It feels a little strange doing a Q3 of 2025 review here at the beginning of May after doing a half dozen 2024 annual reviews over the past couple of weeks.

TMG has been in a word, disappointing. I purchased some in the summer of 2023 and subsequently added them as one of my 2024 Wolf Picks. I gave them a four start review in January 2024, and have downgraded them twice since. I downsized my position last summer and shortly after their last financials I was completely out, all in all for a small gain.

They’ve really been on my ignore list since my last review. As much as I like their products, their investments in people and marketing have thus far delivered dick.

Headlines from their financials release last week were not very encouraging either but let’s get into the details.

Balance Sheet:

Thermal Energy has a very good current ratio of just over 2 (deferred revenue removed) which includes $5.14M in cash, $4.4M of receivables, $1.9M worth of inventory and about $800k in other short term assets over top of $6.1M of short term liabilities. Their ratio last quarter was 1.7.

After a big jump in receivables last quarter, a good chunk of that moved into the cash column with an improvement of $2.8M in the last three months, and the notes in the financials suggest no issues with the aging of their receivables today.

TMG has $1.4M of debt, the majority of which due via balloon payments in Dec of 2025 and April of 2026. Aside from that the company has no long term liabilities except for just under $1M of future lease obligations.

A very good start.

Cash Flow:

After a rough first half of the year within operational cash flow (OCF), things turned for the better with $3M of OCF during the quarter. Unfortunately through nine months the company is still in the red with $350k of cash burn. When compared to the same time last year, they generated $5.66M of positive OCF. Over $6M worse at this stage of 2025.

The company also paid down $1M worth of debt, received $34k for options exercised and paid out $58k in dividends to non-controlling interests (aka - not you). While it looks better than it did last quarter, their overall cash position is 32% less than where they began the year.

Share Capital:

173.1M shares with very little dilutionary measures in the past 18 months

15.5M options outstanding, majority now out of the money

6% insider ownership.

Decent amount of insider buying YTD

Income Statement:

Very tough quarter with revenues down by 4% compared to last year at $5.82M, but making matters worse was over 1100 basis points of gross profit going from 50.5% down to 39%, therefore delivering 26% less gross profit dollars. They were able to save 10.7% on the expenses line driven mainly by much lower admin costs. But at the end the company had their first net loss in their last nine quarters dating all the way back to Q2 of 2022.

The YTD totals do not look much better. Yes they drove a 25% revenue increase but they received 7% less gross profit dollars on that additional revenue due to their rate plummeting from 50.8% all the way down to 37.9%. Making matters worse was a 4% increase in expenses. Even with a few small birdies to last year below the operating income line, TMG posted has posted a slight $65k loss after delivering nearly $700k in net income at this stage last year.

Overall:

Literally zero to get excited about. Even the operating expense savings in Q3 was more related to foreign exchange than anything the company did and that was the best part of their last three months.

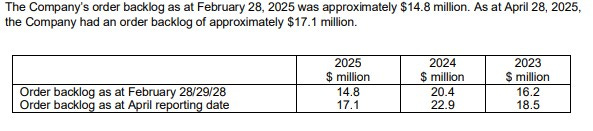

Backlog numbers are down 25% and the company’s margin numbers have been shite and unpredictable. They continue to spend more dollars on sales and marketing without much to show for it.

There may again be a day, but that day ain’t today. Into the ignore pile and another downgrade to 2.75.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

spending money on sales and marketing with no positive results is a big question. Thanks wolf for another review.

Thank you sir; I called it a day earlier this year as well. sales team is not getting it done so they are now just treading water.