“Don’t use weather as an excuse”.

This is what I was once told a couple of decades ago. Back when I had full P&L accountability for a $300M business, snowblowers were part of that merchandise mix. It wasn’t a core part of what we did, a seasonal line with slimmer than average margins, but it was important enough particularly in certain areas of our great country.

It’s been a long time so the exact numbers will be off but the story is directionally accurate. Our five year growth rate was steady and sometimes lumpy, let’s say growing from about $15M - $20M annually. In year six, we sold a record $38M as almost every community in the country received record annual snow including the lower mainland and Vancouver Island in B.C. (places we never even shipped inventory).

Fast forward to year seven planning, and I was handed a goal of selling $32M in the following year - an absolutely ridiculous goal given the “one year event”. I bitched up the management chain and at the end of the day I believe I was offered some reprieve but not much. North American manufacturers (who were much smarter than senior leadership responsible for the plan), had empty warehouses after scrambling to meet that years demand and were not planning to build as many machines nor had the engine components to meet my demand. With the buyer’s help, we scrambled and had additional engines shipped from China. We did pre-season events in August, and dedicated more promotional activity throughout the season.

That wasn’t all we did. Since snowblowers were not our core business, we changed over 100 store merchandise maps to dedicate space for a new product line that delivered very high margins. At the end of the year we beat our total revenue and profitability targets (all merchandise lines) but missed badly in our snowblower line. We achieved somewhere around $25M - 25% more than our second best year but well off that year’s target.

At a recap meeting with senior management, I obviously focused on our overall results and attempted to gloss over what we did in our snowblower segment. That didn’t go over as well as I had hoped. After mentioning the average snowfall across the country was down over 50% year over year in addition to other fancy PowerPoint slides used as rationale, ultimately I was told “Don’t use weather as an excuse.”

Pretty blunt. Those career learnings stick with you.

So Wolf, I thought this was a ZoomD financials review, why are you subjecting us to this story? I’m not sure yet, let’s see if I can tie it all together at some point.

As you likely know ZOMD released their Q3 financials yesterday. It did not go well. In fact, the stock PLUNGED by 26% which created this mess of a chart to end a crazy week of earnings across Canadian microcaps. Yesterday’s bloodbath was not unique to ZOMD, as there was carnage in a lot of popular names today.

But 26%? Let’s drill in.

Balance Sheet:

A current ratio of 3.7 made up of $18.3M in cash, $11.3M of A/R and $300k of prepaid expenses overtop of just $8.1M in current liabilities. In fact their total liabilities are under $9.5M as the company has no debt and little outside of leases in terms of long term financial commitments.

Liquidity is also very strong with a quick ratio of 3.6. Even without their receivables their current cash position is 2.25x their future 12 months commitments.

I’ve said it in the past, but ZoomD puts out the simplest financial statements on the Venture with very little notes or additional disclosures. With A/R making up nearly 37% of their current assets, I would like to see an aging report but the fact that account is only up 9% while YTD revenue is up 37% minimizes any potential concerns.

Cash Flow:

ZOMD has generated $14.25M of operational cash flow through their first three quarters, 182% more than at this time in 2024. That includes $5.4M generated in this recent quarter, but about 1/4 of that is due to timing differences within receivables and payables. They have already generated 86% more cash via operations than all of last year with a quarter to go.

ZOMD spent $386k in investing activities YTD, the majority of which for capitalized software development costs. They fully extinguished $2M of short term bank debt and insiders utilized net option exercises for proceeds of $3.6M, thereby cancelling about 3.8M options. This method saved about 3.5% worth of dilution, but did account for 90% of the company’s operational cash flow for the quarter.

Approximately 1.5M options were cancelled in the same way at a much higher share price post financials and I estimate that impact to be about $3M to ZoomD’s total cash flow in Q4.

In total, through three quarters, the company nearly doubled their cash position from the start of the year (+98%).

Share Capital:

100.8M shares outstanding with 2.5% dilution since the start of 2024

After the net options exercise including post financials I estimate 3.6M outstanding. Again the lack of disclosures including option tables doesn’t exactly help a brother out

20% insider ownership per YF

Insiders were involved in one large cross trade in Q2, otherwise no activity on the open market

Income Statement:

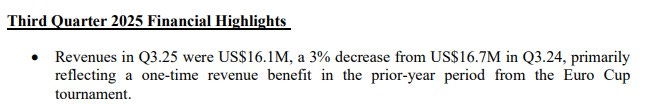

Revenue for the third quarter came in at $16.1M, 3% off what they achieved in the same quarter in 2024. Gross margin increased by 330 basis points to 42.6%, so even on a sales decline of 3%, they delivered 5% more dollars to the gross profit line.

Operating leverage continues to shine with operating expenses declining by 5%. The margin and opex improvements carry through to the bottom line with net income of $3.8M, 20% better than their performance last year.

Through three quarters:

Revenues of $53.9M, a 37% increase over 2024

Gross margin up 430 basis points to 43.2%, in the process generating 52% more GP dollars

2.6% increase in operating expenses. Opex as a % of revenue fell from 23% last year to 17.3%.

Net income of $14.6M, 2.5x more than achieved in 2024 through three quarters

Easily a Wolf Trifecta on the YTD numbers, but missing that honour in Q3 with the slight sales erosion to last year.

Overall:

(all numbers above in USD, switching to my native CAD from here)

In no way do I see anything within those numbers to warrant $50M in market cap vaporization yesterday. This was a 3% miss to last year while putting 20% more net income on the bottom line. On a QoQ basis things look less than stellar also as that drop is 18% in revenue and 38% in net income.

Let’s not also forget that the stock had already declined 30% from their ATH five weeks ago. But if you thought that was priced in, you were badly mistaken (like me).

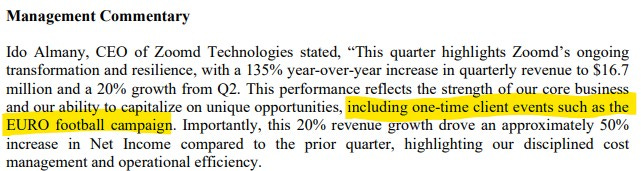

There was some writing on the wall that the QoQ numbers would not be as strong, as the CEO eluded to it himself in recent interviews. What I heard during that interview was “for investors not to concentrate on QoQ but focus YoY” (I’m paraphrasing). From my perspective that led me to believe revenues would come in between $23M - $27M, and we got $22.2M). Did that contribute to the harsh selloff which saw the largest number of shares trade hands ever?

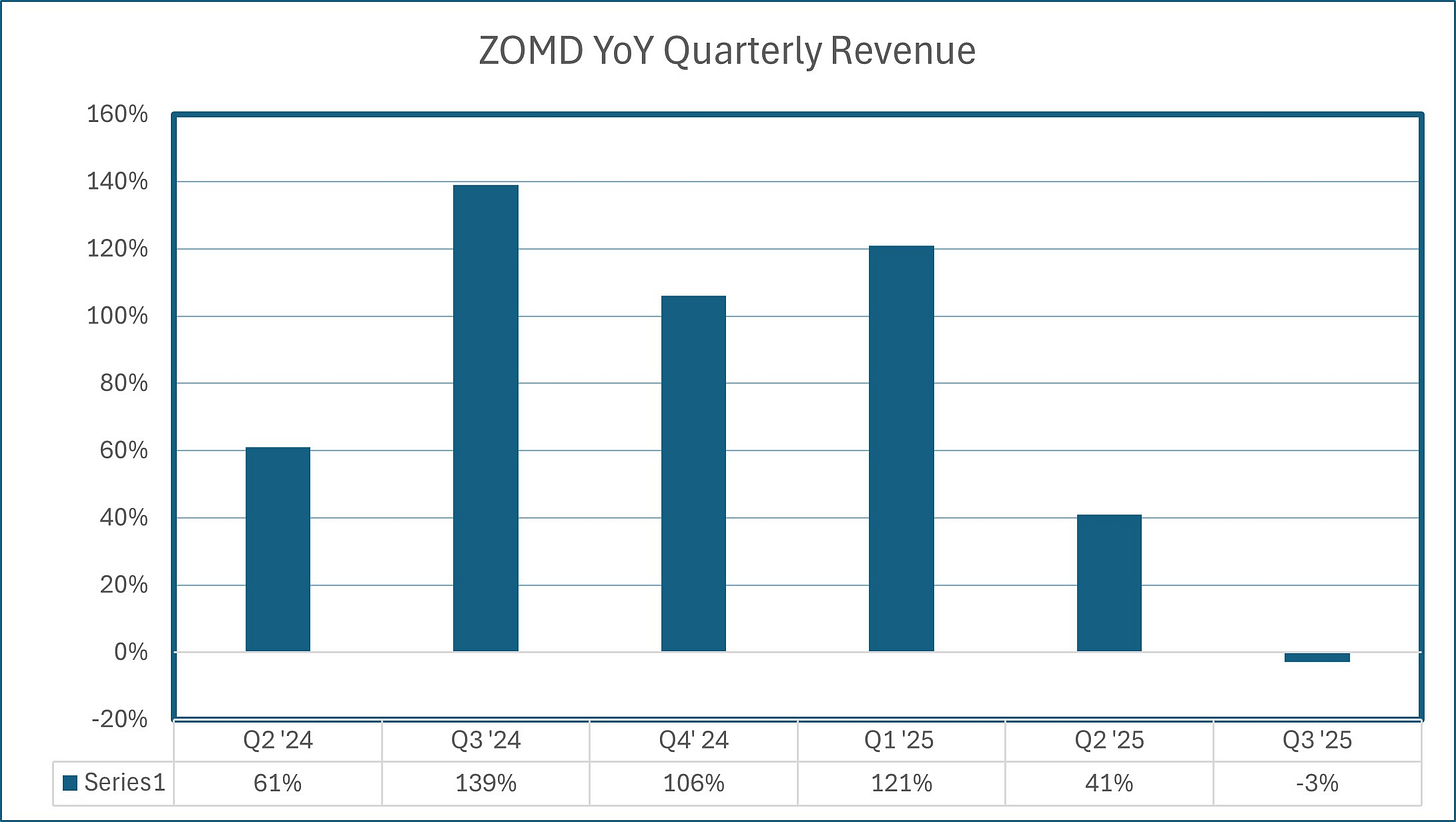

For context, here is what their last six quarters have achieved on the revenue line on a YoY basis:

They have also delivered higher YoY net income in nine straight quarters.

With just under $25M in net income on a TTM basis, were looking at a P/E of 5.7, EV/EBITDA of 4.5, with a ROIC of 78%. Considering they’ve grown at close to 40% in revenues YTD, those numbers make the stock look very cheap.

Other considerations should include future taxation. Due to tax pools ZOMD has paid no income taxes YTD. This likely changes at some point in 2026 and into 2027 they would more than likely start paying a tax rate on taxable income somewhere in the neighbourhood of 20-23%. Now if that taxation was applied today, it’s still a P/E around 7.5 with identical EV/EBITDA metrics. I’m also just an asshole on the internet, not an Israeli tax expert, but I think this is directionally accurate nonetheless.

I’m not sure I got a lot out of the earnings call itself, but the 2026 World Cup and getting a foothold into sports gambling opens up a lot of opportunities going into.

Right now the chart is as ugly as an overcooked hotdog, even while being up about 3x since their last third quarter and almost 2x YTD. The stock filled the gap dating back to the significant move upward after their last earnings and finally found support around the $1.40 mark. This feels like the area to watch to ensure it holds up over the next few days at least.

Who else are you going to like in this space? Illumin, Sabio, Adcore? None of those can hold Amit’s jockstrap.

Lastly, the YoY decline was blamed on non-comp income from the Euro Cup last year. I was primed to give the company shit if they did not mention it as a one time event last year. But as you can see below, they did indeed.

Unfortunately for ZOMD’s management, the market gave them a similar message I received for my one time snow event two decades ago. Don’t use it as an excuse!

Minor downgrade to to the revenue miss creating a little Q4 uncertainty.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Still plenty to love about this company, despite the QoQ numbers and recent price action. In it for the long haul. Also, do you have any snowblowers lying around? Asking for a friend of mine...

Hi Wolf,

And others,

This one might be interesting to read up on:

https://mcusercontent.com/4bc421505c66d079778a0d0be/files/f435fb4c-fb89-e5df-dbe0-8fb680d7e84a/20251202_Atrium_Ad_Tech.pdf

Kr,

Dorus