Plurilock's rise has an expiration date (repost)

from Wolfofoakville.com (July 17, 2024)

(Originally published just prior to making the move to Substack)

Slim pickings when it comes to the slow summer months for doing my typical fins reviews. My arm is also a little banged up right now - I can't golf, so it feels like a good time to address what is going on in Plurilock.

I've done four previous reviews of Plurilock's financials, never receiving more than a two star review, with both of the last two receiving downgrades with my latest occurring last September receiving just a single star. The stock (split adjusted) went from about $1.30 all the way down to the twenty cent range. Since April 1st, the stock has been on an absolute tear, going over 7x. So what's going on here and what can be expected moving forward?

Back on April 1st, the company announced some major changes. A change at the top of their board of directors, a 10:1 reverse stock split, and a $3M raise which was subsequently upped to $4.5M at .20 a share with a .25 warrant (if exercised in year one).

Firstly, let's touch on the new leadership. While their was no change to the CEO of the company who has been in the chair since 2016, there was a change to their executive chairman, introducing Ali Hakimzadeh. While I do not know much about Mr. Hakimzadeh, they do mention his recent tenure at HS Govtech in their press release introducing him to the role (I think I drafted this guy in fantasy football back in the mid 2000's). In that press release they talk about HS Govtech's sale which took it private for a 150% premium to the share price on the transactions announcement. This is true and the transaction was worth $33.3M. What is also true is the stock was down 60% from it's 52 wk high in just 8 months (see chart). He was also part of the team that took HS Govtech public, but back then it was Healthspace Data Systems (and Healthspace Informatics prior to that). It IPO'd in November of 2015 and touched $1.90 per share that day giving it a market valuation of approximately $90M. Eight years later it was sold for just over 1/3 that amount.

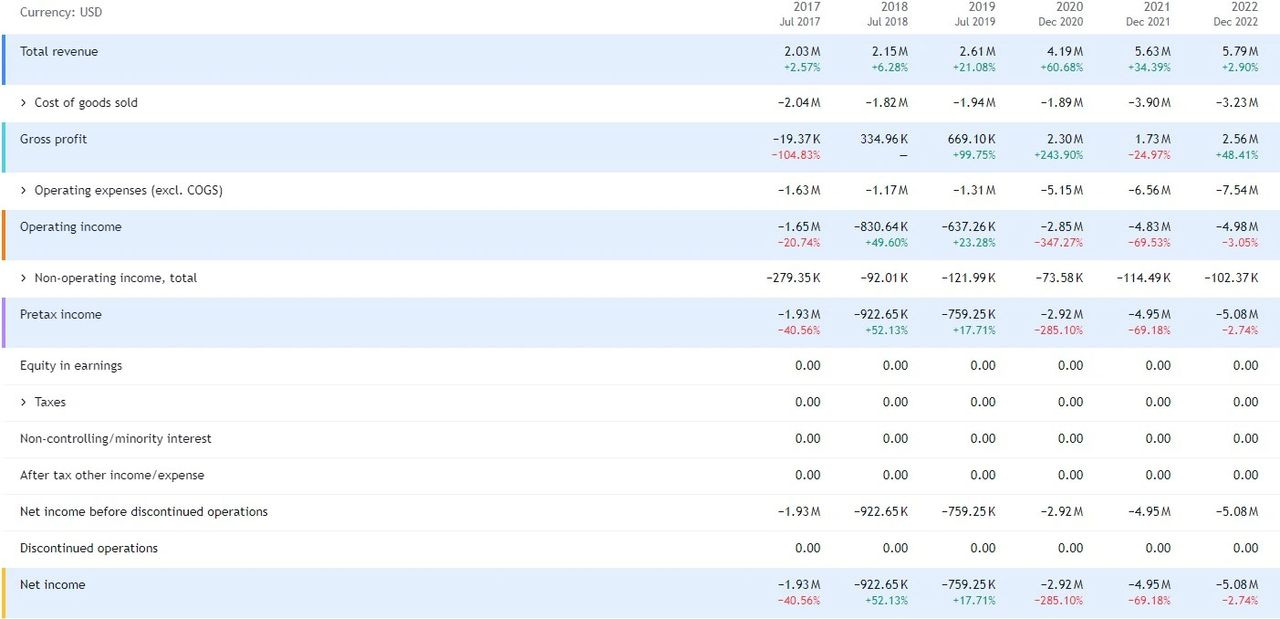

How did HS Govtech financials look during the 2017-2022 timeframe when Mr. Hakimzadeh was the board chair there?

While they did take annual revenue from $2M to $5.8M, their operational losses grew by just as much from $1.9M to $5.2M over the same time span culminating in an overall $19.4M shareholder deficit in the months prior to the business being sold.

Now while my post retirement resume is no longer up to date, I only listed the positive things as well, but that is what certainly took place in Mr. Hakimzadeh's press release introduction. On the other side, his experience with Cannacord and Sequoia certainly bring a wealth of capital markets experience. It helped during the time with HS Govtech as well with multiple raises over a number of years diluting float by 430% from 2015 - 2020 prior to a 8:1 reverse split, and then approximately doubling the float again between then and the time of the sale.

Ok, enough about HS Govtech, but it's a nice segue into the next piece of news from April 1. The reverse split took their float down to a miniscule number of just shy of 10.3M shares. Of course they immediately diluted that by 220% with their $4.5M raise at 20 cents, and only a couple of weeks later raised another $1M with another 4.5M shares. Next, were repricing of older convertible debentures to .25 per share. Owners only had until June 26th to make this happen and one would have to assume that they did. Add another 4.3M shares with more ITM 30 cent warrants. Then, they settled some debt with another 1.1M shares along with debt settlement warrants at .40.

What did insiders do next? The most egregious to me is the company waited for all of the above dilutionary measures to take place prior to introducing their new Share Based Compensation (Omnibus Plan), which consists of additional dilutionary measures of 10% options and 10% RSU's for a disgusting 20% SBC plan total. Note that this was not the first order of business when the company had 10.3M shares outstanding. Instead, they waited until they grew the float by 4x. Insiders did not waste anytime either once the new plan was adopted and announced, immediately awarding themselves 3.8M free RSU shares vesting in one year and another 3.5M options at 30 cents, over 90% that was available to them. At $1.40 where the share price trades today, the value of these awards is now worth a sizable $9.17M to those handful of people. Not bad for a couple of months work.

So how is the actual business performing? As of their latest financials from the end of March their balance sheet had a dismal current ratio of .6 with just $600k of cash and $9.1M of receivables to cover over $19M in liabilities due over the next twelve months. Of course raising $5.5M subsequently will assist, but I don't expect improvements to make this balance sheet look stellar when they report Q2. They also burned $225k per month in their latest quarter which did include some wild swings in working capital adjustments for receivables and payables, but still looks a significant amount of time away from getting to cash flow neutral. Plurilock's top line suffered greatly with revenue decreasing by 26.5%. The revenue they did obtain was at a much higher margin however so even on 26% less of a top line, they actually brought 18% more dollars to the gross profit line. It's still a very lean 21.9%, but miles ahead of where they were. Costs were cut by 2.7% from their cash burning expense lines with most coming out of R&D, but no where near enough to make up for the 26% revenue reduction. Still with the improvements in margin they were able to nearly halve their operational loss to $650k in the quarter, but due to high interest expenses (3x more than last year), their net loss of $1.11M was only an 18% improvement from the same quarter last year. Ok, but far from great and had I done a formal review back then I likely would have upgraded them slightly from the one star they had the previous time.

While the company has discussed taking $2M worth of expenses out of the business, we have not seen it yet. If they achieve this though it would still be shy of making up for their operational burn of 2023 or to pace they are on to burn $2.5M operationally this year. This $2M they speak of likely does not exclude the inordinate amount of money they are currently spending in investor relations since this "transformation" was announced, which by my calculations is around three quarters of a million dollars, nor will these cost savings offset the "self fellating" share based compensation they have rewarded themselves with.

There are two things that will significantly put an end to this historic 7x run that PLUR is currently on, both will be occurring towards the end of August. First will be their Q2 results. While they may make some continuous improvement in some areas, their IR spending and SBC costs will have a very negative impact on profitability so I would estimate a very negative quarter on the bottom line.

The next reason is all the cheap paper scheduled to be released. Two thirds of the float are currently locked up from their April raise, and with four months of lockup means they become free trading near the end of August. 27M of the current 40 ish million when they bought in at twenty to twenty-two and a half cents should create some significant profit taking pressure, particularly with those owners having warrants that are well ITM.

An additional reason is just the insane rise in valuation over the past handful of weeks. They went from a $12M market cap to approximately $60M today and the implied valuation would be much higher. While the float a few weeks back sat at 40M shares, that doesn't include the well over 30M in ITM warrants and finders warrants, the near 8M in options and RSU's, debt settlement shares, and shares granted to the new sheriff under his employment agreement. We are easily over 80M fully diluted for a company that started with just over 10M shares three months ago and that would bring their implied market cap to approximately $112M. $12 to $112 in less than a quarter. Not bad. Deserved? Not a fucking chance.

Serious congratulations to anyone who was a buyer here between April 1 and July 1. It's been an epic run. Is the company on the verge of a historic transformation? We'll know eventually. Is the run over? Who knows with their IR spend, it may indeed reach higher, but Sept 1's expiration date is not too far away.

Hey Wolf recently became a subscriber after viewing you r work on CEO.CA regarding plurilok. This article was very useful I enjoy your elegant and simple way of imparting knowledge. Do you hav any thought on VOXTUR? Keep up the good work.