I’ve been a big fan of TGH since my initial review about a year ago now when I reviewed their Q2 from 2024. Since then they have received all encouraging 3.75 star reviews. There was even a time when it was on my short list to be a 2025 annual Wolf pick.

Back at the beginning of the year I called out a brief buy zone opportunity for subscribers in the low 90 cent range. I took a position myself and sold it for a 30% gain a few weeks later. Unfortunately (for me) they had a major breakout beginning in April and could have been a 97% gain from that buy zone as of today.

In the middle of that spring run the company made a big splash, with the acquisition of Custom Vacuum Services. I’ll dive into that later.

After releasing their latest financials at the end of August, investor response has been rather muted, down 8% since. Let’s see how they did.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

It feels like I have been saying this quite a bit in recent reviews but here we have another microcap with a good looking current ratio with liquidity questions due to a soft quick ratio.

At the end of June, TGH held $5.9M in cash, $20.6M of receivables, $34.2M worth of inventory and $600k in prepaids overtop of $28.9M of liabilities due over the next twelve months. So while their current ratio is a rather healthy 2.1, their cash and A/R combined do not quite cover their next year of commitments with a quick ratio of just .92. It is however, much better than the .6 when I last reviewed them.

Receivables are up 29% from year end and account for one third of their current assets. I’d like to make you feel better about that but the company provides zero further disclosure surrounding them such as an aging report.

TGH has nearly $29M worth of debt, $25M more than the last time we looked due to their Q2 acquisition. The new loan is amortized over ten years, maturing in five with a prime +.95% rate. Their line of credit was also increased from $6M to $8M at the same time and as at quarter end had $4.1M drawn on it.

Cash Flow:

Through six months the company has generated $5.3M of operational cash flow, 55% higher than they did at the midway point of 2024. They utilized a net outlay of $26.9M on the Custom Vac acquisition which was made up mainly through the new $25M loan facility.

Overall their cash position has improved by 27% from the start of the year.

Share Capital:

138.4M shares outstanding, minimal dilutionary activity over the past year and a half

11.4M options, all ITM with 1.25M expiring in the next twelve months under 32 cents

Heavy 44% insider ownership

Nothing worthy of discussing in terms of insider activity on the open market unless you include the former CFO reaching deep to find $856.00 last November to buy 815 shares.

Income Statement:

Revenue for the quarter came in at $45M, 31% higher than the previous years $34.4M. TGH does not produce sexy margins but their gross profit rate did increase by 190 basis points, up from 18.1% to 20% in the quarter and that resulted in bringing 45% more dollars to the GP line.

Conversion below the GP line wasn’t nearly as good with 67% in additional operating expenses, but looking at the grand total could be somewhat misleading. Their largest expense bucket, SG&A grew by 33% which is understandable given the increased headcount from the acquisition. Aside from that, TGH experienced a $520k bogey in foreign exchange with a $458k loss taken in the quarters and experienced much higher non cash burning expenses within depreciation and amortization costs along with a 145% increase in SBC costs.

Below that was $490k in financing costs, over 6x more than a year ago due to the new debt facility. Therefore the net income line grew by only 6.7% on 31% more revenue and 45% more GP dollars, $2.68M vs $2.51M.

On a YTD basis:

Revenue of $80.6M, up 18% through six months

Gross profit up 330 basis points to 20.8%, GP dollar growth of 38%

Operating expenses up by 67% (SG&A up 34%)

$5.5M in net income, 12% more than last year

Overall:

A bit of a mixed bag as you would like to see better profitability conversion of 7% when your gross profit dollars increase by 45%. A good chunk of that variance however is non-cash burning and it’s hard to lay blame on the company for foreign exchange hits.

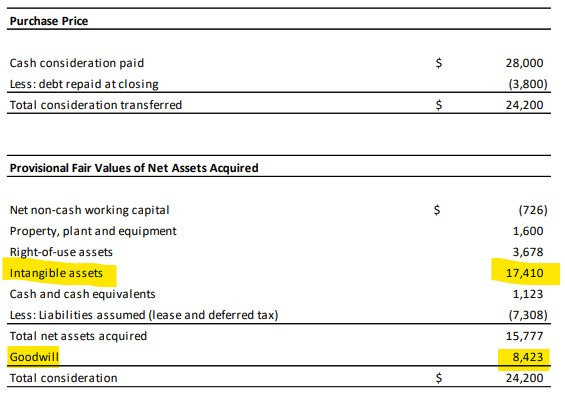

The reality is much of this will continue, as the acquisition was virtually an all intangible and goodwill transaction.

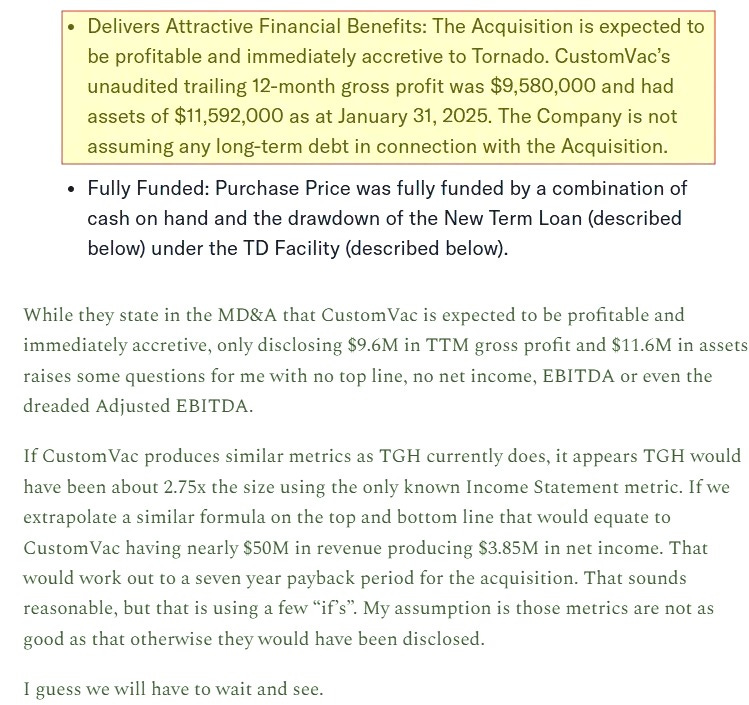

I had the following concerns about the acquisition in my last review:

The metrics disclosed in the acquisition press release were strange and lacked disclosure. Typically when companies report after an acquisition there is some sort of a breakdown of the new acquisitions impact on their financials so it’s notable that they do not disclose that here either.

The debt impact from the acquisition resulted in $490k worth of finance expense compared to $74k last year and that was only the impact of six weeks. When you combine all of this, investors should expect a large gap between EBITDA and Adjusted EBITDA numbers and their Net Income.

On the more positive end, revenue should continue to be strong with analyst estimates of $192M for 2025 and $242M for 2026 thanks to the acquisition and increasing their truck manufacturing capacity by 33%, among other initiatives. That would represent a 40% top line increase this year and 27% in 2026. While I have some net income concerns going forward there cash flow should be better, but in the range of $10-$12M on those level of revenues will not exactly make them a cash producing juggernaut.

Tornado is now trading at it’s most expensive since 2022 with a P/E over 23, EV/EBITDA of 16 and 37x cash flow. You would have to think execution on all of that additional revenue will get substantially better than what they did here in Q2 in order to jump in at these prices. I’m going to wait it out.

I was close to downgrading them last quarter, but will follow through with that this time out. Still a solid rating of 3.5 stars, but the company could make me feel better about this valuation with more disclosure, and they choose not to.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for a great write up!

While this Q wasn’t as scalable as one would hope, they’re in the middle of acquisition and manufacturing capacity addition so a lot of non-recurring expenses flying around currently. Would expect different dynamics for Q3, and especially Q4 and beyond.

Thanks for the review, Wolf. This one's been on my watchlist for a while; just can't seem to find a decent entry point.