FOBI ($FOBI.V) FINS Review

2024 Q1 (From the archives - originally published Jan 16, 2024)

Well, we finally have them. The 2023 annual financials, originally due at the end of October, are finally in the hands of investors, bagholders, and doom predictors, albeit ten weeks late. At the same time, they also dropped their Q1 for 2024. I suppose for most of this review in terms of balance sheet and cash flow metrics I’ll use the most recent quarter but based on this mess that were released, I think we’re going to have to touch on the annuals in a big way also.

I also need to point out that the previous review for their Q3 should be ignored, given their Q3 and YTD numbers were revised after auditor intervention. More on that later. Let’s get into it - this could be a doozy.

Balance Sheet:

We begin with the worst shape FOBI’s balance sheet has even been in since I’ve been posting reviews, and that feels like an eternity. A balance sheet with a current ratio of under 1 is concerning, FOBI’s Q1 is .49 and that is after removing deferred revenue from current liabilities. As of Sept 30th, they had $161k in cash, $325k in receivables, $305k in prepaids against $1.64M in current liabilities due over the course of the next twelve months. No long term debt with $107k in deferred taxes. A very, very rough looking start.

Cash Flow:

After making some strides during the first three quarters of 2023 in terms of operational cash burn, they have regressed backwards in a big way, and at an inopportune time given what I previously said about the state of their balance sheet. In Q4 of 2023, they burned $1M via operations, and in Q1 of their new fiscal year, burned a staggering $1.75M. That is their worst operational cash burn of their last five quarters, and $60k more operational cash burn than the comparable quarter from last year.

During the quarter they raised $1.5M via their failed PP, and received $293k of funds through options being exercised. These were all exercised by the CEO while they were out of the money.

Post financials the company received $172k via exercised options, and $150k from exercised warrants. These transactions do not appear on SEDI, so one would have to assume they were not exercised by an insider.

So the cash listed on the balance sheet, the post financial warrants and options, and heck lets throw in the A/R too, amounts to $808k. Their accounts payable are $1.6M, and over the last six months of results have burned $458k a month. This math is very dire and that is information from four months ago.

Share Capital:

174.1M shares outstanding, with approximately 15% dilution occurring during their 2023 fiscal year

17.9M options and 6.9M warrants outstanding, all significantly out of the money

20% insider ownership (per yahoo finance)

$366k of SBC during the quarter, a fraction of the $12.2M awarded during the previous two years - about 3x the amount of revenue the company generated during the same time frame

Income Statement:

This may get complicated, this is a Q1 review but we need to revisit their 2023 annuals first.

In early May, when the company released their Q3 results, they reported $2.29M of revenue through three quarters. As of their audited year end income statement, they reported $2.02M, a .6% decrease against the $2.03M they achieved in 2022. But Wolf, the results after 12 months were $270k less than their revenues after 9 months - how can that be? Well, as suspected, it appears that the auditors had issue with revenue recognition from their much talked about Bevworks transaction. At the time of that big announcement, they reported a $10M deal over 5 years, which worked out to $500k per quarter. That was removed from Q3 revenues. I will rant more about this later. So that revision would mean that their Q3 was actually $750k instead of the $1.25M. Clearly not ideal. What is more concerning is their Q4 revenue only came in at $234k. While that is modestly up over Q4 of 2022, it is by far their worst quarter of the year revenue performance wise.

To finish up their 2023 P&L, they generated $15.4M in total operating expenses on those $2M in revenues, resulting in a loss of $13.4M before other items. Their 2023 payroll alone of $4.35M was more than double their revenue.

Let’s not move away from this revenue line just yet though.

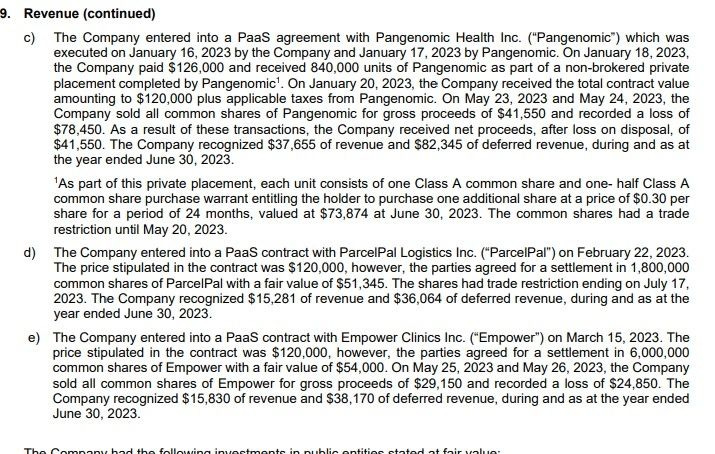

I mentioned my concerns many times of the PulseIR segment of their business and there are additional disclosures in their audited financials, and I’ve attached the notes related to it.

In 2023, FOBI entered into agreements with $NARA, $PKG, and $EPW, not exactly the class of the CSE. The original deals were for a total of $360k, but turned into $294k due to Empower Clinics being Empower Clinics. Of this, about $69k was recorded as revenue in 2023, with $156k going into deferred which will be recognized in 2024. Don’t expect any actual cash to come in for those sales which will be recognized through 2024 though. Of that initially announced $360k, they sold shares for $102k, taking losses on the rest not including Empower, which will likely never trade again.

So how did Q1 look. Well revenue came in at $733k, 38% better than the $532k achieved in Q1 last year. Operating expenses were over 4x those revenues unfortunately, at $3M, resulting in a loss before other items of over $2.27M.

Overall:

So, where to begin? Let’s just start with what investors were told over the past year, and I will try to be as straightforward for some of the longs who are a couple of figures to the left on the human evolutionary chart.

Revenues:

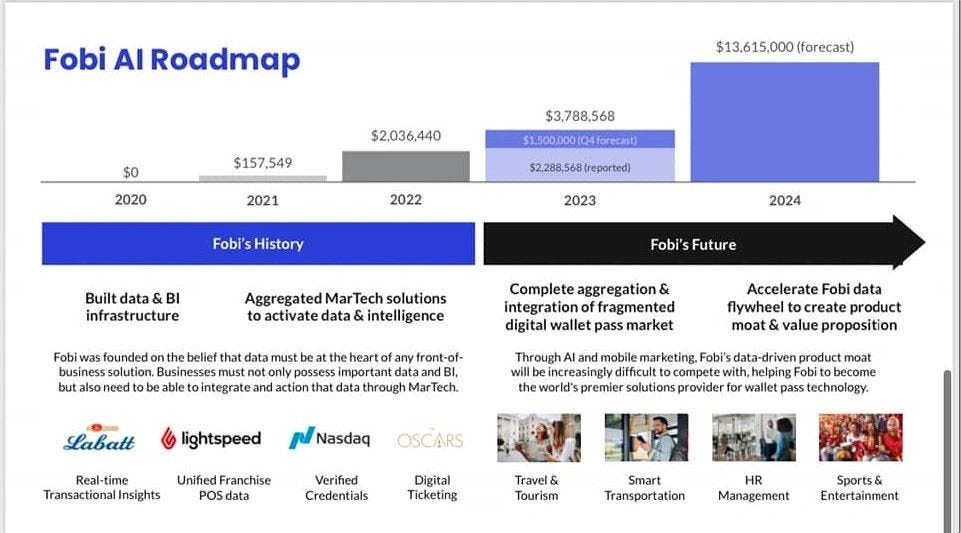

FOBI was projecting their Q4 at $1.5M. They delivered $234k. They missed their sales projection by 84%. Their year ended June 30th. This projection was discussed during their conference call in mid May, and that slide (image) was still available in their investor deck at least well into October, a full 3.5 months after their fiscal year ended. Even if you remove the $500k from Bevworks, they still missed this target by over 75%. How did they not know their April - June revenue numbers by mid October and miss them by that much? These projections were also included in analysts write ups from Echelon.

Bevworks:

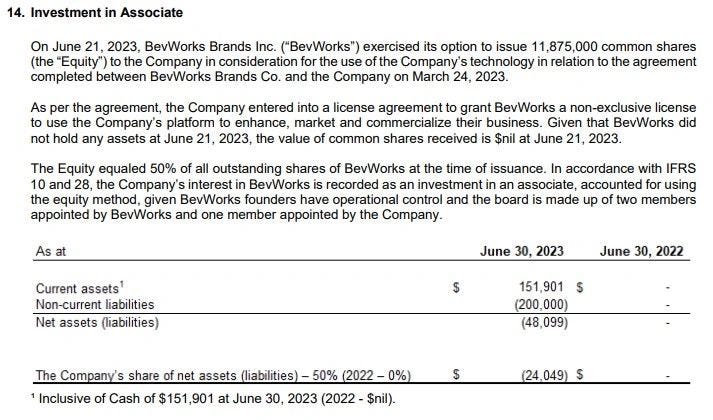

Announced in March of last year, was a $10M contract “The largest in company history” with a company called Bevworks over a five year term. Never heard of them? It’s ok because nobody else had either. From the press release we were told Bevworks is “a Canadian beverage manufacturer that specializes in in-house production across various markets, including alcohol, beer, RTD (ready-to-drink) liquor, and alcohol replacement. With proven success in the craft brewery and hospitality industries, BevWorks disrupts beverage manufacturing through strategic M&As.”

But outside of webpages and social media accounts (created around the same time as the press release), a lot of questions arose on Bevworks and how viable a deal this actually was and if FOBI would ever see a penny from it (See my Q3 review).

FOBI’s IR partner, Agoracom had a hard to be ignored 15 second promo where they called it a “Monster Artificial Intelligence deal” (see video)

Three months later, the next press release announced a “Receipt of Payment” in regards to the deal. It turned out that the one time payment was an issuance of shares for 50% of the company. The release also stated that revenue would be recognized over the five year term per IFRS policies.

It turns out that the auditors needed to school FOBI on IFRS policies, as that will not be recognized as revenue after all, as I had suspected for some time.

The auditors do not even define it as a typical subsidiary, instead an “Investment in Associate”. The auditors determined the value of Bevworks to be $0 consisting of $47k in cash with $105k in non current liabilities (As of Q1). That is the extent of their balance sheet. Oddly missing from Bevworks balance sheet is any equipment that would be required to perhaps, you know, make some fucking beverages. In fact, FOBI’s partial ownership of Bevworks is valued at negative $29k.

It’s hard to describe just how foul the stench is with this - what the initial news release purported it to be, and how much of a gong show it has turned out to be.

Positive Cash Flow:

How often did we hear that the company’s goal was to be “cash flow positive in 2023”? From the CEO, a couple of times for sure, but FOBI bulls ran with this like they were in Pamplona in July.

To be honest, during my last review I gave them credit for making strides in that regard. In Q1 of last year, they burned $1.69M, in Q2. $1.26 and $1M in their 3rd quarter. But Q4 was another $1M, and their most recent quarter was their worst in the last five coming in at $1.75M.

Recurring Revenue:

I have always questioned their former CFO’s statement of recurring revenues of 70-75%. If this were the case, how do revenues bounce around as much as they did during the course of the last five quarters. Recurring revenues bring stability, and predictability. Their five recent quarters from oldest to current were $532k, $501k, $755k, $234k and most recently $733k. Their best quarter ever was EIGHT quarters ago at $922k. This is far from what I would expect from a company with a high percentage of recurring revenues. It is also worth noting that their North American revenues, which would include PulseIR numbers was down 16%.

In conclusion, FOBI’s biggest problem right now is their cash position. Their liquid assets are half of their current accounts payable, and this does not include many other amounts included in their monthly cash burn. Options and warrants are way too far out of the money to think there could be any assistance to the treasury, and their last PP was disastrous, unable to close 50% of what they initially wanted to. Debt? I don’t think so. So where is the next wave of funds going to come from? It’s going to have to come from insiders again in my view as if they couldn’t complete a raise in September, they sure as hell aren’t going to be able to after these results. With the share price as it is, to fund what they appear they need to make it through 2024 would come with serious dilution.

The company has lost over 70% of it’s market cap value since my last review eight months ago, and their current $18.6M valuation feels about 70% too high again. Coupons, wallet passes and hobnobbing once a year with Hollywood’s elite at the Oscar’s isn’t saving this very sick puppy and these financials give the appearance that someone needs to take FOBI out behind the barn.

Absolutely brutal from top to bottom, and as a result will receive just my sixth ever zero star rating.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.