Simply Solventless ($HASH.V) FINS Review - a 2025 Wolf Pick

Q2 2025 (Insert your own rating here)

I’m not sure if it’s because this is my fifth review in as many days, the terrible sleep I had last night or the fact that I exited my position here yesterday, but I’m having a hard time getting myself geared up for this one. Nevertheless, we will endeavor to persevere.

My previous review was for their 2024 annuals, which received the largest downgrade I’ve ever given a stock - a rather humbling one considering it was my first Wolf Pick of 2025. Since their annuals were filed late, I did not bother reviewing their Q1 which was released only shortly thereafter.

While I’m not going to relitigate that review which involved a tirade of obscenities, the market was just as displeased as I was sending the stock tumbling by over 60% over the next two trading sessions. At the end of that review I announced I was planning an exit strategy, and as of yesterday that three month long process is now complete and I feel fortunate I was able to do so rather unscathed. That involved selling the remainder of my position at the top of yesterday’s bounce.

If you bought on that 60% drop, particularly if it was your initial entry, you’d have a double over a relatively quick timeframe.

Were yesterday’s results worthy of that double since mid June?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

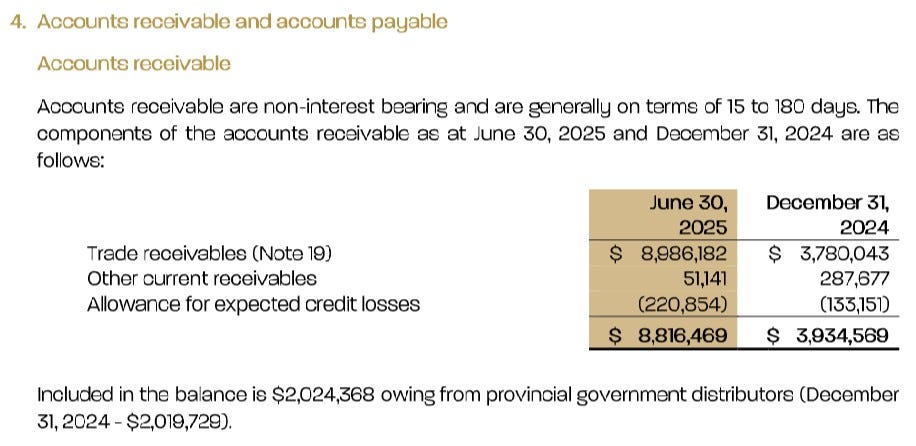

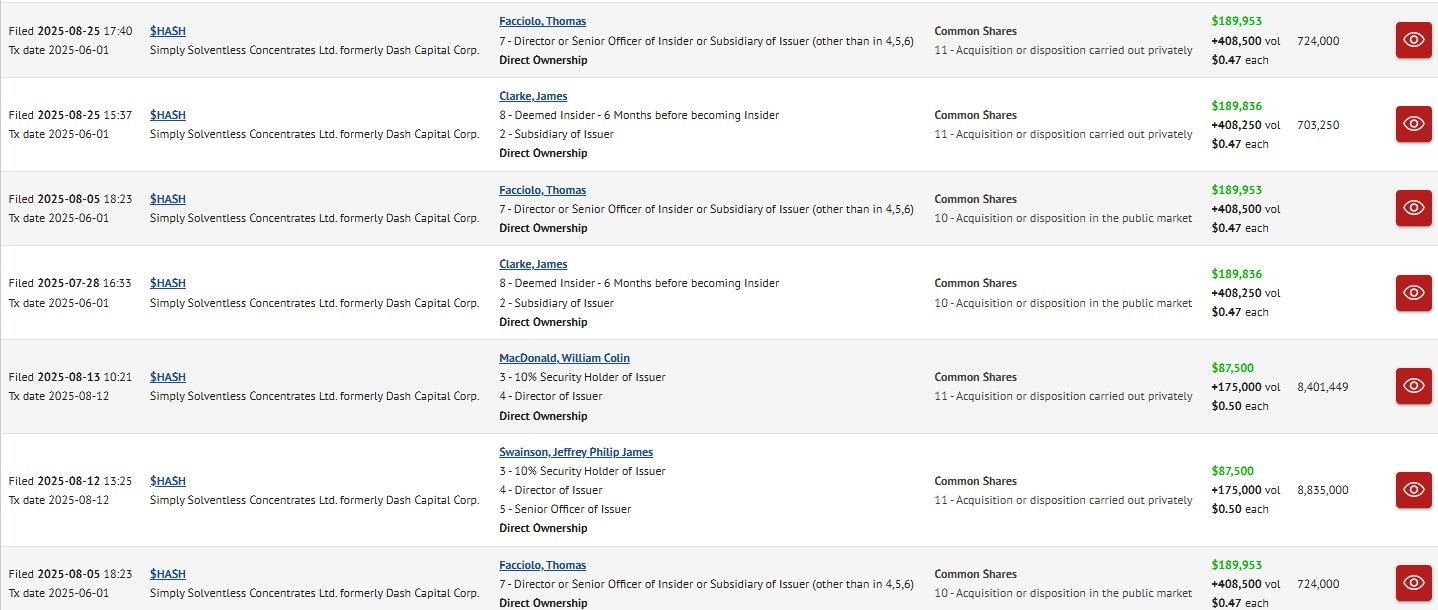

HASH has a very good current ratio of 2.6 and that is made up of $1.5M in cash, $8.8M worth of receivables, $21M worth of inventory and $1.4M in prepaids overtop of $12.5M of liabilities due over the next twelve months.

Their current ratio is good, but their liquidity looks problematic with their cash position only covering 12% of their one year liability commitments.

Given their rate of revenue increase the jump in their receivables isn’t overly concerning but I do find a couple of things odd. The first is their payment terms ranging anywhere from 15 days to 6 months. In all my reviews I don’t think I have come across a company in this sector with those kind of terms. The notation within the aging report I also find strange, particularly the “believes are current” portion of that statement. Current portions of your A/R are those which are within the defined terms on the invoice. If I bill a customer for something on Jan 1 has 90 day terms, any day prior to April 1 would qualify that receivable as a current one. Any item within 90+ days typically means it was due over three months ago and you’re still waiting to get paid. If you have 180 day terms on an invoice and it’s sitting at 90+ days, that tells me it was over 270 days since you billed that customer. How do they believe that’s current.

As you can see from the $12.5M in liabilities they have, the collection of those receivables is pretty damn important, sitting with only $1.5M in cash.

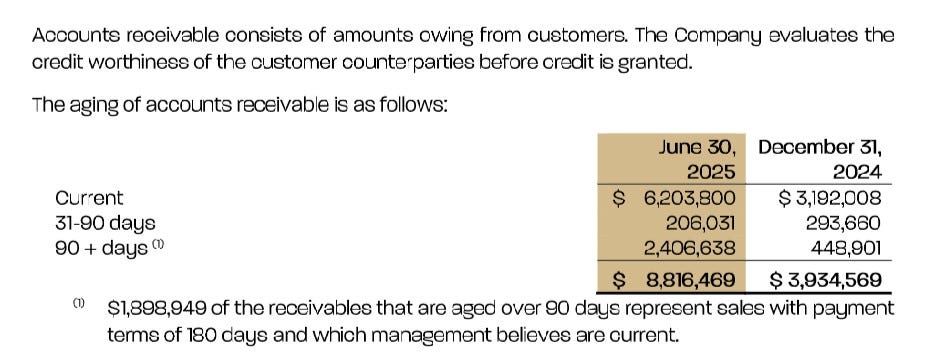

But it looks like they caught a bit of a break during the quarter with negotiations with the CRA as they have been delinquent with taxes and excise duties (not uncommon in the Canadian weed sector), with regular monthly payments pushed out into the end of September.

In all previous reviews, even when I was more bullish about the company’s prospects, I have raised the yellow flag about their inventory levels. Those levels are up from their year end by 33% and make up 64% of their net assets. Not good.

HASH has $8.5M worth of debt made up of promissory notes and convertible debt.

Cash Flow:

A sight that investors have been waiting for, an OCF positive generating quarter with nearly $1M delivered in operational flow. On a YTD basis they do still have a $1.8M burn which is 6x worse than the same stage last year. This is heavily influenced by $6.15M in working capital adjustments due to growth in inventory and receivables.

Also occurring during the first six months of 2025 were $5.5M worth of additional debt in the form of convertible debentures and $3M of that was used for the acquisition of Bio-Tech.

Overall, HASH has burned through 20% of the cash they started 2025 with.

Liquidity as mentioned is very tight here, but the break from the CRA and new payment plan could help them avoid a raise as long as the positive OCF keeps rolling in. Very important to continue to monitor on a QoQ basis.

Share Capital:

115M shares outstanding, 115% dilution from the end of Q2 last year when there were only 53.8M outstanding.

13.7M warrants - 4.3M well ITM at 20 cents with the balance well out at $1.02

10.2M options, over 9M are ITM. 1.25M awarded post financials at 29 cents

6M in future convertible debenture dilution but not until Feb 2029

Insider ownership of 19% (per YF)

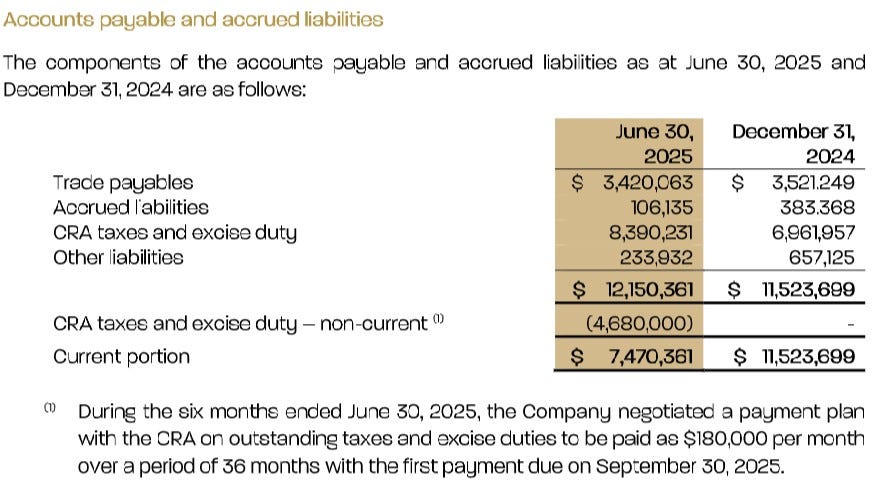

Insider activity has been interesting and also confusing (to me)

After the big pullback, the CEO purchased nearly 250k shares on the open market for $54k. Those are straight forward.

But then in August a series of transactions appeared on SEDI, among a couple others in July (not shown here) that were filed significantly late. I find them puzzling.

While filed from late July through late August, all have a June 1 transaction date. June 1 is an interesting date as it was the day before the company released their annual financials which caused a 60% decline in the share price. The following questions come to mind

Would the company have not been in a self imposed black out period then?

They would have known the upcoming financials would not have been well received by the market. If they thought otherwise I’d wonder if they have the ability to tie their own shoes. Why buy then if they could buy twice as much or more for the same price in a few days?

Normally insiders are very eager to share insider buys with the investing public. So why release them so late, and why all five insiders who made similar moves on June 1?

Weird.

Income Statement:

HASH had to restate all of their 2024 financial statements which had a significant impact on both revenues and inventory and thereby gross margins. As I said I’m not going to dwell on my disdain or relitigate why that happened, but due to that I am not going to discuss comparative figures as they are essentially useless.

Revenues were impressive with $13M in the quarter, 5% more QoQ from Q1 which brings their YTD number to $25.4M. Gross profit rate lagged what they achieved in Q1 coming in at 36.2% bringing their YTD to 37.5%.

SG&A costs were $2.06M or 16% of revenue and $3.8M YTD or 15% of revenue.

Income from operations were impressive at $2.63M or 20% of revenue and $4.7M YTD or 15% of their top line.

It gets messy below that with one time gains from their Bio-Tech acquisition and restructuring and acquisition costs. HASH loved to talk about NNI (normalized net income) last year so let’s talk in those figures. Their foreign exchange losses are negligible, so other than that Finance costs would be the only one to take into account to normalize their earnings. With those two accounts used below income from operations gives a NNI figure of $3.53M at the halfway point of 2025.

(I noticed later they did their own NNI calc in the MD&A and we're almost identical)

Overall:

Through most of last year and much of 2025 these are the kinds of P&L’s I was looking forward to sharing - with 15-20% of each revenue dollar being put on the bottom line.

If you annualize my NNI calculations from above they now trade at a 5.2 P/E and a .7 P/S ratio, and with the tolling fiasco seemingly behind them there are reasons to be optimistic if you are a HASH bull.

On the flip side the 5% QoQ growth figures look rather weak given the Bio Tech (now Humble Grow) had three months of revenue in Q2 compared to one last quarter. The bigger factors for me however is their historical inability to translate net income into operational or free cash flow. I think those factors are worth some sort of a discount on any reasonable investors valuations.

As for me, I’m still bitter AF, and for that reason I’m going to leave this Q2 review un-rated, but it is obviously much better than the one star given last time out.

Despite that lingering bitterness and taste of shite residue in my fatch, I think I was able to put those things aside for the most part in a rather unbiased view. You can be your own judge of that.

Yesterday, there were lots of investors (many I respect) on the BUY BUY BUY button, I chose the BYE BYE BYE route. No regrets.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

This was my first and likely last pot stock. I bailed when they were late on financials along with the cancelled deals. Couldn't have bigger flags if they tried . I managed to lose only 3 cents . When it crashed I bought 10 x what I had at 17 and dumped half at 36 earlier in the week the rest yesterday at 37. I will brag on this and Aritzia at under 23 and not mention the tons of losers I have had . Like a gambler at Woodbine bragging about the one horse in the 7th race.

Thanks for the review. I was less bothered by the accounting restatements; obviously, not good but something that happens when you don't have the right staff in place to either account for acquisitions or to co-ordinate with your auditor. I tend to think that they have addressed this with the new CFO and while there is still a lot of hair here, the low valuation metrics and cash flow performance is enough for me to hang around. Appreciate the warts and all review sir.