We are only 30 days removed from their 2025 annual filings released at the end of December - a downgraded rating of their financials which has seen the stock fall by 16% during that time frame and the current share price is now down 49% from their peak in the first week of October.

Last months review below:

Gatekeeper Systems ($GSI.V) FINS Review

Gatekeeper Systems is one of ten Wolf Picks from 2023 - 2025 to go 3x or more. What makes GSI unique of those ten? I didn’t hold the stock for that run up.

From a pure fundamentals perspective, GSI had a terrible 2025 with revenue declines of 16%, margin erosion of 440 basis points and 30% increases in operational spending, all contributing to a $3M net income loss vs producing $2M in profitability the year prior. 68% of that net loss came in Q4, ending the year with the rare double reverse Wolf Trifecta.

Despite those figures, the stock is still up over 300% in the past year, and that is due to the incredible news flow that began around May of last year.

I ended last months review with this summary, discussing my dilemma of not having enough insight into how they intend to put the profitability “biscuit in the basket” :

In my more recent What’s Wolf Watching article which previewed Gatekeeper’s earnings, I suggested they had a real opportunity to blow the doors off of revenue, but I would be watching to see what they did with margins and operating leverage.

With the surprising headlines last night of another revenue miss to last year in the high teens, where do we go from here?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

No issues are present on the balance sheet after raising $12.5M during the quarter giving them a current ratio of over 10. That consists of $18.1M in cash, $5.3M in A/R, $12.7M worth of inventory and $2.7M in prepaids overtop of just $3.8M in short term liabilities and $700k of those are unearned revenue.

Gatekeeper only long term liabilities are $325k worth of lease obligations and zero debt.

Cash Flow:

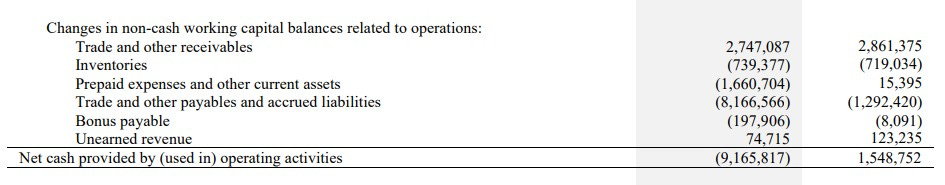

Ugly operational cash flow numbers showing $9.2M of operational burn in their first three months compared to positive OCF of $1.55M in the comparable quarter.

These numbers are heavily influenced by working capital changes, most notably from reducing their accounts payable by 75% or $8M and a significant increase in their prepaid expenses.

While their OCF is not good, investors shouldn’t panic by thinking they are on pace to burn $3M per month either.

As previously mentioned, GSI raised a net amount of $12.5M in the quarter, but their overall cash position only improved by $3.3M in Q1.

It’s also notable that that raise of capital was done at $2.10 so participants in that raise are already under water by 23% with no warrants.

Share Capital:

110.4M shares outstanding representing 18% dilution over the past year

4.7M options outstanding, all but 100k are well ITM

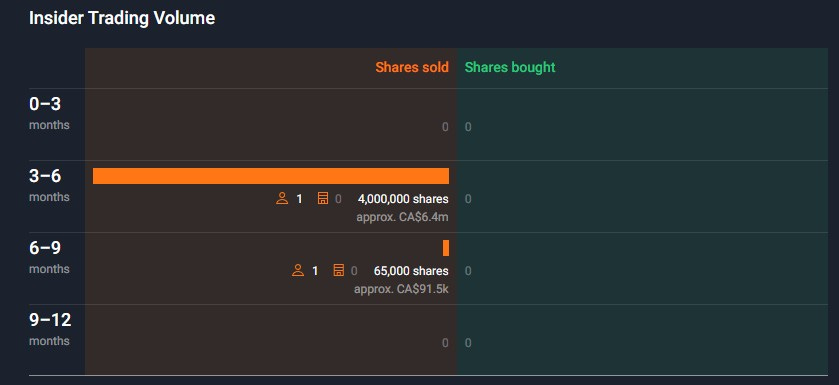

Only 4.5% insider ownership - approximately half of what it was a year ago with 4.2M shares sold by insiders in the past nine months

Income Statement:

A rather surprising rough quarter on the top line of only $5.9M ($5.905M to be exact which makes the $6M headline in their news release an interesting round up). That represents a decline of 19%.

Gross margin improved by 210 basis points to 45.4% reversing a troubling trend helping to offset the poor results on the top line with gross profit declining by 15%.

Operational spending grew by 36% with increases in all three spending buckets, G&A by 60%, Selling and Marketing by 13% and R&D by 38%.

All those combine for a $1.57M operating loss compared to a modest gain of $32k last year. After a foreign exchange birdie of $263k and $298k in deferred tax amounts, a net income loss of $1M vs $363k of profitability.

Overall:

Given the top line results, I don’t believe we have enough information to learn what I was hoping we would coming into these financials.

My concerns coming in would be on gross margin trends and operational leverage, two things severely lacking during their 2025 year.

Margins improved in Q1 while operational costs went from 43% of revenue to 72%. Without evidence of any of those 2025 contracts making their way into these Q1 financials, I feel both of the above are rather irrelevant.

As I did in my last review, let’s go back to Raymond James coverage which has forecasts of $45M in revenue. Should that continue to hold true that represents an average of $13M a quarter for the rest of the year. That would represent revenue increases of 120%, 74% and 17% in the next three quarters.

But when I look at that RJ coverage, the $1.8M in adjusted EBITDA for the full year stands out even more given their price target of $3. As that would represent a 183 multiple on ADJUSTED EBITDA. At today’s $177MC that translates to a 98 multiple and I’m not interested in that either. Let’s also remember that RJ was the co lead on their latest $13.5M raise, so when the two companies covering you are the two that lead your raise, any price targets they issue have to be heavily scrutinized.

The conference call did little to assist with any of my questions above but I think that hosting their first call is a step in the right direction. The team did a good job updating retail on backlog and what they are working on. Doug was noticeably fired up - he sounded like he could have squatted a school bus. Unfortunately retail was typically singularly focused on contracts and sales funnel and not much else. Curiously neither of the two analysts covering the company asked any questions.

The company’s updated deck is attached below:

These financials themselves are deserving of another downgrade here, but given we will see much better top line numbers throughout the year with the potential for other large contracts to be announced, I’ll hold off until Q2 until we get a better idea of where this bus is headed.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Want to invest in this company, the news seems great, but the financials keep holding me back. Plus that's a lot of insider selling.