I didn’t exactly have Sabio Holdings as a must review this time out but pickings were a little slim this morning and I haven’t written anything in a few days so here we are.

I did review their Q3 with high expectations going in but I came away rather unimpressed giving them a quite mediocre 2.5 stars. You can see that review below. Sorry, not sorry about the visual.

The stock bounced around between fifty and fifty five cents for a few months following their Q3, and then received a heck of a bounce about a month ago during a busy news week including preliminary Q4 numbers which were quite impressive, at least on the top line.

There was nothing mentioned on the bottom line however unless you count Adjusted EBITDA, and if you know me well then you know like Shania Twain, that don’t impress me much.

So it feels like the market had some pretty high expectations coming in based on that mid February preliminary earnings release. How do the actual numbers fare, and how will the market react?

(All amounts in USD unless otherwise specified)

Balance Sheet:

We start with a current ratio of under 1.0 which is never a good place to begin. It comes in at .83 which is some progress after it was .74 at the end of Q3. It consists of $3.3M in cash, $14.7M of receivables and about a half million of other short term assets against a hefty $22.4M worth of short term liabilities.

Receivables jumped 40% and payables by 55% so before we get to the cash flow statement I can already tell we’ll be looking at some massive swings within working capital adjustments.

Liquidity is not a strong suit once again with cash covering only 15% of their twelve month commitments. With their revenue performance in the back half of the year it isn’t overly unusual to see their receivables grow to the extend they did. What I find unacceptable is the lack of disclosure the company provides into their A/R, as it accounts for nearly 80% of Sabio’s short term assets and almost two thirds of their total assets. It’s one thing to not include an aging report and other details in your quarterly statements, but to choose not to within annual filings is a little Mickey Mouse in my opinion.

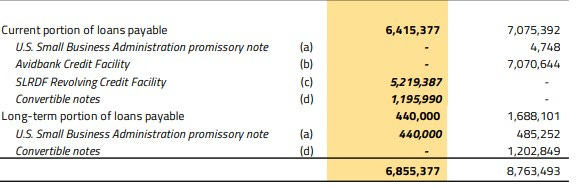

Sabio has $6.85M worth of debt, the vast majority showing as current (due within the next twelve months). That is slightly misleading as $5.2M is within a revolving facility, which doesn’t have a firm expiry.

What I do find interesting and what drew the Ron Jeremy reference during my last review is how often they are “in and out” of this credit facility, and this was even more dramatic in Q4.

The company also has $1.2M (CAD) of convertible notes expiring in August and converting at a rate of $1/share, which is significantly higher than where the stock trades today leaving the possibility of these being extended or restructured later this year.

Cash Flow:

Anyway you slice it, the company has made tremendous strides within their cash flow statement. After burning $5M a year ago operationally, they finish 2024 with $3.8M worth of operational cash flow.

As mentioned earlier, they do have some dramatic swings in A/R and A/P which overall slightly inflates their OCF.

During 2024 they had minimal capital investments ($100K), paid down $1.9M worth of debt, and advanced $150k (gross) to related parties. Overall, Sabio improved their cash position by $700k or 26% from where they began the year.

Share Capital:

Decent sized float of 50.55M shares very minimal dilution over the past twelve months (under 1%)

2.5M options outstanding, with about 1.4M ITM but the vast majority have expiry dates of longer than three years

487k of RSU’s under their reasonable 10% Omnibus plan.

Sabio’s NCIB expires on Friday and during the year bought back a miniscule $12k worth of stock. Their liquidity suggests they should have other priorities

55% insider ownership per investor deck but no serious participation within the open market

Income Statement:

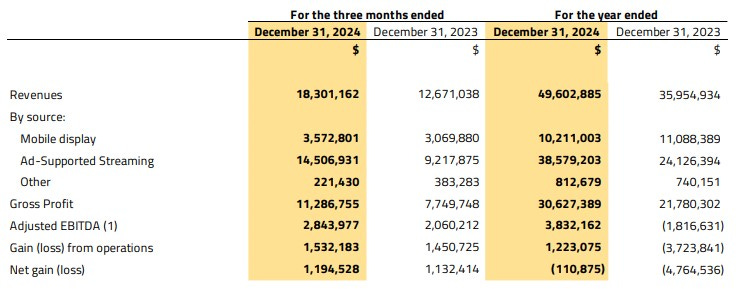

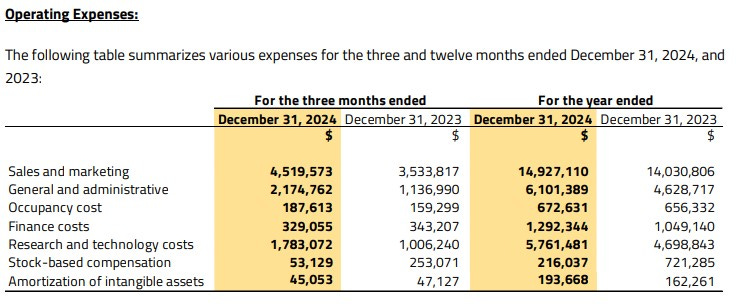

Revenues for the year were strong at $49.6M, 38% better than they achieved in 2023. Sabio delivers some sexy margins with 61.7% gross profit, and that is 110 basis points more than they achieved a year ago. On the year they converted very well on operational spending which grew at only 12% on 38% more business and 41% more gross profit dollars. That all combines for an overall break even year with a net loss of just $110k, a massive improvement over the $4.8M they lost a year ago.

That conversion within operational spending experienced throughout the entire year did not follow through to their last quarter however. Revenue grew by 44% in the final quarter and gross profit by 46%. The company only took 5.4% more to the net income line though which is terrible conversion.

The reason for the poorer conversion in Q4 was due to an increase in G&A costs of 91%, 77% more R&D spending, and Sales & Marketing expenses up 28%. In each expense bucket within the MD&A these increases are attributed to several factors. In each of them though they mention year end bonus accruals based on Adjusted EBITDA targets. Utilizing that metric for annual bonuses is not an encouraging sign for retail shareholders.

Overall:

First time listening to a Sabio earnings call and the usage of Adjusted EBITDA is extremely notable as well as no mention on any of the weaknesses I mentioned above.

Things are certainly on the upswing and despite some overall concerns the company does have a lot of good things going for it including their increasing streaming revenue and recurring revenue. I’d like a little more detail on how recurring revenue is defined however as that does not show up on a quarterly basis.

From a net income perspective, which is tremendously more important that the Adjusted EBITDA metrics the company enjoys touting, they were just below breakeven which means you cannot calculate a P/E ratio just yet. Their EV/EBITDA ratio in the 20 range doesn’t scream extreme value to me here either. They do have an opportunity to make some dents over the next two quarter which saw them lose $2.7M in Q1 and $1.4M in Q2. The top line trend is for a much lower expected number as well so we’ll see how that shakes out in about six weeks.

After a brief 10% pop on low volume the stock is now trading pretty flat which isn’t really surprising an hour into the trading day.

Marginally more confident in Q4 results than Q3 but not enough for me to think about pulling the trigger myself. Moderate upgrade to 2.75 stars and would deem them watchlist worthy.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

The "Ron Jeremy Pick of the Week". An instant classic.

The poor conversion of extra revenue to extra income is even worse when you consider that $2.4M of revenue was a one-time windfall due to US election advertising spending.