Fucking weed stocks, right?

Full disclosure, that isn’t the only F bomb utilized here and by the end it may look akin to lyrics from a Limp Bizkit album than a typical Wolf review.

I was about three quarters of the way through my Trubar review last night and woke up this morning to learn that SSC filed their annuals in the wee hours of the evening. To put it mildly, they look unpleasant, and that Trubar review will have to wait for completion.

After reading the highlights (if you can call them that) for this 2025 Wolf Pick, it is hard to know where to begin.

I awarded SSC a handsome 3.5 stars at the end of their Q3 which included over $2M of YTD net income which was 17% of revenue, almost unheard of in this space. They were far from perfect of course with what appeared to be an excessive amount of inventory and a balance sheet which lacked optimal liquidity.

This cannabis consolidator has added three acquisitions under their wings since September - CannMart, ANC Solutions, and most recently Delta9 at the end of February. Delta9’s company name was later changed to Humble Grow Co. Investors thought there may have been a fourth deal with the March announcement for the acquisition of CanadaBis. Six weeks later, CanadaBis pulled out of the deal, citing a “material adverse change”. While the definition of this out clause was vague at best in the original agreement, it certainly left CANB and HASH shareholders, many who held both feeling weary, and for good reason. Only adding to that weariness was the subsequent announcement that SSC’s annual audited filings were to be delayed due to more time for auditors to complete their work.

Then, with just over an hour left on their latest filing deadline, the company put out a press release and accompanying financials. My initial glance at the financials produced feelings of shock and dismay with a side dish of anger and regret. Let’s dig into this mess and find out if there is anything salvageable here.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

SSC’s balance sheet opens with a current ratio just shy of 1.1 and consists of just $1.9M in cash, $3.9M in receivables, $16.1M worth of inventory and $1.4M of prepaids over top of a rather daunting $21.4M of liabilities due over their 2025 fiscal year.

No issues are apparent with their A/R with more than half of their trade receivables owing from provincial government distributors. Inventory making up nearly 70% of current assets does not make for an ideal liquidity situation, but if there is any good news, inventory values are about $100k lighter than they were at the end of Q3.

SSC had no long term debt, but they do have $7.4M in current promissory notes and a $650k short term loan. About half of those promissory notes was due to ANC as part of the acquisition. On the date of filing (yesterday) this promissory note was restructured. While the amounts were pushed back, the ANC debt holders appear to have made out like bandits - more to say on this in the Share Capital section.

Post financials, in early February the company completed a $6M convertible debenture raise, converting at an above market $1/share with a full warrant at $1.20.

In a few weeks the company is to release their first quarter and we will see how this all shakes out with perhaps a little more clarity then.

Cash Flow:

$5.8M worth of operational cash burn for their 2024 fiscal year with $5.3M coming in the back half of the year including $2.4M in Q4. Up until the end of Q3, you could point the blame towards working capital adjustments related to growing inventory. Prior to working capital adjustments, they historically had positive operational cash flows. Unfortunately, that can no longer be said with over $4M of OCF burn prior to working capital adjustments.

Also occurring within their fiscal year, they raised nearly $12.5M through dilutionary measures and spent $3M via acquisitions and additional assets.

Overall, their cash position at year end sat at $1.8M prior to their post financials raise of $6M in February.

Share Capital:

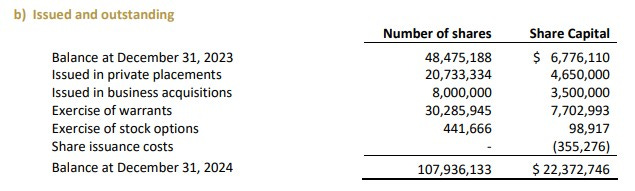

107.9M shares outstanding with significant dilutionary measures from capital raises and warrants exercised, particularly in Q4

4.5M warrants outstanding

8M stock options, all but 550k currently ITM (not for long) with the vast majority not expiring for 3 years plus

Post financials an additional 6M in future convertible shares with an additional 6M warrants at $1.20

18% insider ownership per Yahoo Finance

Two insiders have made open market purchases since March and two insiders also participated in the debenture raise for a combined $420k

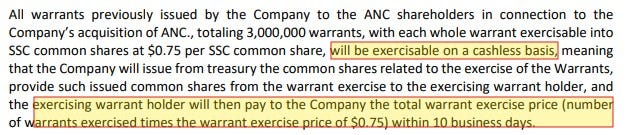

ANC promissory note revisions. The revisions to this note may be more disgusting than the actual financial results. SSC had $3.65M due to ANC as part of the acquisition with that amount due just last week. On the date of the financial statements filing. The amount of the note was essentially doubled with $3.4M to be immediately settled with the issuance of 6.9M shares. The remainder of the new note ($3.22M) will be settled with $1M due in one year, with the remainder to be paid with weekly installments of $25k over a period of 78 weeks and then $10k over a remaining 6 months. If the company retires the full note by year end there are some reduction clauses but the chances of that happening by the look of this current balance sheet seem extremely slim.

The company also modified the 3M warrants ANC shareholders own. At 75 cents a pop with the share price well below that, I’m having a hard time understanding why these warrants would be modified in this fashion. I would assume it would give the holders ten days to dump a portion of these newly awarded 6.9M shares to generate enough cash to fully exercise. Regardless the share price would have to be in the neighbourhood of 75 cents a share and after this set of financials, that appears way into the distant future.

Income Statement:

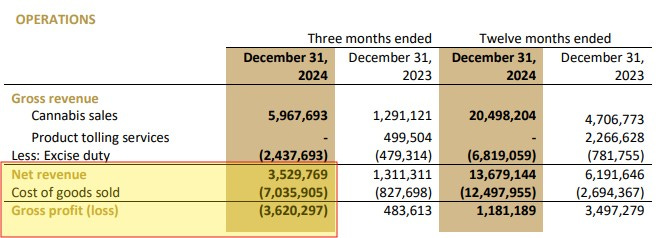

Net revenue for the year came in at $13.7M, 121% higher than the $6.2M the company produced during the previous year.

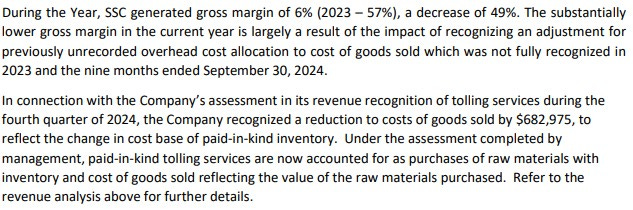

Gross margin is one of the main stories of these results, and not in a good way. The company’s gross profit rate came in at just 8.6% compared to the 56% they delivered in 2023. After Q3, on a YTD basis the gross profit rate was just shy of forty points, but a massive COGS adjustment occurred in Q4 which completely sunk the entire year.

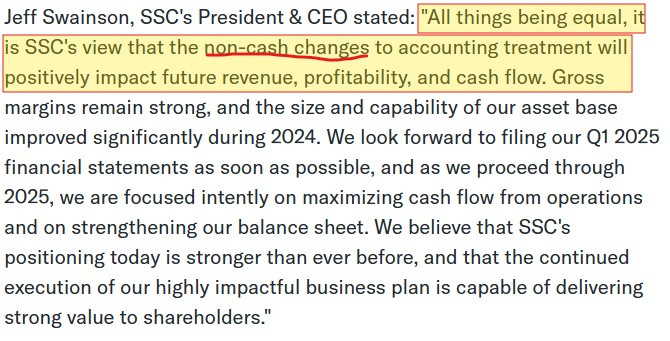

As for the explanation within the MD&A, the company provided the following word salad:

After the above statement, I’m left with more questions than answers. How was this not recognized in 2023 by auditors? Will previous financials statements require re-stating as I feel they should? If the answer to my last question is yes, will it really matter?

In addition to the above, the company needed to “derecognize” $4.3M in tolling revenue with “various arms-length counterparties”. It’s all starting to sound a little bit greasy, isn’t it?

After increased SG&A costs related to the newly acquired companies and $1.45M in financing and restructuring costs all equates to a net loss of nearly $5.2M for their 2024 fiscal year.

A head scratching turnaround of 17% net income through three quarters to losses of 38% of revenue at year end is nothing short of a gut punching disaster.

Overall:

In the end, it appears CanadaBis did have significant justification for pulling out of the deal at the end of April as these financials certainly meet the definition of a “material adverse change” in my opinion, and I don’t believe SSC will have a leg to stand on if they try and collect on the $1.2M break fee.

So where does the company go from here and more importantly how can the market trust any guidance, or quite frankly any statement that comes from head office in the future?

I’ve stared at the above quote for a few minutes now and I honestly don’t know what the fuck he’s talking about. The majority of the failures in Q4 and their historical flawed accounting methodologies do not seem to be non-cash impacting in the slightest.

With CannMart at an annualized revenue figure of $13.6M and ANC at $10.6M along with the newly acquired Humble producing $11.2M, SSC’s top line should continue to be strong in 2025. Everything else becomes a giant question mark, including continued faith and trust in this management group after the fiasco over the last two months.

Above is a portion of what I had to say about SSC from my December Wolf Pick article. In my last review I also said to be a shareholder of this company, you may need to wear a cup and a helmet. Well, we’ve now not only been clobbered over the head by a 2x4 but also punched in the dick.

Consider the football to be adequately fucked.

Monkey 1 - Wolf 0

A never before seen 2 plus star downgrade. One star. Exit strategy implemented.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I listened on these calls and thought mmmm, Weed business lets watch, because every weed business is SHIT!

Added at .18, this might actually be the biggest winner of 2025 at these prices now lol