My first look at Sylogist via request from the Wolf Den discord. I know very little about them, but what is blatantly obvious is that investors did not care for the company’s Q2 that was released about a month ago. The share price is down 17% during that time span and down 31% YTD, $11 decreasing to where it closed on Wednesday at $7.57.

According to recent news articles, there also appears to be some recent drama with a group of unhappy investors.

Personally, I’ve always felt it’s a dick move when a group or entity go to the length of sending out a press release to vent their disdain of management. I’m not sure I’ve seen this ever accomplish very much other than perhaps a temporary ego boost. Let’s find out if OneMove has a point here and get on with the review.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

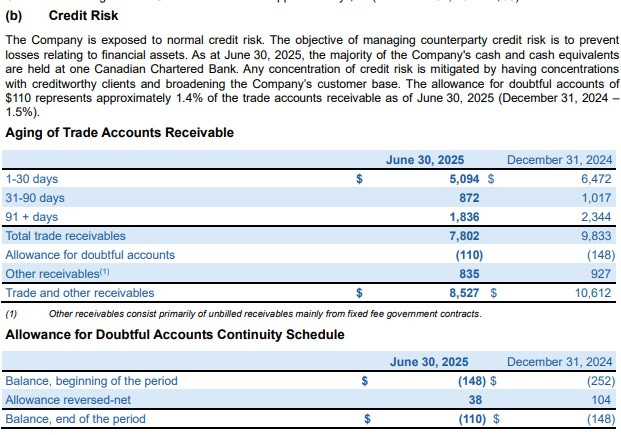

With deferred revenues removed from current liabilties, Sylogist has a more than acceptable current ratio of 1.8 that consists of $4.8M in cash, $8.5M in receivables and $4.4M in prepaid and other current assets against $9.9M of liability commitments over their next twelve months.

Far from the greatest aging report I’ve seen with 24% of their receivables being over 90 days. While the dollar amount is down the percentage of their total A/R is similar. I would have some concern with the allowances for doubtful accounts at 1.4% looking a little light. On the other hand, given Sylogist’s heavy reliance on the public sector this very well just could delays in receiving payments from governments and nobody would be surprised by that.

The company has a little over $19M drawn against a $50M credit facility which also has a $75M accordion feature. I do find it rather interesting that a $175M market cap company has that much in available credit.

Cash Flow:

A rather ugly looking CF statement with $4.3M in operational cash burn in the quarter and $3.2M on a YTD basis. This compares with $1.7M of burn in Q2 of last year and operational cash flow of $1M YTD. Much of this variance is within working capital adjustments related to decreases in deferred revenues.

I’m having a little trouble reconciling their OCF with their press release highlights. If recurring revenue is growing and bookings were up by that much, I find it surprising that their deferred revenue has decreased by 35% YTD. Unless the company has changed their billing practices, I would have expected those deferred revenues to be replaced.

In other cash flow matters YTD, Sylogist paid out $2.5M related to an earn out (assuming for a previous acquisition), spent $1.6M on intangible assets, incurred and $454k of interest on their debt and paid out $466k in dividends.

Overall their cash position has been depleted by a concerning 63% through two quarters of 2025.

Share Capital:

23.4M shares outstanding with zero dilutive measures in the past 18 months

140k in share buybacks in last six quarter but just 2400 shares YTD

Current NCIB expires November 26th but given their current cash burn I wouldn’t expect any more buy backs

1.6M options with only 150k ITM

Once in a while you see something new within SBC or executive compensation. This is a new one for me - (Phantom Interest Award Units)

Several hundred thousand outstanding combined RSU/PSU/DSU’s outstanding. It appears to be a company norm to exercise these units for cash rather than issue shares near year end. Between these and those “Phantom Units”, about $2.5M is on the books to be paid to insiders at year end according to the balance sheet. This will not help the cash flow concerns mentioned earlier. It’s not unplausible to consider the company having to dip further into their debt just to pay this at year end. That wouldn’t be a great look.

A meager 3.5% insider ownership figure with 40% institutional (per Yahoo Finance)

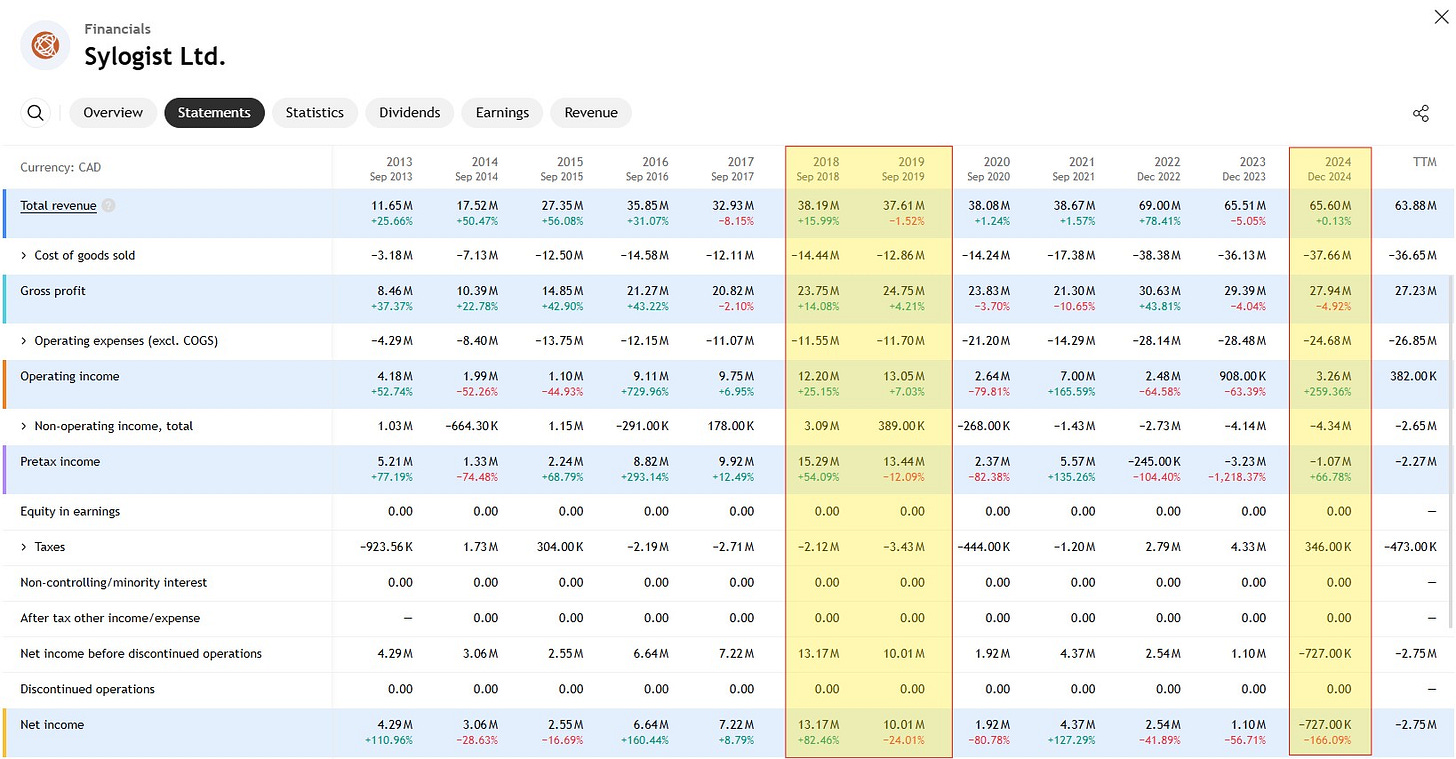

Income Statement:

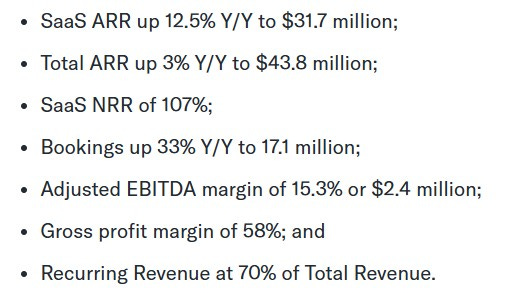

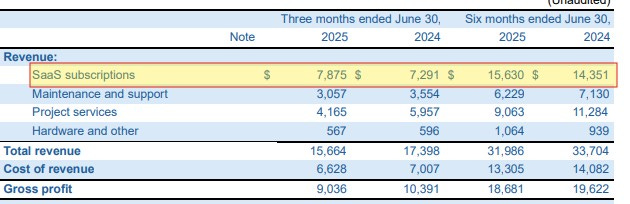

Total revenue was down in Q2 by 10% from $17.4M last year down to $15.7M here. Gross margin was also off by 200 basis points from the comparable quarter to 57.7%. That results in an erosion of GP dollars by 13%.

Normally when you see a company improve their SaaS balance of total revenue and away from project work that typically comes with better overall margins, but we are seeing the opposite here.

Sylogist completes the anti Wolf Trifecta with a 6% increase in operating expenses. The majority of that difference was in R&D spending with more than doubled from $947k last year to $2.1M. Sales and Marketing were up by 17% which makes their 10% reduction in total revenues look even worse.

After taxes and other expenses Sylogist had a $1.9M loss in the quarter, nearly 6x worse than Q1 of last years $332k.

On a YTD basis:

5.1% decreased in revenue from $33.7M to $32M

SaaS revenue up 9%, Maintenance and Support revenue down by 13% and Projects down by 20%

Stable margins of 58.4% compared to 58.2%

Total operating expenses up by 11% driven by R&D (up 101%) and Sales & Marketing (32%)

Total net loss of $2.86M vs a net loss of $844k last years.

Overall:

I’d hate to break it to the company, but this slide is not doing what it claims to be doing.

So maybe OneMove does have a leg to stand on here, as much as I would question their methods of going public with their criticisms. Sylogist has gone from producing a net income profitability rate of 31% in 2018/2019 to being unprofitable in 2024 and even worse looking on a TTM basis.

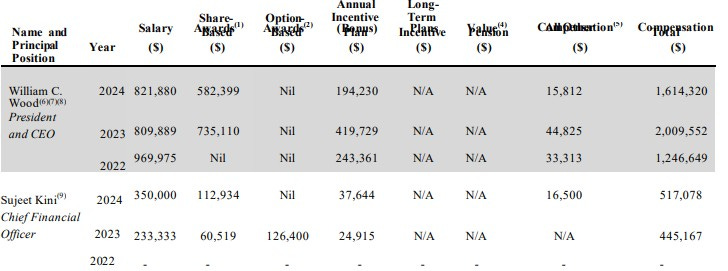

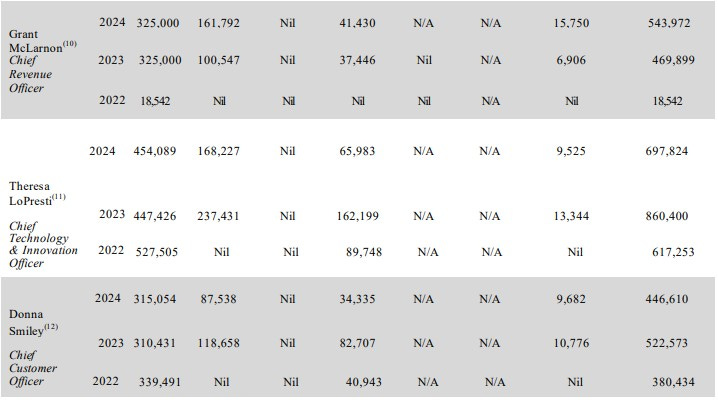

You wouldn’t know it by the executive comp table from their latest management info circular with the top four in the C-suite taking home a combined $3.3M in 2024 and $3.4M the year prior. As a reminder with their SBC typically taken as cash, this also appears to be 100% cash burning. At 3.5% insider ownership, there is very little skin in the game.

It should be no surprise that OneMove Capital, led by Tyler Proud has resulted in this type of action. This is the same guy who went after Dye & Durham, and he was a founding member and former board chair. He then entered into a legal battle to remove one of the directors - unsuccessfully.

Did I mention the CEO of Dye and Durham at the time was Tyler Proud’s brother, Matthew? Clearly Tyler ran out of fucks to give a long time ago.

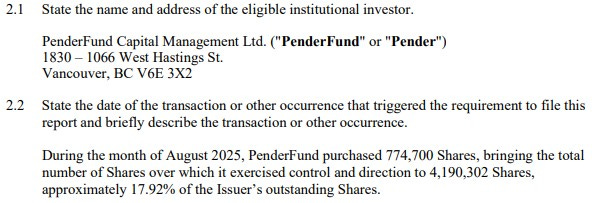

On the flip side, and also announced two days after OneMove’s public rant, PenderFund, already Sylogist’s largest shareholder announced a significant increase in their holdings, now up to almost 18% of all outstanding shares.

I’ll be honest, I don’t see what PenderFund is seeing here. I’ve read the MD&A and investor deck and came away pretty uninspired. Between the timing of their deck (attached below) and their recent MD&A, they have reduced their guidance on SaaS growth and Adjusted EBITDA margins.

In terms of their deck, I consider it pretty weak as it doesn’t give me much of an idea on how they plan to get to where they want to go. Given the revisions downwards in the three months since, I’m not sure they know either. Top management still be compensated over $3M this year though.

Two stars, but I was tempted to go even lower.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

LMAO. Appreciate your response to a Discord request but this is a yuck.

This review made me feel that the company is embroiled in a spat between c suite and personal annoyance of certain investors....rather than running a company successfully....thanks wolf, much appreciated for your proffesionism anyway...!