If you’re familiar with my work, then you know that I have had a bit of a love/hate relationship with Well Technologies.

My overall frustrations with the company can best be summed up by the attached article I wrote about them a little over a year ago.

There is some irony in the fact that the stock is only two cents higher today than it was when I wrote that piece on July 26th of last year - $4.78 currently, but has seen the stock go as high as $7.36, and as low as $3.72. (note I started this article on the weekend).

I ignored the stock when it was $7, but became much more interested when it dipped below four bucks back in April. Since then I have called out two buy zones above $3.72 and $4.50 support levels. I’ve bought the stock in each of those zones.

In true Well Health fashion, upon announcing their earnings, the stock rose by 7% in early trading, but finished the day down 6.5%. Sadly, this is not unusual.

I have some theories as to why this seems to be a regular occurrence, and it’s something that I discussed in length in that article mentioned earlier. Well Health writes great headlines, produces great PowerPoint slides and there isn’t an “Adjusted” number that the company doesn’t like. And when necessary, the company will just invent their own metrics like FCFA2S (Free Cash Flow Available to Shareholders).

Therefore the headlines are typically better than the actual meat and potato metrics that astute investors typically look at. I think swing traders have become accustomed to this, so they buy leading into earnings and then sell the news. Now I will admit that I haven’t fully picked apart the details in this set of financials to determine if the above is indeed the case. Let’s rectify that now.

Note, I did not review Well’s Q1 but their 2024 annual filings received a three star rating which was unchanged.

The good news is that by Tuesday morning, the stock is now above $5 again and looks to be holding $4.98 support, potentially setting up a third Wolf Buy Zone.

Balance Sheet:

Well has historically had a mediocre looking balance sheet and this one is no different. With deferred revenue removed, the company has a current ratio of 1.1 that is made up of $98.9M in cash, $190.2M of accounts receivables and $69.5M in other short term assets against $327.6M of liabilities due over the course of the next twelve months.

I’ve ripped the company in multiple previous reviews for having very large outstanding amounts receivable from members of the C-suite for tax withholdings. This eyesore continues to grow.

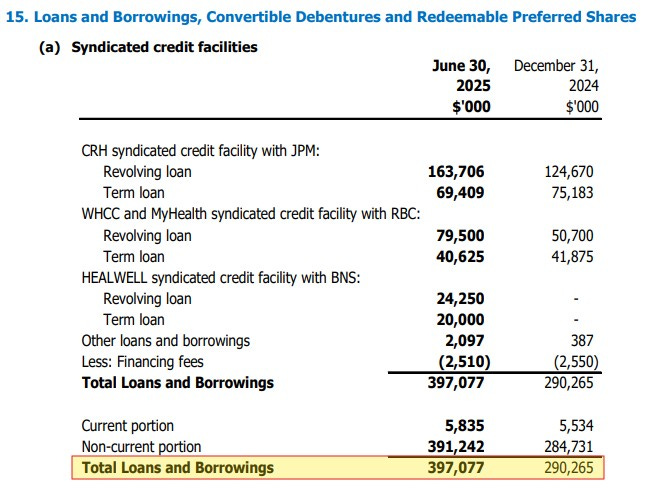

Including debentures, Well Health has over $481M worth of debt, and another $50M in deferred tax liabilities. It’s notable that their debt has also risen by over $100M in just the past six months, about half of which is Healwell AI debt that the company now reports as a full subsidiary.

Cash Flow:

At the midway point of the 2025 fiscal year, WELL has delivered $48.6M of operational cash flow (OCF) compared to burning over $25M during the same period a year ago (OCF was very negatively impacted by working capital adjustments last year). That includes over $27M generated in Q2, a slight improvement on the $21M from Q1.

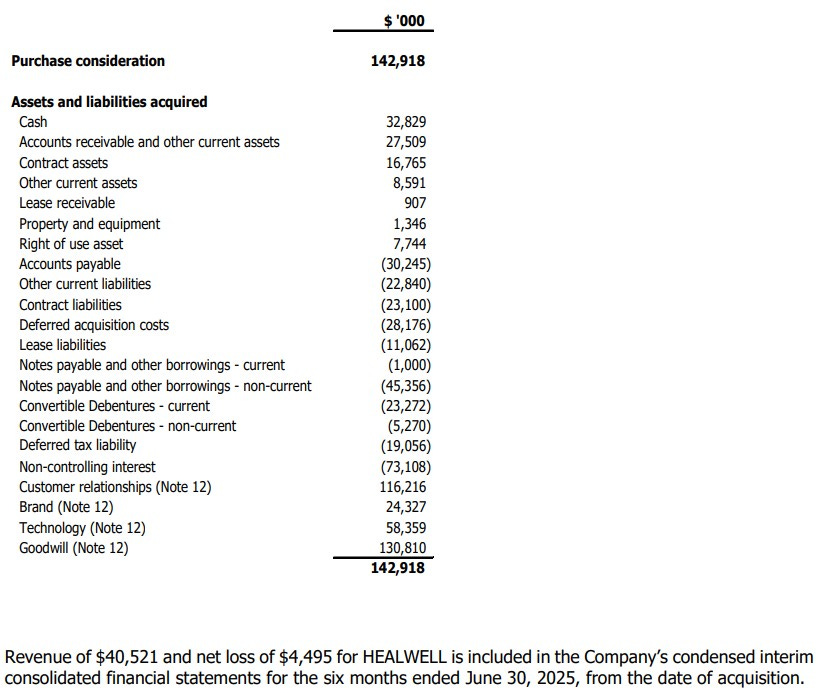

YTD, Well Health has utilized nearly $38M on investing activities, most of which through acquisitions, the largest of course was the completion of their interests in Healwell AI, and it’s notable that over 91% of the total purchase consideration was allocated to goodwill.

Also during the past six months, the company took on an additional $72.5M worth of debt via loans, paid down those advances relating to the CRH billing provider issue (read my previous reviews for more details), made $2.6M of interest payments on convertible debentures and utilized a minuscule $377k on share buy backs (seriously - why are they bothering with this?).

Overall, Well Health has had their cash situation deplete by 25% from the start of the year.

Share Capital:

253.3M shares outstanding as of the end of the quarter with 2% dilution since this time a year ago

Approximately 600k shares have been bought back over the past two NCIB’s, representing about .2% of the outstanding float. Seriously guys, focus on other shit.

Only 285k options remain, as the company has moved to awarding RSU’s and PSU’s. All are well ITM

4.6M RSU’s and PSU’s outstanding with 871k new awards granted and 2M vesting so far YTD.

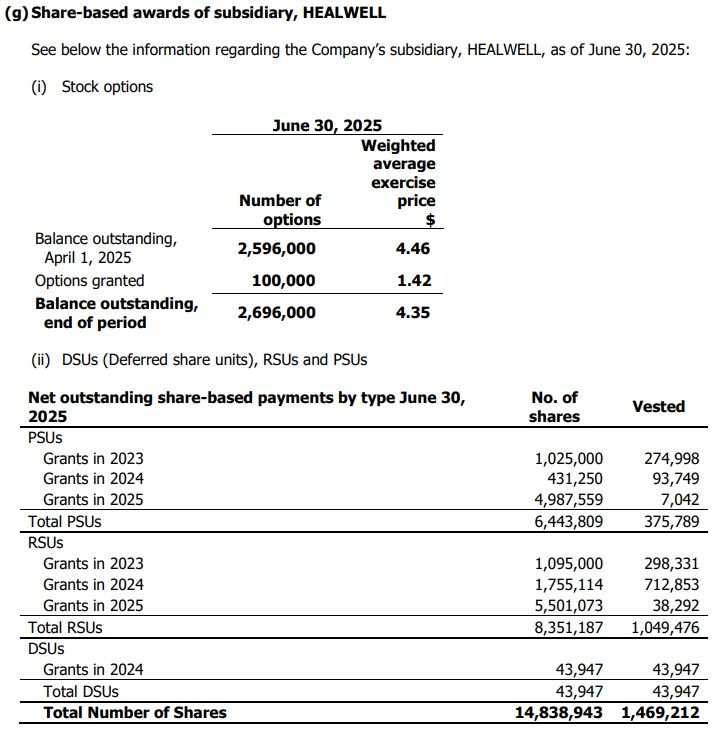

Now that Healwell AI is a reporting subsidiary, the future dilutionary measures of AIDX.TO are a factor as well. Over 10M PSU and DSU awards were granted so far YTD

Per Yahoo finance, 21% insider and 6.5% institutional ownership

Insider activity on the open market has been a rarity, but the share buybacks have continued post financials

$58.4M in deferred acquisition costs with an undetermined amount to be settled via shares. $11.3M were settled via shares YTD

Income Statement:

Well Health reported $356.7M in revenue in their second quarter, a very impressive 57% increase compared to Q2 of last year and a 21% on a QoQ basis. They also had an excellent quarter in terms of gross margin, rising by over 400 basis points to 44.5%, which reverses a troubling trend. This resulted in delivering over 73% more in gross profit dollars. Well also converted better than they have previously within their G&A costs. They still grew by more than 37% to last year, but when you have more than 73% more margin dollars to work with, it is going to result in higher operating income. In this case, $27.1M of positive operating income in the quarter compared to an operating loss of $4.3M in the comparable quarter.

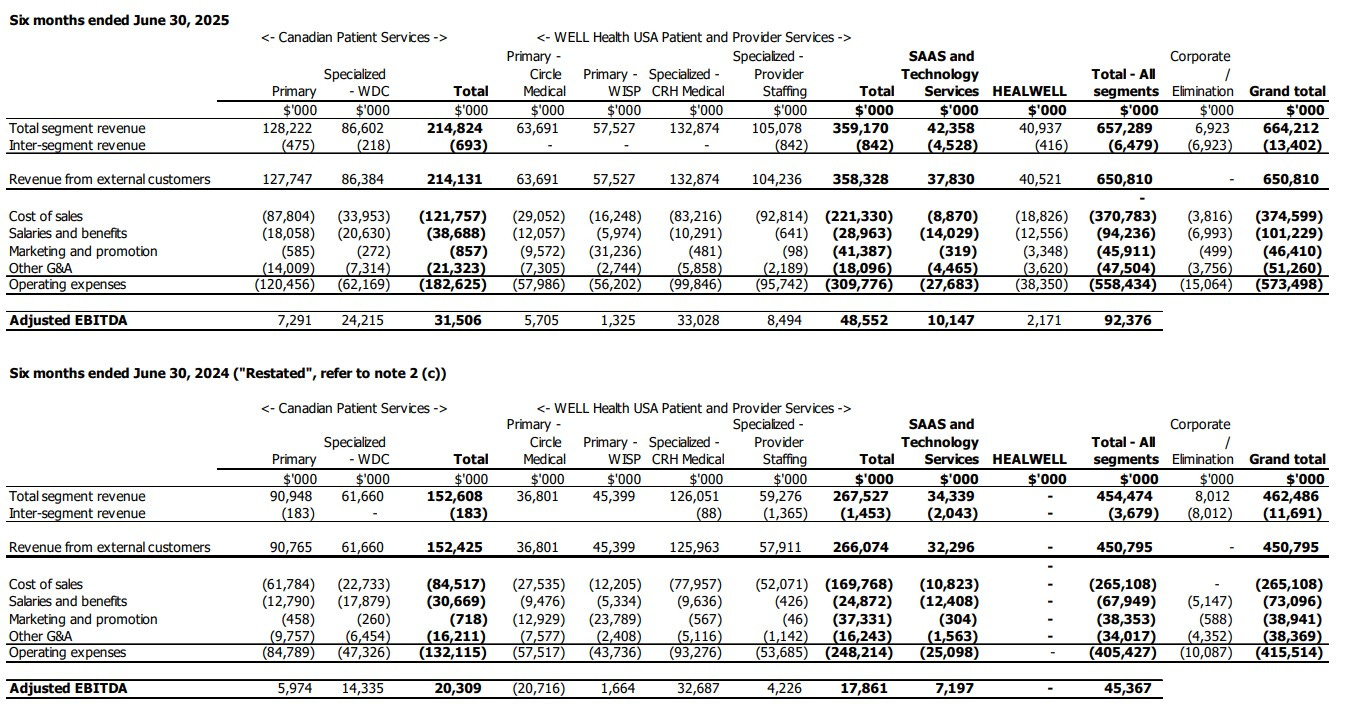

On a YTD basis, Well Heath is up to $650M in revenue, 44% higher than last year. Gross margin through six months is up 120 basis points to 42.4%, cash burning expenses were up by 30% and total operating income totaled $34.8M vs a loss of $3.3M through six months last year.

Below the operating income line, the company has a $150M net bogey within their fair value of investments, which relate to their ownership of Healwell AI. That can be explained by Healwell AI’s share price performance between June 30th last year to this year.

Therefore the total net income looks atrocious with a net loss of $25M compared to net income of over $119M a year ago.

While this isn’t irrelevant as Well does control a very significant amount of Healwell and is tied to their share price performance, if we are looking at their operational progress we should also consider what it looks like without these large swings.

When we do that their “adjusted” net income is a loss of $2.4M compared to a loss of $10.9M last year.

Overall:

With $1.1B in TTM revenue and guidance for over $1.4B for fiscal 2025, Well is becoming a behemoth in the Healthcare space on both sides of the border.

Canadian patient services are up 41% YTD, 34% within the USA with their SaaS and Tech segments up by 23%. Even without the addition of Healwell’s $40M this quarter the company would have grown by 36% YTD.

From a top line perspective, the company has been one hell of a roll up story, going from $9M in revenue in 2018 to a projected $1.4B this year.

The problem is how do you proper put a valuation on the company when they have not had similarly impressive results on any profitability or ROIC metrics during the same time period. That also gets more complex when faced with a company approaching a half billion of debt and over $50M in annualized interest expense. From all of the typical valuation metrics I typically use, it is honestly hard for me to make the argument that they are currently “cheap”. They have negative annual and TTM earnings and even on an EV/EBITDA basis they are near 25, considerably above what I deem “cheap (10 or less).

There is also a whole host of things I don’t love about the company. Historically high SBC costs and while those have scaled back in the last year or so, that has transferred to higher cash burning costs with increased salaries and cash bonuses with similar SBC issues arising within their new subsidiary, AIDX.

I don’t like their method of how they report metrics, as I think they are very selective and border on misleading, and I also feel they could do a better job of converting better within their controllable expenses but the last two quarters have shown better progress.

But all of those concerns still don’t turn me off from holding a position and looking for opportunities to add more. They are likely one of the best consolidators within the Canadian space since MTY, and there is absolutely no sign of them slowing down. They have a lot of goodwill and intangible assets built into their balance sheet - typically a scary proposition for most roll up stories, particularly during the covid era. But Well Health has written off virtually nothing from overpaying an acquisition.

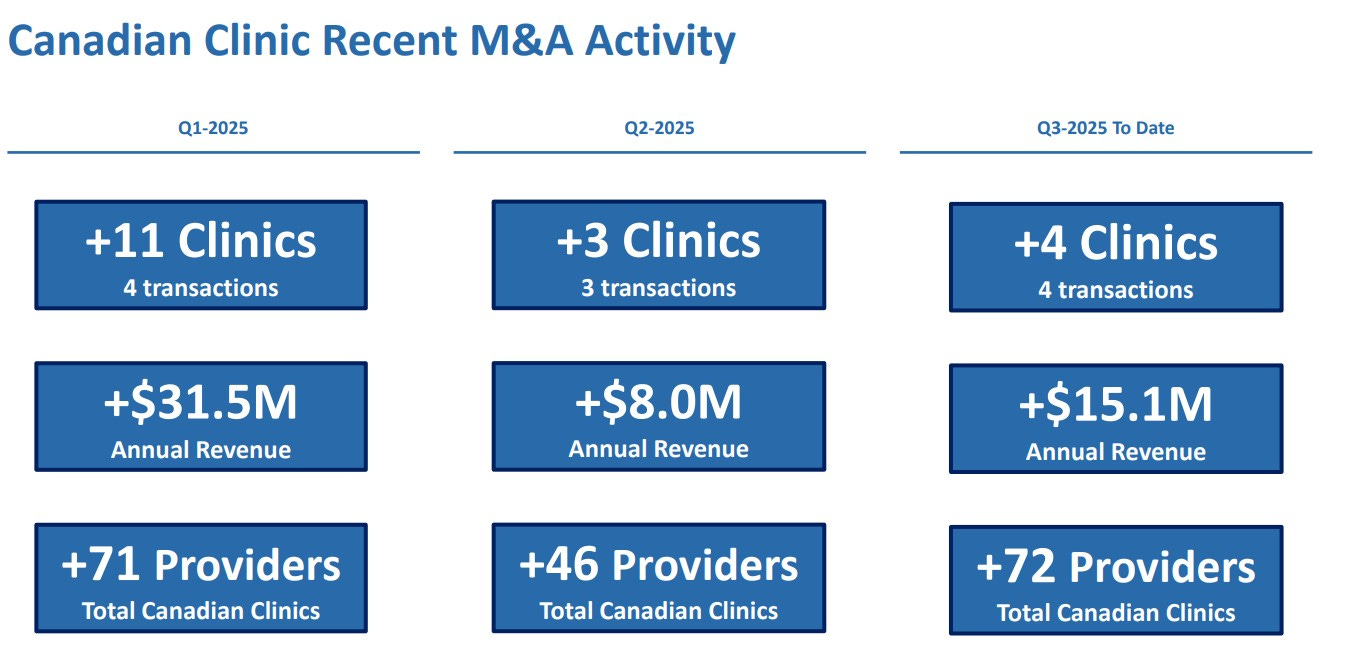

If you think they are about to slow down - it’s completely the opposite.

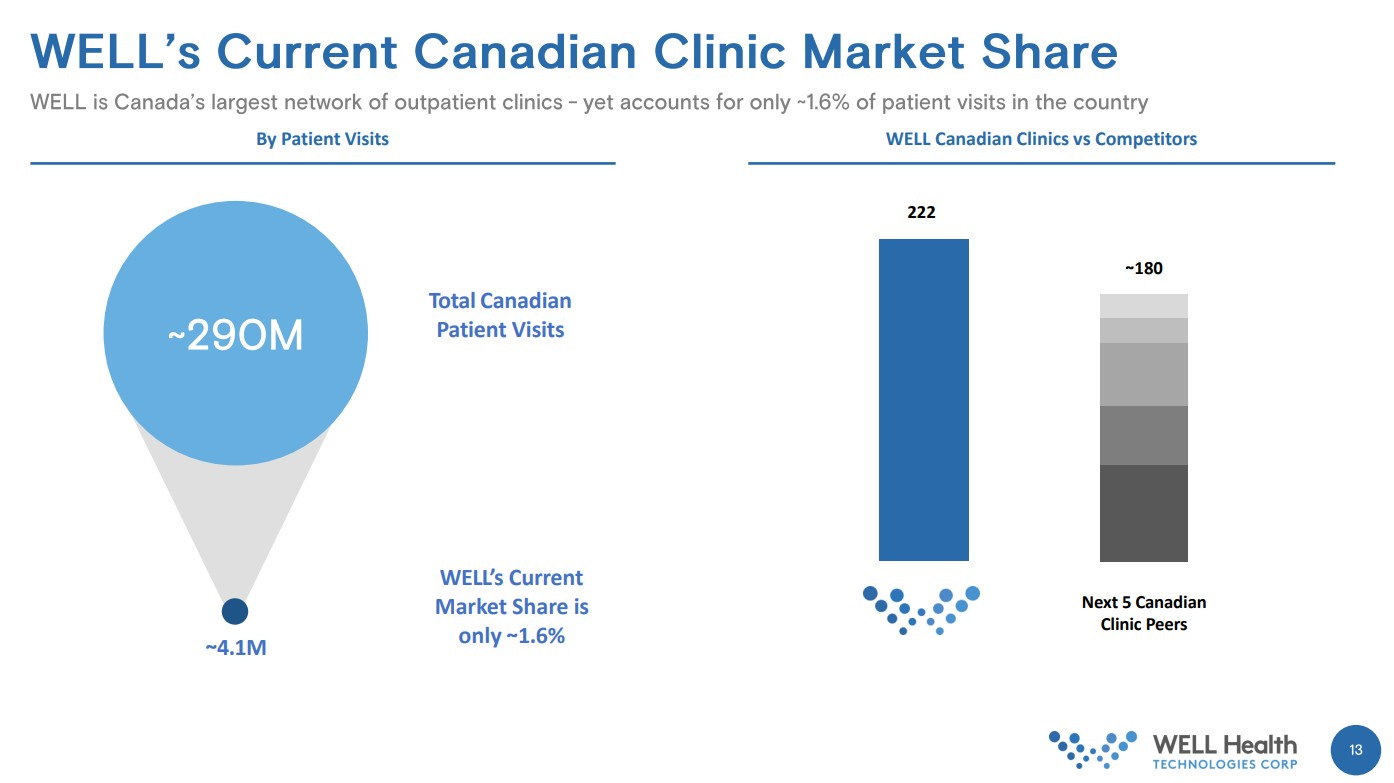

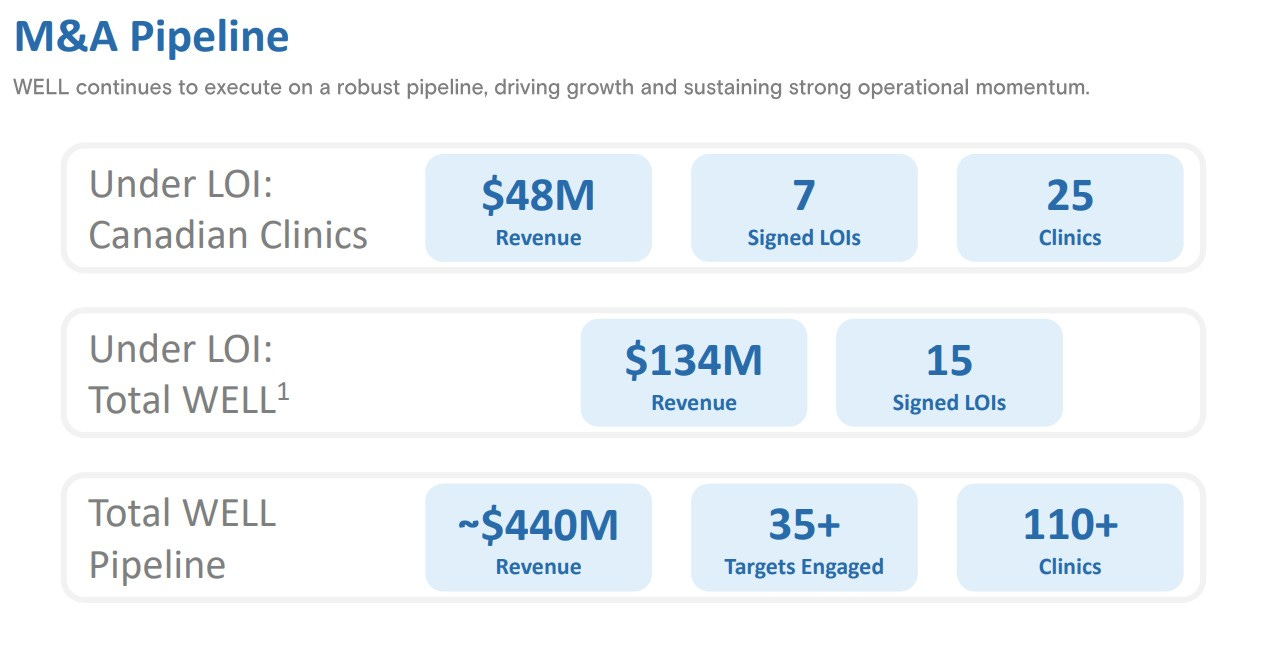

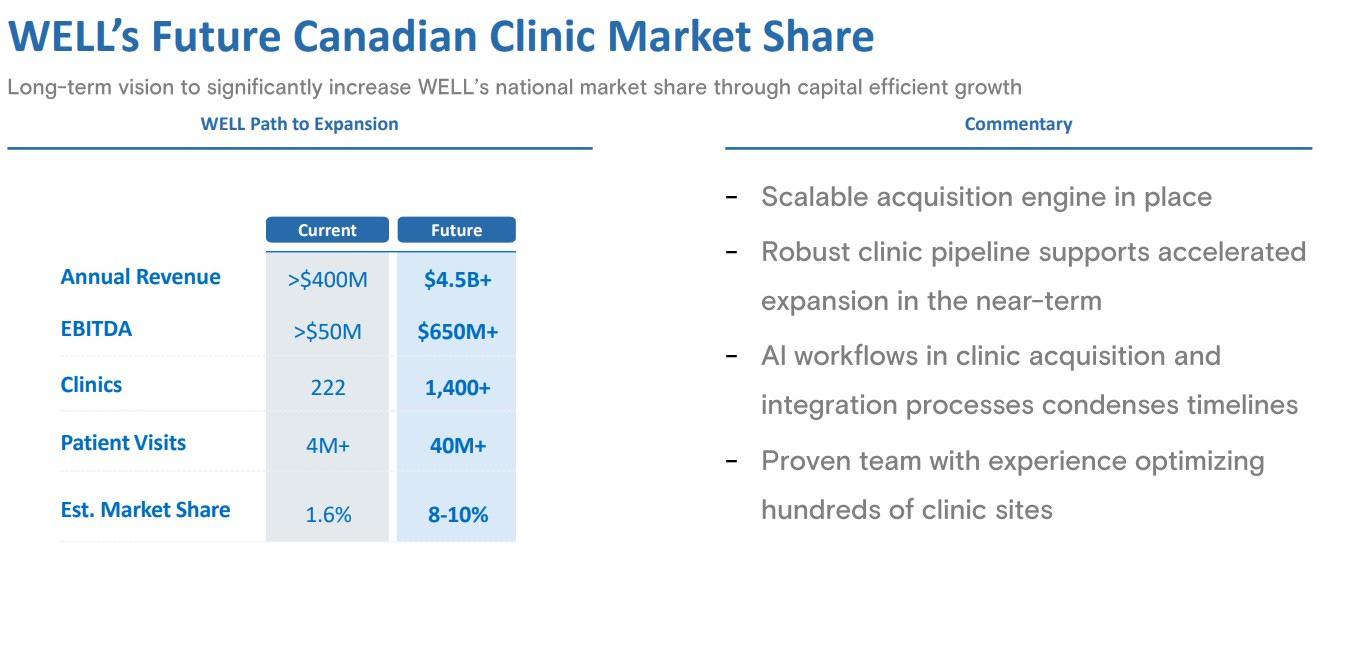

They currently have 1.6% of the Canadian market share with eyes on achieving 8-10%. They have $440M currently in the acquisition pipeline which would put them close to $2B in annual revenue with future goals of getting to $4.5B in their Canadian clinic segment alone, and all of that excludes what they are doing with Healwell and WellStar.

I will continue to evaluate them on a quarter by quarter basis, but Well is still not upgrade worthy yet. Three stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. What the hell is "Free Cash Flow Available to Shareholders?" I've been a shareholder, so where's my cash?