Well Health $WELL.TO FINS Review

2024 Q2 (3 / 5 stars)

Started this review in Edinburgh and wrapped it up today in Oakville for my first multi-continent review.

Full disclosure - I exited my position yesterday (last week now) from a hotel bar after seeing their results. I wrote a piece a couple of weeks ago on how I viewed the importance of the next couple of sets of financials. I outlined some of my concerns and things I needed to see to remain a shareholder. I did not.

This is now my tenth financial review of Well, with the first several receiving three and a half stars but I downgraded them to three about nine months ago. Let’s have a look at what occurred in their second quarter.

Balance Sheet:

Current ratio of 1.25 which is about a quarter point worse from where it was at the end of Q1. As of June 30th, they sat with $46.6M in cash, $181.5M in receivables, and $32M of prepaid sand other short term assets against $208.4M of liabilities due over the next year. The biggest differences from the beginning of the year is a 90% increase in their A/R and an $82M increase in “other” liabilities. The latter is due to cash advance payments received via third party providers for their CRH business and relates to their receivables and a cybersecurity breach their provider had. Probably nothing to be too concerned about here but an unfortunate situation which I would assume will be resolved the next time we see financials. They do have about $3M in anticipated A/R write offs which isn’t much of a concern on a $1B business.

Well Health has $287M of bank debt, $52M of convertibles debentures and $23M in deferred acquisition costs.

Cash Flow:

Through six months, Well has generated $54.2M of operational cash flow compared to $31.8M, an improvement of 70%. An improvement of over $22M, but it’s much less impressive when you note that $15M of that is from differences in foreign exchange and growth of accounts payable and not actual improvements in operations.

They also purchased $6.5M worth of assets, settled $6.4M of acquisition costs, paid down $17M of debt and utilized a paltry $444k via their misguided NCIB.

Share Capital:

248M shares outstanding as of June 30, with 5% dilution over the past year

2.8M RSU/PSU’s added to insiders while 114k bought back under their NCIB

400k ITM options remaining with 1.6M exercised YTD

4.4M RSU and 3.2M PSU’s outstanding with 2.4M granted YTD

Future dilutive measures to come from $52M in convertible debentures and shrinking future deferred acquisition costs

7% insider and 6% institutional ownership

CEO dumped 1M shares at the end of June. Perhaps to pay down some of the $7.1M he owes the company.

Income Statement:

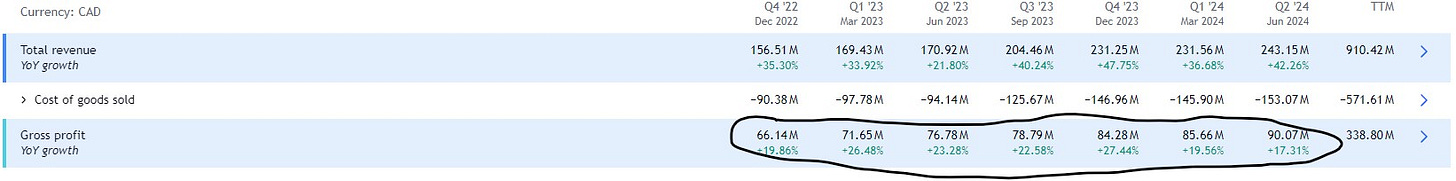

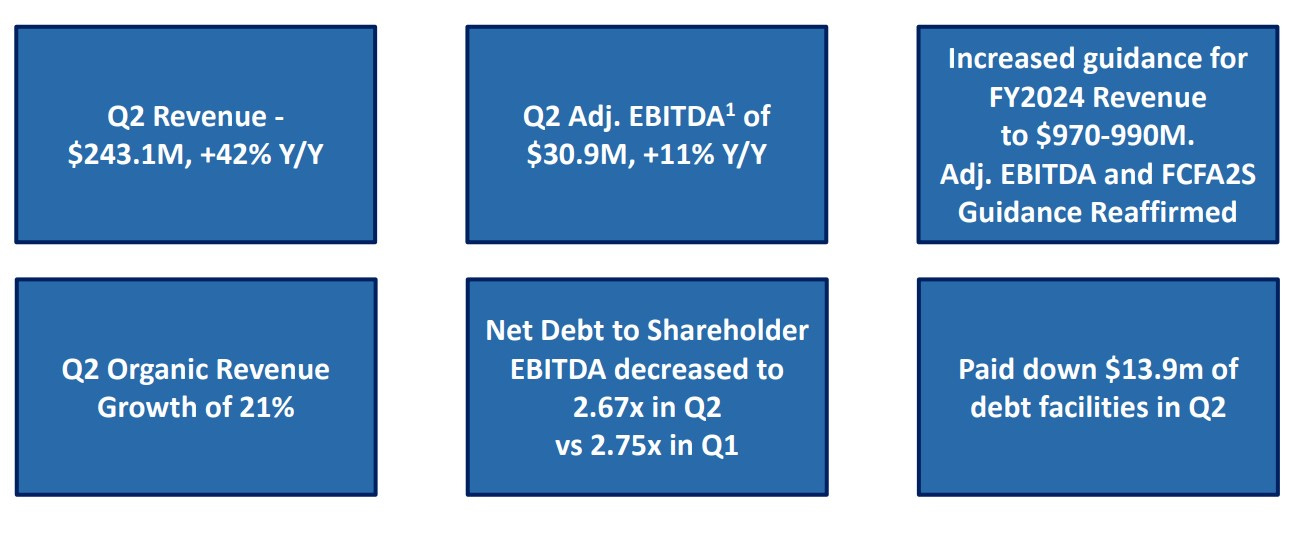

Revenues grew once again by an impressive 43% to $243.1M, up from $170.9M in the comparable quarter a year go, but once again it was coupled with margin erosion of 300 basis points to 44%, down from 47%. YTD the company has lost 850 basis points in gross margin to last year. On a one billion dollar business which Well Health is trending towards in 2024, that is $85M in lost opportunity and that creates a lot of pressure on the rest of the business to make up for. G&A costs did grow at a smaller pace than revenues at a 24.6% rate showing they were able to convert some there, but not enough to make up for the gross profit erosion as their total operating income came in at $9.9M, down from $10.1M last year. On a YTD basis, operating income is slightly less as well at $18.7M vs $18.9M - a truly disappointing result on $134M more in revenue.

I have been talking about the AIDX relationship for quite some time now and the monumental impact it would have on future financials. In Q2, their value of investment in AIDX increased by $116.3M. Without this, Well’s net income would have came in at $600k on nearly a quarter billion in revenue. From a YTD perspective, the impact is over $141.5M, and without that, Well would have experienced a loss of around $6M on nearly a half billion in revenue.

Overall:

They are just not making enough meaningful improvements other than the top line for me which has been my concern for sometime. I wrote a piece a few weeks back of the things I needed to see over the next couple of quarters to remain a shareholder and I simply have not.

I’m not writing them off forever either as they are a substantial player in the space and have a one billion dollar business with positive cash flow to work with. I get the sense that current leadership was great at the initial part of the rollup strategy, and perhaps may not be the right team to take it to the next level.

Here are a couple of problems in the next couple of quarters I foresee for Well Health. First is the inorganic growth train they have relied on for big quarterly headlines will be coming to an end soon. We will likely see somewhere in the neighbourhood of 20% growth next quarter but then in Q4 it could be in the mid single digit range. This for a company with declining margins and not converting enough within their controllable spending to make up for it.

Next is still a highly overvalued AIDX and it looks like that could finally negatively impact WELL in Q3 - the final determination of that will be known at the end of September. Based on Q2, Well’s investment in AIDX equates to about $725k for every cent that the stock increased. As of today, the stock is down 63 cents from the start of Q3 which equals a potential loss of $46M which would hit the books next quarter. Since I believe AIDX is still highly overvalued today this has the potential to get worse - therefore their are much better plays out there for me.

Even the highlight slide is pretty weak outside of the debt reduction. Celebrating 11% adjusted profitability on 42% growth? And I have a strong assumption their definition of organic growth also differs from mine. I suppose we’ll know for sure in Q4.

Once again, FCFA2S is a “sleight of hand” metric and performance pay should be awarded for more than just the top line. I don’t give a shit if it’s awarded under a SBC plan or cash, the management team has not earned the amount they are receiving under either. Net Income matters and they haven’t been able to deliver on that yet.

Maintaining the three stars here but as I said, I’m out - but don’t think that means this will be my last word here.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.