TruBar ($TRBR.V) formerly Simply Better Brands ($SBBC.V)

Q1 2025 (2.75 stars) *Downgrade*

As I was three quarters through this review the other evening, I had to change course and address Simply Solventless’ disastrous results. Sadly, I had to delete my clever and witty intro as it is no longer relevant.

Last time out for Trubar’s annual filings, I awarded them 3.25 stars. They were also of course a 2025 pick in addition to being chosen back in 2023 as well. Since that last writing, the company had a corporate name change and a switch at the top with Erica taking on the CEO role, and Kingsley moving to the role of executive chairman.

The headlines were disappointing to some although this was telegraphed pretty well by the analyst coverage by Clarus. I also spoke to the potential for a soft Q1 in the new Wolf Den discord in the middle of the month and I used those results as a dip opportunity buy.

As expected, the market over reacted to those numbers and I was on mop up duty while vacationing in Kelowna adding as the stock dipped all the way to 80 cent support.

So, what do the results tell us, and what does the rest of the year hold? Let’s get started.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

At the end of Q1, TruBar maintained a 1.25 ratio. Not stellar, but acceptable and improved slightly from their year end. That consists of just $1.65M in cash, $5.6M in receivables, $8.8M worth of inventory and about a half million in other short term assets against $13.1M in liabilities due over the course of the next twelve months.

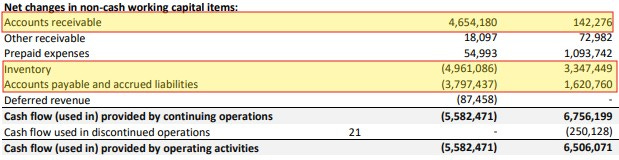

Massive changes within many accounts in just three months including a significant depletion in cash from over $7M. That and the overcollection in accounts receivables was used to pay down almost $4M in payables and a huge $5M in inventory investment in the quarter.

I’m not there yet but I know the working capital section of the cash flow statement is going to be fun.

Cash Flow:

The operational cash flow portion of their cash flow is ugly at best showing $5.6M of cash burn in the quarter compared to generating $6.5M last year.

As mentioned the majority is due to significant working capital changes highlighted above.

The company also paid down $1.9M from their overdraft or LOC facility and received $2.9M from warrants that were exercised. Overall the company’s cash position eroded by 77% from the start of their year, just three months ago.

It’s clear the company can not go another quarter with a similar cash flow statement. I’ve had some ask me since the financials if I thought a raise was possible. The company discussed this on the earnings call that one wouldn’t be necessary to meet their 2025 goals and their $10M line of credit certainly should help them avoid that. I would expect that OCF to have a reversal with the move of the Costco launch into Q2 and to support growth in other channels.

Share Capital:

107.2M shares outstanding, with some significant Q1 dilution due to 9.3M of warrants being exercised in the quarter.

5.7M options with 5.3M currently ITM but none of note expiring until August of 2027

122k warrants remaining with an exercise price of 55 cents expiring in October

2.8M RSU’s with 1.3M forfeited during the quarter

19% insider ownership (per Yahoo Finance)

Positive insider participation. There were multiple insiders who participated in the May raise, many open market buys (most notably Erica Groussman’s $260k September slap), in addition to exercising options

Income Statement:

This P&L was far from the company’s finest with their Costco promotion moving into the second quarter. As a result, net revenues were off by $3.5M or 26% compared to Q1 of last year. Margins were up by 400 basis points over last year to 31.9% but still shy of their longer term targets of 35% plus. Total expenses were $1.6M higher on less revenue therefore the bottom line was off more than $200k with a net loss of $1.2M. This also came with the added benefit of a reversal in warrant liabilities of $840k in the quarter and last years write downs for the exit of their cannabis business. At the end of the day, these results were about $2M worse on a comparable basis when one time items were removed.

Not a great start to the year no matter how you look at it.

Overall:

The shift of the Costco promotion into the second quarter had a huge impact here but as I mentioned off the top, that was anticipated. While margins were stronger than Q1 of last year, they were way off the positive trend we have seen over the last couple of quarters and I’m more concerned about that line than the revenue number which is anticipated to recover well for the remainder of the year.

That brings me to the Q&A portion of the earnings call which I felt was pretty weak on two fronts. First I felt Erica’s comments lacked a lot of colour, were too brief, and didn’t instill the same level of confidence as Kingley did on their annual call. I’ll chalk this up to leader the call for the first time, as I feel she is still the right leader. I also felt that Noel from Clarus threw too many softballs as the gross margin question had to come from a retail investor.

On to more encouraging things and there is no shortage of those. With the Costco events not matching on a year over year basis, Q2 is now expected to be a record quarter for TruBar sales in the $18 - $19M USD range with the company only up against $9.7M CAD, so with the exchange that could come close to tripling up last year’s revenue.

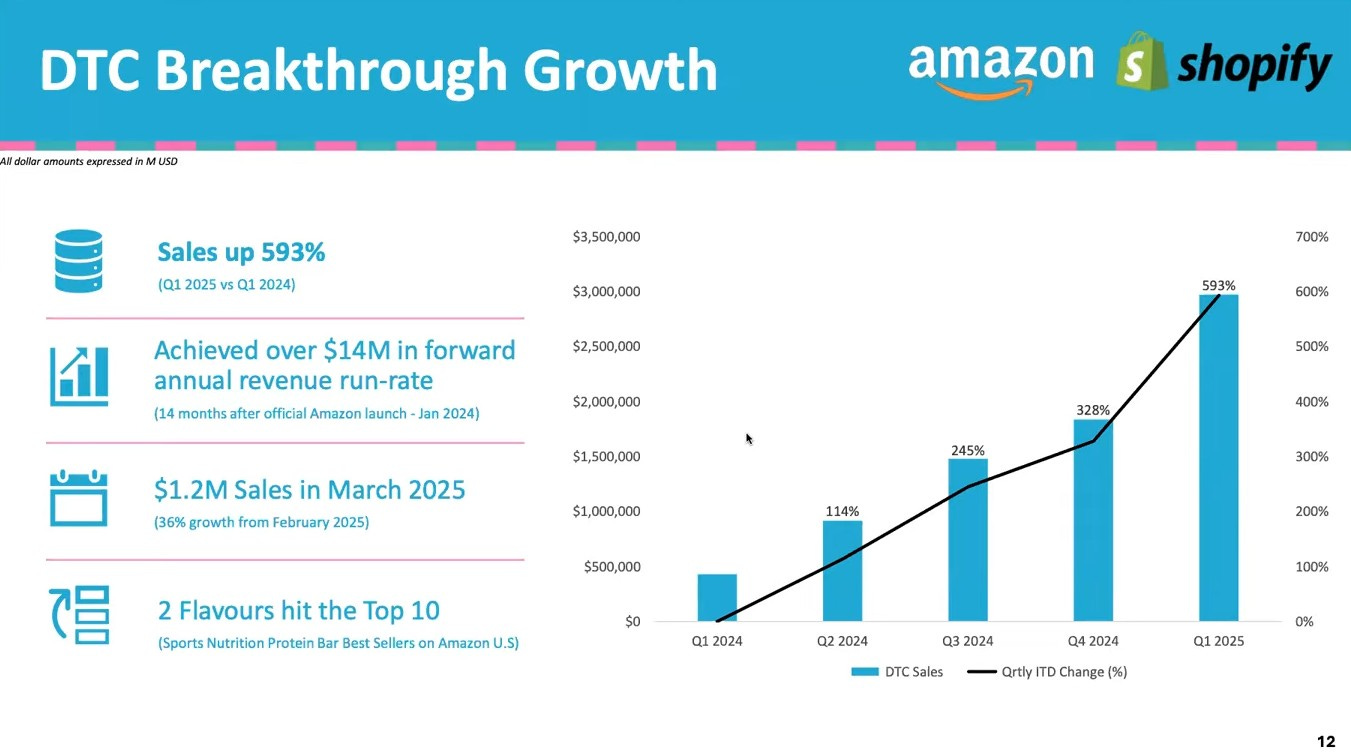

While the Costco promo shift hurt the overall top line due to the company’s club concentration, the company’s success within the DTC (mainly driven through Amazon) were nearly up 600% YoY ($2.6M) and are now on a $14M run rate. Trubar also gained $1.3M in retail channels (excluding Club).

As of quarter end Trubar is now in 18,000 locations (up from 15k at year end) with a goal of 25,000 by the end of 2025. Post financials the company had a test launch in Target and reports are they had a successful sell through, along with successful Walmart performance according to Clarus’ inventory tracking data. Trubar is also launching new products including kids and mini bars in the near future.

After disappointingly not providing 2025 guidance after their annual earnings call last month, they have this time around with the range of $65-$70M for this fiscal year which would deliver a 50-60% increase over 2024.

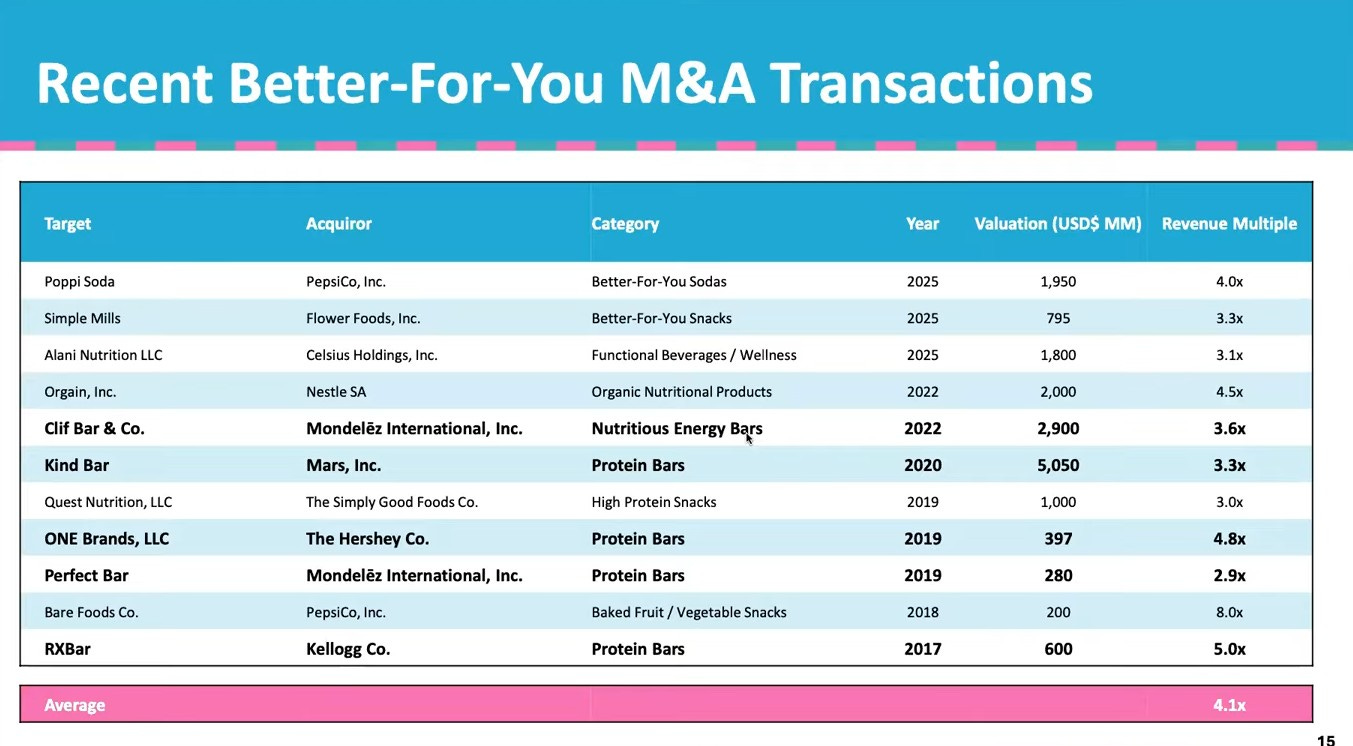

Top end of that guidance puts it ever so close to $100M CAD. That would have it trading at under 1x 2025 revenues at a current $90M market cap. While I personally do not like to perform potential valuations solely on revenue multiples, the company’s exit plan is to eventually sell TruBar to the highest bidder, and we have plenty of comparisons in this space.

With the average multiple of over 4x revenues, you can do your own math on where you think the company should be valued.

As for these financials, I can’t in good conscience maintain the 3.25 stars with these results. Downgrading to 2.75 here, but I fully expect a reversal when we see Q2 results out in August.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf and appreciate a good conscious always. Fantastic job on the break downs and details.

Thanks for the review, Wolf. Feel better after reading this.