Today started off as a great day. I woke up early as I most often do, made some coffee, commiserated with my son over our failed prop bets on last night's football game and then sat down in the Wolf Den, looking forward to the upcoming market action. I then chatted with those in my Substack and fellow TSA discord members as I do most mornings, made some breakfast, watched Uber gap up for the third straight day since buying it, and then holy shit Trudeau resigns. What a glorious morning!

As the afternoon progressed, I crashed for an hour missing the closing bell and then I started receiving DM’s across multiple platforms about a YouTube video targeting yours truly - which also unfortunately slandered Cam from Common Sense Investing as well.

To summarize, I was accused of the following:

Being in my 50’s

Divorced

Targeting his picks and obsessed with him

Front loads my picks

Gets paid under the table from ROOF

Shorts the companies who receive poor reviews

In an separate video posted earlier that I was completely unaware of (who’s obsessed with whom?) accused me of deleting a previous review on Verses due to embarrassment since the stock has become hot again in the last few weeks.

Well, you got me on the first two, but I should point out that I’m married once again and couldn’t be happier. She’s currently watching your videos. She wants me to address the facts, be professional and keep the name calling and other stuff to a minimum - so clearly she knows me well enough to recognize my instinctual nature. I’ll try honey. Here is my response to (that douchebag) YOU in the best way I know how - eloquent prose.

First, as dirty, unfair and corrupt the Canadian junior stocks can seem a lot of the time, I’m sure you find it difficult to believe that there could be people out there who sincerely wish to advocate on behalf of retail investors. But that happens to be the case. The TSA discord’s origin and their founders all came from another discord which was basically comprised of pump and dumps and we wanted to do things differently. I think we have achieved that. Now I also don’t want to paint myself as a saint, a hero to the masses, or doing philanthropic work here. I’m also in the market to make money, but I also think it can be done successfully at the same time as helping others.

I’m also a capitalist, so I don’t fault you for the way you choose to earn a living. I also think the regulations around the paid promotion business are a joke and need to be addressed and I have written to regulators about my concerns in the past. To be clear, you get paid to promote stocks and as far as I know you go through the necessary disclosure protocols that are in place which make it a legitimate business. I wish those disclosure protocols were as clear as warning signs on cigarettes, but that is a topic for another day.

I do not specifically target YOUR stocks. My reviews for Aduro and Plurilock date back to early 2022 and I probably wasn’t even aware of your existence at the time. I’ve also done several reviews on Voxtur - but I can see why you left that one out. If the price action on LEEF since mid December hadn’t occurred I probably wouldn’t have bothered covered the stock, but I will admit your video on ROOF which was targeted at someone else did add some incentive - so I will grant you that. It was not completely unrelated to (you being an asshole) your previous work, but seriously, get over yourself.

The accusations after that are ones I’m more insulted, offended and quite frankly angered about. I try to be overly transparent with my readers and those whom I come in contact with on social platforms and elsewhere. When you read my 2025 Wolf Picks, I point out which stocks I have a position in and since I discuss my entries and exits those positions would have been quite well known to my frequent readers in the first place. Two of the six annual picks this year were stocks I did not own when published on December 15th. ROOF was 31 cents at that time and I did not take a position until a week later when it was 9% higher.

In addition, while they fell off my radar a bit, I was interested in ROOF almost two and a half years ago.

I made two longshot picks this year, the other was MTLC, and it is currently up 142% since my top picks article. I DO NOT nor have I ever held a position in MTLC. I anticipated it would stay in that price area for sometime. Clearly I missed that one and I don’t buy runners so we will have to see if more attractive entry position presents itself. My readers are all aware of that as well.

A similar story can be said about last year’s longshot pick, NCI. I picked it at 3 cents (pre split), and made my only buy subsequent to making it a Wolf Pick at 4 and 4.5 cents in March after calling it out in mid December.

I think that should addresses the front loading accusation but just in case, let’s go deeper. Anyone who would want to employ a “front loading” strategy would likely be continually pumping the stock only to later dump it back on them at a significant profit. The facts are that I don’t continually talk about my stocks or try to “sell” them to others. I share their news releases and I celebrate milestones on social media but I am rarely on message boards singing their praises. I have conviction in the stocks I choose and when their successful, I celebrate them, and more importantly when they are not I point out their shortcomings and failures. The biggest takeaway is that my picks have been mostly successful (unlike yours) so I still hold a position in the vast majority of them.

Lastly (on this topic) I’m very cognizant that my picks or words could have influence over someone’s buying decisions. I take this very seriously. Here is some of what I shared with my subscribers the night before publishing my 2025 Wolf Picks article, and I released it over a weekend to enable readers to do as much research as possible.

Your next claim is that I (and others) were being paid under the table by ROOF (NorthStar Clean Technologies). I’m honestly flabbergasted that ( a prick like you) someone with any intelligence could make such a slanderous accusation without any proof whatsoever, and to be (fucking dumb) brazen enough to put it on video. I have never accepted a cent from a publicly traded company that I have reviewed.

After I wrote about being disappointed with a customer service issue with one of my top 2023 picks, they subsequently offered me a resolution that I felt went way beyond what they would normally offer any other customer, and I’m assuming I received this offer because I write about the company. I declined because I didn’t feel good about it as I didn’t want it to cause any bias for future reviews. Would you have done the same? I highly doubt it. I take this these kind of accusations very seriously, so I suggest you step very lightly.

The next one is not a new one, usually thrown at me by bagholders holding shitty stocks after I’ve given a company an unfavorable review (see FOBI, VSBY and your shitco’s too). If you go back and read my poor reviews (1 star and under), there is no doubt there was a lot of money on the table to be made by a short position. I also think shorting is a good way to maintain a healthy market. But I just don’t have the stomach for it - it’s just not for me.

Your first point (or my last) which I didn’t even know what out there until after your most recent video, is that I have deleted reviews on VERSES AI (VERS.N).

It is true that if you search my previous VERSES AI reviews you will find broken links. What you, (slapnuts) aren’t privy to like most of my frequent readers is that ALL of my reviews prior to moving to Substack in late August and subsequently my domain also have broken links. This is over 500 reviews and quite honestly a frustrating and depressing development.

The good news is that I still have access to them and slowly over time (or by request) I have been republishing them. So just for shits and giggles I’ve reposted my latest on VERSES AI if you care to read or reread it in its entirety below.

So that is about it for responding to your (bullshit) slander, but this article is far from complete.

Let’s just break this down to its nuts and bolts and talk about what is really going on here. Your success rate just isn’t any good and you’re not worthy of holding my jockstrap. You only wish you were a happily married man in his fifties with my success rate. You’re a hack and I, unlike you, bring receipts.

As far as I can tell, these are the five stocks I’ve known you to be associated with:

Aduro Clean Technologies

Plurilock Security

Voxtur Analytics

Oroco Resource Corp

LEEF Brands

I tip my cap to you and all Aduro longs. Coincidentally it is the only stock of your five listed that I have awarded some favourable reviews (four in fact of 2.5 stars). I also held and profited myself from it, but no longer hold a position. But let’s not forget its still a pre revenue play with a quarter billion dollar valuation who’s projections have been pushed further into the future. The full story is far from being written completely on Aduro.

I’ve never personally looked at Oroco - pre revenue miners are just not my thing and aside from a few exceptions, I’ve refused requests to review stocks in this sector as a fundamental analysis of their financials makes much less sense.

Your other three however have all received one star reviews, and their charts tell the story why. Some people like to call these pump and dumps. I’m not that harsh in my analysis - I just think they are very poorly managed, and in most instances you can see in their financials that their goals are not aligned with retail investors. They are not good companies, and deep down I think you know this too. I honestly don’t think you’re a dumb guy (ugly maybe) - I’ve seen you walk through financials results once or twice. You are only talking about these stocks because they pay you for that service, whereas I call it as I see it, even when I own it. I’ve given several downgraded reviews of stocks that I own at the time.

Of all my picks, you decided to go after NorthStar Clean Tech (ROOF).

ROOF is of my two longshot picks this year and while I have talked about what I like about their upside, at the same time have talked about the risks of investing in a pre revenue play such as this. That’s another key difference between you and I - I will tell all sides of the story when I perform a review. I often criticize my own picks, address the downside and risk in addition to any bullish outlook I have. ROOF does have some valid critiques and I don’t have a problem with you or anyone else talking about them. I legitimately want to hear bearish cases on stocks I like. Perhaps I missed something in my analysis that I would like to re-visit.

Now let’s look at my picks which you decided NOT to shit on and for good reason. My 2023 picks were up 351% over two years while my 2024 picks rose by 311% last year. Here are four stocks that I still hold a full position on:

Enterprise Group:

Kraken Robotics:

Happy Belly Food Group:

NTG Clarity:

To be fair, I’ll include my worst performer over the past two years. I chose it at the end of 2022 and by May of 2023 I told my readers I fucked up - I didn’t like where they were headed and I exited my position. Despite their recent resurgence, I’m still not interested.

NOW Vertical:

Let’s have some more fun with comparing our picks. Is it ok that I call them YOUR picks - I mean you’re paid to talk about them after all? But do you REALLY believe in them?

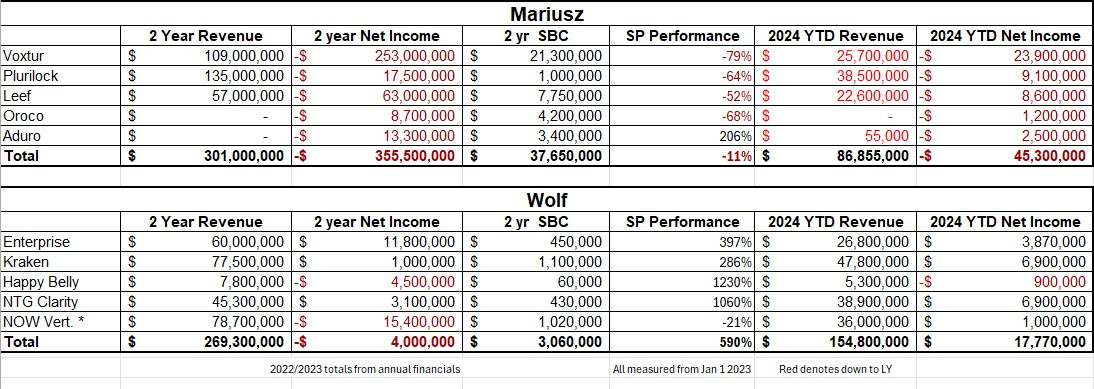

In less than three years YOUR five stocks have lost over $400M dollars on the net income line. Not one of them has been come within a (fucking) sniff of being profitable in the last three years (maybe forever) and all of them have seen their revenue DECLINE in 2024 against last year. Four of the five have lost over 50% of their share price value since the beginning of 2023. Aduro did save you from a clean sweep - once again a stock I gave more favourable reviews on. With the exception of Oroco (unreviewed) the rest have received some of my poorest reviews ever.

Another interesting tidbit is that your picks awarded 10x the share based compensation that mine did, while underperforming them by a staggering margin. Maybe that’s why I talk about that topic so much in my reviews - there’s is a correlation.

Wolf (that’s me MF’r) picks have delivered a combined $17.8M in profitability at well over 10% of their combined $155M in revenues so far this year. They also happen to combine for a 590% share price improvement since the start of 2023 and have delivered two 10+ baggers. Remember I’m being kind and included my worst performer in this analysis, one that I haven’t held in twenty months. I could have went with KITS or AEP which would make these massive variance between my picks and your (dogshit) even wider!

To be honest this was exhausting and I hate myself a little for spending so much time on (a waste of skin such as yourself) this article. Let’s face it, your YouTube video tirade on this topic likely has more views on it thanks to myself and Cam addressing it. I’d call you a ‘has been’ but that would imply you’re a ‘once were’.

Remember I went after your stock, but you came after the one thing that I will defend as vigorously as my family - my integrity. Shit on my picks all you want, IDGAF. They all probably have some warts, they are microcaps after all. But don’t question my integrity, don’t falsely accuse me of intentions with my followers and subscribers, or non existent financial relationships with the stocks I cover.

This was me being nice. I’m moving on to other things and I hope you decide to do the same.

Wolf, out.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

You cooked that fraud.

I’m a stockbroker of almost half a century spanning two millennia. I PAY to read Wolfy. That “other” person that posted the libelous video I DON’T. As I’m @ an advanced age I have less time in front of me than I do behind me so time has never been more valuable for me than now. I’m deeply regretful that I spent some of my precious time viewing that “other” person’s video.

Wolfy! Please keep up with your great work and renew my subscription..! ! !