I’ve been eagerly awaiting this one. My first review of TGH was after their Q2 results and I was quite impressed and gave them a very solid 3.75 stars. Since those financials the market has rewarded them gaining 23% in share price. The stock did hit an all time high of $1.36 about a month ago and had quite the retrace to the $1.05 - $1.10 area.

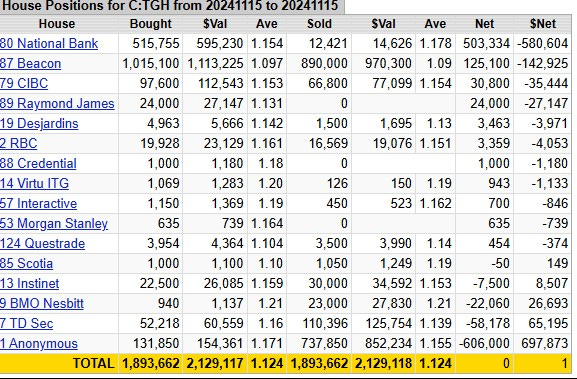

About a week or so ago I highlighted a potential opportunity to my subscribers, identifying a buy zone area above $1.02 support leading into their Q3 financials, as a significant earnings beat looked quite possible based on their YTD trend. Full disclosure I put my money where my mouth was at the time of that call. On Friday others appear to have agreed on a day which saw 10x their three month average volume which included a 600k share block trade. Financials were released after market close.

Time to review how their third quarter of 2024 finished, and what may happen for the rest of the year for this stock that is on my short list for a potential 2025 annual pick.

Balance Sheet:

TGH has an excellent current ratio of 2.2 that consists of $3M in cash, $9.8M in receivables, a hefty looking $34M worth of inventory and $1M in prepaids against $21.6M in liability commitments due over the next twelve months.

As was the state of things during my last review, an excellent current ratio does not necessarily equal strong liquidity, and with cash plus A/R only making up 60% of their twelve month commitments, it is a little concerning. I noted their rising inventory levels in my last review and QoQ it has grown again and now stands 50% higher than at the same time last year, outpacing their revenue performance. The company has stated in current and previous MD&A’s that this was expected due to higher production in the back half of the year. Something to monitor.

Tornado has $4.26M of long term debt and this term loan matures in mid 2026 at a very attractive 2.83% fixed rate.

Cash Flow:

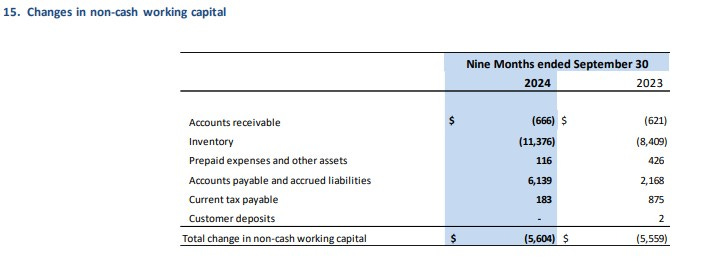

The company has generated $2.54M of operational cash flow YTD, a $3.6M turnaround from last year at this time when they had operational burn of $1.1M. Q3 alone had $900k of operational burn however as they were sitting in much better shape at the midway point of the year.

The dip in Q3 is primarily due to the inventory investment mentioned previously. Prior to working capital adjustments, the company’s OCF is actually 82% better than a year ago. As long as these inventory investments pay off down the road, this will balance out, but remains a concern due to their soft looking liquidity.

Through nine months the company has also invested $1.4M in long term assets, paid off the full $3.1M from their LOC and received $533k via options exercised. Overall the company’s cash position has depleted by a third since the start of their fiscal year.

Given the gap between their financial commitments over the next twelve months and current liquidity, dipping back into that line of credit appears highly likely. While the company’s statement in their MD&A suggests it will be adequate without a capital raise, it doesn’t exactly rule it out and neither would I.

Share Capital:

137.6M shares outstanding with minimal 1.2% dilution over the past year

8.34M options, all well ITM. With 5.4M not expiring for 3+ years, likely not a lot of near term assistance to the treasury expected

Per Yahoo Finance, 45% insider ownership but nothing worth mentioning in terms of insider activity on the open market.

Of note, the company is planning to modify their SBC plans to introduce RSU’s in addition to or as an alternative to stock options. The plan will overall remain a 10% plan.

Income Statement:

The company achieved $30.5M in revenue, a 12.6% improvement over the same quarter last year. This brings their 9 month total to $98.8M, 38% better than at this stage in 2023.

While margins in the high teens aren’t sexy, they’re improving. Gross profit for the quarter was 17.2%, 250 basis points better than last year, and 17.4% YTD, a 160 bp improvement. SG&A expenses, the sole cash burning expense bucket increased by 18.9% in Q3 and is up 27.6% on the year, converting fairly well on a YTD basis.

The revenue gains, margin improvements and expense conversion all translate to $2M of net income in the quarter, 110% better than a year ago, and through three quarters, $6.9M, 149% better, and that after an additional 168% increase in income taxes.

Note to company - stop using EBITDAS - it makes you look silly.

Overall:

The company has had a couple of outstanding years, growing revenues by 59% CAGR over the last three years. But, with most microcaps, it’s not without it’s warts.

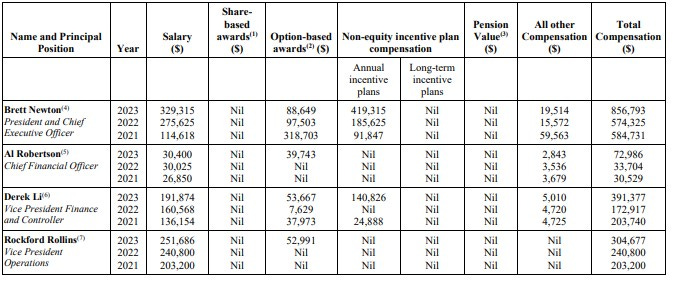

The sketchy looking liquidity is a risk to incur additional debt next year and I wouldn’t eliminate the potential for a raise. Q4 net income also looks like it will be quite a feat to match or beat when the company releases their annuals next year. Management comp is also something to watch out for, particularly give the planned addition of RSU’s.

Beyond the warts, TGH has had QoQ growth for a staggering 13 consecutive months. That is until this month, doing almost $4M less than they did in Q2, so it will be interesting to see how the market reacts to this next week. The bottom line on the other hand was exponentially better, growing by 110%. If you can do that then I can forgive you for one QoQ miss in 3.5 years.

Due to the the company’s contract with Ditch Witch (Toro), sales relationship with Custom Truck One and their new production facility coming online in Q2 of next year, the company’s commentary within their MD&A remains bullish going into 2025 and beyond.

Valuations right now appear quite reasonable at 1.1x TTM revenue and their 12 P/E and 10’ish EV/EBITDA put it just below their much larger peers.

Is this enough to make them a 2025 pick? Not sure yet but it’s not an immediate no brainer with the handful of question marks. It is however a hold for me right now and just enough for me to maintain the 3.75 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.