I wrote about VSBLTY earlier this month covering their attempt to resurrect themselves from the depths of a long standing CTO (cease trade order). Another blast from the past is trying to resurrect themselves after trading was halted about fifteen months ago dating back to November of 2024. Once again for failing to file their audited annual financial statements, unable to pay their auditors, employees and vendors.

It’s possible I’ve written about FOBI just as much as any other stock since I started writing FINS reviews six years ago. Ironically it was also one of my larger wins in the last five years, entering around 30 cents and selling most of those shares in the $3 to $3.85 range.

So yes, I bought into the initial hype. Thankfully I was one of the first to see there was little behind it, and I’ve spent much of my time since trying to convince others including the regulators on the TSXV and CIRO.

At the start, the hype did have some merit. They had pilots with the likes of Sobey’s and Pharmassist which had the potential of their devices being part of tens of thousands of registers, terminals and checkouts across the country. There were “involvements” or “partnerships” with Shopify, Wynn Resorts, World Boxing organizations, ski resorts, planned Vegas resorts and a host of others that I’ve likely forgotten about. Heck, their software was even used at the Oscars since the pandemic and even once had a partnership with Canadian golfer, Adam Hadwin.

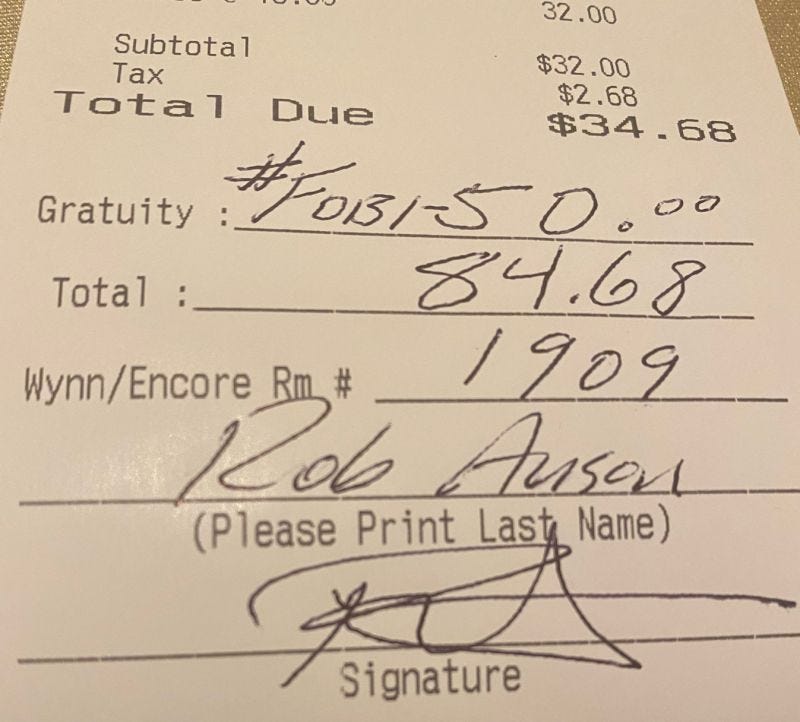

FOBI50 became a hashtag referencing the potential for the stock to get to $50 one day. The CEO himself latched on with pictures of FOBI 50 cakes and even leaving a $50 tip on a $35 bar bill.

Of course the stock never traded above $3.85 and when the CTO occurred in early November 2024, it sat at $0.04, 99% down from it’s peak.

Despite all of the warning signs along the way (yes, even now), FOBI bulls continued and STILL continue to hold out hope. They are the type of investors who wouldn’t heed the “Don’t Eat The Big White Mint” graffiti warning above a truck stop urinal.

It’s almost unfathomable that is has been over two years since I published my last full review of the company. I brought that back from the archive and included it below.

So, why am I deciding to write about the company now, a full fifteen months since the company stopped trading on the Venture?

Well, it appears they are attempting to resurrect themselves. They are back to putting out news releases, their twitter account is active again, and their IR partner Agoracom is back with new promotion as well. All around a FOBI 3.0 theme, much of which include videos with AI voiceovers.

They have nearly caught up on all of their financial filings too, dropping a dump of them in October including the latest; their Q3 filings which ended March 31 of 2025. With a June 30 year end , their annual filings would have been due at the end of November, and Q1 of their new fiscal year at the end of December. Therefore they are still owing the market two more sets, and I’d imagine they would have to release those prior to their CTO being lifted.

In June, the company introduced a new CTO (Chief Technology Officer), Uddeshya Agrawal.

Visionary is quite the word to use in a press release about your new incoming member of the C-suite.

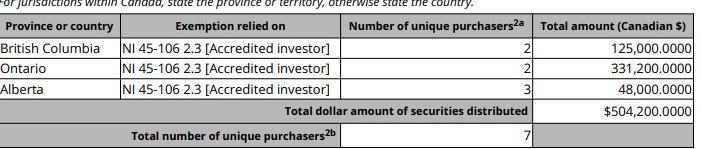

Most recently on January 23rd, the company closed a first tranche of a private placement for a little over $500k, issuing a little over 10M shares at an above market 5 cents. It appears seven shareholders participated based on that filing.

Based on that and a potential second tranche, the likelihood of FOBI trading once again in the not too distance future feels much more realistic. They are even out with new YouTube interviews discussing the new direction for the company. But here are top five reasons why I would be avoiding them like the plague should that day occur:

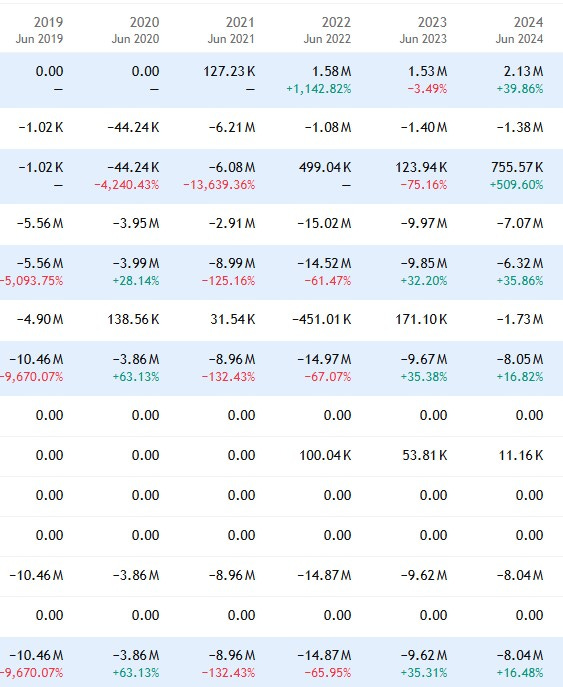

Historical Financial Performance:

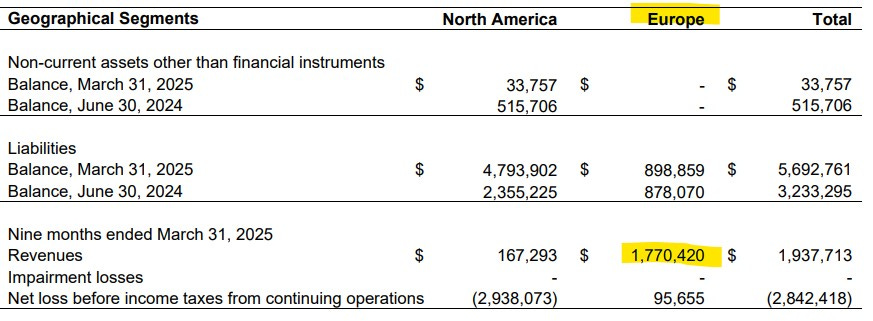

This one is pretty simple. Since 2019 FOBI generated $5.4M (USD) in revenues and $55.8M in net income losses. During that same time frame the company burned through $25.2M of operational cash flow, sporting a return on invested capital of -3770%.

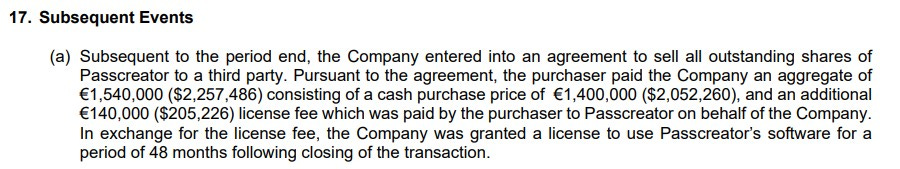

Best Performing Asset is Gone

Since FOBI has never provided systematic breakdowns of their revenues, this is a subjective opinion, but all clues point to the fact that Passcreator represented perhaps as much as 90% of their most recent reported revenues.

Guidance Lacks a GPS Signal:

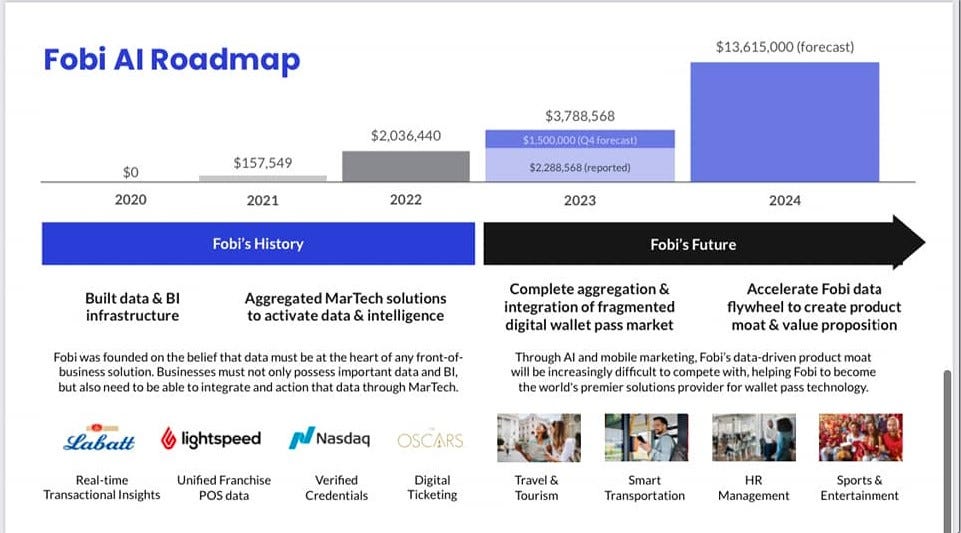

In 2023 the company provided guidance for the first time. It did not go well.

The actual reported totals were $2.02M in 2023 and $2.92M in 2024 compared to $3.79M and $13.6M forecasted. Even the YTD figure in 2023 turned out to be incorrect when auditors disagreed with their ideas of revenue recognition. That $1.5M Q4 forecast was made during Q4 and their actuals came in at $234k. Therefore they missed that virtually real time forecast by 84% and then their 2024 forecast by 78%.

When Revenue Isn’t Revenue:

Two examples to speak of here. The first was PulseIR - an investor relations platform that was meant to improve communication with investors via a mobile wallet app.

By my count, they signed three contracts for $120k each, all had some form of previous relationship with FOBI and none that you would consider a quality investment. These all ended up being service for share transactions which FOBI ended up selling at significant losses where they could.

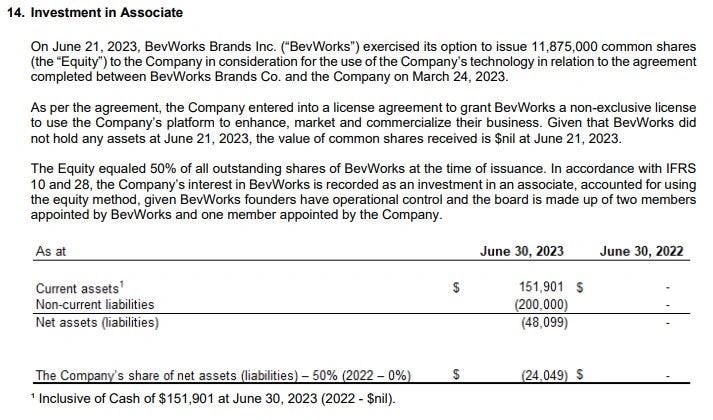

What I believe to be the biggest spectacle in the history of the company was BevWorks. This was initially announced as a five year, $10M contract.

In the initial press release in March of 2023 investors were told this about BevWorks:

“a Canadian beverage manufacturer that specializes in in-house production across various markets, including alcohol, beer, RTD (ready-to-drink) liquor, and alcohol replacement. With proven success in the craft brewery and hospitality industries, BevWorks disrupts beverage manufacturing through strategic M&As."

Two of FOBI’s biggest cheerleaders (the Big White Mint Eaters) were gushing upon this announcement.

This is how it was reported by their Investor Relations partner. A monster AI deal worth $10M over ten years.

Questions from skeptics immediately began to occur as Bevworks had only been registered as a business for a short time and their social media pages on Twitter and LinkedIn only launched days prior to this news release. In the first review following this announcement, I said this, “Colour me skeptical, but will FOBI get ten bucks from these guys, never mind $10M over five years.”

Three months later, the next press release announced a “Receipt of Payment” in regards to the deal. It turned out that the one time payment was an issuance of shares for 50% ownership of the company, thereby valuing this company at $20M. The release also stated that revenue would be recognized over the five year term per IFRS policies.

It turns out that the auditors needed to school FOBI on IFRS policies, as those amounts were never recognized as revenue.

The auditors didn’t even define it as a typical subsidiary, instead an “Investment in Associate”. The auditors determined the value of Bevworks to be $0 consisting of $47k in cash with $105k in non current liabilities. That was the extent of their balance sheet. Oddly missing from Bevworks balance sheet was any equipment that would be required to perhaps make some actual beverages. Instead of owning half of a $20M business, FOBI’s partial ownership of Bevworks was then valued at negative $29k.

The company’s first social media post came on the same day as the press release. They have not posted since August of 2023, and the bevworks.ca domain is now available. I’m considering buying it as a souvenir.

Insider Filings:

One of the reasons the stock received the attention it did in the early days was the CEO putting his money where his mouth was, or at least we thought. He very often purchased shares in the open market and exercised warrants and options - sometimes even out of the money.

When I did my analysis on the CEO’s personal and indirect ownership (through a company called FOBISuite) I counted 85 total transactions dating back to 2020 where he added to his share count, either through open market buys or exercising options/warrants. With a few exceptions, all of these were reported to SEDI within the required five day window. During that same time period, 225 transactions occurred with selling on the open market. Zero of those 225 transactions were reported on time. Over 200 of those transactions were filed and released to the market on March 12 of 2024, all of them between five and fifteen months late.

There are numerous examples of SEDI filings with open market buys that correlate to increased volume and a spike in share price. At the same time the market was not aware of the open market selling. The CEO even went on podcasts and complained about market manipulation while the market was unaware of him selling stock.

According to my analysis at the time, the CEO had a $2.38M net gain on trades of FOBI securities.

I could go on, and discuss the over paying of acquisitions like Qples, and the entertaining disappointments of NBC Comcast, and more. I think you get the idea by now. If FOBI 3.0 becomes a reality, remember how versions 1.0 and 2.0 went.

DON’T EAT THE BIG WHITE MINT!

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I've never heard the phrase "big white mint" till now. Thank you for adding it to my repertoire. I'm amazed at how this company just continued to spiral downward. How do you go from offering services to the Oscars and the NASDAQ (remember that?) to this CTO? Seriously, they've had relationships with some pretty big names but still somehow messed up.

Thank you Wolf for the great honest review with facts. May you continue the frequency and quality of the reviews. I will pass on fobi myself.