearned revenue removed, the company has one of the better current ratios that I can remember them having, at 2.1. That consists of $1.4M in cash, $8.7M in receivables, a staggering $19.8M in prepaids and deposits and about $600k in other short term assets against $14.6M of liabilities due throughout their 2025 fiscal year.

The swings within their inventory and prepaid accounts are very notable with inventory values dropping from $5.1M to just $12k, and prepaids from $700k to over $18.9M. Feels unusual as most of these prepaid expenses are for inventory, but it is consistent with what they did a year ago.

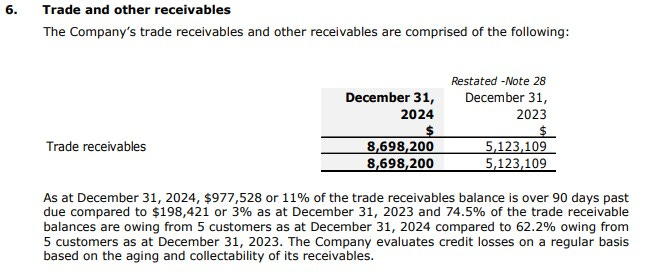

Plurilock does not provide a traditional aging report, but they do mention 11% of their A/R is aged past 90 days.

While their current ratio with deferred revenue removed isn’t concerning, however their liquidity is evidenced by a slim .28 quick ratio with their cash and receivables not covering their A/P and debt payments. Speaking of debt, Plurilock has $2.4M owing on their $10.1M line of credit with interest at prime plus 4.25%. The company has no long term debt outside of $330k of convertible debentures.

Given all of the above it shouldn’t have come to anyone’s surprise that the company raised capital shortly after their year end. They did this through an unusual special warrant offering which basically worked out to a PP at 40 cents plus a full warrant at 50 cents. It was announced with the share price trading at 44 cents. Surprisingly, at least to me is that the offering was a huge success, was oversubscribed and raised nearly $5M or about double what they initially intended to raise. Insiders participated for a measly $50k of that $5M, and today the share price is down 35% from that raise. The company also received funds from the exercise of their April 2024 warrants with multiple attempts to escalate their redemption.

I’m starting to get a feeling on how their cash flow statement is going to look before we get there.

Cash Flow:

Plurilock burned through a staggering amount of cash in 2024, over $7M in operational cash burn in 2024 which was 3.75x more than the $1.87M they burned in 2023. Also during the year they spent a minor $42k in assets, paid down nearly $2.5M worth of debt and raised over $9.5M through previous capital raises and warrant exercises. Their burn rate within Q4 of $622k was much less than the $4.4M they burned during Q3 but with the wild range of changes in working capital items it’s hard to know how much credit to give them for this.

Overall their cash position depleted by 31% during fiscal 2024

Share Capital:

Plurilock’s share capital section is a lesson on how to absolutely butcher a float and fuck retail investors in the process.

59.6M shares outstanding at year end - 486% dilution during their fiscal year

Company is just passed their one year anniversary of completing a 10:1 reverse split

4.75M options outstanding, almost all awarded this year. All currently sit out of the money but none expiring for four or more years

18.7M warrants outstanding at year end. 16.2M exercised during the year at an average price of 26 cents - where the share price sits today

12.5M in post financials dilution with their “special warrant” converting automatically to common shares upon close. An additional 12.5M warrants at 50 cents were also issued plus 690k of broker warrants

3.8M RSUs awarded and 800k post financials

Company issued a $200M BSP back in September

Insider ownership is almost irrelevant here with the moving target of the float

Not much in the way of insider activity on the open market although a substantial amount of warrants exercised

Fully diluted float in the area of 115M shares outstanding, over 11x where they began their 2024 fiscal year. LOL

Company has one of the more egregious SBC plans I have seen in recent memory. Read my previously linked article for more details.

Income Statement:

The company issued a statement last week along with their earnings release stating they were changing how they were recognizing revenues. It started off as follows:

As reported, revenue was a little worse than flat at $59.1M, but the company said without making these accounting changes revenue would have been in the area of $81M vs $70M. Obviously that is a massive difference. I do find this bizarre however as I’m aware of other Canadian companies who needed to change the way they reported revenues and it had nothing to do with practices in the US. Both standards fall under IFRS rules and the last time I looked, the “I” stood for International.

It’s also notable that the company was down almost $10M in revenue as of the end of their Q3. IDK, I guess I’m just not buying this explanation at face value and the fact they would even mention a possible US listing while the stock is at a $20M market cap and around a quarter in share price is beyond amusing. I digress.

As previously mentioned, Plurilock delivered $59.1M in revenue in 2024, .44% less than 2023. The company did grow their gross profit dollars by over 53% on flattish sales, but unfortunately if is still in the low teens at 13.1%, but an improvement nonetheless over 8.5% last year.

Overall operating expenses were flat but if you remove their SBC which rose by 433% over last year, cash burning expenses rose by 8% with G&A costs up by 31% which includes $1.8M in IR spend.

After $3.6M in other expenses including $1.07M in interest costs and some one time items the company lost $11.5M, almost identical to their loss experienced a year ago.

Overall:

After removing some one time items, a more generous look would put the company’s losses around $9M. Even with their improvement in gross margins, their break even revenue on the same level of spending would be in the area of $128M. They delivered under $60M.

That’s it, that is basically the entire review right there. Even if they double their revenue last year, at those sad margins and level of expenses, the company would have still seen negative profitability.

That is before you consider their terrible float management and one of the most egregious share based compensation plans in Canadian microcaps.

How do you begin to value a company that has never been profitable, even on the EBITDA line? IDK, and I’m not even going to try.

One star & five poop emoji’s.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Got me to laugh on the five poop 💩.

wow 90% down and not profitable how is it not 100% down? thanks wolf keep it up saves me allot of money and most importantly time