Gatekeeper Systems is one of ten Wolf Picks from 2023 - 2025 to go 3x or more. What makes GSI unique of those ten? I didn’t hold the stock for that run up.

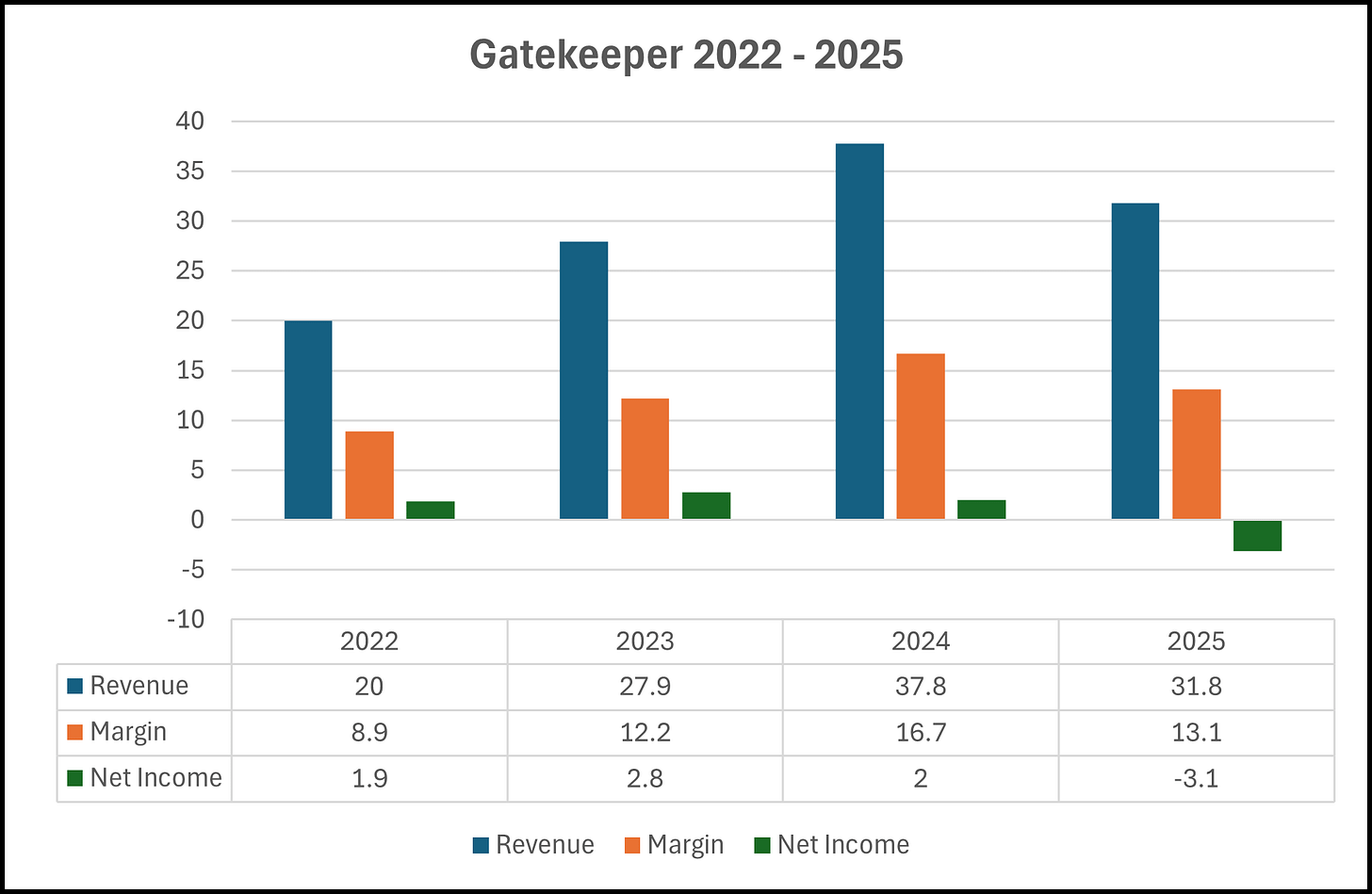

At their peak in early October the stock touched $3.15 for a 7 bagger from my 2024 pick at 43.5 cents. In fact, the stock fell below 40 cents just after the company produced their Q2 only eight months ago. That was after GSI reported back to back significant revenue losses of 26% and 40% with worse performances on their bottom line.

So what changed?

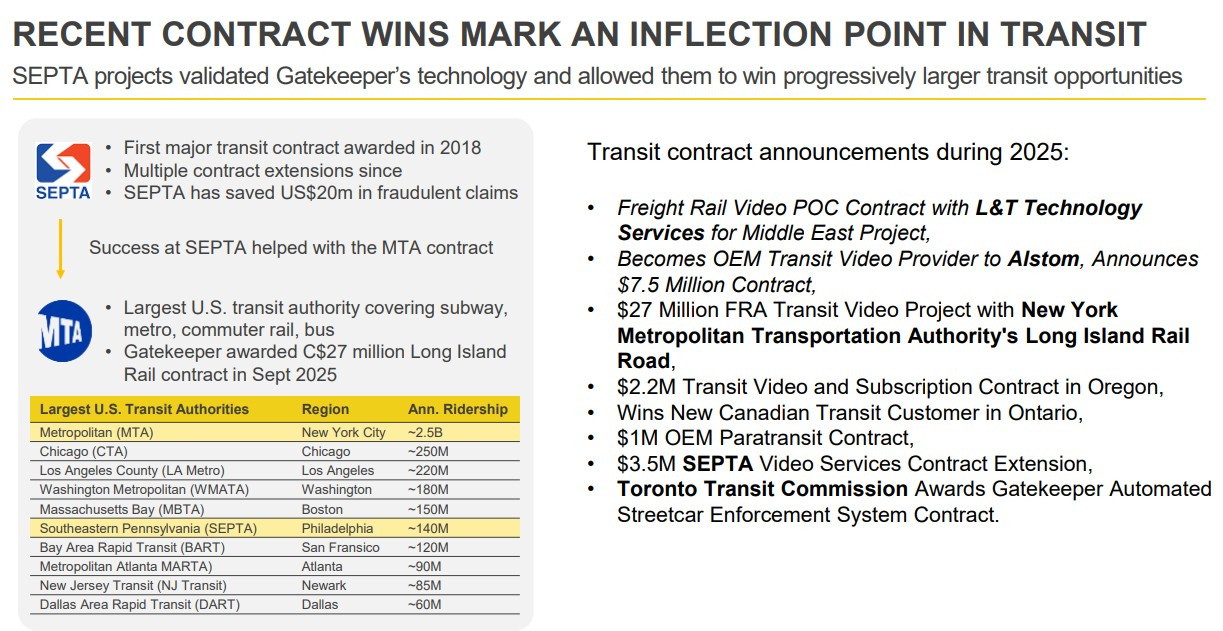

A significant amount of contract wins. Approximately $45M worth with most announced within a thirty day window. There was the big one of course with LIRR (Long Island Rail Road) for $27M, with additional opportunities across North America as more regions adopt legislation requiring products for which they are considered an industry leader. Then most recently, a middle east contract opening up other areas many investors were not even discussing until recently. The bull case re-awakened.

But since that October 7th high, the stock has dropped by 39% to close yesterday under $2 for the first time in three months. Gatekeeper also waited until after market on deadline day to release these annual filings, and you typically don’t wait that long when you’re proud of your numbers.

Is there cause for concern here within these financials or is it nothing but blue sky ahead? Which way are these train tracks going?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Gatekeeper’s balance sheet looks strong with a current ratio of 3.1 (deferred revenue removed) that consists of $14.8M in cash, $8M in receivables, $11.8M worth of inventory and $1.1M in prepaids over top of $12M in liability commitments during their 2026 fiscal year that began on September 1st.

The company does not provide a full aging report, but they do mention that only 8% of their A/R is over 90 days which is partially helpful.

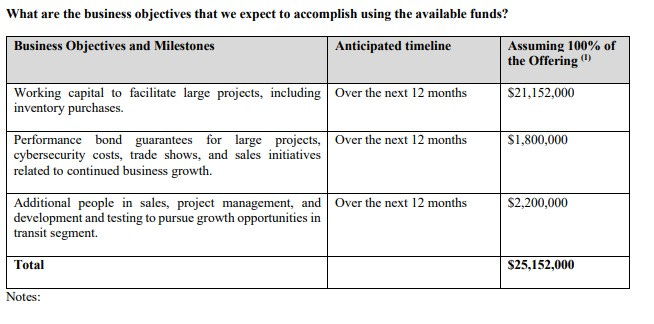

Inventory ballooned in 2025 to $11.8M from $4.7M at the start of the year and $5.2M at the end of their third quarter, but this was foreshadowed in their offering document in their latest capital raise.

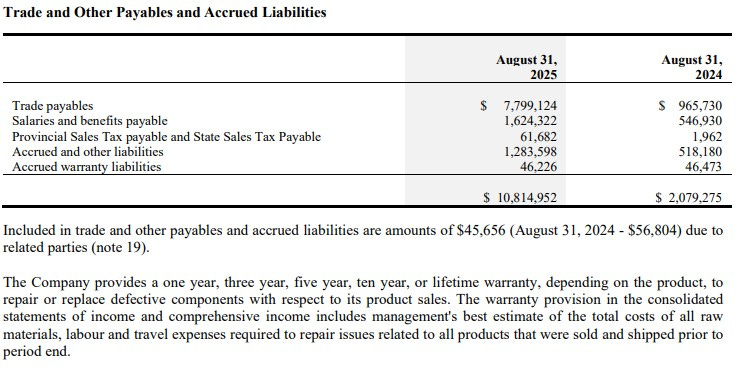

This has also had an impact on their payables which when combined has reduced their current ratio from nearly 10 to 3.1 in just three months. Their total liabilities also includes $1.7M in salaries and benefits payable including bonuses, but we’ll get into that later.

Cash Flow:

After generating $6.5M in operational cash flow in their 2023 fiscal year and $4.2M in 2024, GSI burned nearly $2.2M this past year, and if they paid out the additional $1.7M in total accrued bonuses awarded, their operational burn would have been near $4M.

They utilized $175k in asset purchases in the year, raised a net of $10.6M via private placement and received $128k via the exercise of stock options.

Overall with the benefit of the capital raise, the company improved their cash position by over 83% during the year.

Post financials in November, Gatekeeper raised an additional $12.6M after costs in a raise at a $2.10 share price with no warrants.

Share Capital:

110.4M shares outstanding including the November PP which works out to 18% dilution over the past sixteen months

4.75M options outstanding, all well in the money under 87 cents

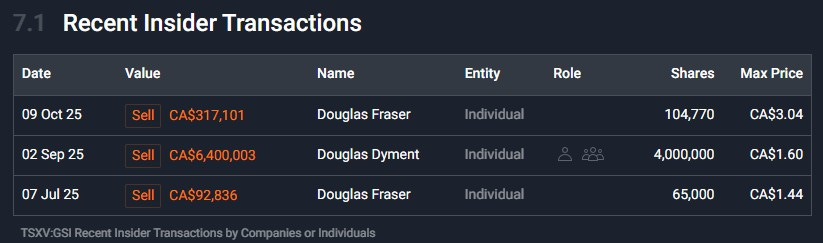

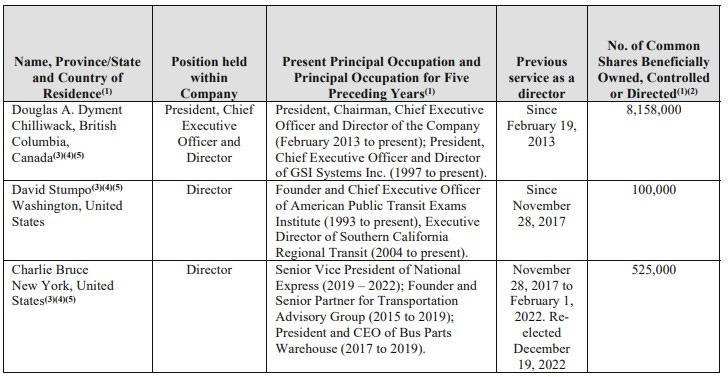

Insider ownership of under 5% and that is approximately half of what it stood at this time last year

The CEO, Doug Dyment sold half his stake at $1.60, interestingly just days after the company released their annual information circular.

Income Statement:

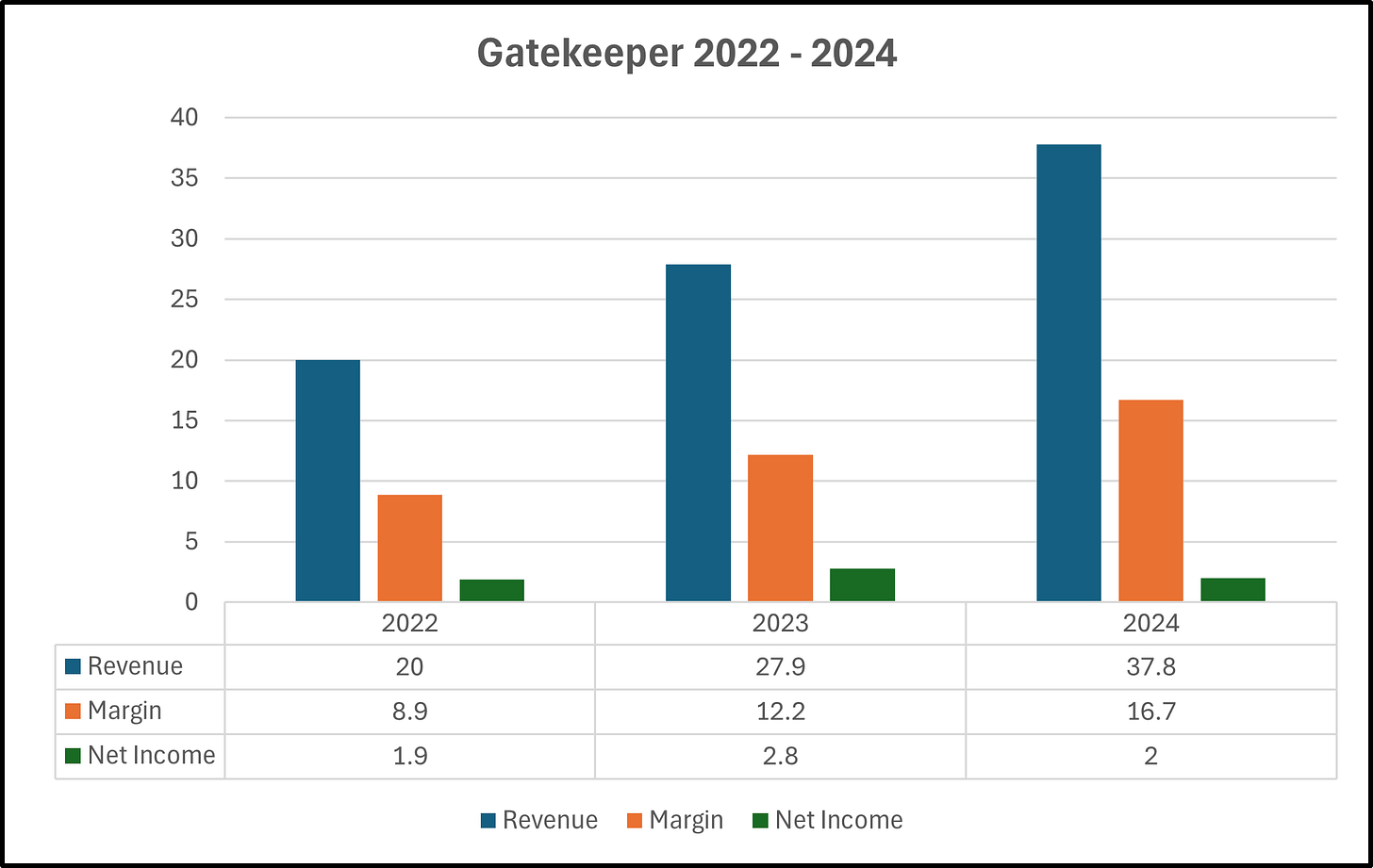

On the full year revenues declined by over $6M or 15.9% to $31.8M. Gross margin slipped by 440 basis points from 45.6% to 41.2% resulting in a decline of 24% in gross profit dollars.

Operating expenses also went the wrong way, increasing by 30% to $16.9M with all of their three main expense buckets growing by double digits. G&A grew by 30%, Selling and Marketing by 13% and R&D by 30%.

Overall a terrible trio of sales decline, margin erosion and significantly higher expenses all contributing to an $8M bogey to last year on the operating income line going from $4.26M of profitability to a $3.75M loss in just twelve months.

After a $2.5M birdie in income taxes to last year, their net loss in 2025 amounted to $3.07M compared to net income of $1.99M a year ago.

When we splice out their Q4 it is as follows:

Revenue of $11.1M down 5%

Gross profit dollars down 14.5% with margin erosion of 420 basis points to 35.7%

Expenses up 67%

Operating loss of $2.5M compared to operating income of $776k

While revenue likely exceeded many expectations the rest is a dog’s breakfast and results in a rarely seen double reverse Wolf Trifecta on both the quarter and the year.

Overall:

2026 now looks like a very interesting Bull v. Bear scenario.

On the plus side you have a company with significant potential in front of them shown both by their news over the past six months with large contract wins and operating in a sector where they are arguably a market leader with plenty of governmental spending which could potentially go their way.

The stock has also gained some new discovery and momentum with interest from the SCD crowd and other YouTube “personalities”.

But this past fiscal year leading into next year is not without some warning signals.

Below is the company I was interested in that made them a Wolf Pick:

Here is what that chart looks like today after their recent annuals:

That latest graph is not your typical performance for a company that has seen their share price increase by 225% in the past twelve months.

Revenue does not look like it will be a problem over the next couple of years. That seems pretty bankable right now but what will their margin and expenses look like?

Q4 of 2025 was their worst gross margin since Q1 of 2023 while operating expenses have gone from 39% of sales in 2022 to over 53% this past year. That is a terrible combination regardless of how well you’re doing on the top line.

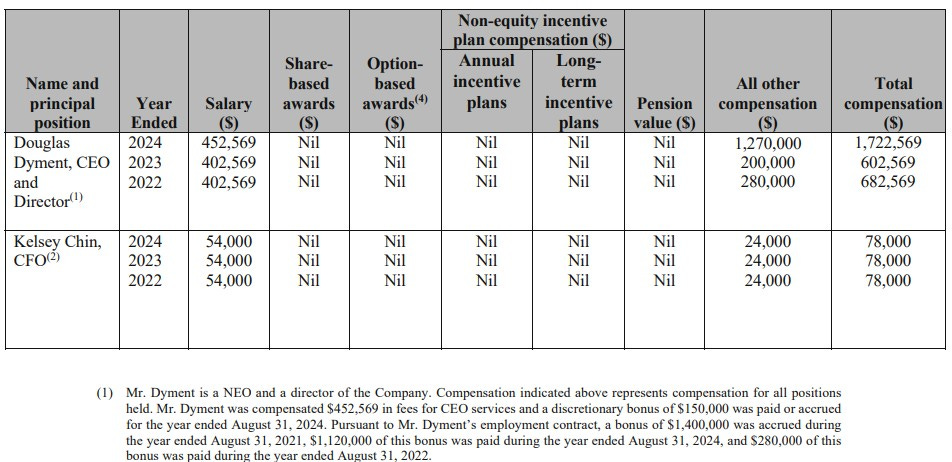

Now let’s get into the CEO’s compensation over the past couple of years, particularly surrounding the bonuses paid out over the past two years which totaled $3.17M. Those payments were granted during a time when the combined net loss over two years was $1.07M and represented 154% of the company’s operational cash flow over two years with $1.7M in bonuses still to impact their 2026 fiscal year. If the board could award those after two declining net income years, what bonuses will investors be looking at on improved results?

Deserved? Well, I think you know my opinion.

So how does one begin to develop their own valuation of Gatekeeper. The company doesn’t help much in that regard as they do not provide guidance nor do they report on their contract backlog.

Given the continued margin erosion, one does have to wonder how much the company dropped their pants by in order to obtain these new contracts, and what operational leverage they will have going forward. Recent trend is not their friend.

One potential starting point could be from recent Raymond James coverage, so let’s start with that. Their forecasts for 2026 is for $45M in revenue (a 45% increase) with adjusted EBITDA of $1.8M, and 72% of that AEBITDA number occurring in Q4. In that coverage they also give a $3 target share price which represents a 56% upside from yesterday’s $1.92 close.

A $3 share price would represent a $330M market cap. Since their current EV is close to their market cap today, let’s assume that continues. That’s a 183 multiple on Adjusted EBITDA. ADJUSTED. Even if you extend that out to their 2027 estimate of 7.5M on $67M in revenue, that’s a 44 multiple, and probably close to a 100 P/E metric two years out.

I was going into these financials thinking about what would be a good price for re-entry, and even with all of the positive news, I’m not sure what that is but I know $1.92 is not it. The top line is just not enough to get me re-excited here as I just don’t have enough insight into how they intend to put the profitability biscuit in the basket and that presents enough risk where that 56% upside to a very high valuation multiples isn’t worth it to me. Couple that with a management team halving their total insider position, not participating in either of their two raises, and awarding themselves egregious (IMO) bonuses - it’s a hard pass from me.

Could I be wrong? I have with Gatekeeper before, at least with a temporary share price surge. I’m ok with that.

Downgrading these financials to 2.5 stars but 2026 does present the opportunity for upgrades.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Christ, I'm not in on this company, but I gotta say wolf, it's great to be able to lean on your expertise and translation of a company financials...have a good new year !!

Thanks for the review, Wolf. I'm surprised at the poor numbers given all the news they've been putting out. The reverse Wolf Trifecta and those big bonuses mean I'm passing on this one.