<Updated charts added between introduction and 2026 Picks>

2026 will be my sixth year performing reviews of the financial statements of micro-cap companies. These picks will be my fourth time announcing my annual picks to that community.

2025 was the first year where I began selecting mid-year picks, because why wait when a stock stands out to you that much. Those ones I affectionately refer to as my Seal of Approval picks. Combined, I have now announced 19 of them across three years. Ten of those picks or 53% of them went on to at least triple. An equal investment across all nineteen picks would be up a combined 419%, or a 105% average annual return.

That would also mean that you would hold nineteen microcaps (not recommended) and Happy Belly Food Group would represent over a quarter of your portfolio as the stock has gone 21x from when it was selected at a dime. Currently, I still hold seven of them.

No matter who you are, all of your micro cap picks are not going to turn out to be Happy Belly, Kraken Robotics (11x at peak), NTG Clarity (19x) or D-Box Technologies (6x since selected in February). As I was preparing to write this article over the past few days, I couldn’t help but think of a few of those picks that haven’t gone so well. Let’s face it, if I don’t bring them up, my haters sure will. That caused me to tweet the following on Monday morning. Since my annual picks are my most read articles I think it is important message.

If past is prologue then I will likely hate one of the picks I am about to discuss in about six months time. It’s a funny thing to think about right now but it happened with Now Vertical in 2023, Simply Solventless this year, and to a lesser extent Thermal Energy Group in 2024 - while I no longer hold TMG I still think there could be better days ahead. The message I’d like to convey here is I only took a small loss on one of those nineteen picks - HASH. Continuous evaluations of your microcap holdings is a paramount task - these are not set and forget blue chips.

That doesn’t mean that all of my exit decisions are great ones either. I exited Gatekeeper Systems before the big run up which peaked at 6x from my 2024 Wolf Pick, but we move on and look for the next one.

One of the things I pride myself most in is telling my readers exactly what I’m thinking, including listing concerns for any stock that I’m currently holding. That message goes out to all CEO’s as well. I may compliment you today and publicly pull your pants down tomorrow.

How about we get into the 2026 edition?

January 1st chart updates:

Atlas Engineering Products ($AEP.V)

Progressive Planet ($PLAN.V)

iFabric ($IFA.TO)

Pharmacorp RX ($PCRX.V)

Pudo Inc. ($PDO.C)

Avg return up 31.1% from paid subscriber release on Dec 17.

Atlas Engineered Products ($AEP.V)

We are going back to the well with the first pick as Atlas was included in my 2023 version of annual picks. Just three weeks ago I covered their Q3 results pretty extensively so I suggest starting your reading below as it outlines many of the reasons why they are being chosen here in 2026.

In the article, I discuss one of the risks being a slower than anticipated rebound in macro conditions. That risk is real, particularly when you consider much of that momentum will come from governmental involvement. But even if that macro turn around is slower than expected, I still think there are many reasons to like Atlas going into 2026. The first is the rather weak comps they will be reporting against, and it starts when the company reports their Q4 towards the end of April.

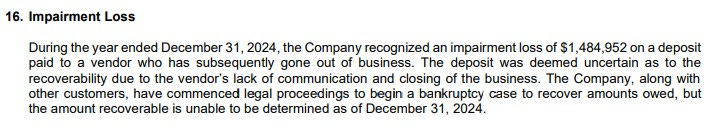

AEP suffered an $800k net income loss in Q4, and this was mainly due to a $1.5M impairment they incurred due to a lost deposit from a vendor bankruptcy. I think it’s safe to say that will not repeat itself.

While not large dollars, they will also have the benefit of their latest acquisition, Penn-Truss included in their next three quarters on a non comp basis. Their automated robotics facility in Ontario is also anticipated to be operational in Q3.

I think my thesis can be summed up best this way. I first liked them in mid 2022 in the 50 cent range. It went on to triple from there and then suffered mainly due to poor macro conditions with the industry hitting the bottom cyclically. We’re three years later, the price is once again back in the fifties, the macro cycle is on the verge of an upswing period and they are a much larger and stronger company then they were in 2022.

Progressive Planet ($PLAN.V)

I ended the last pick with a summation of my thesis so let’s start with Progressive Planet’s.

To me, Progressive Planet is like investing in a speculative pre-revenue play, but one that already has a profitable and well run legacy business funding it. I like to think of them as investing in a better version of NorthStar Clean Technologies $ROOF.V.

That best describes my interest and why I hold a position.

Now if one were to just look at the company’s current suite of products that include cat litter, ice melt and a host of other agricultural, industrial and household products, I can see how one would potentially overlook this $32M market cap company operating out of British Columbia. Cat litter and their other products are not headline making or sexy industries. But Progressive Planet has been able to go from $0 in revenue in these product lines to over $20M in under four years - all while doing so profitably and generating $4M in free cash flow in both 2024 and on a TTM basis. So we are already looking at a business valued at 8x cash flow generation before we get to the exciting parts.

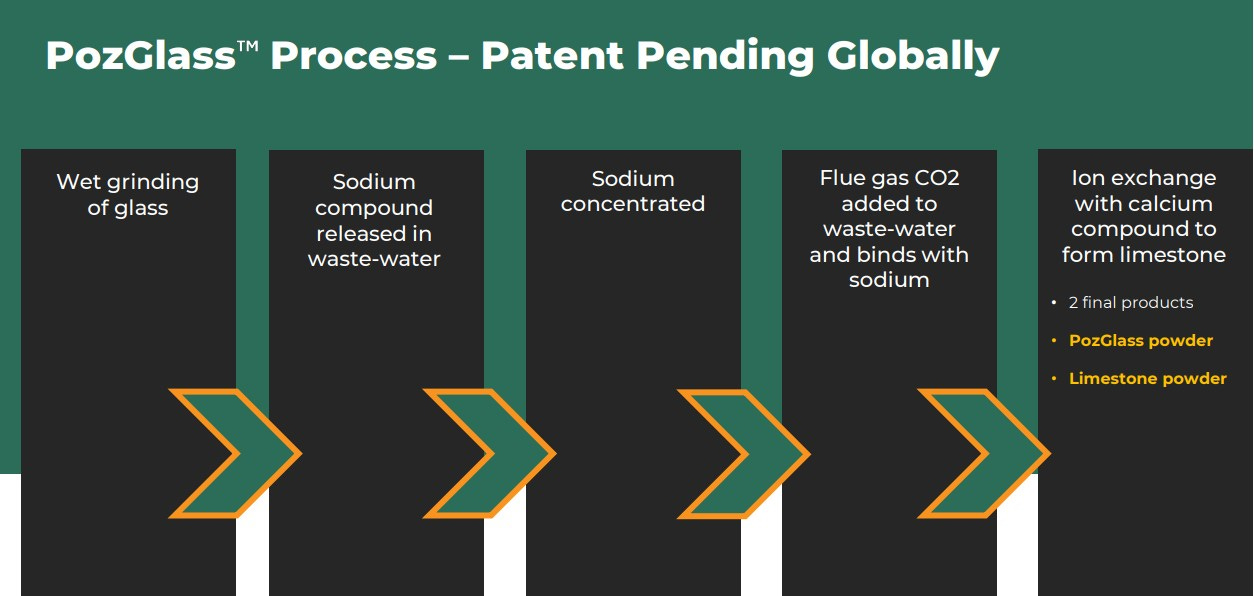

The exciting part is PozGlass, a scalable cement alternative derived from recycled glass.

Earlier I made comparisons to NorthStar Clean. They have these similar traits in common.

Feedstock supply are landfill diversions (shingles/glass) and the company’s are paid to take them

Traditional product additives (asphalt - shingles / fly ash - cement) are declining

Established partnerships with large North American manufacturers. In this case, Lafarge (now Amrize) who has committed to buy up to 3500 tons of PozGlass per year.

Clean Energy funding grants

Scalability through licensing their technology through future plants

Those are the main comparisons, but I strongly believe PLAN has these advantages:

Current profitable business

Cleaner relationship with Lafarge without exclusivity or royalties

Cleaner cap table with much less future dilutionary risk.

Easier path to licensing as it integrates into existing cement manufacturing operations

While NorthStar does have their Calgary facility operational, Progressive Planet isn’t that far behind, pouring their first metric tonne of finished PozGlass SCM powder less than a month ago.

Further reading to enhance your due diligence:

My Q1 2026 review:

Progressive Planet ($PLAN.V) FINS Review:

My last review of PLAN came back in April where I gave them an encouraging 3.25 stars but felt they were still a bit of a dice roll. That review was initially behind a paywall, but I’ve since opened it up for everyone (attached below).

And finally for your viewing pleasure, their presentation from the recent Rivemont Microcap Event:

iFabric ($IFA.TO)

I’ve covered iFabric for quite sometime now and back in October I highlighted them as a buy zone leading into their most recent earnings and while it took a little while the stock is up 25% since then. The company is also up about 40% YTD, but it feels like this could be a story just unfolding.

The most simplistic description would be to refer to iFabric as a textile or apparel manufacturer. While this is true there is more to this story. They have two main segments of apparel. Intimate apparel and what they call Innovative fabrics.

While intimate apparel can garner some excitement in various ways, from an investment and growth perspective, my eyes are “up here” looking at their Innovative Fabrics.

While their intimate apparel business is a little worse than flat YTD, their Innovative Fabrics are up by 40% and several initiatives are in place to have this growth continue into 2026 and beyond.

Their retail presence is quite an impressive list considering we’re looking at a sub $45M microcap. Within the last few months they have had some significant announcements which appear could send their revenue to another level. All of the occurred since September:

Launch of one of medical scrubs line into Walmart both in-store and online

Launched a new apparel line (Versuz) into Costco with an expanded roll out planned in 2026

Signed an agreement with Doctor’s Choice (Mercury Athletics) to design, manufacture and sell medical scrubs and medical apparel under their brand

Renewed their 5 year agreement with TUMI to integrate their smart fabrics into TUMI products

Marks & Spencer will utilize their PROTX2 technology within select items of their Autograph collections across the UK and EU.

iFabric also has a current EPA “kill claim” registration pending approval with the organization. If successful, that would give them a significant competitive advantage in a $10B per year industry.

The company’s fundamentals are mixed but in general are on the positive side. They have shown consistent revenue growth from 2019 when they were a $10M top line company to over $32M on a TTM basis, and they have delivered positive net income in three of their past four quarters.

Their balance sheet is decent, but their cash flow does stand out with over $2.6M in operational cash burn thus far in 2025. This is caused through working capital adjustments and specifically through deposits against future inventory deliveries. This specific account could really be a bellwether into the company’s future revenue performance (also explained in the video below).

If revenues are as strong as the company suggests they could be in the next couple of quarters, then the operational cash flow problem should turn quite dramatically to the positive.

No microcap is risk free and iFabric is no different. The company hasn’t been immune to the tariff situation and are not only impacted by USA/Canada relations but those that impact China as well. This has had an impact on gross margins (3-5%), but it certainly has not impacted their top line as revenue to the USA is up by 77% this year. Anticipating where tariffs could go in 2026 is a fools errand. Any agreement would likely result in rather significant bottom line improvements carrying down from the gross profit line. Tensions could also escalate and further impact margins.

An unsuccessful EPA “kill free” designation would also be news that would hurt the stock - no where near as dramatic as an FDA decline would on a biotech but would remove a potential dramatic future catalyst. The other large one would be a loss of one of their major brand partners.

Overall the potential catalysts for 2026 do seem to outweigh the negatives or risk here. For a better idea on leadership, I have included their recent video detailing their earnings with Adelaide Capital.

Are you willing to bet against two leaders named Hilton and Hylton?

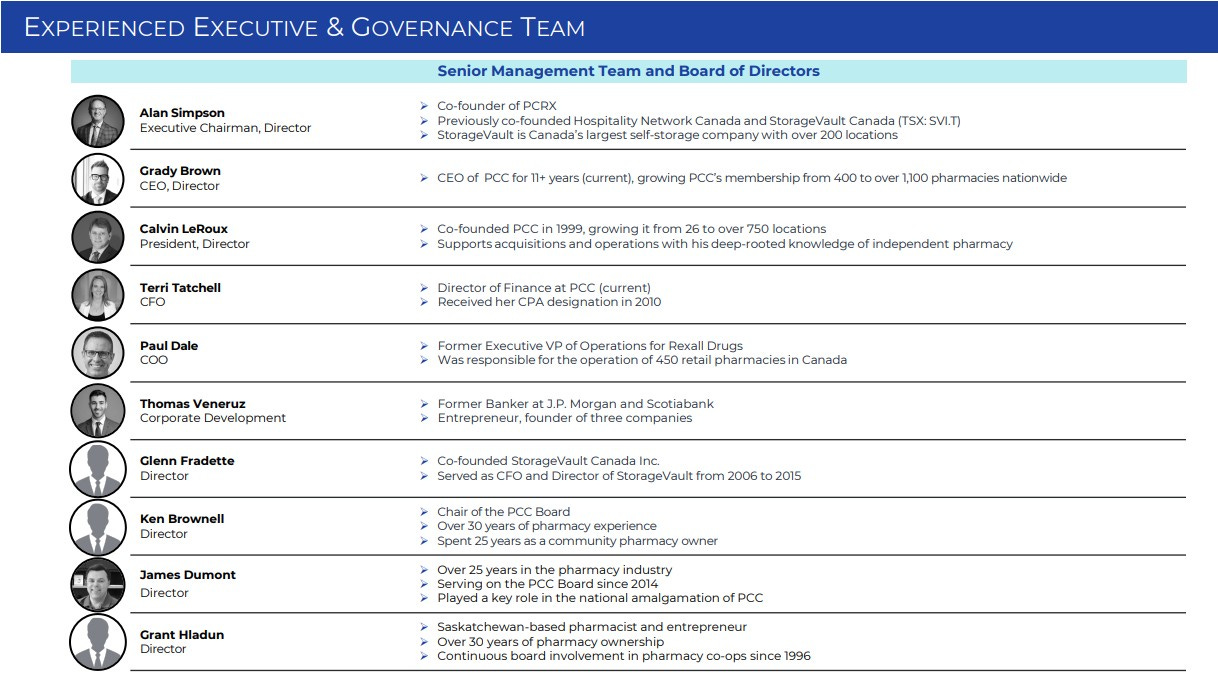

PharmaCorp Rx ($PCRX.V)

Do you like roll-up stories? A potential boom/bust story? That may just be the case with PharmaCorp. Earlier in my introduction I talked about that one stock that I just might hate in six months - the early candidate for that could be PCRX. LOL

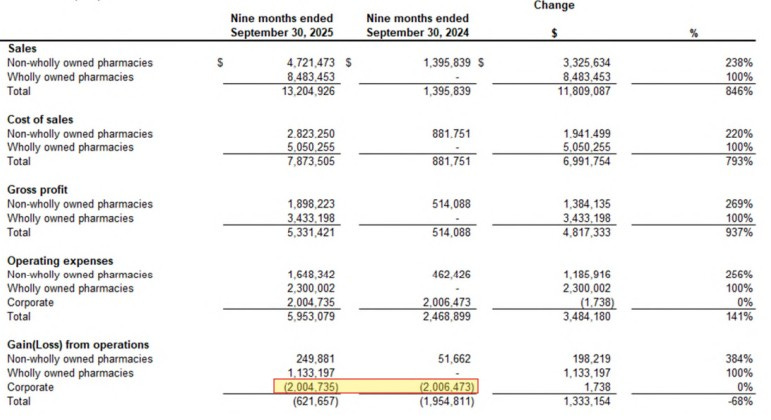

PharmaCorp’s business model involves acquiring independent pharmacies and rebranding them under the PharmaChoice Canada banner through a strategic alliance agreement. They only began trading on the TSX Venture less than 18 months ago and have gone from $0 in revenue in year one to $18M on a TTM basis and all indications are significant revenue growth will be major headlines for several quarters to come.

At their most recent quarter end (Sept 30), the company owned or had the majority control over 4 pharmacies across the country. Three days after their quarter closed they added 3 more pharmacies under their banner on October 2nd. The future pipeline of acquisition targets is huge with an exclusive first right of refusal on over 1100 pharmacies across the country.

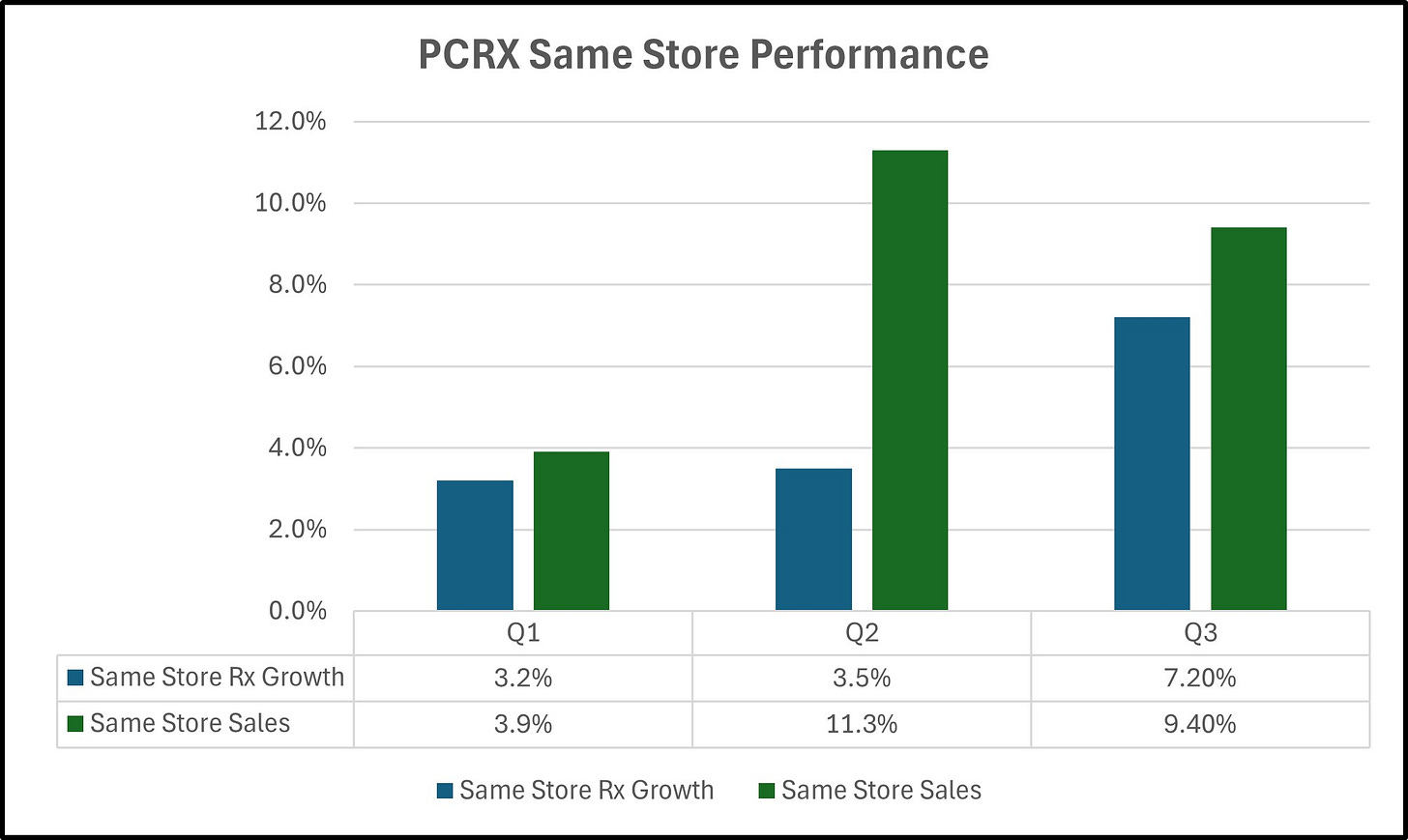

One of the things that caught my eye with PCRX was what they can do with pharmacies post acquisition. Pharmacists are not merchants and I don’t think anyone would expect them to be. This is where an experienced leadership can take charge optimize the store on a number of fronts, from merchandising to buying to operations.

It is one thing to add bullets to a slide, and another thing to execute. What I find most encouraging is they appear to have been able to begin to achieve this in a relatively short amount of time post acquisition by improving both revenue from scripts and the rest of the store.

Also occurring post financials was a raise of capital for $23M to support future acquisitions. What was initially a $15M raise, was upsized to $20M and eventually closed a week later at $23M signaling some significant interest which also included some healthy participation from insiders.

The fundamentals themselves are very early on to fully rate, but the revenue being generated from their first few locations look quite sustainable from an operational cash flow perspective, are EBITDA positive and near break even on Net Income. With just four operating pharmacies they are quite positive on their own from an operational gain/loss perspective with their corporate expenses sending them into the red. But those costs are flat YoY suggesting with additional scale they could turn profitably quite easily with added locations.

In terms of risks, yes this stock has them. The first is the amount of dilution already nearing a cap table of 170M shares with future dilutionary risk from additional raises and warrants baked in from previous PP’s. Next is what I deem some lack of transparency into the individual acquisitions themselves. Typically I would like to see some form of revenue and profitability metric announced with each acquisition and the company provides none of that. There isn’t massive goodwill involved in these locations but there is just enough that if those planned operational improvements don’t come as advertised, future write offs of that goodwill could be in the cards.

Either way this is going to be an intriguing story going into 2026. They will create some buzz with their revenue headlines, but will they create headlines anywhere else is currently the question. As far as I can tell, few if anybody are talking about these guys in microcap land. I think that changes in 2026 and one day could be compared to Well Health.

PUDO Inc. $PUDO.C

WHO. right?

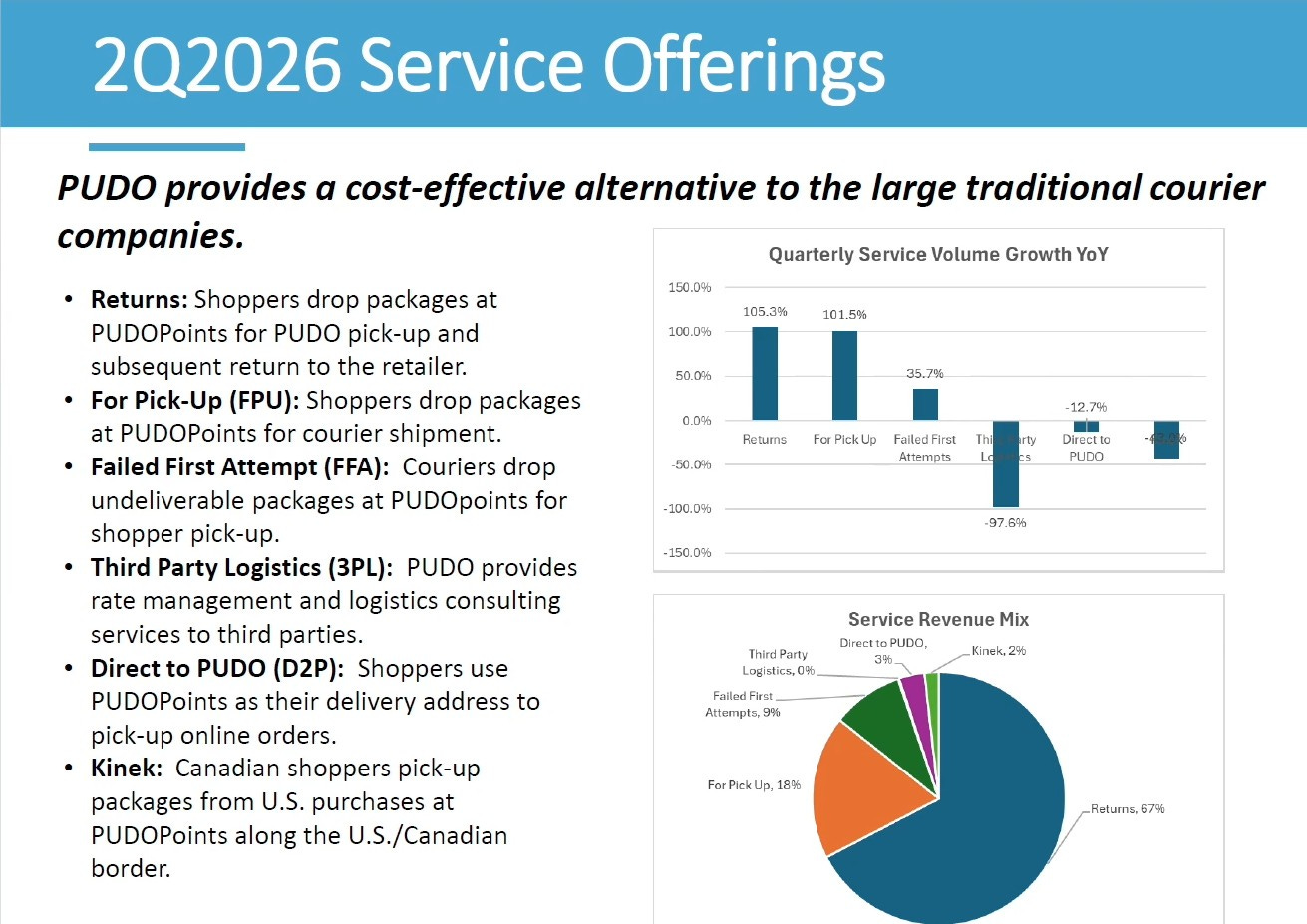

Pudo is a $10M market cap company trading on the CSE and their name is an acronym for Pick-Up, Drop Off. They provide e-commerce retailers with a low cost, convenient returns solution.

If you own a convenience store or a dry cleaner business, you can become a “Pudo Point Counter”. Do you remember Sears Catalogues? In addition to their retail stores, they had several thousand pick-up points across the country that enabled customers to pick up their catalogue order. Pudo works in a similar fashion but can be used for an endless number of retailers.

They are an official Amazon hub channel partner and have relationships with courier companies like Purolator, Canpar and Loomis. They have Pudo counters in national retail locations like Staples and are located in regional convenience stores like Hasty Market. I have three counters within a short drive of me here in Oakville.

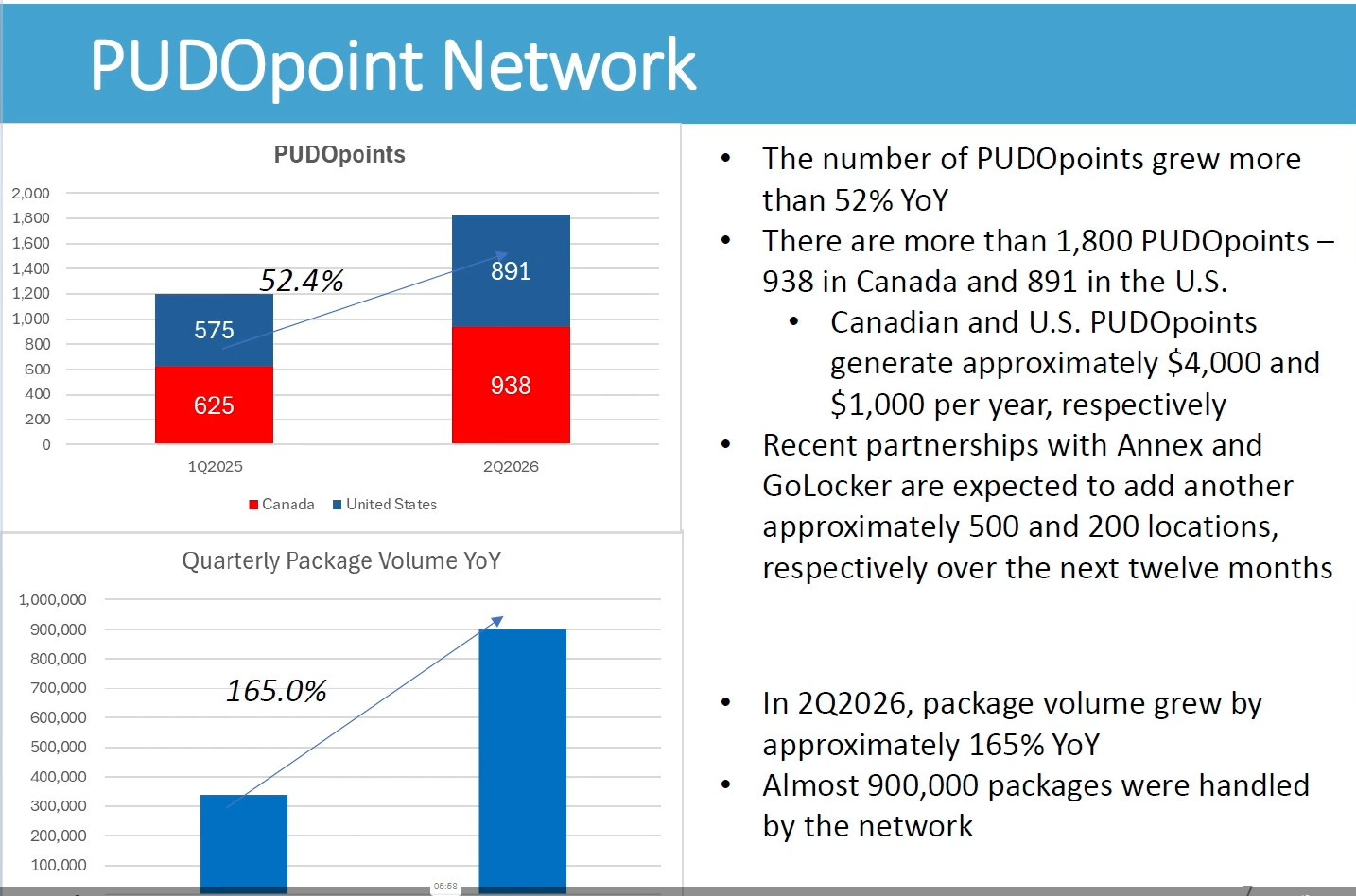

Above are the avenues in which Pudo drives revenue. As you can see above, their top two revenue segments that make up 85% of their total revenue more than doubled in their recent quarter.

Pudo’s network has also grown by 52% YoY with another 700 locations coming in the next twelve months due to new partnerships. There is also quite the disparity between revenues generated from Canadian and US locations. That is currently due to the limited number of services offered in locations based in the USA, but additional services are being rolled out south of the border as well.

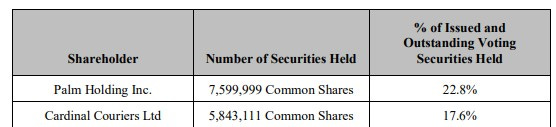

The biggest challenge for a wannabe shareholder is actually obtaining a piece of the company. Liquidity is not something you’re getting with Pudo. It can go days on the CSE without any shares traded. Their top two shareholders above hold 40% of all outstanding shares and insiders and directors hold approximately another 21%. That still leaves about 13M shares unaccounted for. That will typically generate some daily volume, but that is not the case with Pudo. Current shareholders appear to have some diamond hands so prying enough away for a sizable position will be a challenge here and could also be the biggest risk.

From a financial fundamentals perspective, nothing is exactly jaw dropping. The company will produce their Q3 sometime next month. That should be another very strong top line quarter and that will put their TTM revenue somewhere in the area of $6M annually. Currently they are operationally cash flow neutral and are slightly better than break even on the P&L. Their latest raise of capital was back in March which has significantly improved their balance sheet and the participants in the raise included both insiders and one of their customers - Cardinal Couriers.

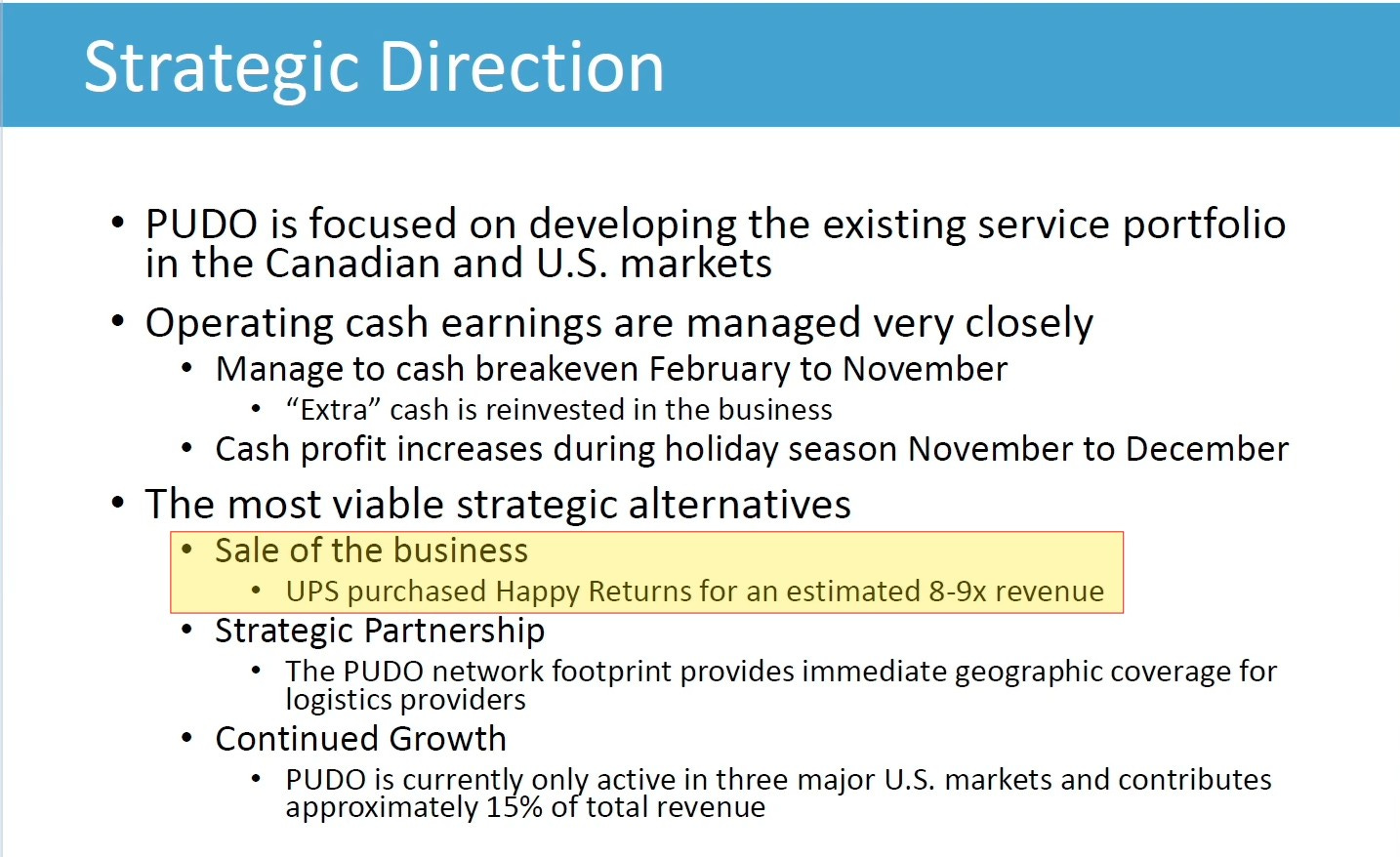

Similar to the two 2025 Wolf Picks that were acquired in the previous month, that outcome could provide the best return, and it certainly seems Pudo is building themselves into an acquisition target.

Happy Returns with a very similar business model was purchased by PayPal in 2021 for $265M, and two years later was purchased by UPS for $465M, and that was done at a 8-9x revenue multiple.

That presents some very enticing potential math for this $10M market cap with their current growth trajectory and ongoing initiatives.

How about some bonus picks or others I’m watching heading into 2026:

ZOMD.V

While the stock is still up 150% from my first call out to subscribers prior to their Q3 last year, it’s now off more than 50% from it’s highs. All of the metrics suggest this is highly undervalued and the reaction to their 3% decline from their record quarter is a significant overreaction. $100M in TTM revenue with 25% profit margins driving an P/E ratio of under 6 and an EV/EBITDA of 4.0 with an ROIC of 78%.

Enough said.

GLOW.C

I’m not sure I’m a long term believer here given their history of mishandling their cap table, but the stock is setting itself up for a decent spring swing when those 39M warrants expire.

ROMJ.V

A couple of months ago I was almost sure Rubicon Organics would have made my top Wolf Picks, but the disappointment of last quarter caused me to reduce my position. Their cash burning expense growth needs to slow for me to fully get back on the train.

TMG.V

I was hoping for the opportunity to potentially get back into TMG under 12 cents as the tide feels like it may be turning to the upside. They are still up against a tough second quarter when they report in late January. I will look for that dip opportunity again around that time, as the balance of 2026 will see the company up against much softer and beatable numbers.

NPTH.V

I covered NPTH in this very space for my 2025 Wolf Pick article, and it nearly three bagged in the process. They still aren’t getting some of the operational leverage I wanted to see but they are continuing to grow the top line at an impressive clip. Should that operational leverage start to happen, look out as it could create another big move to the upside.

Enjoy the remainder of 2025, and I wish much success to you and your family’s in the new year. Happy Investing.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Just wondered why didn't you add dbox to the list! Seems you're super positive about them and still adding to your position.