Well, yesterday sucked. Enterprise group appears to have left a floater in the punch bowl with their Q3 financials that were released pre market on Friday and the stock was absolutely hammered finishing down over 19%.

As one of my five 2024 annual picks it was a little painful to watch, as it was for many longs.

To put things in a perspective, the long term trend line here is still very positive, and could be a point to attack if the stock continues to slide. Enterprise is still up 133% from my 2024 selection and almost a four bagger from my initial 4 star review and initial buy at 45 cents back in May of 2023.

The stock was getting way ahead of it’s ski’s at $2.50 back in October, getting additional exposure from sources like BNN among others. I was expecting a pull back and wake up call, but I can’t say I was expecting the headlines yesterday. Maybe the moral of the story is to get in when I pick it and not when Bruce Campbell does (I’m teasing).

Let’s dig in and see if it’s as bad as it looks.

Balance Sheet:

Very strong current ratio of 3.8, consisting of $8.1M in cash $5M in receivables and $2.4M of other short term assets against only $4.06M in liabilities due over the next twelve months. Their current cash position is more than double their commitments over the next twelve months with an additional $5M in A/R so liquidity is very strong, but it is notable that their ratio was 4.2 three months ago.

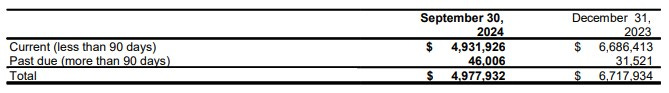

You won’t see an A/R aging report looking any better with 99% current. Enterprise has $17.2M of debt and a $3.5M mortgage.

Cash Flow:

Enterprise has generated $12.1M of operational cash flow YTD, 14.5% better than they achieved last year, and even in this latest lackluster quarter, delivered $1.5M of positive OCF.

They have paid down $500k of debt, a whopping $2M in interest and borrowing costs, raised a net of $6.3M earlier this year and have received $2.25M via exercised options and warrants so far this year. They have also invested and utilized $13.1M into hard assets including $5.5M for a new plant under construction. Overall, Enterprise has improved their cash position from the start of the year by 115%, $3.8M to $8.1M

Share Capital:

60.8M shares outstanding, 22% dilution from the start of the year primarily from the previously mentioned raise

5.1M options, all ITM with 5.1M at 45 cents expiring next November

2.6M warrants, all ITM at 95 cents expiring in early 2026 and 247k broker warrants at the same terms

Fully diluted float of approx 68.7M shares

35% management and insider ownership per the company’s latest investor deck

Latest NCIB program expired in August that went unutilized but over their history have bought back over 11M shares

No insider buying since January at 77 cents, but insiders have sold on the open market to generate proceeds to exercise their options

Income Statement

What you are feeling right now is your gastrointestinal tract quivering.

A bedshitting performance on the top line of $6.8M, 19.4% down from the similar quarter last year. Gross margin was exponentially worse bringing in 35% less margin dollars than a year ago due to a near 900 basis point erosion in GM rate, from 46% to 37.1%. To top it all off the spend 50% more in their only cash burning expense bucket - G&A. Tack on nearly $700k in financing expenses and that results in their first losing net income quarter in the last five with a $200k loss on the net income line. A tough quarter such as this also puts a large spotlight on the company’s debt.

On the year the company has delivered 12.3% more revenue from $23.9M to $26.8M through three quarters. Gross margin looks a lot better as well on a YTD basis which is up 300 basis points over last year up to 47.4%, producing 19.5% more margin dollars on 12% more business. They have also converted better on a YTD basis on their G&A expenses, up 11%, and that all equates to producing 15% more operating income. Unfortunately, due to almost $900k in additional financing expense due to their increased debt, they give that all back, finishing a little worse than flat on the Net Income line, $3.9M vs $3.9M.

Overall:

Sadly, the quarter itself is as bad as the headlines read. I personally think the companies commentary surrounding the quarter was equally weak. The latter part of their commentary however, regarding the positive outlook for the remainder of 2024 and next year do stack up, and they are positioned very well to take advantage.

These are not the 4.5 star financials that we looked at three months ago so we are certainly downgrading them, but by how much? Even with the soft quarter, they are still trading under 3x TTM revenues for a company that delivers 17 cents of every revenue dollar to the net income line. It’s EV/EBITDA ratio is around 7 but keep in mind that the ITDA portion of that is growing faster than the actual E.

The quarter alone is a three to three and a quarter star at best, but their YTD performance and outlook are still deserving of four.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Mgmt team not giving more infos on this quarter is crazy

This analysis of Enterprise is still intact and it includes a 1 hr 28 min video interview with Des O'Kell (president of Enterprise) https://rockandturner.substack.com/p/enterprise-group-the-soaring-eagle

One quarter is just white noise. The big picture looks great.