A 2 pm afternoon drop was very unexpected here with their conference call scheduled for 11 am tomorrow morning. I had turned off my screen for the afternoon and was pondering a nap!

About a week prior to releasing their Q3 financials, I posted this to paid subscriber chat when it traded at 50 cents and I made a subsequent buy at 49 cents:

A week later, the stock doubled on earnings, and in one of those days that I wished happened more frequently, I sold at the top at 99 cents, then rebought later in the day at 75. Not long afterwards, I named ZoomD as one of my 2025 Wolf Picks.

The expectations were high (for me) and upon first look I was pretty pleased. But the devil is in the details, so let’s get into ZOOMD’s Q4 and annual filings.

All results in USD unless otherwise stated.

Balance Sheet:

One of the things I am starting to remember is how I didn’t like the format of their Q3 financials - let’s see if these ones live up to higher expectations.

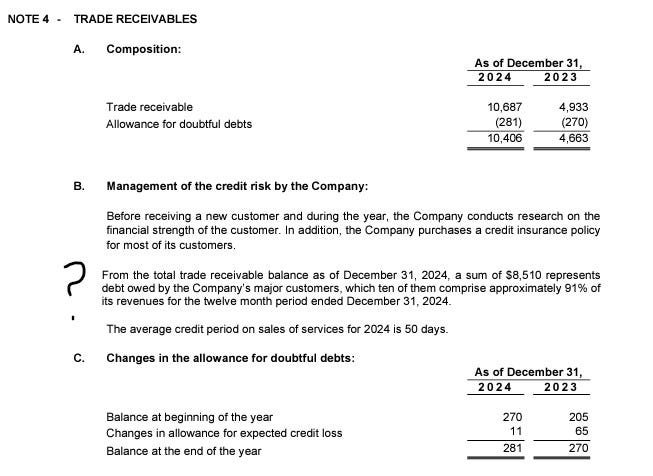

We begin with a very healthy current ratio of 2.1 that consists of $9.2M in cash and $10.5M in receivables against $9.5M in liabilities due of the course of 2025.

Receivables are up significantly but that is an expectation on this strong top line growth.

While I would prefer to see an aging analysis in their financials the anticipated credit losses are quite low as a percent of A/R and revenue.

I think I found the instrument they use to prepare these financial reports with:

In Q3 we did not have any detail into the company’s line of credit. Here we do and it’s for a $2M LOC facility at a mediocre SOFR + 4.75%. A little surprised this is still maxed out given the strength of the rest of the balance sheet, but overall we are off to a solid start.

Cash Flow:

$7.7M worth of operational cash flow during their 2024 fiscal year. That is more than 17x better than they achieved a year ago. Not much activity within the other sections of their cash flow statement other than $560k invested in assets and software development costs.

Overall, ZOMD improved their cash position by over 350% from the start of the year.

Share Capital:

98.7M shares outstanding with only 1.5% dilution over the last two years

9.3M options outstanding. They really do a shitty job with the table here but it does appear they are all well ITM but none expiring until into 2027

22% insider ownership per YF

Insiders allergic to the open market outside of the ex CEO who did some selling last year and is slated to sell more after Q1.

Income Statement:

Annual revenues of $55.5M for 2024, compared to $32.1M, 70% better YoY. Gross profit dollars rose even better by 79% due to their 210 basis points increase in gross profit rate which came in at 39.5%

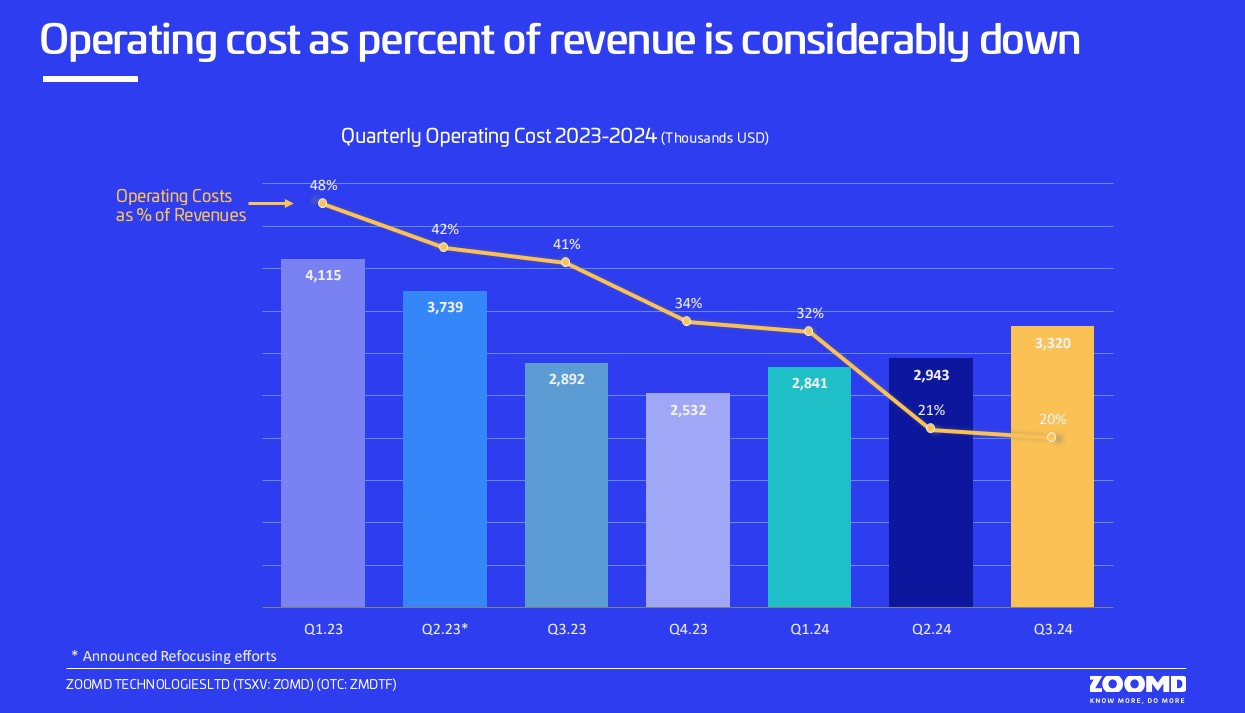

Perhaps more impressive is they were able to achieve the above by spending 25.6% less within their total operating expenses.

$2.8M of the savings to last year were for a one time write off, but they were still able to reduce their opex by over $1M or about 7.5% out of their two main cash burning buckets to last year while driving 70% more revenue with higher gross profit rates. That is the very definition of a Wolf Trifecta.

Down to the bottom line and ZOMD was able to produce $8.9M in net income after losing $4.65M in 2023 - a $13.6M profitability turnaround on $55M of business. You don’t see that kind of one year turnaround performance very often.

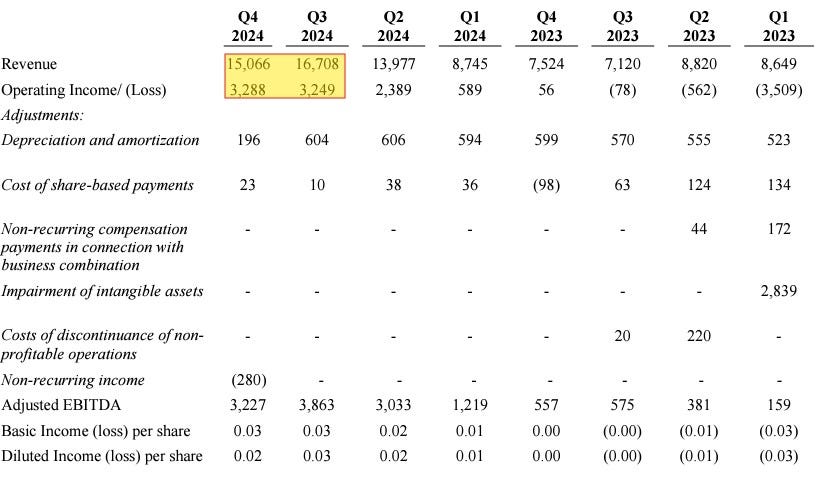

Moving into the Q4 numbers, revenue came in at $15.1M, 100% or double the $7.5M they did in Q4 of last year. Gross profit outperformed last year and their total YTD number coming in at 41%, a full 660 basis points better than the 34.1% in Q4 a year ago.

Bucking the trend were operating expenses being higher than last year with SG&A costs up 29% but that is still excellent conversion when you double your revenue. As a result, net income for the quarter was $3.05M, compared to losing $31k in the comparable quarter. Outstanding all around.

If you were to be nitpicky, on a QoQ comparison revenues were down 9.8% to their Q3 numbers, but due to the significant improvements in margin they were slightly more profitable, driving over 20% net income.

Overall:

This has to be one of the most bizarre trading days I have seen for a particular stock. Prior to these financials being released, the stock had touched a daytime high of 91 cents. After releasing these results which I contend were stellar, the stock retreated by 23% to close at 70 cents. I made multiple buys on the route downwards so I may have to sit on a donut for the rest of the evening.

Lot’s of conspiracy theorists on the message boards on a wild last two hours of trading as one would expect, but I will not partake in. I do believe that someone pulled the trigger on the financials early in error since the accompanying press release did not hit until after hours. But let’s look at exactly what we have here and how I view the valuation now.

With just shy of 100M shares outstanding, ZOMD currently sits at just shy of a $70M market cap. With the currency changed to CAD, the company delivered $76.3M in revenue and $12.5M in Net Income. That drives ratios of of .91 P/S and 5.6 P/E. That screams a bargain as it is.

But we also need to consider that the significant operational efficiencies the company has shown during 2024 did not really show up until Q2 of this year.

Q1 of 2025 should look significantly better on the top and bottom line. Some time in May we will see their new Q1 and they are up against only $11.8M in revenue with $727k in net income. That net income rate was 6.1% and in the three quarters since has come in at 15.4%, 18.9% and 20.3%. If you average out their last three quarters on the top and bottom line their TTM after Q1 could look something like $84M in revenue with $15.4M in net income. That would give new ratios of .83 P/S and a P/E of 4.5 and somewhere near 4-5x cash flow.

I’m not sure there is a ticker on the Venture as undervalued as ZOMD based on that paragraph above.

Now if I were to be critical of Zoomd and as an annual pick I feel I need to, they need these operational improvement to translate to their IR department. Pulse check.

Outside of telling investors when they are planning to participate in investor conferences, the company just doesn’t put out any news. When they do, they do a rather mediocre job of it.

Case in point the headline on these phenomenal results is “ZoomD reports Fourth Quarter and Fiscal 2024 Financial Results”.

Then they go on to discuss Adjusted EBITDA numbers. Do you know which kind of company’s discuss Adjusted EBITDA numbers? Ones who do not fucking produce over 20% Net Income!

COGS increase of 80% - are you guys fucking high?

Did the CFO or a marketing person write this word salad?

I’m going to re-write their press release below, just for shits and giggles.

Zoomd Reports Q4 and 2024 Fiscal Results Celebrating Record Revenues, Gross Profit and Net Income Due To Operational Transformation Efforts

Revenues increased by 100% in Q4 and 70% for the 2024 fiscal year

Gross profit rose to 41% in Q4 vs 34.4% through better pricing initiatives. Fiscal 2024 rose to 39.5% compared to 37.4%

Due to operational transformation initiatives reduced expenses to just 22% of revenue in 2024 compared to 50% in 2023 returning significant value to shareholders

Operational cash flow improved by over 1800% compared to 2023

Above successes contributed to Net Income of $8.9M compared to a loss of $4.7M in 2023 including $3.3M in net income in Q4 which accounted for over 20% of revenue

That’s it! It’s half as long, says twice as much and I’m halfway through my second glass of wine right now.

COGS. COGS! I can’t fucking get over that man.

I digress…

Not to take away from all of the incredible things the company has done this year. The transformation year over year the company has undertaken are immense, almost unheard of really on the junior exchanges. Every nano or microcap stock is going to have their warts, and to be frank I’m glad it’s their communication that is the weak spot as that is the easiest thing to fix. I look forward to meeting and chatting in Vegas next month over drinks. I’ll buy.

I give the IR team two stars but these financials are a solid four.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

What about customer concentration? Maybe that should be priced in. Interesting to tune in today on cc

Dose of sanity there my friend, thanks.

Also, the re-written press release did make me laugh 😂