I have reviewed ZTE on one previous occasion back in March of last year. It was a sad little $6M market cap then that I gave an encouraging 3.25 stars.

The stock has been about a five bagger in the past year making longs extremely happy. While I do not keep official statistics, I’m willing to wager if I did that Ztest Electronics was the most requested company for me to review in the past six months. I have outright refused on so many occassions I have lost track. While I pride myself on always trying to maintain unbiased in my reviews whether I’m a shareholder or not, this one will probably test that like few have. I have some big problems with ZTEST. Here’s why.

Ztest Electronics first hit my radar back in late February just prior to their financials via email from one of my readers. I found the results quite intriguing but trying to perform any due diligence at the time proved very difficult which I spoke to in my initial review. I’ve pulled from the pre Substack archives and included it below.

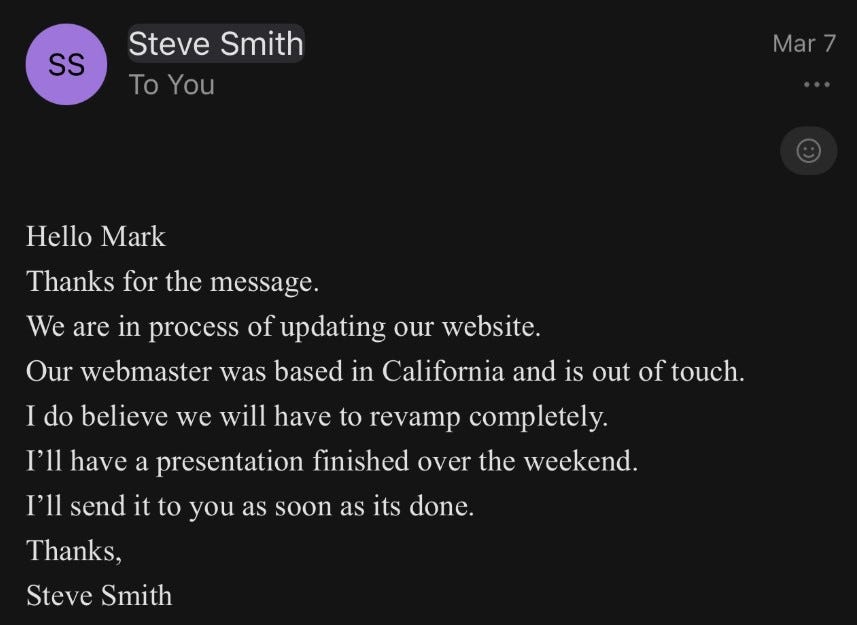

When I went searching for more information to start my due diligence, I initially went to their website. I was horrified to see that their website had not been updated since sometime in 2020. There was no investor deck and no contact information. There was a webform however. I honestly thought it was going to go into some black hole, never to be seen from an actual human being. But shortly after sending it, I received this reply from the CEO:

I’m still waiting Steve.

So, am I a little bitter? No, I’m very fucking bitter. LOL

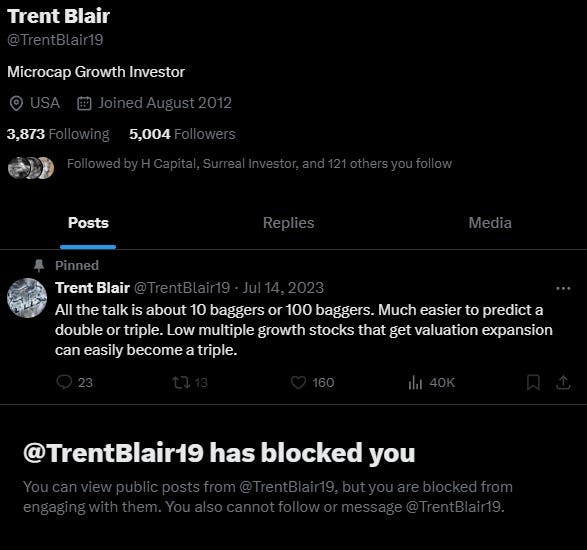

Not really, I jest for the most part, but it is very disappointing that an opportunity was lost for me personally. One of my first rules in business is to do what you say you’re going to do. Almost nobody was talking about this play back in February or March of 2024. Except one guy, and I noticed today that he has me blocked on Twitter. I’m unsure of the reason, but I’m also fully aware that I can upset some people from time to time. Regardless of his distaste for yours truly, I do want to congratulate Trent who seemingly found this one much earlier than most, if not everyone. Someone should let him know. Now of course almost everyone is on it, including many in small cap land whom I respect a great deal.

We even opened up a temporary channel on the TSA discord for this one around that time. We do that once in a while when we feel we find an off the radar stock that nobody is talking about with some potential. Sadly after the weeks went by with no reply, we removed the channel.

So that’s the story. That’s why I’ve refused to take a look at them until now, and why that I’m unsure I’ll be able to be 100% unbiased here. With all of that preamble out of the way, let’s get into their Q1 financials.

Balance Sheet:

Very strong beginning with a current ratio of 3.15 that consists of $3.26M in cash, $1.2M in receivables and $1.37M worth of inventory against just $1.85M of current liabilities. Ztest has only $105k of debt at a very attractive 3.4% loan that matures in April of 2026. No aging report on their A/R but it is down $500k from their year end so no yellow flag on that. We’re off to a good start. Damn it.

Cash Flow:

Operational cash flow is quite strong, generating $531k compared to only $27k in the comparable quarter last year for a 20x improvement.

Nothing significant within investing and financing activities so overall they were able to improve their cash position by 17% in the first quarter alone.

When my balance sheet and cash flow sections are this brief that is usually a very positive signal. Bastards.

Share Capital:

36.7M shares outstanding, but with 37% dilution over the past twelve months

2.74M warrants, all ITM at 30 and 25 cents

1.75M ITM options

31% insider ownership

Since early November, three different insiders have been on the sell side in the open market or through block trades, including the CEO

Income Statement:

Strong revenue performance in Q1 of $2.02M with an upper single digit improvement over last year of 7.5%. A bigger story than the top line was their margin improvement of 45.6% and that is more than an 1100 basis point improvement over the 34.5% they did in the comparable quarter. That results in a 42% increase in additional margin dollars over last year on just an 8% revenue improvement. That’s pretty stellar.

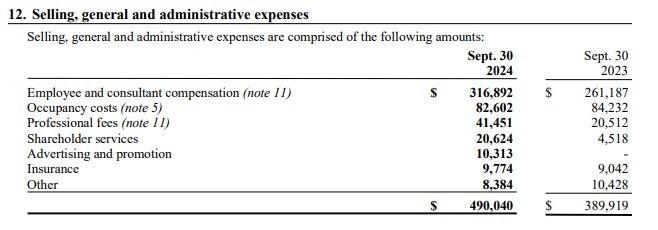

Total expenses rose by 33% however, so they converted well here on the margin line but the top line not so much, therefore they miss out on achieving a Wolf Trifecta. SG&A expenses, the bulk of their cash burning expense rose by 26% Q1 over Q1.

Net Income improvement is still something to celebrate which was up by 90% to $324k.

Overall:

Well I wanted to dislike them but the numbers are just too good. Their revamped website and the attached investor deck look pretty good as well but it is missing a key component for me - future initiatives. Showing me the TAM doesn’t really count.

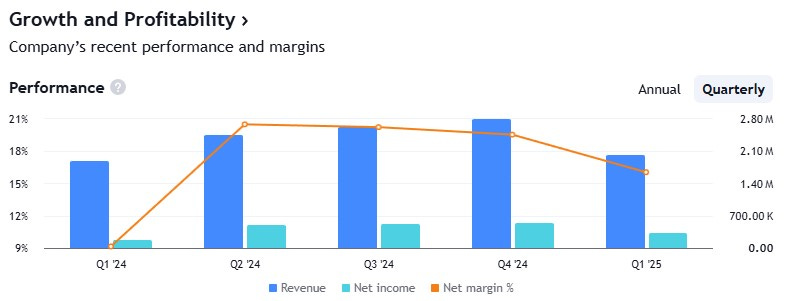

If there’s a negative that stands out to me it’s that their Q1, while up 7.5% to last year is the worst top and bottom line quarter of their last four and on a QoQ basis was down by 28% in revenue.

The CEO mentioned a softening in Q1 but was rather vague in terms of when the “environment” could actually rebound. So that sounds like future quarters could be at some risk and it’s notable that the company has been silent on the news front since these financials were released. The stock is up 37% since those FINS were dropped as well.

I was originally was attracted to Ztest at a $6M market cap. What do I think about them at $16M. All of the current TTM metrics still seem attractive at a 1.6 P/S, 5.1x EBITDA and a 7.5 P/E.

With the RSI is currently pretty hot I think anything in the target zone above could be a good entry point leading into their Q2 financials, but that does carry some risk as they are up against much stronger quarters for the rest of the year, and if they fail to meet or exceed them, the SP could easily fall below that area.

I was afraid of this but I am going to upgrade them all the way up to 3.75 stars based on their performance and potentially very attractive valuation. A CEO breaking his personal commitment to me still stands above all else, so I will not be partaking. All in all I think I did a decent job on the whole personal bias thing, and I hope you agree.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3200+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for another review Wolf. Would you consider doing a general post on share structure and how you think about share count, options, warrants, dilution in general?

How can increasing the share count 37% not lead to anything significant in the financing?