The first request out of the brand new Wolf Den discord is this miniscule $5M nanocap called Yanagroo. I immediately question them based on the choice in their company name, as it sounds about as appealing as a rub n’ tug called Edward Scissorhands.

Results are more important however and the stock has doubled from 4 cents since they released their recent financials and has been a four bagger since November.

For a 62M share float, it is very thinly traded and sometimes goes for days without any action. One of the last thinly traded nanocaps I reviewed (NTG Clarity) and subsequently selected as a 2024 Wolf Pick turned into a 14 bagger - does it have that kind of potential? Let’s find out.

Note: $YOO.V reports in USD

Balance Sheet:

A current ratio around 1.5 is solid, around 1.0 is acceptable and anything under has reasons for concern. That is where Yangaroo is with a current ratio of a rather putrid .51 that consists of just $231k in cash, $1.5M in receivables, and about $200k in other short term assets against a rather daunting $3.8M in liabilities due over their next twelve months.

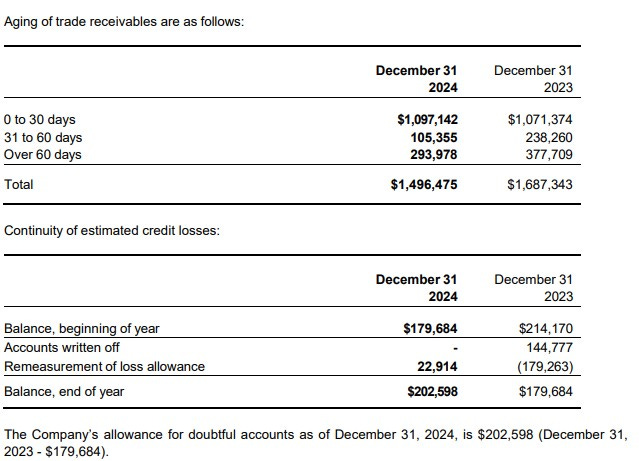

78% of the company’s current assets are tied up in A/R, so the cleaner it looks the better. I don’t have any major concerns but 27% aged over 31 days isn’t great when your balance sheet looks as rough as this. Their A/R manager needs to be on collection calls like a fat kid on a smartie. Any write offs are equally as bad when you have liquidity concerns and they are currently estimating $202k.

Yangaroo has $2.3M worth of debt (all current) made up of a revolving credit facility, term loan and convertible debentures.

Their revolving facility is at a decent rate of prime plus 1.95%. Their term loan facility has been through a bit of drama however. The loan has been amended on three occassions with increased rates to prime + 4.45%, incurring additional amendment fees and not in compliance with financial covenants. That $1.16M is due at the end of next month. Their convertible debentures are at an extremely high prime + 8% and convert at 10 cents expiring in November of 2027.

Things are looking a little messy so far.

Cash Flow:

Operational cash flow (OCF) is quite good and the best part is is wasn’t assisted by a lot of working capital changes so that OCF production of $1.65M for their 2024 fiscal year is legit, and it is 75% better than what they achieved during 2023.

They spent $627k on assets during the year, paid down over $650k of debt and another $115k in contingent consideration for their 2023 acquisition of Mellenia3.

Overall the company slightly improved their cash position during the year.

While the balance sheet looks like ass, the combination of their balance sheet plus cash flow statement is slightly better.

The question is can their 2025 OCF offset their working capital deficiencies without raising additional capital. If they can amend (for the fourth time) their term loan and collect on their A/R, it’s possible, but I’m not sure I’d bet on it. Then the question becomes how do you exactly go about executing on a raise while you’re trading around 8 cents? The options are not great.

Share Capital:

62.4M shares outstanding. Not a drop of dilutionary measures in the past two years which is rather remarkable given everything I’ve said up until now

35k options outstanding as 498k expired in Feb unexercised at 12 cents

2.5M RSU’s awarded post financials. Feels a little gross to be awarding RSU’s instead of options when the company could benefit from some help to the treasury

Insiders own 18% with a surprising 25% owned by tutes

No insider buying in the past two years. Even at 2 cents this year which makes one wonder

Income Statement:

Yangaroo delivered $8.05M in revenues during their 2024 fiscal year, a modest 2.1% increase over 2023. Sadly the company does not produce a margin number, but total operational expenses did decrease by 7.4% on small revenue gains showing a nice increase in productivity. Therefore operating income was up by nearly 60x to $767k vs just $14k in 2023. After interest expense and a $216k foreign exchange birdie and taxes the company ended up with $536k of positive net income compared to a $4.1M loss last year. Much of that loss last year was due to a $3.6M impairment.

Their back half of the year has trended somewhat better with revenue increases of 16% and 8% respectively, with each of those quarters also showing better profitability on the net income and EBITDA lines.

Overall:

Profitable $5M market cap stocks are difficult to find, and with Yangaroo trading at a 7 P/E, a 4 EV/EBITDA and a P/S ratio of under .5, I can see the potential interest here. But with the balance sheet in the state it is in, I feel that needs a sizable rating downwards in terms of their valuation.

The company has grown slowly from 2013 from $3.5M (CAD) to $11M in 2024 for a CAGR of about 11%. But it’s still very small potatoes. Does the company have a path to $20M or $25M over the next few years? I don’t know and to be honest I had a heck of a time trying to do initial DD here. Their investor relations has no deck and it honestly didn’t interest me enough to dig any deeper than I already have.

Don’t hate it, but don’t like it nearly enough to keep my interest level up.

2.5 stars

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Never heard of it, and from the name I assumed it was an Australian company. Maybe the dingo ate its balance sheet, or maybe not. Either way I'm staying out of it.