Listen to your elders. A sage piece of advice that all young people receive frequently. The unfortunate part is most don’t realize how great that advice is until they’re a bloody elder themselves. Hi, I’m referring to me now.

As I have grown older, often something will occur in my life that brings me back to a “Dad’ism”, and not just the funny ones like, “if you’ve seen one, you’ve seen em both.” Occasionally I will think of another pearl of wisdom that came from someone aside from my father. Trubar’s results were reported on Monday evening and all day I have been thinking about something one of my former CEO’s told me.

I was a naive, yet energetic aspiring young exec and it was the time of year for annual planning and budgeting. The process was an archaic one where the C-suite with very little resources applied or thought given, forced sets of numbers downwards and it was then up to channel management to make their case as to why their revenue should be smaller and expenses higher. It was a torturous endeavor.

In short, my channel’s plan for the following year was being asked to deliver a double digit revenue increase with no additional marketing spend. Seeing these numbers for the first time gave me heart palpitations. There were appointments made for the following week to present your case for desired revisions to senior management. I had some work to do.

The meeting arrived and there I sat in front of the CEO, CFO and another senior level person from finance who didn’t know the difference between his ass and a hole in the ground (he was the one responsible for the initial numbers). My plan was to hit them first with my revised numbers, wait for pushback, and then back up my numbers with rationale. This was all done with some very slick, old school PowerPoint. If memory serves I was given a $6M marketing budget, and I came in asking for $7M. In the end, we agreed on $6.6M in and I received some other concessions. I would have been happy with $6.5M so overall I considered it a win. On my way out the door the CEO yelled something, and it was something he would end up repeating to me very frequently during his time there.

“Wolf. Be careful, marketing is a drug.”

He was right, and that is the quote I have been thinking about after Trubar’s earning release Monday evening.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Things have been going extremely well over the last couple of months. Swing plays clicking, share prices jumping out of identified buy zones and earning season has been very kind to me. Until now. I think Trubar’s earnings and the market reaction can best be summed up by a tweet I sent earlier today:

A 21% decrease does feel like a bit of a hit to the groin area, indeed. Just after the stock had moved 28% up from the bottom of my buy zone over the last couple of weeks.

No more preamble, let’s get into the numbers here.

Balance Sheet:

* Unless otherwise stated, figures in USD

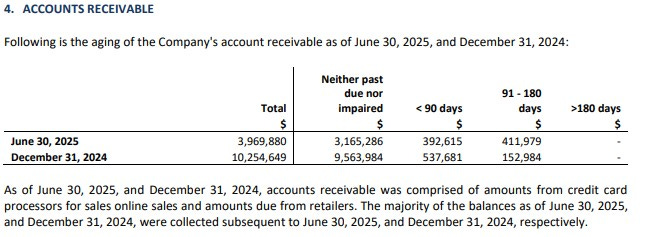

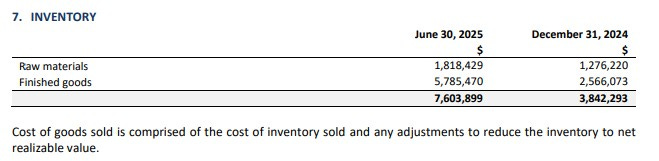

Trubar’s current ratio at the end of the quarter was 1.1 and slightly better than that if warrant liabilities are removed, and that seems even more appropriate to do so after yesterday’s share price declines. As of June 30th, Trubar possessed $1.2M in cash, $4M of A/R, over $7.6M worth of inventory and $2.5M in other short term assets overtop of $12.3M in liabilities. With their cash situation alone only covering 10% of their next twelve months, liquidity looks like ass here.

Receivables are way down from the start of the year which will aid the cash flow statement and their aging report looks adequate.

Inventory has doubled from the start of the year, but let’s not forget that their inventory stood at $8.8M at the end of Q1. This made sense at the time with the Costco promo shift so it brings into question why this is still so high. Whatever the rationale is the lack of liquidity on the balance sheet tells us one thing - they need to turn this inventory into cash. Quickly.

In terms of debt, it is all current with $3.6M drawn on their line of credit (down from $4.1M at the start of the year) and $2.5M in promissory notes which are scheduled to be paid off by May of next year.

Cash Flow:

The cash flow statement looks like an absolute shit show with over $7.3M worth of operational burn YTD compared to generating $2.2M at the same stage last year for a $9.5M swing to the negative. They do have $8.5M of working capital adjustments from their inventory ramp up and a significant paydown of their payables, but that is partially offset with improvements in receivables. It may not be as bad as it looks, but it’s still quite poor.

Outside of operational activities they paid down over a half million on their LOC, received $2.9M from warrant exercises and paid down over $1.1M in promissory notes.

Overall, Trubar burned through 83% of their cash position in the first half of their 2025 fiscal year.

Share Capital:

107.5M shares outstanding, 10% dilution from the beginning of the year, almost all from warrant exercises.

5.7M options with 4.9M currently ITM but no significant amounts expiring before May 2029

122k warrants remaining with an exercise price of 55 cents expiring in October

3.8M RSU’s with 1.5M awarded to the CEO in the final days of Q2

21% insider ownership and 30% institutional (per company investor deck)

Positive insider participation. There were multiple insiders who participated in the May raise, many open market buys (most notably Erica Groussman’s $260k September slap), in addition to exercising options

Income Statement:

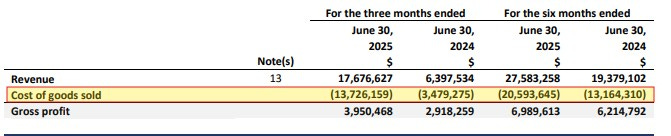

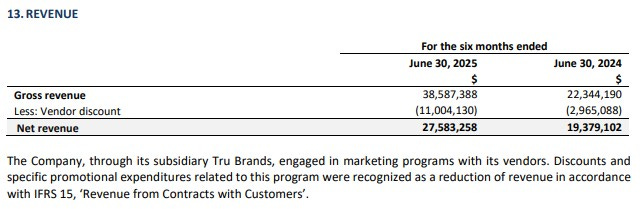

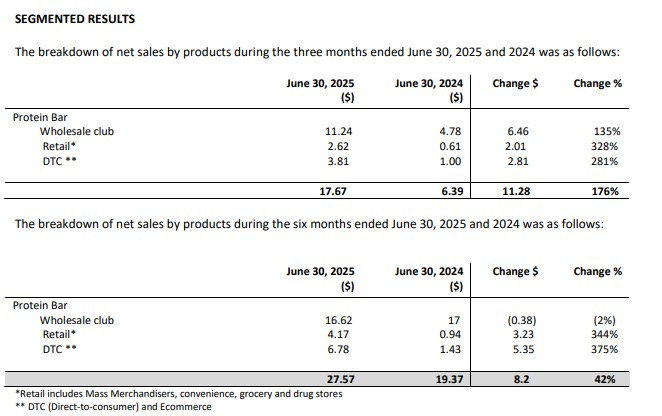

No issues on the top line even though they missed Clarus’ estimates by nearly $1M. Revenue for Q2 came in at $17.7M which is a 176% increase over what they achieved in the same quarter last year. This more than offsets the 20% decline they experienced in Q1 due to the Costco promo shifting quarters to last year - YTD they are 42% better on the top line through their first six months.

If you’re queasy, you might want to stop there as that is the end of the good news. Margins tell most of the story here. On all of that new business, 176% more, the company only delivered 35% more in gross profit dollars and only 12% more on a YTD basis on 41% more revenue. The ratio to revenue dropped by over half, from 45.6% all the way down to 22.3% in the quarter. Total operating expenses also rose by 87%. All of that adds up to a loss before other items that is 4x worse in the quarter than the comparable quarter - $2.8M vs $700k. Between there and the net income line are a couple of non comparable items including the large one time gain from exiting the PureKana business, but overall they experienced a $2M net loss in the quarter bringing them to a $3.1M loss YTD.

Overall:

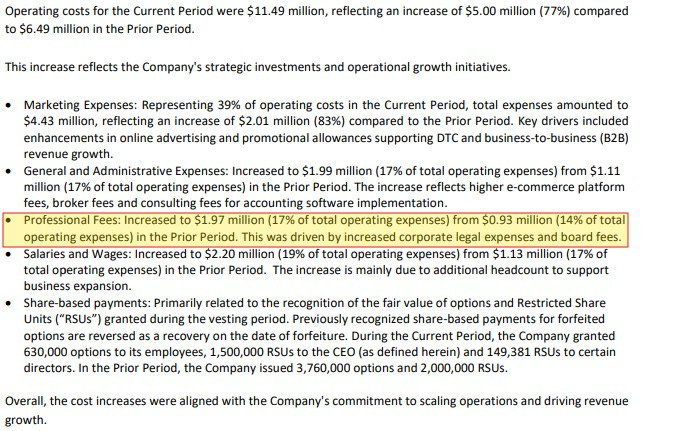

On 176% more revenue that increase of 87% in opex spending isn’t overly terrible.

I’d question some of this, particularly the professional fees doubling to last year, but the most troubling thing to me goes back to my story at the top of the review.

“Wolf. Be careful. Marketing is a drug.”

If one simply looks at the marketing spend bucket alone and sees an increase of 83%, it’s not all that alarming given the their expansion, promo activity and everything else we know about the company. But that is only one of three ingredients in this marketing drug cocktail.

The second is gross profit.

Gross profit can be viewed as an extension of marketing activity. When one wants to entice a customer to buy, one way of doing so is by reducing the price. It’s much more of a direct impact on DTC business (which we saw with Amazon discounts) but essentially it works the same way when selling through their retail establishments - it just hits COGS instead of Marketing spend. On 176% more revenue, COGS grew by nearly 4x.

The third ingredient are vendor discounts.

The amount of vendor discounts increased by 271%, again well above the 41% increase in net revenue. These discounts can happen in a variety of ways in CPG from securing initial shelf space to featured product placement to absorbing a portion or all of a retailers promotional activity and a host of others as well. With the company expanding into new doors and new retailers like Walmart and Target, seeing increases here isn’t surprising.

Let’s compare the above to a chart the company provided just in April regarding a path to 40% gross margin.

Trade spend YTD is 28.5% of gross sales compared to 15% in their model C above and with gross profit at 22%, their Gross margin is just 10.2% so far YTD.

So how does one get off this promotional drug? If you pulled your pants down all the way to your ankles, can you achieve better revenue results next year by only pulling them down to your knees next time?

That may turn out to be a difficult task since they went from ankles to knees this year and did not match off what they did YTD in their largest sales channel - Club (aka Costco) as they saw a YTD decline of 2%. All the promo shift has now been accounted for and likely includes many more doors than it did a year ago. This is not a great sign for being able to get off that drug and improve gross margins.

Now all of the numbers are not bad news with both Retail and DTC sales showing substantial growth, both well over 4x. They have also launched new products with mini’s and kids packs and have more initiatives planned in the second half.

Eventually a company needs to ease back on this promotional marketing drug, while also continuing to drive revenue increases. Can they achieve both is a question investors need to start thinking about. I certainly am.

Lastly was the conference call, which I also found disappointing. I’ve attached it below so you can judge for yourself. While it was suggested these margin numbers and EBITDA losses were the plan all along, I felt talked down to with an way too excited tone, no accountability for investors expectations, analysts who tossed softballs and many tough questions from retail were not given any air time.

Now is the bull case completely obliterated here by this quarter and the year to date numbers. No, far from it but I do have more concerns on this teams ability to execute than I did six months ago. I’m certainly not looking to buy any dips.

Second consecutive downgrade. 2.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks Wolf great story and a not so great story seems like stories tell a story. Thanks for putting this out so quickly I appreciate you being on top of things for us. Keep up the great work.

Brutally honest review. Thanks Wolf.