My initial reaction is ouch, followed by a series of expletives upon initially reading the press release and skimming these financials.

Initially covered back in the fall of 2023 is when Enterprise first hit my radar screen. I was so impressed with them I made my original entry in the 45 cent area. Not long after I selected them as one of my 2024 Wolf Picks.

After an incredible first half which resulted in an upgrade to 4.5 stars, I downgraded the company after their Q3 for their “Turd in the punch bowl” like results (which you can relive below).

After that review the stock traded very bizarrely reaching as high as $2.69 on two occassions coming all the way back down by nearly 40% over the past couple of weeks. In the past year the stock has been selected by multiple pundits, including BNN which resulted in Enterprise trading way over their ski’s. In hindsight, cashing out with a six bagger a few weeks ago to re look at it later might have been the right play.

Are these financials as bad as they appear on the surface? Will a dip on these numbers present an opportunity? Am I still long term bullish? Let’s find out together.

Balance Sheet:

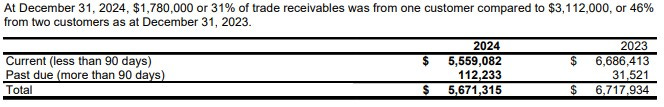

Despite the poor P&L numbers, Enterprise’s balance sheet is likely in the best shape I’ve seen it in. They have an incredibly strong current ratio of nearly 8.5 that consists of $30.7M in cash, $5.7M in receivables and $4.8M in other short term assets overtop of just $4.9M in short term liabilities. With their cash position covering their short term liabilities by a factor of over 6x, they are extremely liquid and well positioned.

The reason they are in this enviable position came at a rather costly raise to shareholders when they raised $28.75M worth of capital at $1.90/share back in December. And that was the second raise of their 2024 fiscal year as they also raised $7M back in March at 85 cents.

Accounts receivables are solid and Enterprise has $20.7M worth of debt which is slightly down from last year.

Cash Flow:

Enterprise delivered $12.1M in operational cash flow during 2024. At over $1M per month is quite the accomplishment given their size, but that is 10% less OCF than they delivered in 2023.

As I briefly touched on, the company had a shit ton of financing activities. Two separate raises which brought in a total of $35.75M to the treasury, $3.2M of warrants, options and broker options were exercised, they paid down $830k worth of debt and mortgage costs and incurred and paid $2.7M worth of interest costs. On the investing side, much of that influx of capital was used for net purchases of $16M worth of assets.

Overall the company improved their cash position by over 8x during the year.

Share Capital:

After reducing their float in 2023 buying back about 2.5% of the float, Enterprise now sits at 77.2M shares outstanding with an incredibly high 55% dilution during the 2024 fiscal year

4.4M options outstanding, all ITM with 900k issued and 1.6M exercised during 2024

2M warrants and 250k broker warrants, again all ITM under $1

Insider ownership down to 30% ownership from 35% due to dilutionary measures

No insider buying since January at 77 cents, but insiders have sold on the open market to generate proceeds to exercise their options

Income Statement:

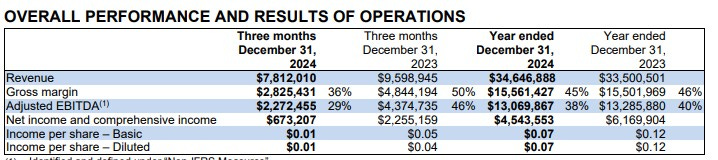

On the full year, Enterprise delivered $34.6M in revenue, just a modest 3.4% increase over last year after being up by 30% through their first two quarters. Gross margin came in less on a rate basis dropping by 170 basis points to 44.9% thereby only delivering 0.4% more in gross margin dollars.

When you see numbers like the above you would like to see operational spending curtailed to offset. We in fact saw the opposite with 9.2% more spending in the company’s only cash burning expense bucket.

You’ve heard of the Wolf Trifecta, this is a No-fecta, and I’m still just speaking about the annual results.

After 46% more interest expense on their debt, the company delivered $4.67M in net income, down a very hefty 24% from last year. With the dilution that worsens with EPS figures of 7 cents a share vs 12 cents a share last year, down 42%.

Looking at Q4 alone is an ass puckering experience with an 18.6% decline in revenue, 1400 basis points in margin erosion and a 70% decrease in profitability. I feel that is pretty sufficient with no need to comment further.

Overall:

So yeah, there isn’t much point trying to put any lipstick on this pig, so I’m not about to.

The first half of the year compared to the back half of the year is like a read through of Dr. Jekyll and Mr. Hyde. During the first two quarters, Enterprise produced $20M in revenue with $4M in net income. In the last two, $14.6M of revenue with $470k in net income. Maybe a better comparison is when I go out and shoot 38-48 during a round of golf.

I’m suddenly reminded by this video clip:

So, am I pissed? Yeah I suppose you may have garnered that through my tone. Unlike many, I will call a spade a spade even when it’s one of my former annual picks. Company’s like this are not immune to bad quarters, particularly micro caps, and even more so in this type of sector. But I am extra pissed when management has been out there with glowing comments and putting statements out like this in their press releases.

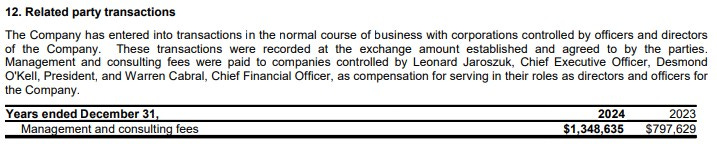

Adding insult to injury is shit like this with a 69% increase in related party management and consulting fees.

Ok, deep breath.

At the end of the day the company still put up 13% net income on the bottom line and that is still light years above most company’s I review. Another plus is they eliminated the vast majority of their debt, settling $15.7M of debt.

Up against a big quarter next time out. We need a lot better than this to remain bullish.

From 4.5 stars, to 4 stars, and another downgrade here. Awarding 3.5 heavily influenced by the year as a whole. Q4 on its own was a three at best.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Nice review wolf, appreciate the honesty and proffesionelism

Thank you for all your work. I look forward to all of your analysis. I have learned a lot on how to look at financial reports from your approach.