Anyone who knows me at all, is probably aware that I have showed some pretty big disdain for Plurilock over the years. I did several one to one and a half star reviews during 2022 and 2023 and after the one star rating I gave them in September of 2023 I thought that may have been the last.

Instead, enter some organizational changes, a massive pump effort though investor relations, marketing spend and add in some misguided bulls which started an epic run from 26 cents in June to $2.75 in August for a two month ten bagger. Unheard of outside of pump and dumps.

To me, the term pump & dump is too easily floated around, used by trolls and bagholders as an excuse for their bad decision making. Plurilock is a legitimate business. It appears they just fucking suck at it so far.

In July, during the midst of that summer run up, I published the following piece.

The main thesis of the piece was to point out all of the flaws in the company and to state by the end of August, the combination of the financials and massive warrant overhang would send the stock plummeting. I added that coloured box as an estimation on where I thought the stock would end up, and also placed a bet with a Plurilock bull. I think the chart below explains who was victorious. In fairness I lost a previous bet on how high the stock would actually get to, so we’re 1-1 on our gambling for breakfasts.

Those August financials received a two star review. It was still wasn’t investable in my eyes, but there were a couple of indicators of some progress, despite everything I disliked such as the grotesque SBC plan, float mismanagement and the pumpy IR spend.

What does Q3 look like? I’m dying to find out myself so let’s review.

Balance Sheet:

Since I’ve already used profanity once, their balance sheet historically has been a significant weakness and that continues with a current ratio of .88 after Q3. That consists of $3.4M in cash, $10.4M in receivables, $5.1M worth of inventory and about $1M in other short term assets against a $22.7M of short term liability commitments due over the next twelve months (deferred revenue removed).

While Plurilock doesn’t provide a detailed aging report, they do provide some decent commentary and as of quarter end looks relatively clean. Inventory investment has been significant YTD rising by 2.75x from where they began the year, but that overall has produced $10M less in revenue YTD making their turnover look quite inefficient.

The company has no long term debt, but does have $3.9M drawn on their line of credit (down from $4.5M a year ago) at a rate of prime +4.25%. As of quarter end, they would have approximately $4M more ability to draw from their LOC as it is based on a percentage of receivables.

The overall balance sheet paints a near term liquidity problem with nearly $19M in payables due within twelve months not including loan payments with only $3.4M in cash and $10.4M in A/R to cover that.

Cash Flow:

This past quarter really went the wrong way with $4.4M in cash burn during the last three months alone, bringing their YTD burn to $6.4M which is nearly four times larger than their cash burn through nine months last year. A good chunk of their quarterly burn and about half of their YTD results from the large increases within inventory.

So far in 2024 they have received $8.8M in proceeds from a private placement and warrant exercises, but due to their burn rate, only have $1.5M more than they started the year with.

The burn rate through three quarters works out to be about $715k a month. Given their liability commitments and weak balance sheet, a near term raise appears likely but could potentially make it to their annual reporting date if they chose to max out their line of credit. My guess would be a raise by the end of Q1 - otherwise why the continuous lavish spending on IR.

Share Capital:

After a reverse split in late spring, Plurilock has put on a clinic on how to butcher a float.

56.9M shares outstanding as of Sept 30th - 460% dilution in nine months achieved via their private placement and warrant proceeds, debt settlements and egregious share based compensation

22.6M warrants outstanding. All appear to be currently ITM at ranges of 30-33 cents.

4.3M options, 3.5M of which are currently ITM but none expiring before September 2029.

In addition to the above, 3.8M RSU’s awarded to insiders as part of their 10% + 10% Omnibus SBC plan. My readers likely now know that I will not invest in a company with a 20% SBC plan. Making the plan more ridiculously self serving is the company waited to reverse split, then quadruple the float through a private placement and debt settlement prior to reworking their SBC plan, thereby significantly increasing the amount of shares available to them under the plan. I don’t know if a bigger signal could be sent to retail shareholders that management does not care about them.

5% insider ownership per SimplyWallSt, but I believe this number to be higher.

No insider participation in the open market in over a year, but multiple insiders did participate in the spring PP

Fully diluted float approximately 87M, the equivalent of 870M pre split

Income Statement:

Here’s where the rubber meets the road, but in Plurilock’s case it is where the financials drive off the edge of a cliff and ignite into a giant ball of flames.

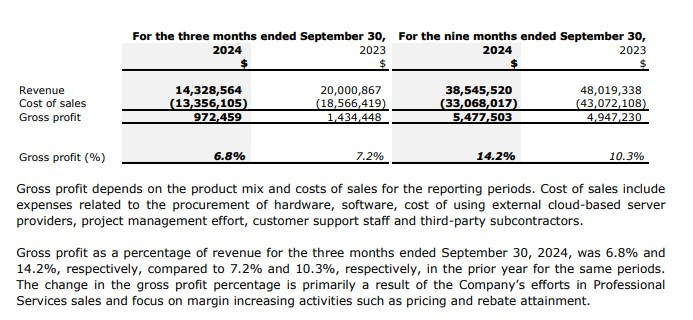

Revenue for Q3 came in at $14.3M, a 28% decline over the comparable quarter. This brings their YTD revenue to $38.5M, 20% less than what they achieved last year.

After showing some improvement in the previous two quarters on the gross profit line which I noted as a sign of encouragement in my previous review, Q3 came in at an atrociously low 6.8%, staggeringly worse than the 7.2% in the comparable quarter. On a YTD basis things look slightly better with a GP rate of 14.2%, 140 basis points better than 2023.

When revenue is down, margin rate is down the last thing anyone looking at a P&L wants to see is increased expenses. Not only did they increase, but they were 45% higher than a year ago.

Even with non cash burning expenses removed (SBC, Amortization and Depreciation), expenses rose by 33% on 28% less revenue and 32% less gross profit dollars. After adding in acquisition related expenses and interest charges from their debt, their net loss for the quarter was $4.1M, more than double the losses they experienced in the same quarter last years.

Their YTD numbers are marginally better but that isn’t saying much. They have achieved 10% more margin dollars on 20% less business. But even after relatively flat spending year over year their operating loss is larger than last year, and then you can tack on $3.6M in additional other expense for a $9M loss through nine months vs a loss last year of $5.9M. Even if you normalize their net loss by removing one time items, losses are still in excess of $6.5M and last year.

Overall:

I wasn’t expecting a lot, but after making some baby step improvements through their first six months, Plurilock’s Q3 is a major setback in almost every measurable way.

The biggest surprise for me was how poorly they delivered on gross margin in the quarter and the MD&A unfortunately glosses over it. It’s virtually word for word of their Q2 MD&A when it looked much better than it did in Q3.

To put the Q3 in perspective, their breakeven point on their GP rate and expenses was over $60M. They did less than 1/4 of that. So if they quadrupled their revenue and not spent another penny in expenses they still would have lost money in Q3.

They have driven quite a few new contracts in previous months and are bullish about Q4 on the top line, but with lumpy margins and increasing costs will any of that improvement make it to the net income line. Recent history suggests that’s unlikely and nothing in their press release or MD&A commentary would lead me to believe otherwise.

In addition to these poor financials, they have wasted an enormous amount of funds on their IR spend this year, almost $1.2M so far including three quarters of a million this past quarter. What did this get them? A raise at twenty cents and did not capitalize again on an inflated share price and now sit in a position where I’m of the opinion they will need to raise capital again in the next few months. That is after more than quintupling the float this calendar year already.

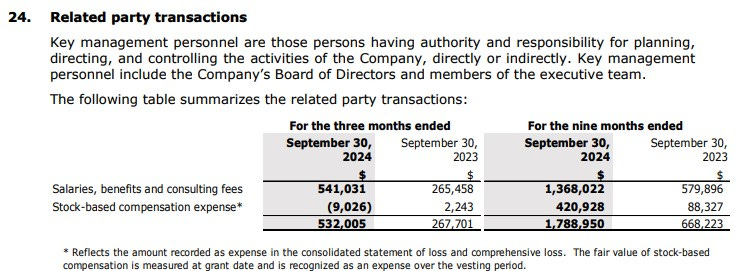

Add in the 20% SBC plan and their total compensation increasing by 168% on worse results YoY, and there is virtually nothing attractive in here for me. This is what happens when investors look at the P/S ratio and not much else.

Full star downgrade to one star on this absolutely miserable shit show of a quarter.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.