“Heaven has no rage like love to hatred turned, Nor hell a fury like a Wolf scorned.”

A twist on a quote from William Congreve’s three century old play, The Mourning Bride. It felt like the appropriate lede to this 2025 Wolf Pick story. Microcap stock pickers do not bat 1.000. The key for success is knowing which stocks to keep, and when to get out of the ones without experiencing catastrophic losses.

Simply Solventless falls into the latter category, but overall I feel fortunate to have exited with a relatively light loss to the pocket book, and to some degree the ego as well.

The company went from a 3.5 star hopeful last year which led into their annual pick selection to a one star rating for their annual financials (late filed) to an unrated review last time out for their Q2 released in August. That last spike on the chart below is where I made my exit, and as of today trades 46% lower.

There were identified risks and sore areas in those more solid looking financials last year - inventory sell through the main culprit and the extension of that were significant operational cash flow problems. What came as more of a surprise was the accounting irregularities surrounding revenue and margin recognition which resulted in re-stated financials which resembled a dog’s breakfast.

Their last quarter kept and even brought back some bulls to the story, but in the three months since the share price continued to erode, almost curiously. I feel like I’ve discussed “the revenge trade” frequently lately - it’s a real thing. The revenge trade is the attempt to win back what you lost on a ticker that previously steered you wrong. There’s a little degenerate gambler in most that invest in microcaps, and I can’t deny I possess a little of that DNA.

Admittedly, my success rate at the revenge trade is terrible, but I was thinking about it earlier this week.

Judging by the financials that were released last night which I quickly perused after a full day of NFL football, resisting that temptation appears to have been a good choice.

Let’s delve into what Q3 tells us.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

I feel like a bit of a theme has emerged in some of my recent reviews - solid looking current ratios, with poor quick ratios. Let’s try and turn this into a bit of an educational moment.

A current ratio measures total current assets over total current liabilities, whereas a quick ratio only takes current assets that are deemed to be quickly convertible to cash within 90 days (cash and cash equivalents + receivables) divided by those same current liabilities.

A weakness of solely using a current ratio is it has the risk of overstating a company’s liquidity - particularly when it comes to slow moving inventory, and even overlook accounts receivables concerns. Simply Solventless’ balance sheet is a good example of looking at these differences.

HASH has a current ratio of 2.5 that consists of only $900k in cash, $7.3M of receivables, $1.4M of prepaid expenses and $23.2M worth of inventory including biologics. That sits overtop of $13M in current liabilities or known financials commitments over the next twelve months.

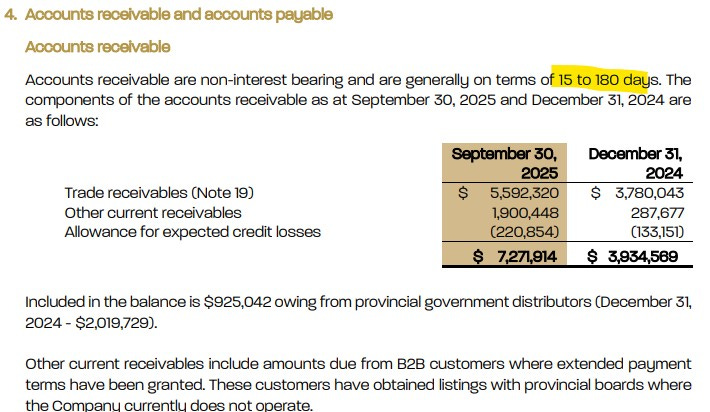

Seventy-one percent of their current assets are inventory related. With prepaids removed their liquidity measure (quick ratio) falls all the way down to .63. In dollars the current liquidity shortfall is almost $4.8M. But there are items with their A/R that perhaps make that already weak quick ratio number appear inflated. When you look at the top part of the quick ratio equation (cash + A/R), cash only makes up 10% of that.

Simply Solventless uses A/R terms that can extend as high as 180 days. If quick ratios measure near term liquidity within 90 days, then it makes sense to further discount that .63 ratio. The unknown is by how much as we don’t know how much of those receivables the company will turn into cash over the next quarter.

When we move to looking at their inventory, it has risen by 44% from the beginning of the year. If that were a one time occurrence, investors could easily shrug that off, but it has been one of the company’s major problems since they became a publicly traded company.

HASH has $8.8M of total debt made up of a short term loan, promissory notes and convertible debt. I’ve written in more detail about their debt in the past. Find it at your leisure.

In addition to their traditional debt, $4.4M worth of excise taxes due to the CRA were renegotiated and to be settled over three years.

Cash Flow:

At the 3/4 pole, HASH has burned $1.7M in cash via operations. That compares to $3.7M at the same time last year. They did however achieve positive OCF in the quarter of $100k. Once again however their total operational cash flow was negatively impacted by working capital adjustments.

When a company is growing, it is not uncommon to see negative working capital adjustments. Typically these are mainly related to A/R in a high revenue growth company. While that is partially the case here, their inventory has been the main culprit. Usually this balances out in one or two quarters but HASH has now reported negative working capital adjustments in seven straight quarters pointing to something more systematic. I will note that due to their accounting issues revealed at year end in the spring, all of there 2024’s interim statements would have needed restating so it’s plausible that looking at re-stated cash flows from 2024 could make that 7 quarter streak look different. The company has never submitted those to SEDAR that I have seen.

Also occurring so far in 2025 was the acquisition of Biotech with $3M utilized for that purchase, along with $5.65M added to the treasury from convertible debentures and a repayment of promissory notes of $450k.

Overall Simply Solventless’ cash position is a little less than half of where they began the year with - $900k vs $1.89M.

It’s not looking very good here at this stage in the review. In the last twelve months, renegotiated their promissory note which pushed $5.5M into long term debt. They also did the same with the CRA relating to outstanding excise taxes payable, and $4.1M of those were pushed into long term liabilities. Even after that I project nearly a $5M liquidity shortfall in the next twelve months. When you have a liquidity shortfall the first thing you look for (at least I do) is can their OCF cover that shortfall. Everything I have said up until this point makes that very difficult to believe that could happen.

Their third quarter ended on September 30th with $900k of cash on hand and we sit nearly two months after that. It’s almost surprising that the company hasn’t raised capital by now by purely looking at what the numbers tell us. I think there is an extremely high likelihood of that occurring prior to when the company is scheduled to release their annual financials in April, and I would bet sooner rather that later. It’s also possible that they could attempt to renegotiate some of these payables as they did in the past to extend extend that cash runway. Obviously raising capital near 52 week lows presents them with plenty of challenges.

Share Capital:

115M shares outstanding, 115% dilution from the end of Q2 last year when there were only 53.8M outstanding.

13.5M warrants - 4.5 currently in the money at 20 cents but I don’t expect that to be the case at the end of today’s trading.

10.3M options, the vast majority out of the money with 900k at 15 cents expiring next month.

6M in future convertible debenture dilution but not until Feb 2029

Insider ownership of 18% (per YF)

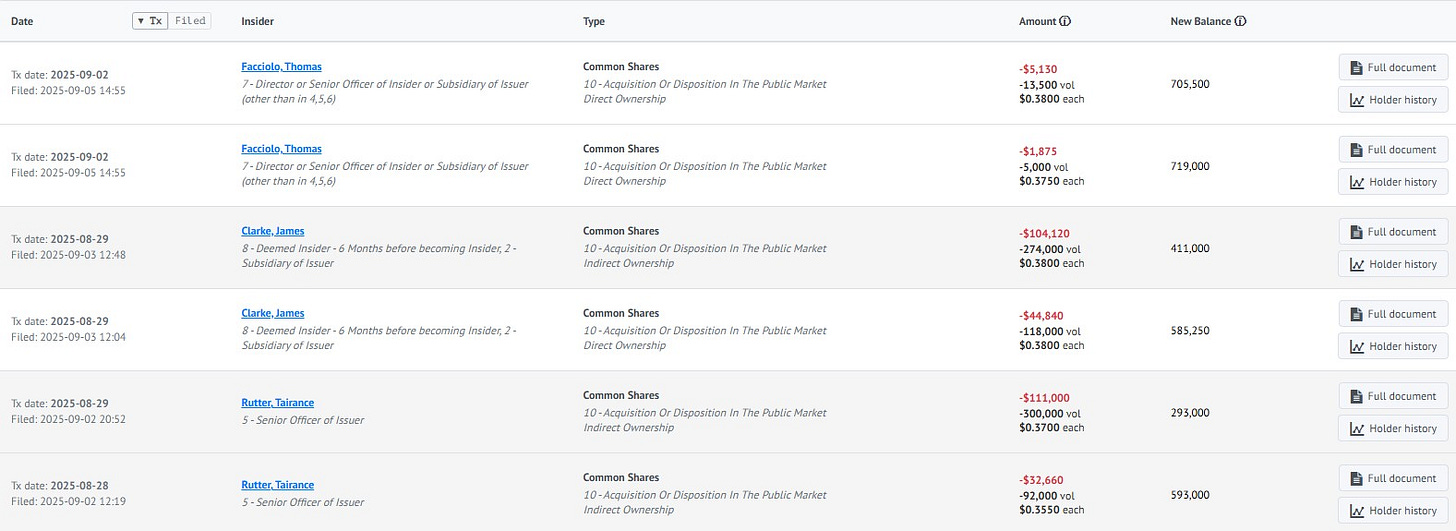

Up until relatively recently there was a theme of insider buying, but that has reversed since the end of Q2, so I wasn’t the only one selling the Q2 FINS news

Income Statement:

Net revenue for the quarter of $6.35M growing by 56% over the comparable period. Margins are quite encouraging with a 1000 basis point improvement to 45.7% and that generated just more than double gross profit dollars.

Unfortunately total operations expenses didn’t cooperate, growing at a much higher rate than revenue and gross profit at 125%, thereby creating a shortfall of 78% in operating income to last year. To be fair, a big portion of that opex was in significantly increased non cash burning depreciation and amortization of asset purchases, but their main operating expense bucket G&A also more than doubled.

Below that are $1M in financing costs, $145k of restructuring and a couple other offsetting one time items, a near $500k birdie to last year relating to income taxes, all contributing to a $300k net loss in the quarter, just about tripling the loss from a year ago.

YTD metrics are as follows:

Revenue up 279% to $27.2M

Due to the disastrous accounting missteps from last year their margin isn’t comparable but it comes in at 47.9% this year

Operating expenses up 3x to $8.2M

Total net income of $10.9M including $9.5M of one-time gains related to their bargain purchase of Delta 9, and renegotiating promise notes

Overall:

That ended up much more verbose than originally intended.

As I wrap this up the market has now opened and the stock has been down by as much as 30%, and it feels like the next little while might be a scalpers delight.

What isn’t obviously apparent in these financials is while the YoY revenue looked solid, the QoQ for the second quarter in a row is concerning. The $6.35M is 42% less than what they delivered in Q2, and combined with the balance sheet and cash flow problems has all contributed to what we are seeing with the market reaction here. The previous QoQ growth was only 5% that included a full quarter of their new acquisition and the beginning of the launch of Sluggers. Both is suggestive of weak organic growth, and I’m not sure the word salads tossed up in the MD&A give me any optimism.

Bulls gonna bull. Bears gonna bear. Both however are going to have to hibernate for the next five months until either see the company’s Q4 and annual filings. Let’s not forget how that turned out.

1.5 stars. Scorned.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Not gonna lie, this one hurts.