After a long five month wait since SBBC released their Q3, they announced their annual results early last week. I happened to be in Vegas attending the Planet Microcap Showcase, so I’m just catching up with the details now.

Shortly after their strong Q3 results, I announced them as a 2025 Wolf Pick. The stock nearly doubled from 64 cents to $1.26 over the two months following that monster Q3, but has since lost one third of that value. The share price is also a little worse than flat since these newest numbers came out Tuesday evening. The headlines I read from afar certainly had some concerns, but let’s dig into the meat.

Balance Sheet:

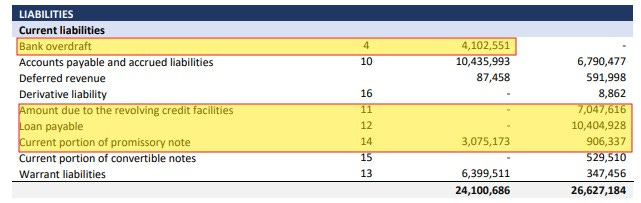

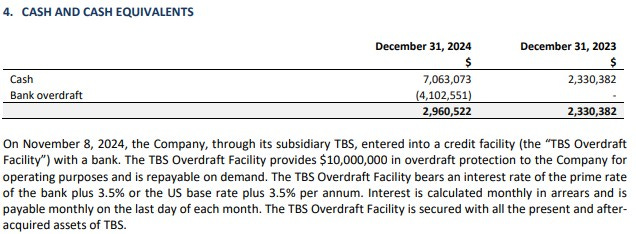

Dramatic changes within the balance sheet over the last quarter and on a year over year basis. At their fiscal year end their current ratio (with non cash impacting warrant liabilities removed) was 1.2 which consists of $7.1M in cash $10.3M of receivables, $3.8M worth of inventory and $630k in other short term assets over top of $18.2M in liabilities due over their 2025 fiscal year. Their current ratio last year was a paltry and concerning looking .55.

The company’s cash position nearly doubled from last quarter while both their A/R and A/P just about quadrupled during the same time frame which is highly unusual and suggests a lot of activity in the final few weeks of the year.

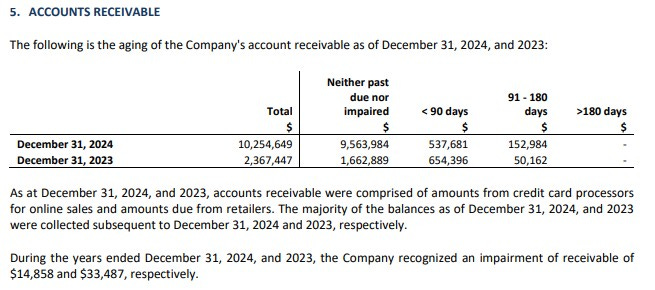

Despite the giant rise in receivables over the past three months, they are extremely healthy at 93% current with insignificant amount of write downs over the past two years, and the notes suggest the majority was collected post financials.

The big story year over year however is debt reduction. Simply had over $18.3M of debt on the books, which was reduced to $7.2M which includes $4.1M of new activity from last quarter in their overdraft facility.

I did see some people on social networks freaking out about this overdraft number, but this $10M facility was entered into during Q4 and investors should just think of this as a different form of a line of credit. I have much bigger problems with the company’s promissory notes, for which carry a ridiculous 15% annual interest rate with the majority loaned by insiders. About 90% of these notes are scheduled to be paid back within Q3.

Cash Flow:

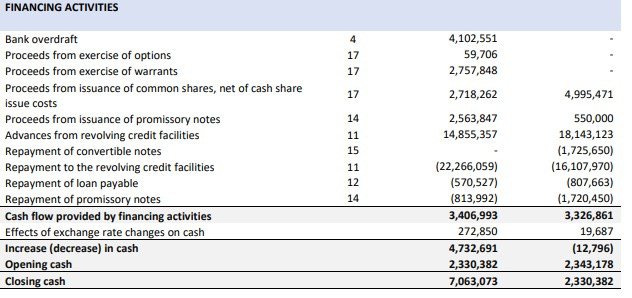

Operational cash flow for 2024 came in at $1.2M vs burning $1M last year. Very little in the way of investing activities during the year but that cannot be said for financing activities.

Rather than listing them all I provided all of the ins and outs above which translates to $3.4M added to the treasury. Overall their closing amount of cash was near $7.1M, 3x better than where they finished 2023.

Operational cash flow in Q4 was flat.

Share Capital:

97.8M shares outstanding at the end of 2024, with considerable 35% dilution during the year and 130% over two years.

5.5M options outstanding with a fairly egregious 5.05M awarded during 2024 and another 280k awarded post financials. All but 100k are ITM but no significant amounts expiring until May 2029.

2.7M RSU’s outstanding with 2.1M awarded during 2024 and another 150k awarded post financials.

15M warrants outstanding as of their year end. Post financials 9.3M warrants were exercised for proceeds of $4.16M

Approx 20% insider ownership. Some smaller director buys in the open market, but with the overly generous SBC I wouldn’t expect much open market buys in the future

Income Statement:

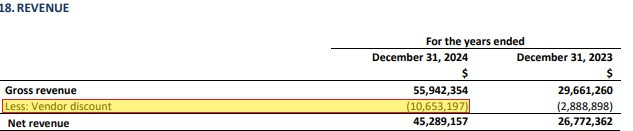

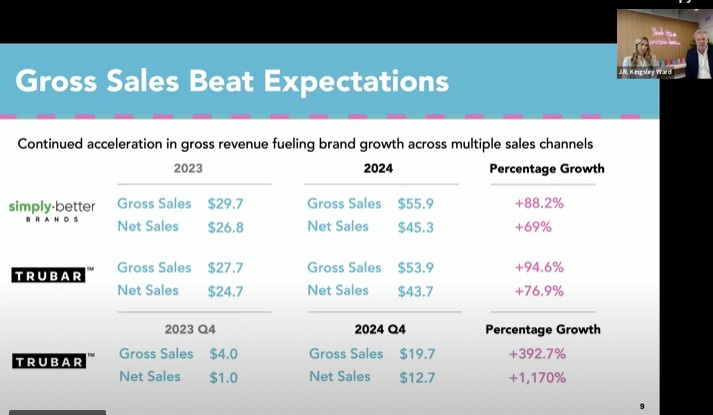

SBBC’s top line for the year was very strong with a 69% increase on a comparable basis going from 26.8M in 2023 to $45.3M in 2024. Margins on an annual basis were up 130 basis points on the year to 29.3% but certainly look funky within the quarter itself which I’ll touch on later. The good news overall is that margin dollars grew by 77% on 69% revenue growth.

Total expenses grew by 25% which is much less than their growth which is nice conversion to profitability, but it is a little misleading. When you back out amortization and SBC and look at true cash burning expenses, they were actually up 63% with significantly more spending within G&A which grew by 179%. Something to keep an eye on.

Their operational loss of $2.94M was therefore a reduction of 47% from 2023’s $5.52M.

Due to the share price appreciation they took a big one time hit of $7.1M which makes their overall net loss look terrible at $11.5M. If you normalize their net income by adding their interest expenses to operational losses it works out to a $4M loss in 2024 vs a loss of $6.9M a year ago.

Overall:

My biggest concern when I was in Vegas without the benefit of seeing the financial details was how soft Q4 looked on a QoQ basis.

While the company’s net revenue was $12.7M, a mere 5% increase over Q3, their gross revenue was substantially better achieving $20.4M, with the variance coming in vendor discounts. So the company sold an incredible amount of more bars, they just had $8M of vendor discounts applied to them due to promotional activity, likely attributable to the amount of new doors they added. If this vendor spend had been allocated to marketing spend, I think the market would have reacted much differently to a much more positive top line, but IFRS rules are IFRS rules.

The company tried to illustrate this during their conference call with this slide:

My initial thought when I watched the conference call this morning was it was an odd fireside chat setup that gave me me Bill Belicheck/Jordan Hudson daddy vibes. But as it went on I actually think they did a pretty good job explaining the state of the company and how they are moving forward.

I’ve linked the full call below but one of the more impactful portions for me came around the 18:35 mark during the Q&A. This talked to the margin growth goals the company has and it also addresses the trade spend impact (gross sales vs net sales) issue as well as COGS improvements with a lofty goal of a 12 to 18 month implementation.

A few final points from the call and news release:

There is an LOI on the table to dispose of the No B.S. line that could end up closing in Q2. I don’t anticipate a significant windfall here but anything that helps put more focus on TruBar is a positive step

An upcoming name corporate name change to TruBar as well as a ticker change

Negligible expected tariff impacts

Possible guidance after Q1. I would have liked to hear something more definitive

Hearing that other acquisitions to add on to the SBBC brand are now off the table was welcome news as I wasn’t a fan of adding additional complications right now. “TruBar focus. Full stop” coming from Kingsley was great to hear

After reviewing the financials in detail and listening to the call I feel much better than I did after reading the press release in my hotel last week. I still have some concerns overall with management - the SBC, the interest on insider loans does not help the trust factor. I’m here for the eventual buyout opportunity as are many others, but don’t think management won’t shiv you for an extra piece.

Reluctantly maintaining my previous 3.25 star rating as I feel much better days are ahead.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

fantastic wolf honest and straightforward. Impressive especially your a share holder. Keep it up

Informative read. Thanks Wolf. Love the line "but don’t think management won’t shiv you for an extra piece."