It seems we have a trend. I have reviewed Tilray on two previous occassions, both occurring two years apart and both received a pathetic one star. I’m not sure I could stomach reviewing these guys more frequently. The first was back in January of 2021 and the second in January of 2023. The share price is down 54% from my latest review and 94% from the 2021 review, although that is not atypical for stocks that receive one star reviews. Since it is almost two years to the day of my last review, let’s look at this perennial ditch pig once again, which may more resemble a Comedy Central Roast than a financial review.

Balance Sheet:

Off the top their current ratio actually looks pretty good at 2.5 and as of November 30th that consisted of $190M in cash, $62.6M in marketable securities, $113M in receivables. $266M worth of inventory and $76M in other short term assets including some assets held for sale, and those figures are up against $278.5M of liabilities due within the next twelve months.

Accounts receivable and inventory make up more than 53% of their current assets. We do not have much detail into their A/R here with no calculation showing their net amount nor an aging report. Couple that with inventory values trending to be just over 3 turns on their total business suggest the liquidity of this balance sheet may not be as strong as their current ratio may indicate.

From a long term liability perspective, they have nearly $150M in long term debt, $123M of convertible debentures and $126M in deferred obligations to the tax man.

The most telling number on their balance sheet may be the $2.8B accumulated deficit. They have been a very bad organization a very long time. Very bad, Jerry, very bad.

Cash Flow:

Tilray has been a cash burning company since their inception, and halfway through their 2025 fiscal year has been no different. Through their first two quarters they have over $76M of operational cash burn which is almost $30M worse OCF than they experienced at the same point a year ago.

Year to date they raised $111M through their ATM program. Tilray has utilized $18M in acquisitions, purchased $30M in marketable securities and paid down $10M worth of debt. Post financials they issued more shares for another $11M through the ATM program, already going through about half of the $250M ATM announced in just May of 2024.

Their cash position has depleted by 17% or $38M from the beginning of the year, despite raising $111M through additional dilutive measures. Speaking of which, let’s talk about their share structure.

Share Capital:

As of Nov 30, 929.3M shares outstanding with 41% of dilution over the past eighteen months

8.35M of additional dilutive measure through their ATM in the two weeks post financials

6.2M of worthless warrants at a conversion price of $5.95 as well as 2.8M options at $14.88

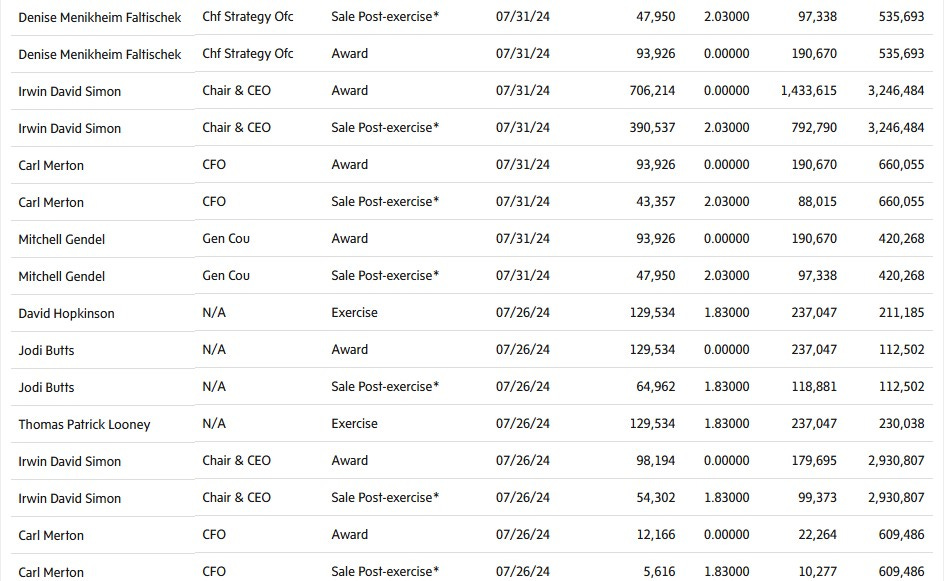

As of their year end, 26.1M RSU’s plus 13.3M granted so far YTD. It is very telling that zero options have been awarded over the past 2.5 years, instead the company has awarded free stock awards in the form of RSU’s. A retail friendly plan for a cash burning company would be to offer options for some hope that some funds would then make it’s way back into the treasury. Instead these vested RSU’s are more often than not dumped back on retail (or exercised for cash) for some decent insider wins.

In the past 18 months alone, just shy of $46M have been awarded in Share Based Compensation, all in the form of RSU’s

$123M of convertible notes with future dilutive measures

Approximately 16% insider and institutional ownership per fintel.io

Income Statement:

Things actually look decent above the margin line. Revenues in Q3 were higher by 8.9% to $211M and through six months have grown by 10.8% to $411M. They have also made improvements in their margin which improved by 450 basis points in Q3 to 29%, and 470 basis points YTD to 29.4%. That overall combines for a 32% increase in gross profit dollars at the midway point of their 2025 fiscal year.

Sadly, operating costs are up 19% at a time when they need to be leaner so those $200M in YTD operating costs result in an operating loss of $79M, and that is before interest costs of nearly $3M per month and non operating expenses of another $20.6M, which all translates to a net loss of $120M.

Their breakeven point through two quarters on this margin and spending is approximately $820M. They achieved half of that.

Overall:

Tilray is more of a hybrid play than your typical cannabis stock with about one third of their business coming through traditional cannabis, another third made up of pharmaceutical distribution and the other third made up of alcoholic beverages and wellness.

Virtually all of their YTD revenue gains are from their beverage segment. In fact the other segments combined would be in the negative on a YTD basis. With margins around 40% it is the main reason why their blended margins are up YTD.

There are some companies in the cannabis sector that are starting to look like they can turn the corner and make a go of a profitable business and even some smaller producers producing decent net income levels and not looking like the historical cash burning swine that Tilray is.

In the YouTube interview above, we have the CEO whining about excise taxes rather owning the company’s own failures. I can’t tell you how big of a cop out I think this is. Two minutes later he uses the excise tax example as rationale for why the US should adopt similar policy - you can’t make this shit up.

Everybody knew what the rules were going in. The excise tax rate should not have been a surprise to anyone entering the business. Instead, legalization brought a bunch of bad business operators into the sector, and I’m fine with a little Darwinism taking place which will be better for the market place long term. Canada isn’t in the position to provide more tax breaks for bad business, and I’m certainly not willing to increase my tax burden to reward poor performing company’s like these assclowns.

The company is on the verge of crossing $3B this year in historical comprehensive losses which includes poor expenses control, mismanaged share structure, egregious and undeserved executive compensation, and a historically poor acquisition execution strategy.

Somehow, this is still trading at a $1.6B (CAD) market cap at a 1.5 P/S ratio and about 100 EV/EBITDA. I’ve seen better stocks trade at under .5 P/S ratio and more attractive porkers at the Toronto Zoo. This will likely always trade at a higher value than what is actually worth due to WeedBro’s delusions of grandeur on what changes to regulations in the US could bring in terms of improvements.

Downgrading to .75 stars. Oink.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3200+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I think you should tell us how you really feel...

Thanks for the review Wolf. I knew things were bad, but not to this extent.