Thermal Energy International is the runt of the litter from my 2024 Wolf Picks. The other four have at least tripled in value and includes Enterprise Group, Kraken Robotics, Gatekeeper Systems and NTG Clarity Networks. An equal investment in those five from the date of those picks would be up 456%. Thermal Energy’s contribution to that, down 27%. I have not held a position in TMG for well over a year now.

Once a four star darling, my latest review way back in early May for TMG’s third quarter received another downgrade to 2.75 stars.

What went wrong? After a couple of very successful years on the top and bottom lines, management made investments in people, much of that on the sales side that have just not paid off. At least not yet and not to the investment community’s expectations.

TMG designs, engineers and implements carbon and energy reduction solutions, and one of the reasons I first invested in them in mid 2023 and later selected them as an annual pick is the value proposition they bring to their customers. TMG’s solutions typically offer very quick payback periods of five years or less and with rising energy prices, it ideally should be that much more attractive.

TMG’s annual financials dropped this morning and while the overall top line (15% up) looks good, a lot of questions appear to remain throughout the rest of the financial statements. Let’s figure it out. Should they be on my radar for repeat pick in 2026?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

With deferred revenues removed, Thermal Energy has a current ratio of 2.1 that consist of $2.8M in cash, $4.5M in receivables. $1.8 worth of inventory and $800k in other short term assets overtop of $4.8M in short term liability commitments for their fiscal 2026 year.

TMG’s A/R looks solid including their aging and historical write offs. Debt which stood at $2.35M at the start of the year was whittled down to $330k by year end.

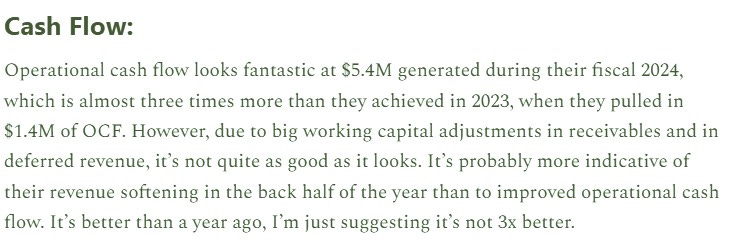

Cash Flow:

After generating $5.4M of operational cash flow in 2024, TMG has $1.7M of operational cash burn in 2025.

I will say that due to working capital changes, last year really wasn’t that good as I suggested in my review of last year (image below). For similar reasons, 2025 isn’t as bad as it looks either, but there is no doubt it’s a significant fall off from a year ago.

TMG made minimal investments in assets ($78k), paid out $58k worth of dividends and most significantly paid down their debt by $2.07M with the final lump sum payment coming in the spring of 2026.

Overall TMG took a significant hit to their cash position from the start of the year, decreasing by 60%

Share Capital:

173.1M shares outstanding with minimal dilution occurring during the year from 380k of options exercised

15.4M options outstanding with about 9.5M ITM

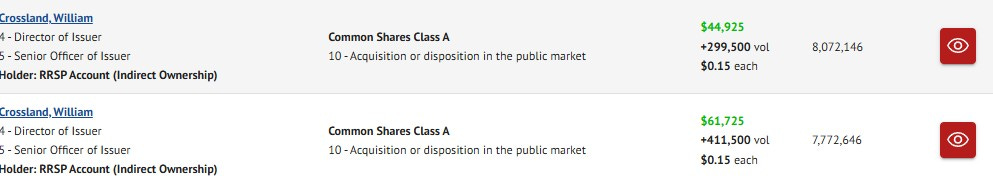

Under 7% insider ownership - the CEO did make some healthy purchases on the open market back in Feb at 15 cents

Post financials have attacked their NCIB with 2.26M shares repurchased

Income Statement:

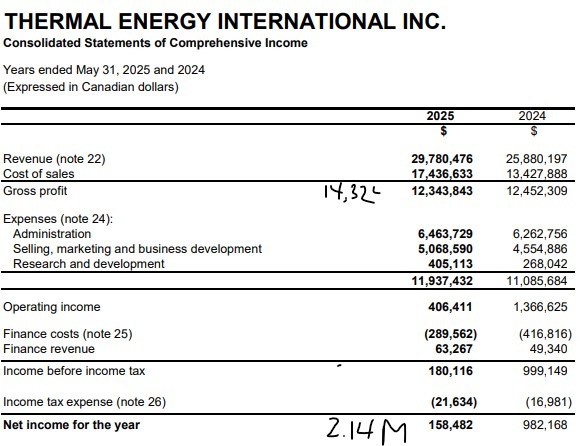

Revenues grew by 15% during 2025 to $29.8M, up from $25.9M in 2024. That is where the good times end however. Gross margin fell by nearly 700 basis points from 48.1% last year down to 41.4% this year. As a result, the company delivered less gross profit dollars than last year on 15% more business.

Operational expenses rose by 8% with each of their three spending buckets increasing over last year on less GP dollars. G&A increased by 3.2%, Selling and Marketing by 11% and R&D by 51%.

Due to the significant reduction in their debt, 30% savings to last year were realized in finance costs, and that salvaged a positive net income year for the company. Unfortunately it was 84% less than 2024 coming in at $158k vs $982k.

Overall:

In my opener I mentioned their investments in people haven’t paid off to a large degree. While I still believe that to be the case, it was their gross margin variance to last year that killed their profitability in 2025.

Had the company been able to maintain their gross margin level from 2024, it would have made a $2M difference in gross profit dollars, and that would have funneled all the way down to the net income line. Imagine what the stock would look like with 2.14M in net income for last year with a $26M market cap. While margins did improve in Q4 to 54%, the company suggested on the earnings call that we should measure their revenue on a TTM basis so I’m going to do the same for the rest of the P&L

Speaking of the earnings call - myself and 31 others attended which they did through Microsoft Teams of all things.

I’m not sure about the thirty-one other retail investors who joined me, but I was left rather uninspired afterwards.

While their backlog was soft at year end, it did sit at a record after receiving $11.4M in orders post financials. The issue is the bulk of that business won’t be recognized until the back half of 2026, and TMG is up against their strongest two quarters of 2025 in the first half. When you couple that with current metrics of a 164 P/E and a EV/EBITDA of 19, I think there is time to sit and continue to wait this one out.

Maintaining the 2.75 stars, and remain off the current radar.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. They should've used Sangoma instead of Teams.