Don’t call it a comeback, I’ve been here for years.

Too soon? Probably, but the current scrub from my 2024 Wolf Picks is starting to catch some new and old eyeballs the past few months, including my own. They are the only selection of the 2024 pick class that hasn’t at least tripled, currently sitting at 19 cents when they were selected at 20.5 cents back in mid December of 2023.

Unlike other Wolf Picks that I’ve completely soured on (Now Vertical and Simply Solventless) and put permanently in the ignore pile, Thermal Energy was always one that I felt would get things back on track someday.

I did not review their Q1 with my latest review in September for their 2025 annuals. That was a downgrade to 2.75 stars.

Thermal Energy International ($TMG.V) FINS Review

Thermal Energy International is the runt of the litter from my 2024 Wolf Picks. The other four have at least tripled in value and includes Enterprise Group, Kraken Robotics, Gatekeeper Systems and NT…

That current share price has them up 90% from their May 2025 low, and 52% from when I included them in my 2026 Wolf Pick article as a bonus pick to watch out for. Unfortunately my bid at 12.5 cents never materialized from a few weeks ago.

TMG released their second quarter yesterday morning and the stock gapped up at the open and closed 17% up. Coming into these results I thought they were up against some tougher numbers and a dip opportunity could await. Oops.

Let’s dive into the details.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Solid current ratio of 1.8 that consists of $2M in cash, $7.3M worth of accounts receivable, $1.7M worth of inventory and $1.2M in other short term assets over top of $6.6M worth of liability commitments over the next twelve months (deferred revenue removed).

Trade receivables have doubled within the past six months but only 1.1% of the total is over 90 days, alleviating any concerns over that rise.

Thermal Energy has no long term debt and overall have decent liquidity.

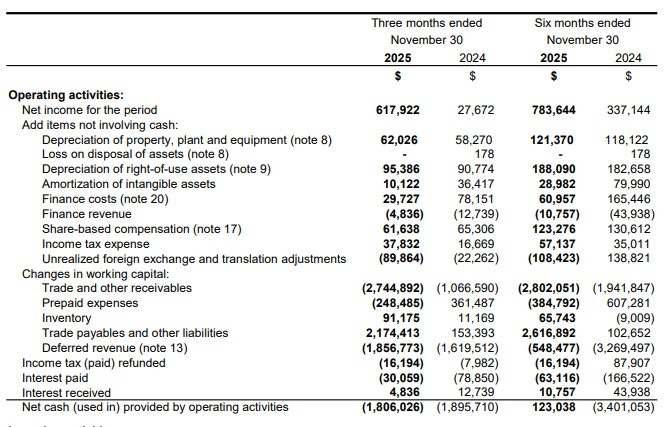

Cash Flow:

Operational cash flow results are mixed with slightly better than positive operational flow on a YTD basis, much better than the $3.4M of burn last year, but similar operational burn in their latest quarter of around $1.8M.

Due to the significant working capital adjustments throughout, I would expect this to look slightly better as the year progresses.

Not much occurring within the rest of the cash flow statement. The most notable item is the company has repurchased $500k worth of shares YTD. Note that the company has also paid out $61k worth of dividends to non controlling interests who hold 1/3rd of the stock.

Share Capital:

170.7M shares outstanding, 1.4% less shares outstanding than the beginning of the year

3.56M shares repurchased under their NCIB. Latest buybacks occurred at the end of October

18.4M options outstanding including 5M granted in their first six months, outpacing their buybacks. 2.06M have also been exercised YTD. Over 12M options are ITM

10% insider ownership

2.5M shares were purchased in the open market 6-12 months ago but 230k shares have been sold by insiders in the past 3 months

Income Statement:

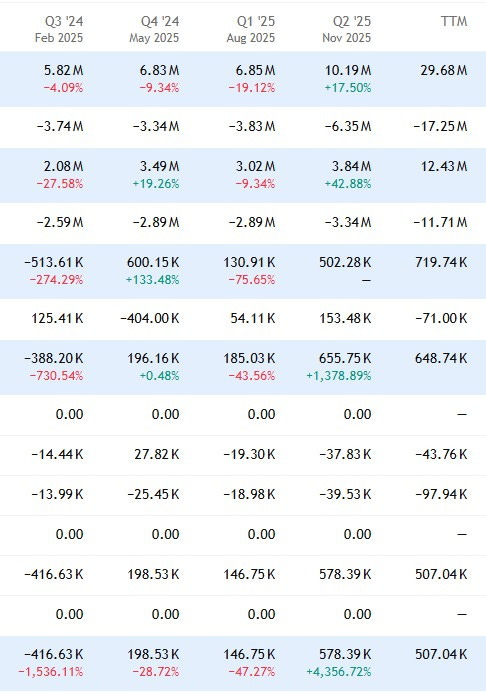

Outstanding and unexpected growth in Q2 surpassing $10M for the first time ever with $10.2M in revenue against $8.7M last year growing by 17.5%. Those revenues also came with over 600 basis points of additional margin at 39.3% vs 33.1% which drove gross profit dollars nearly 40% higher on only 17% more business. The higher margin rate in the quarter was due to more heat recovery systems and GEM business.

Expenses rose at a greater rate than revenue at 20% but less than their gross profit with the most notable growth coming from admin expenses which were 39% higher.

Net income came in over 22x higher at $618k vs $28k last year.

Overall the quarter helped to offset their poor Q1 which saw a 20% decline on the top line. Their performance at the mid way point of the year is as follows:

Revenue slightly less than flat. $17M vs $17.1M

Gross margin of 42.2%, nearly 500 basis points higher than last year with gross profit growth of 12% on slightly less revenue.

Operational expenses grew by 6.7%

Net income of $784k vs $337k

Overall:

I expected TMG to start showing some improved results but I was banking on those improvements to occur in the back half of the year. That appears to have cost me a cheap reentry.

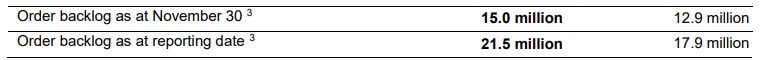

By the sounds of the Earnings Call revenue was moved up to Q2 and the company is not updating their annual targets they provided at the end of Q1 despite the nice growth in their backlog.

I certainly liked it at 12.5 cents and unfortunately swung and missed. At 19 cents it has to go back into the watchlist pile however with it now trading at around an 18 P/E and that’s only extrapolating these last six months. They sit at a 48x multiple on a TTM basis.

Given the very weak Q3 they will be up against when they report at the end of April, there may be a little more juice to squeeze out here, but this is not a spot I’m willing to dive into as I see a limited short term upside. Amazing for those who did get the dip between 10-12 cents though.

Unfortunately there is an analyst report out there with comps to $86B market cap Trane Technology so given that comparison I think you can safely ignore the rest.

Upgrading to three stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Appreciate the review, Wolf. Short and sweet.