I awarded TMG a “maintain” last time, awarding them 3.5 stars which may have bordered on generous. The real test for me was going to come this quarter. When you look at their TTM (prior to today), half of their profitability arose from last years second quarter. So they are up against it here.

While the market has been bullish recently giving the SP a 24% boost since the calendar turned, I’ve been pretty skeptical given their recent history but as it was one of my 2024 picks, I remained hopeful.

Hope is a poor investment strategy however. I halved my position quite a while ago and these financials were going to determine my decision on whether or not I continue to hold the rest. Let’s find out.

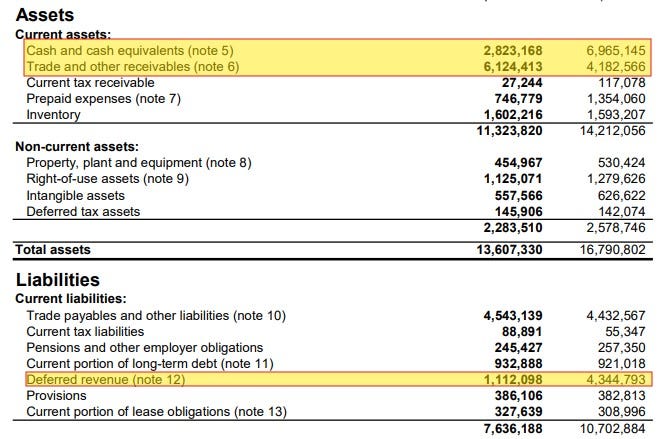

Balance Sheet:

TMG still holds a strong current ratio of 1.7 (deferred revenue removed) that consists of $2.8M in cash, $6.1M in receivables, $1.6M worth of inventory and about $800k in other short term assets against $6.5M worth of short term liabilities due over the course of the next twelve months.

While their current ratio still looks ok, they are much less liquid than just six months ago (2.2 at their fiscal year end).

Receivables have jumped by nearly 50% and while I don’t see any red flags in the financial notes, their aging comments are selective disclosure at best. The cash position has depleted substantially during their first two quarters - the cash flow statement should provide some answers.

Thermal Energy has reduced their debt by 18% from the start of the year which stands at $1.9M and that amount is about evenly split between current and long term.

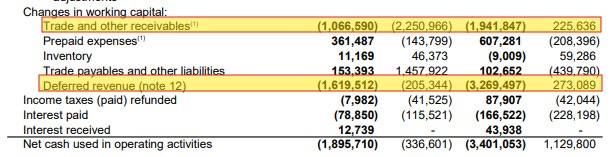

Cash Flow:

After burning $1.5M in Q1, their OCF unexpectedly worsened in Q2 with the company burning $1.9M in Q2 for a six month burn burn of $3.4M after generating $1.1M over the same time span last year. While much of this is due to working capital changes including A/R which may reverse in future quarters, the largest working capital adjustment is from deferred revenue meaning they have not replaced that with new future prepaid revenue. While their OCF isn’t as bad as it looks here, it’s not good and trending in the wrong direction.

Not much to speak of in the way of investing activities, but they have paid down $464k in debt, received $33k via options exercised and as mentioned last quarter paid out $58k in dividends that I don’t recall get a cheque for.

Overall the company’s cash position has eroded by an alarming 58% since the beginning of their fiscal year.

Share Capital:

173.1M shares with very little dilutionary measures in the past 18 months

15.5M options outstanding, all ITM (at least at the time of writing)

1.4M additional options awarded post financials

6% insider ownership. No activity in the open market since last May.

Income Statement:

Top line looks great with $8.7M of revenue achieved in the quarter (a company record) and 22% better over the comparable quarter extending their YTD performance to $17.1M through six months, 39% better than at this stage a year ago.

That is where the good times end unfortunately as gross margin performance continues to be a bit of a train wreck. Q2 came in at 33.1%, a staggering 1600 basis points worse than last year and YTD comes in at 37.3%, over 1300 basis off of a year ago. So on 39% more business, only a little more than a 2% made it to the gross profit line.

Expenses were a little better than flat in the quarter which is much improved from where it was trending but on a YTD basis operational spending is up by 12%. When you only deliver 2% more gross margin dollars that’s a formula for a worse bottom line and that is exactly what we have here.

Net income was down by 94% in the quarter to a barely break even $27k and through six months, net income is down by 48% - very disappointing considering they did 39% more business.

Tack on foreign exchange and those numbers get slightly worse with negative EPS achieved in the quarter.

Overall:

It’s a shitty feeling looking at these results knowing you choose them as an annual pick just thirteen months ago. It’s 10 am as I finish this last section up and I’ve already fully exited my position. Given where I sold my original 50% earlier last year I probably still made it out slightly in the green but that provides little comfort. The market definitely seems to share that sentiment (down 23%), and as I expected that SP boost over the past few weeks was just a mirage.

There really wasn’t much to make me feel great from the earnings call either.

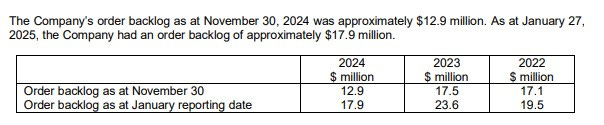

There was a lot of talk around the above two slides around the TTM investments of $2.3M. My issue here is about three quarters of that is recurring, and when you look at these backlog numbers, “still to be realized” is a massive understatement.

As of yesterday on a TTM basis the stock was trading at about 40 P/E. After this turd of a quarter (which is their worst from a profitability perspective in two years) that is approaching a 70 P/E at a $40M market cap. It’s not much more attractive to me at the intraday $31M market cap either.

This is why you don’t put a ring on your small cap stocks, even when it’s one of your Wolf Picks. The divorce is now final and I now have some extra funds. Think of me as an investor on the prowl looking for something new with sexier legs.

Half star downgrade to three stars (almost went 2.75 given the cash flow but I suspect that will improve in the second half).

Wolf, out. Literally.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Good work on validating that the story that got you into a stock isn't holding up, admitting it and getting out. Respect.

Since you have cash burning a hole in your pocket, you might want to consider my personal top pick right now, DavidsTea.

- epic turn around story, not yet fully recognized by the market (NASDAQ listing in 2015 at US$19/share; pandemic cut down of 240 locations to 18, dramatic re-basing of business at a much lower level)

- scale back and rebasing now done, DavidsTea is back to growing again

- already a ten bagger off its summer lows, another ten bagger from present levels very possible

- 15% revenue growth at existing footprint

- no debt, clean cap table

- cash flow positive; would have shown IFRS profit in Q3 but chose to non-IFRS their way into a loss because they wanted to give the finger to their fired IT-vendor (how often does management do that!?!)

- they don't need to do investor relations as the business is giving them the cash they need, so they don't do investor relations

- based on last year's Q4 and financial base set in Q2 and Q3, I expect EPS of ~$0.27/share in Q4, then EPS ~$0.07 in each of Q2, 3 and 4.

- FY25 EPS at ~$0.48, yet stock is ~$1.15 now (forward PE 2.5!!!)

- $8M cash pre-4Q Christmas rush, likely ~$15M+ as of now

- added two stores just prior to Q4 rush, 18 to 20 stores, the extra stores will show up in Q4 revenue

- management plans to go to 40 stores 'by 2027', funded from free cash flow

- likely now generating more cash flow than needed to expand at that rate, so dividend or buy-back (I think buy back as management already owns 44.8% of stock)

- 4Q (Nov-Jan) reports in late April/early March, at which point a version of this would show out as true and the stock should do a quick multi-bagger off current levels. Little room for downside as the price is already crazy low given what should have shown as earnings per share of ~$0.05 in traditionally the worst quarter of their cycle .

nice job wolf...thanks