After a long hiatus, ECOM came back on my radar in July when they reported Q2. In the midst of writing that review I decided to open a position and I’ve since added to it, on a 7.5 dip. Initially that was a article for paid subscribers only but I’ve recently opened that up to all subscribers which you can peruse if you choose below.

Emerge Commerce ($ECOM.V) FINS Review

While I briefly discussed ECOM in my August “What’s Wolf Watching” piece a couple of week ago, I haven’t covered the company’s financials since the end of 2022. That review did not go very well, a bi…

Emerge released their third quarter this morning. Much of the highlights are not news to the market as the company pre-released preliminary numbers on October 22nd. I therefore anticipated a rather muted response and as I write this in the mid-afternoon, that appears to be the case. Even with that lack of investor excitement today, the stock is up 171% YTD.

What do the FINS tell us that the preliminary highlights didn’t, if anything?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Current ratio isn’t a strong starting point at .94, but it is miles better than the putrid looking .39 they were at the beginning of the year which speaks to the potential turnaround story. At the end of Q3 they held $4.3M in cash (including restricted), $2.7M worth of inventory, $550k in receivables and $460k of prepaids over top of $8.56M in liabilities due over the next twelve months (deferred revenue omitted).

While no aging reports are disclosed detailing their A/R, 70% are from payment processors so no issues there.

ECOM holds $8.3M of debt including convertible debentures and an eight year inventory payment plan as part of their acquisition of Tee 2 Green. A pretty shrewd part of a solid acquisition which I covered last quarter. The remaining portion of $5.7M is within a recently renegotiated debt facility. Emerge’s total debt is significantly down from the start of 2024, when it stood at $16M.

Big improvements but still plenty to do to improve their liquidity with their quick ratio of .57. Their cash + A/R sits $3.7M shy of their 12 months financial commitments.

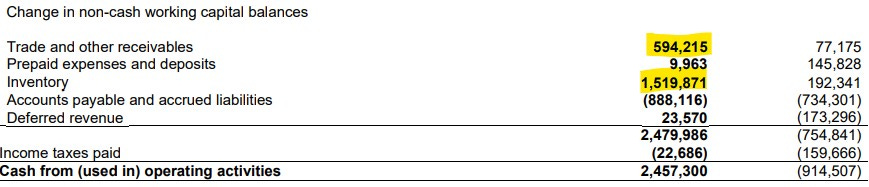

Cash Flow:

Emerge also has big improvements within their operational cash flow (OCF) this year growing to nearly $2.5M generated, compared to burning over $900k at this stage in 2024. That improvement also includes some pretty significant adjustments for inventory and receivables, so trying to trend this forward is difficult.

ECOM utilized $750k (net) on their acquisition of Tee 2 Green, disposed of another one of their brands, Carnivore Club for $370k, received $280k from options and warrants and paid out over $800k in interest and debt issuance costs.

Overall their cash position has improved by 34% since the start of the year.

Share Capital:

149.5M shares outstanding, 7% dilutive measure YTD via the acquisition, exercise of options and warrants, and vesting RSU’s

In terms of outstanding warrants, that is a bit of a story in itself. They key point is within a matter of weeks, 0 will be outstanding. A big 12.2M overhang of 10 cents expired two days ago - that was the rationale for the 31% gain in stock price on Monday.

650k options outstanding, all out of the money

2.9M RSU’s outstanding, all on an unusually accelerated one year vesting sked

Insider ownership at 13.4% per Yahoo Finance

The CEO has purchased 80k shares on the open market since Q2 financials and exercised 90k of OUT of the money warrants. Something I’d never do but a nice signal to the market.

Income Statement:

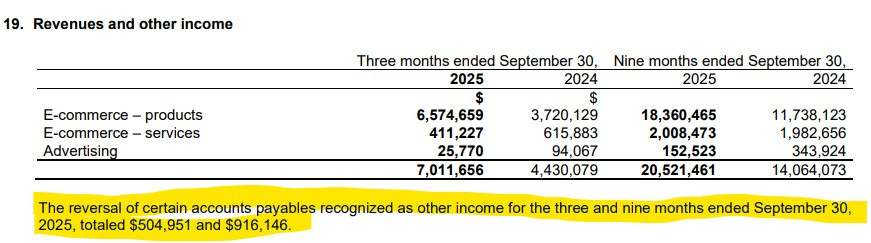

Revenues continued there very positive trend post acquisition with $7M in the quarter, a 58% increase over the comparable period. Those additional revenues came at a big expense to margin with nearly 600 basis points of erosion down to 34%, therefore only bringing 35% more dollars on 58% more business down to the gross profit line.

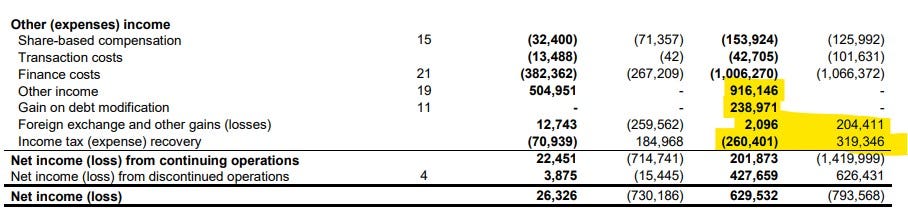

Conversion on expenses were quite good, with cash based operating expenses only growing by 13.5%. That produced positive operating income compared to a loss of $300k last year. It gets a little messy underneath with SBC costs oddly below the operating income line, $382k of finance costs and an usual $505 one time gain.

The circumstances for amounts like these falling into the other income bucket are rather rare. Certainly not something you could consider quality earnings and something to back out when valuation modelling. I don’t recall catching this in my last review TBH. Wolf is not infallible it would appear.

That one time gain helped contribute to a slightly positive net income of $26k, an improvement over the $730k loss, but maybe not quite as good as it initially looks. Hmmm.

Through three quarters, their P&L stacks up as follows:

Revenues up by 46% to over $20.5M

Gross margin of 36.2%, a 520 bp decline. Gross profit dollars up 27.5%

Cash burning opex up 6.5% showing nice conversion, particularly with including costs stemming from the acquisition

Net income of $630k vs a loss of $800k last year

Overall:

Going back to that last bullet, there is a lot of noise underneath the operating income line. Those unusual items including the gain from reorganizing their debt is $1.15M. On the flip side they did not benefit from foreign exchange like they did last year and they had a $580k bogey by paying $260k in taxes this year vs a recover of $320k last year, not to mention the impact of two years of right sizing (discontinued operations).

So if you try and normalize these earnings (omitting all of that highlighted shit and discontinued operations it looks more like a $700k loss vs a $1.9M loss pre tax impact. Improving, yes but maybe not the positive net income producer one might think at first glance.

As much as the highlighted numbers above impacted the results, the margin erosion was as much if not more of a differentiator. In my last review I included the following line from their MD&A.

In Q3, an additional 23% sell through of the Tee 2 Green inventory was achieved. So they have about 1/4 of that merch left so it appears these one time adjustments will happen at least one more time. That makes it harder to project what to expect on the margin line a little bit going forward. The comparable figures are nice, but if it’s based on fair value they will need to procure new inventory to replace it in order to have more stuff to sell. If that’s at a similar fair value, margins would remain relatively unchanged without a big improvement in the quality of their buying.

My more immediate concern may be the balance sheet/cash flow situation. That $3.7M quick ratio shortfall doesn’t look like it can be offset by the next twelve months of free cash flow. The company seemed pretty adamant they were not looking to increase debt on the conference call, so that leaves capital through dilutive measures, and it’s really tough to imagine that not happening at some point in 2026.

The CEO is still talking very aggressively, and talking about additional acquisitions despite those balance sheet concerns should opportunities present. Ghassan is more active on the social media side, and from what I hear has also joined my former discord. Mixed feelings on this - aside from Sean Black, the CEO experience in discords I’ve been associated with have not ended well. Let’s not turn into Michael Saylor here, Ghassan.

We’re looking at at a Venture company with a market cap under $16M here, so anyone expecting a wart free business is kidding themselves. However, they are in a much more positive place than they have been in years. They look like a different company on the upswing, and that’s why I’m taking a shot. The upside appears to outweigh the downside risk. I’m not putting a ring on it just yet, but I’ll play just the tip to see how it feels for a while.

Maintaining 2.75 stars with hope of better ratings to come.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I think I agree with this assessment. More good than bad but worth a punt.

Thanks for the review, Wolf. Not my kind a company, but still appreciate learning more about it.