While I briefly discussed ECOM in my August “What’s Wolf Watching” piece a couple of week ago, I haven’t covered the company’s financials since the end of 2022. That review did not go very well, a big downgrade to one star.

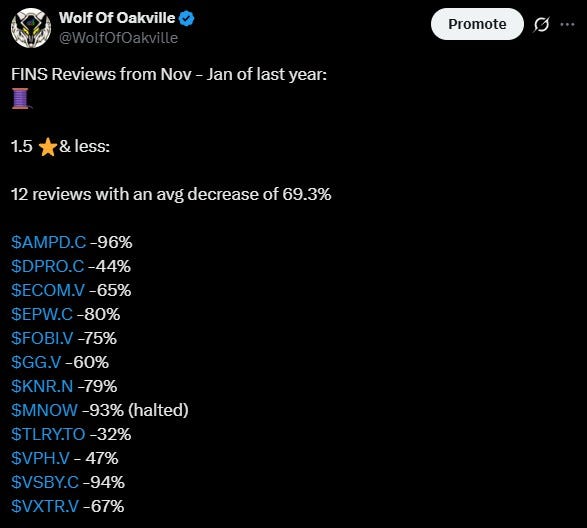

One star reviews historically have been a pretty good warning sign that the share price is in trouble. In January of 2024, I took a look back at a three month window of stocks I awarded 1.5 stars or less to. A year and a half later, a good chunk of those stocks aren’t around or not trading anymore.

Emerge Commerce is still around, still trading, and may even be seeing a resurgence with the stock tripling in value from their three cent lows at the end of 2024. Clearly, miles away from their covid highs trading in the $1.70’s.

Here is how I ended my review nearly three years ago. Yes, my writing has always been this witty and charming. I was also a customer of one of their brands - TruLocal for sometime.

Is this recent resurgence in share price enough to take them off that ignore list? It just might be, but let’s drill in a little further.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Even with $700k of deferred revenues removed from their current liabilities, their current ratio sits at a lackluster ratio of just .92 consisting of $3.7M in cash including $200k of restricted funds, $3.1M worth of inventory, $570k in receivables and $350k in prepaids against $8.3M in liability commitments due over the next year.

While you never want to see a current ratio under 1, if you look back just six months ago, their current ratio was a putrid looking .39, indicating some significant improvement since.

A big part of that improvement was a renegotiation of their debt, now sitting at $5.8M which could extend the debt’s maturity as far as April of 2027. It’s also notable that this debt load is down from $16M from the start of their 2024 fiscal year.

Even with those improvements if you add up their cash and receivables, they are still over $3M shy of funds to cover just their A/P and that is before we get to other commitments such as taxes and lease payments. Also not included in that is an unusual “inventory payment plan” which relates to their April acquisition of Tee 2 Green. More on that later.

While the balance sheet is improving and looks a heck of a lot better since the start of the fiscal year, they still do face some liquidity challenges ahead, making this next section more important.

Cash Flow:

At the halfway point of the year, ECOM has delivered $1.54M of operational cash flow which is over a $2M improvement compared to the $500k of operational burn experienced at this time last year.

Outside of operations, ECOM had a net cash outlay of $750k for the acquisition of Tee 2 Green, disposed of their Carnivore Club brand which generated proceeds of $370k and paid out $400k in interest costs. Overall the company has improved their cash position by 14% from the start of 2025.

For the quarter alone, ECOM generated over $2M in operational cash flow, but due to assists from working capital changes I don’t think we can expect that good of a number on a continual basis moving forward, but they are headed in the right direction.

That trend is much needed to assist with their short term liquidity challenges, but this needs to be closely monitored on a quarter by quarter basis. The potential for some form of a dilutive raise cannot be taken off the table.

Share Capital:

146.7M shares outstanding, with nearly 19% dilution over the last year and a half from debt conversion, the Tee 3 Green acquisition and over 9M RSU’s - hmmm

As of June 30th, 29.8M warrants outstanding - all out of the money and all expiring before the end of this year. Interestingly 12.3M have already expired since these financials and 2.7M were exercised while out of the money at a dime.

The CEO was responsible for 90k of those money losing warrant exercises, but no indication on who exercised the other 2.6M in SEDI filings

700k options outstanding, half ignorable at 92 cents expiring in a year with the other half at 11 cents not expiring for over two years

2.9M RSU’s outstanding from a June issuance

13% insider ownership (per Yahoo Finance)

Nothing significant in terms of open market activities by insiders although exercising out of the money warrants is interesting. The CEO has randomly slapped the ask over the years for small amounts but of the 2M more shares owned since my last review, most have come the way of free RSU’s within their SBC plan

3M shares issued as part of the Tee 2 Green deal with a 180 day lock up period. That expires on or around Oct 5th so keep that date in mind when perusing the L2

Income Statement:

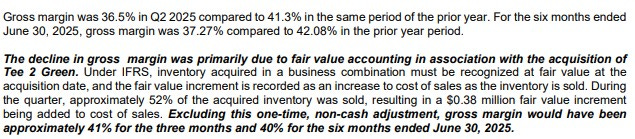

ECOM reported very strong revenue in Q2 driven in large part by their April acquisition of Tee 2 Green. Revenue came in at $8.5M, an increase of 70% on the comparable quarter yet non comparable business. That revenue came at the cost of 550 basis points in gross profit rate which fell from 41.9% down to 36.4%. I initially thought that this was the result of the acquisition and going forward we could expect their new blended margins to come in lower.

But it appears that could be just temporary with normalized margins very much in line with what they achieved last year. That is a $425k one time non-cash hit and without it would have trickled all the way down to the net income line. Cash burning expenses grew by 18% in the quarter, but that is pretty darn good conversion on 70% more business.

Net income in the quarter came in at $200k vs losing $550k in the comparable quarter.

YTD numbers are as follows:

$13.5M in revenue, 40% more than their halfway point last year

Gross profit rate of 37.3% down 480 basis points from 42.1%

Cash burning expense growth of only 3.3%

Net income of $600k vs a loss of $63k through two quarters

Overall:

The company certainly looks more attractive than they did a few years ago going from a cash burning pig to one that is now OCF positive and producing a small profit for the third straight quarter. The rather large margin hit looks to be a one time thing, but if you normalize that you also have to consider the majority of their current YTD net income comes from the one-time gain from selling off Carnivore Club. If you tried to generate an NNI number (normalized net income) it comes pretty close to netting back out to what they delivered. If we then annualize that it comes to about $1.2M. At a $14M market cap that’s a P/E of under 12 that should deliver some relatively healthy revenue increases over the next three quarters. They delivered $8.5M here and their next three quarters they face are $4.6M, $5.6M and $5.0M respectively. That presents some future earnings pop potential if they can deliver margins in the 40% range and remain lean within their opex.

A big part of their Q2 success stemmed from the Tee 2 Green (T2G) acquisition so let’s get into that, as it was a very interesting purchase. The deal closed just a week into the second quarter and Emerge paid a purchase price of $2.2M, half of that up front, $900k deferred over three years and 3M shares valued at $200k eluded to earlier. They also received $2.3M worth of inventory which is going to be paid over a period of EIGHT years, a pretty unheard of advantage as long as I’ve been reviewing M&A within microcaps.

From an early July press release disclosure we know that T2G produced $3.3M of Q2 revenue which was up 34%. They also sold through about half of the inventory levels that they will be paying for over eight years bringing tremendous cash flow advantages. By parsing out the T2G numbers the rest of Emerge Commerce banners would have grown organically by 3% in Q2. Note that QoQ numbers could be a little challenging as T2G is highly seasonal with Q2 representing about 40% of their annual business.

T2G now joins two other golf brands under the Emerge portfolio now representing 3/4ths of their brands. This should allow for a lot of synergies moving forward from purchasing to operations leverage.

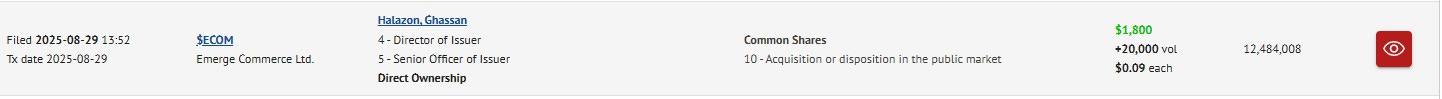

I think you’re getting the idea that I’m starting to like them here and that would be an accurate statement. In fact if you’re a regular within the Wolf Den discord than you probably know I took a position mid day on Friday on the dip to eight cents.

Sometimes timing is everything and later in they day the CEO filed an insider buy about an hour after my entry. Let it be known that I bought a hell of a lot more than he did, but it did help the stock close up on the day at 9.5 cents, a quick three hour gain of 19% for yours truly.

While directionally I like the potential here, Emerge is not without it’s problems including liquidity challenges and that brings with it potential dilutive measure to raise capital. As the share price increases that could be more attractive for the company to look at those option.

But I’m in to see where this goes over the next couple of quarters at least. Let’s ride.

2.75 stars but since it’s been so long, it’s hard to call it an upgrade.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.