I’ve chronicled my love-hate relationship with Well Health on numerous occassions over the past few years so I won’t re-hash them here - I’m sure that will become evident as we move through this review.

Between January and April the stock fell nearly fell by 50%. After that prolonged dip, I identified a buy zone opportunity in the $3.70 area and once again became a shareholder. After identifying another buy zone range around $4.50, the stock soared to over $6 again. I considered selling at $6, but my pull out game was weak and after yesterday’s earnings, the stock is back just above $4.40 support after declining by 8% after their earnings release on Thursday, and another 1.3% on Friday.

Back in August, I tweeted the following, highlighting the stock’s propensity to bounce in the first hour of trading on earnings release day only to become a sell the news event.

That held true again as well with the stock tumbling 10% from the early morning session high.

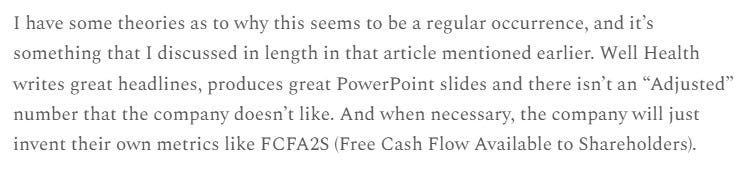

I have a theory which I shared in my Q2 review back in August, and that is the headlines are typically better than the actual results.

Within their Q3 news release the company spoke to Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA, Adjusted Net Income, and Operating Adjusted Cash Flow. Well Health adjusts their results more often than I adjust myself when I wear boxer shorts under loose fitting pants.

There’s a visual for you. Let’s get on with the review, shall we?

Balance Sheet:

As has been true for several straight quarters, Well sports a mediocre current ratio of 1.05 which consists of $83M in cash, $199M in receivables, and $67M in other short term assets against $328M in short term liability commitments (deferred revenue removed).

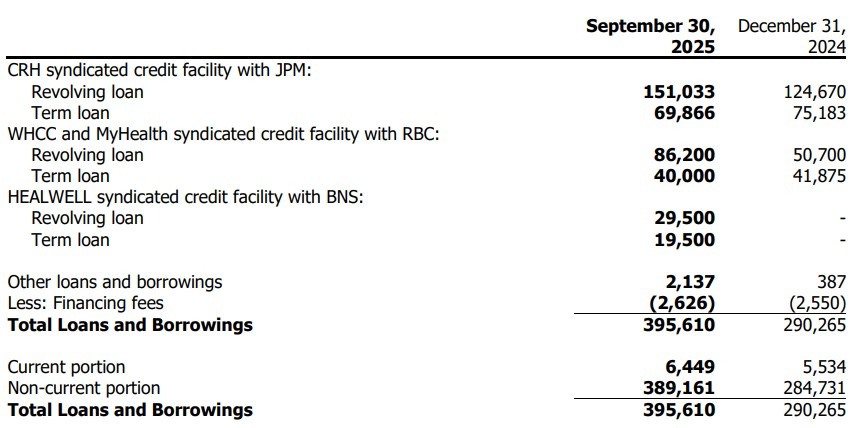

The following continues to be a growing eyesore on their balance sheet.

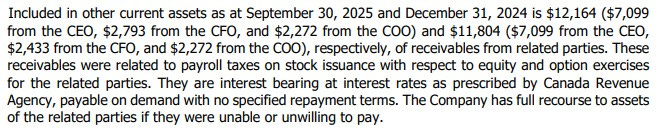

Including convertible debentures, Well has $485M worth of debt. That is up about $100M from the beginning of the year, about half from the Orion acquisition and the other inherited from Healwell AI coming under their umbrella as a subsidiary.

Cash Flow:

Through three quarters, Well has generated $75.8M of operational cash flow, which is nearly $110M better than the $31.6M of operational burn experienced through the same time last year.

So far in 2025 the company has spent $31.7M in net costs via acquisitions, spent $31.2M in other hard assets, added $66.M in net debt, repaid over $91M in advances relating back to last years cyber attack involving CRH’s payment processor, and bought back $1.1M worth of stock.

Overall, the company has burned through 37% of their cash position from the beginning of the year.

Share Capital:

253.9M shares outstanding at quarter end with 2% dilution year over year

225k options, all ITM

2.7M RSU’s with 1.6M vested and 1M granted YTD

2.55M PSU’s with 1.12M vested and 1.25M granted YTD

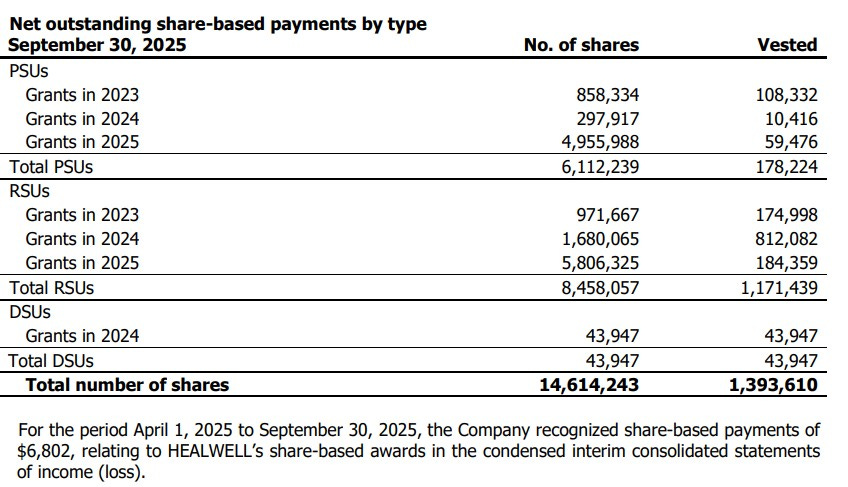

Within their subsidiary Healwell AI, 14.6M PSU, RSU and DSU’s outstanding including over 10.7M stock awards granted this year

Approx $61M in deferred acquisition costs. Historically these have been settled averaging approx half cash and half through dilutionary measures

Less than 300k shares repurchased under their NCIB from May 20th

21% insider and 5% institutional ownership

Income Statement:

The top line has never been the company’s problem and in Q3 they delivered $364.6M in revenue which is a 56% increase above last year. Gross margin on the other hand has not been as kind in the past year or so. It is very encouraging then to see this trend start to reverse as Well Health improved their margin by over 500 basis points in the quarter, achieving 45.5% vs last years 40.4%. Five hundred basis points is huge on that volume of business and as a result delivered 75% more in GP dollars in Q3.

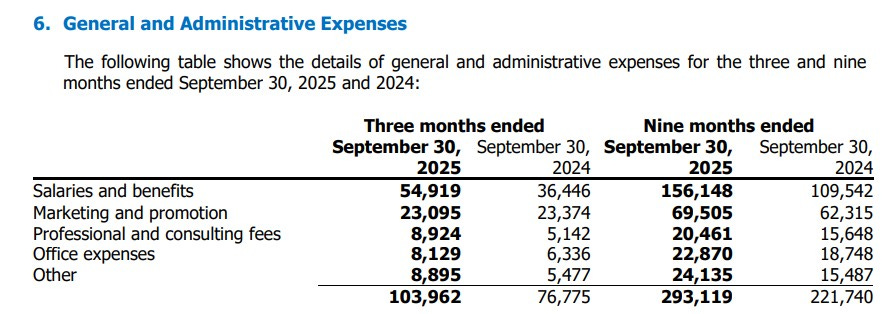

Within their main cash burning expense bucket, G&A rose by 35%. That is actually fairly decent conversion when you consider they generated 75% more in gross profit.

Non cash burning expenses were up by 119% however with depreciation costs up 50%, SBC costs up 178% and they took a $10.5M impairment charge related to goodwill on the acquisition of Healwell AI. Note that in my last review I noted that I felt the total purchase price was problematic with over 90% of the acquisition assets were related to goodwill. Note that the majority of the SBC costs also traced back to Healwell.

After interest costs rose by 78% and a $13.4M bogey in income taxes. Well Health suffered a $2.65M loss in the quarter. This compares to a $88.4M loss last year but it’s more like an $11M comparable loss when the investment value of Healwell is taken into consideration.

On a YTD basis, Well Health has already exceeded $1B in revenue at $1.02B, a 48% increase. So through three quarters they have already exceeded their 2024 total revenue by nearly $100M. Gross margin has improved by 260 basis points.

Up until the Operating Income line the story still looks quite good with $51.8M in positive operating income compared to a $5.1M loss at this stage last year.

But after $12M in additional interest costs and a $27M bogey in income taxes, it results in a $27.5M YTD net loss vs $30.9M in net income. Healwell’s volatile share price (particularly in 2024) highly impacts these results. When the impact of that is removed results do look somewhat better comparatively = a $4.7M net income loss vs a $22.2M loss YTD.

Overall:

Well Health continues to be a very difficult company to assign value. The only glaring metric where you can define them as cheap would be on a price/sales basis, a little over 0.8. I would also tell you buying any stock solely on a P/S ratio is a losing game.

They have negative TTM earnings, negative TTM free cash flow, negative ROIC with an 18 EV/EBITDA ratio with 25% more debt than they had last year and in my mind have irresponsible SBC expenses. None of these are attractive metrics screaming at investors to buy. Yet I’m probably looking to add more than I’m looking to sell.

They have a 4 year CAGR of over 50% within the Canadian health clinic space and have another $350M of revenue within the acquisition pipeline. They plan to spin out WellStar in 2026 with a corresponding IPO, and they are looking (still) for strategic alternatives for their US assets, which should bring in some considerable amounts of cash to parlay into more acquisitions and/or debt reductions.

$2B of revenue in 2026 does not look to be out of the question here, yet they are priced at around half the value of when they did $300M in 2021.

It’s odd that I can list more things I dislike about a company and still want to buy more of it. But that’s where I am - I believe there is still much more value to be had here.

Here is the company’s Q3 presentation deck from their investor call

Maintaining three stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Very Nice Wolf. I have come in and out of this stock and I am out right now. It seems like it is a trading stock not a investment in a business. I believe lack of focus and concentration is not only with this company but well as with many others. Considering all the reasons this should be working it really isn't creating sustainable movement up and up. Maybe it will and maybe it won't but many other opportunities waiting for investors money.

Thanks for the review, Wolf. Some nice numbers (and some not so nice), but still staying away from it.