I originally covered Ztest back in March of 2024. I’ll admit at that time I found it interesting and for good reason as it was a profitable and seemingly growing nanocap at about a $6M market cap. Here is the end of that review from about a year and a half ago.

I highlighted the last line as that investors deck the CEO promised at the time never came. It was then I decided the company would never see any of my investing dollars. I can’t say the same for many of my subscribers who still maintained an interest or a position in the company.

The stock is up about 20% from that initial review but well off where they peaked in January of this year. Just last week I had ZTEST in a “Danger Zone” for my October “What’s Wolf Watching” monthly earnings preview. While it is early in the trading day, the stock is down 5.3% on the day and 9% from that article.

Let’s dive into their annual financials that were released this morning.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

As usual, Ztest sports an excellent balance sheet with a current ratio of over five consisting of $4.1M in cash, just over $1M in each of receivables and inventory, $63k in prepaids against just $1.24M of liability commitments looking ahead during their 2026 fiscal year. On top of that they remain relatively debt free with just $56k which will be extinguished this year.

Of note, their current ratio was 2.7 at the end of last year.

Cash Flow:

ZTE delivered $1.62M of operational cash flow during fiscal 2025. A solid number but that was down by 33% from the $2.43M of OCF in 2024.

Aside from operations, they purchased $53k worth of assets, paid down $65k worth of debt, received $90k from warrants/options and bought back $78k worth of their own shares. Overall the company improved their cash position by 48% despite their reduced cash flow year over year.

Share Capital:

36.8M shares outstanding with less than 1% dilution last year. Shareholders were diluted by 37% in fiscal 2024 from a private placement and shares issued to settle debt.

2.6M warrants outstanding. 2.37M at 30 cents and 200k of broker warrants at 25 cents. All those expire in about two weeks (Nov 8th). They will likely miss out on over $700k to the treasury as a result.

1.55M options outstanding, 650k of which ITM

27.5% insider ownership (per Yahoo Finance)

350k shares repurchased under their NCIB which began April 1st. Since year end have bought back another 126k

The only insider transaction in the last six months involves the CEO who sold 80,000 shares in August at 32 cents

Income Statement:

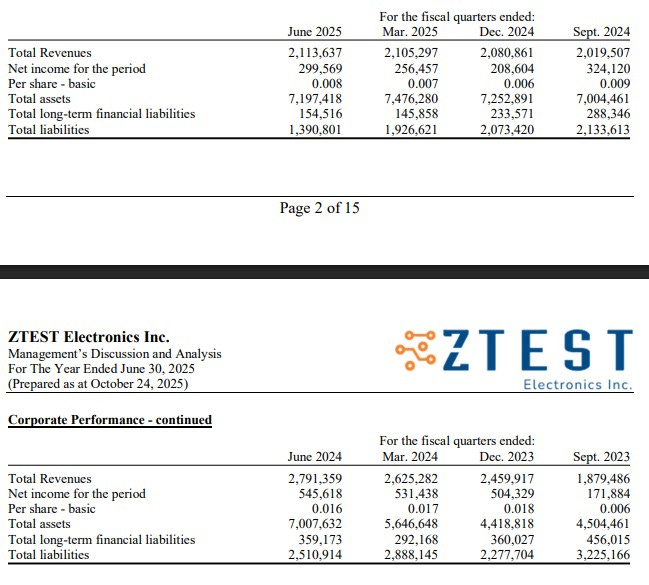

Ztest was up against a record revenue quarter in Q4 and for the third consecutive quarter experienced a double digit revenue decline. Q4 revenues were down by 24% to $2.11M vs $2.79M a year ago.

On the year total revenues were $8.3M, down 15.2% from $9.76M in 2024. Gross margins for the year were off by 140 basis points to 58.4%, and when combined with their revenue performance resulted in a 450k reduction in gross profit dollars.

The triple whammy comes in the form of total expenses which grew by 18% on a 15% reduction on their top line. That is the definition of a reverse Wolf Trifecta.

Unfortunately expenses were higher in both non cash AND cash burning expenses with share based compensation, up 143%, and SG&A costs rising by 13%.

That all results in a 38% reduction in their net income on the year, $1.09M vs $1.73M in 2024.

Overall:

Trend is certainly not their friend with three straight quarters of poor performance relative to last year.

As I write this their market cap currently sits at $9.75M. So even on a rather dismal year over year performance it still trades at around a 9 P/E. That is just a little over 2x the amount of current cash too. Most people may find that attractive but I can’t say I would include myself among that group.

Yes, even in down years they can still remain profitable and produce cash flow but in order to be bullish about the prospect of a stock, you’d have to feel optimism about upside potential and if you count yourself among a bullish Ztest shareholder then my question to you is, where does that come from?

I do give the company some credit for updating their archaic website from my first visit there eighteen months ago. It is now operational and does include an investor deck, attached for your perusal.

I’ll also link their presentation from last week’s Planet Microcap. The most bullish item in here is some generic conversations with customers but “no purchase orders” have come in yet. I’ll admit to some personal bias and perhaps animus towards the CEO (Steve Smith) for ghosting me after showing interest in the company last year, but if you could sit through that presentation and feel inspired, we are not the same. I’ll be kind and leave it at that (doesn’t sound like me I know).

They have not put out any newsworthy press releases in 2025 unless you include their strategic review from January, but there hasn’t been any follow up to it since. I do recall some speculation on potential M&A at the time, but the CEO seemed to trash that idea last week at Planet Microcap.

At the end of the day there are much more interesting companies out there for me. These financials aren’t bad by any means, but to garner any interest I’m going to need to see where a potential quantum leap is. And it ain’t here.

From one Steve Smith to another. Three stars and one thumbs down.

Update: Stock now down 7.2%

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Appreciate the review. First time I heard of a Reverse Wolf Trifecta.

Thanks wolf the expenses going up on a long established company is very strange to me. Appreciate the reviews.