Like Chico Escuela’s affection for baseball, ZoomD has been berry berry good to me.

I first highlighted ZOMD to paid subscribers back in late November of last year leading into their Q4 financials which I felt was going to be a great swing, and I bought plenty at 49 cents.

A few days later their financials dropped and the stock rose to $1. I was not only able to sell at 99 cents for a very quick double, but I also rebought all of those shares the same day after it retreated to 75 cents.

A couple of weeks later after some additional due diligence research, I selected them as one of my 2025 Wolf Picks when the stock was at a similar 75 cent valuation. Their previous quarter also received an upgrade to 4.25 stars - rare territory for a microcap on the Venture. It now sits among my top four microcap holdings along with HBFG, TRBR and NCI with two of those other three achieving ten bagger or greater.

In my recently published my August What’s Wolf Watching for paid subscribers, and it was also one of the Buy Zone opportunities going into earnings, with my fair valuation at the time in the $2.25 - $2.40 range.

Now that the company has released their second quarter earnings, where does that fair valuation stand now?

(Note: ZOMD reports in USD)

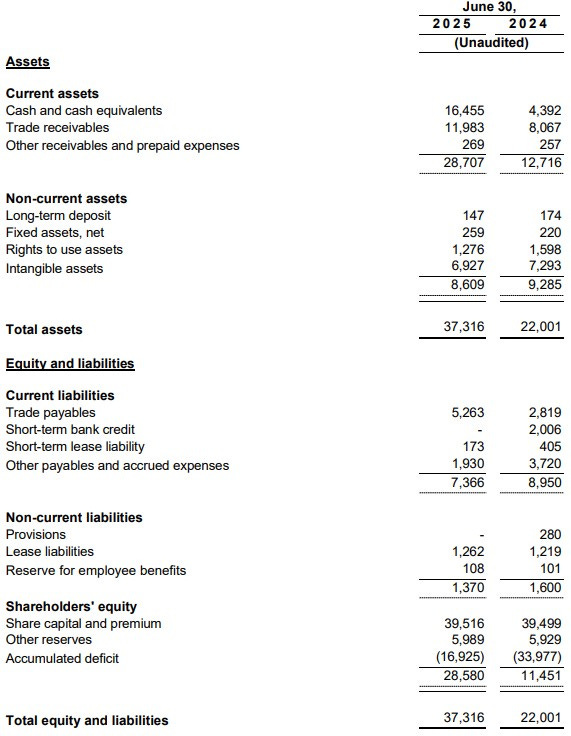

Balance Sheet:

Looking at this balance sheet on a YoY basis is pretty incredible.

The company has gone from a 1.4 current ratio to 3.9 in the past year. As of June 30th, that consisted of $16.5M in cash, $12M in receivables and a quarter milly in prepaids against just $7.3M of current liabilities, and is now debt free.

If I have a complaint with ZOMD, they do put out some of shortest financials I’ve ever seen at just eight pages long including two for the cover and table of contents, it only contains one page of notes, not to mention appears to be created on a typewriter from the 1980’s and subsequently printed on a dot matrix printer. But I’m GenX, so I can handle it as long as the numbers are this good.

Cash Flow:

$8.9M of operational cash flow through six months including $5.25M generated in the most recent quarter. Not only has their revenue performance been absolutely incredible over the past twelve months, but their A/R collections must be outstanding as well given the very small working capital adjustments relative to revenue.

In the last six months the company has spent $260k in capex and completely paid down their $2M line of credit.

Overall, ZoomD has improved their cash position by nearly 70% at the midway point of their fiscal year.

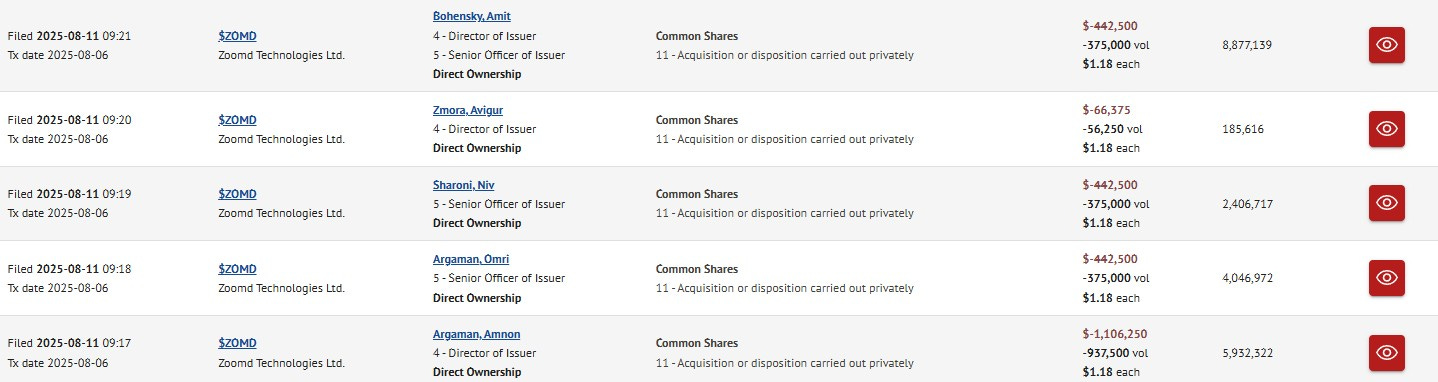

Share Capital:

99.2M shares outstanding with only 2% dilution over the last two years

8.9M options outstanding. They really do a shitty job with the expiry table here but it does appear they are all well ITM but none expiring until into 2027

21% insider ownership per YF

Insiders cashed in last week in a large after hours cross trade. I was a little surprised that they would have cashed in this early, but the good news is they did not flood the market. Remember, this stock was a nickel 15 months ago, so good for leadership to cash in some of their bag. They earned it.

Income Statement:

It’s so pretty it brings a tear to the eye.

Revenues were up by 40% in the quarter to $19.6M vs $14M in Q2 of last year. They also delivered extremely well on margins with a 460 basis point improvement in gross profit from 38.1% to 42.7%, generating 57% more margin dollars than last year in the process.

ZOMD continues to display phenomenal operating leverage with expenses growing by less than 4% on those impressive revenue and margin numbers. So yes, they once again are awarded the Wolf Trifecta.

Due in large part to their improved cash position and debt elimination, had a net birdie of $1M between their finance income and expenses.

All of the above drove an incredible $6.1M of net income, a 182% increase on the bottom line compared to the $2.15M of net income in the comparable quarter.

It keeps getting better as their YTD numbers have similarly outstanding metrics.

66% increase in revenue to $37.6M

490 basis point improvement in GP% to 43.5% and 87% more gross profit dollars than last year

Operating expenses only rose by 7%

Net income of $10.8M, over 4x more than the $2.7M at their midway point last year

11 cents EPS YTD

Overall:

Note: This is where I being to speak in CAD. Eh?

The market closed with ZOMD rising by 14%, ending the day at $1.66 after peaking at $1.83. I added some more on the late morning pullback at $1.60.

At $1.66 takes their valuation of $165M. It’s hard to imagine saying a stock that has multi-bagged by 33x since last May still could have a lot of meat on the bone left, but all signs point to that being the case here.

After converting this recent quarter from USD to CAD, I have their TTM at approximately $97M of revenue, producing $23.9M in net income. That’s a P/E of under seven for a company with 66% more revenue YTD and nearly putting 25% of every revenue dollar on the bottom line. If you annualize their YTD performance that comes in at around $30.3M of net income and generates a P/E of 5.4. At a modest 10 P/E on the YTD numbers that adds up to a $3 share price which is just short of a double from here.

As lean as the company is, the CEO Amit Bohensky suggested in the earnings call that with continuing to develop AI automation tools, there are even more opportunities for more operational leverage. They have come an incredible way in the past two years with their operational spending as you can see in the chart below.

They are also cash rich, debt free and are becoming an operational cash producing beast. What they decide to do with that cash will be interesting to watch. There could be some M&A opportunities, but they will not be seeking anyone else’s technology - instead look for them to acquire customer relationships.

Are there any negatives, red or yellow flags?

Nothing within the financial statements themselves, but the largest risk for ZoomD Technologies is their customer concentration with 83% of revenues coming from their top five customers.

Amit does do an exemplary job explaining how they are sheltered from this risk with their largest customer utilizing their services in up to thirty countries, each having it’s own budget. Therefore if things were not working in one area of the country the customer could move things around or the impact of one of those budgets would lessen any large blow to their top line. This does mitigate this to a degree, but it certainly doesn’t eliminate the potential of a complete lost relationship.

Does that in itself garner a discount? Potentially and each investor is going to have to weigh that risk individually. I have and it didn’t prevent me from adding more yesterday, and I won’t be afraid to do it again.

Upgrade to 4.5 stars which only a handful of companies have ever achieved in the four or so years I’ve been spewing my drivel on the interwebs.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf, appreciated as always

These numbers are amazing! Considering their growth, the decline in expenses is stunning. It's hard to imagine they keep up this kind of momentum, but they keep topping themselves. As always, thanks for the review Wolf!