Initial coverage from a request out of the Wolf Den discord. My initial look generated a little bit of interest and the further I looked the less interested I became. Where will that interest end up after a deeper dive? Let’s find out.

Revolve is a $16M market cap company trading at an interesting sub 7 P/E who are producing positive cash flow on a TTM basis. They operate in the renewable electricity sector and have assets throughout North America.

The company has an interesting approach to their model whereby they build or buy smaller projects, fully develop them and if they reach a certain scale, sell those assets off to recycle those funds back into their development and M&A activities.

The performance of the stock itself isn’t anything to write home about, down 15% over the last year and off by 38% from their 52 week high back in July. On the other hand if you jumped in from their May low of 15 cents then you would be up a handsome 44%

How do their numbers fare?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Revolve’s balance sheet is less than impressive, sporting a current ratio of under .9 consisting of $2.2M in cash (including $600k in restricted cash), and $2.6M in other short term assets spread across seven small accounts overtop of $5.5M of current liabilities. This includes $2.6M in current debt, and then has another $7M of long term debt.

I never like to see a related loan receivable on a balance sheet but that is what we have here. While these financials stated there would be a corresponding note in their Q3 financials, I had to go all the way back to their 2024 annual statements to find it.

Revolve’s $9.6M of total debt is across multiple facilities with one or more having the maturity dates pushed back, each time coming with a higher interest rate.

Post financials, in fact the day after the quarter closed the company announced a $10.5M acquisition. This was to add another $8M (USD) of debt, financed by RE Royalties (RER) once again, and in addition to 12% interest, they would also pay 5% gross revenues to RER. The deal mentioned it was expected to generate $2.2M in annual revenues and $885k of EBITDA in year one. Those numbers would work out to nearly a 12 year EBITDA payback period which seems extremely long when factoring in the 12% debt and royalties payable to RER. The remaining $2.5M for this acquisition was to come from “a combination of cash from the Company's balance sheet, equity financing and/or debt facilities.”

While there has been no further news since this April 1st announcement, at this point, I think I’d rather hold shares in RER than Revolve, as this review is going downhill quickly.

Cash Flow:

Through nine months, the company has burned $164k, a significant improvement over the $1.5M burned at the same stage of last year. It’s notable that on a TTM basis, the company is OCF positive, but we will look at those challenging Q4 numbers later.

Revolve has utilized a net of $714k on assets, $240k of their restricted cash and paid out $466k of dividends to non-controlling interests. Another yellow flag - did you get any dividends retail shareholders?

Overall the company’s cash position has depleted by 50% since the start of their fiscal year.

Post financials, the company issued a LIFE financing for 4.8M shares at 25 cents with a full warrant at 40 cents.

Share Capital:

63M shares outstanding and zero dilution in the past twelve months

2.05M options well out of the money at 50 cents. 3.5M shares at 50 cents also expired this fiscal year

8.1M warrants outstanding, again all out of the money at 45 cents

Unsurprisingly, with options out of the money, the company moved to DSU awards early in 2024. 2.5M have been awarded in the past five quarters. Another 500k+ were awarded post financials under their 10% SBC plan.

38% insider ownership per Yahoo Finance

More selling than buying from insiders on the open market in the past year, although rather insignificant

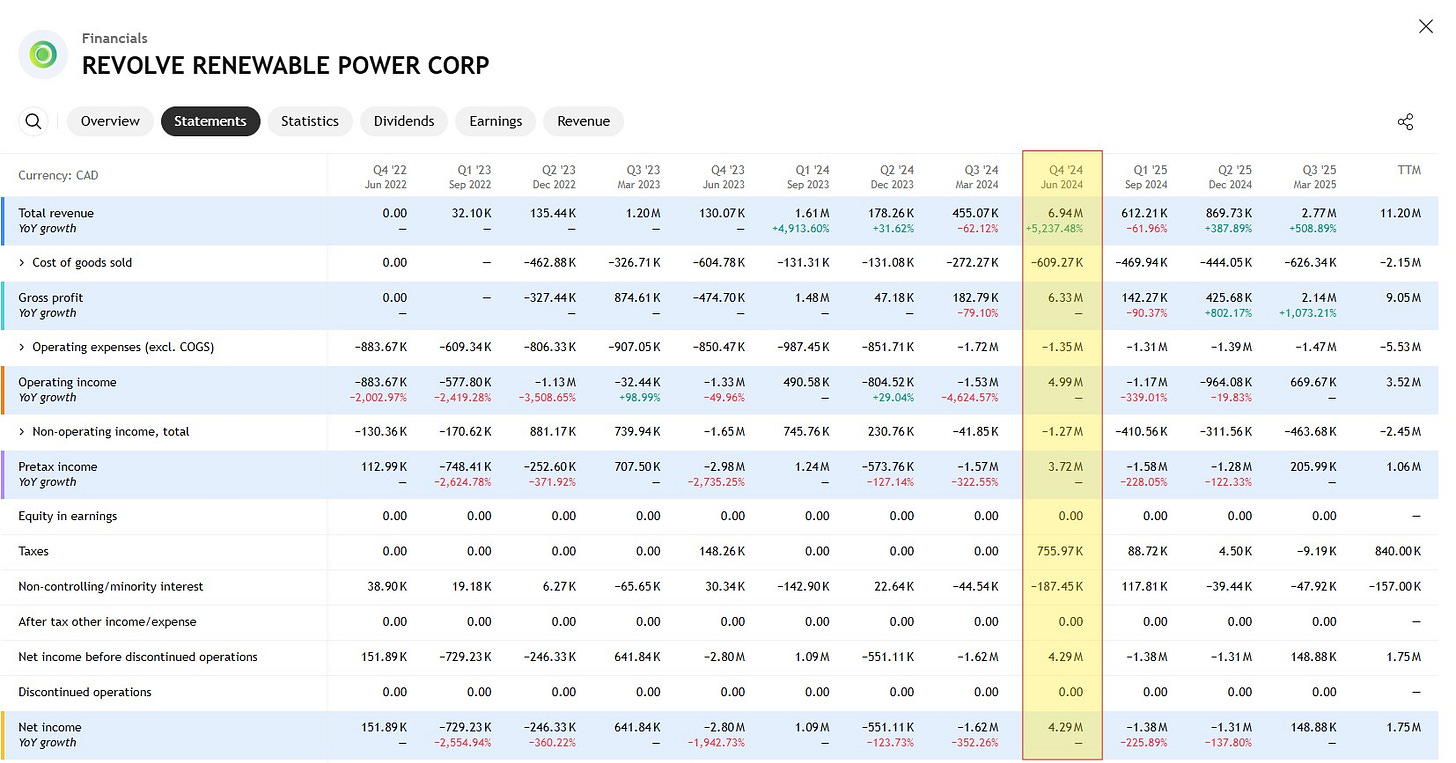

Income Statement:

Revolve had $1.9M in revenue in their third quarter, over 5.7x what they did in the same quarter a year ago. That represents 64% of what they have achieved on a year to date basis, bringing their total for the year to $3M, 80% greater than what they did at this stage in the prior period.

The company’s margin numbers are distorted due to 45% of their YTD revenue derived from a single asset sale back in February, which had very little COGS associated with it. On their core businesses, they still touted a rather impressive 72% gross profit.

Total expenses were up by 25% YTD resulting in an operating loss of $1M, and after interest, royalties and other expenses, net losses for the year amount to $1.87M, almost 3x worse than what they achieved a year ago. Due almost solely from the project sale in Q3, their quarter looks much better with net income of $137k compared to a loss of $1.17M last year.

Overall:

I feel the only reason this stock would hit anybody’s radar is they look somewhat attractive on a TTM basis. But this is all due to a monster Q4 of last year, the quarter that they will be up against when they next report at the end of October - a long four months from now.

That quarter translated to $7M of revenue with $4.3M of net income. In the three quarters since, $4.25M of revenue and $2.5M of net losses. The vast majority of last years Q4 revenue came from milestone payments from the 2023 sale of two project assets to ENGIE. Therefore this Q4 is shaping up to be a disastrous P&L comparatively.

Overall there are numerous reasons why I’d never toss a penny at this play. The results are extremely lumpy and appear to only get within a sniff of profitability when they sell off an asset. Their debt is unattractive and could be poised at taking more on. That not only comes with higher than average interest rates but also includes royalty payments off gross revenue in addition to those rates. Management compensation appears out of line with results, and the company pays out dividends to non controlling interest regardless of the performance of the company. The state of their balance sheet is hot trash, and the $1.2M raise (a weak LIFE offering at that) looks like it could just be a temporary stop gap.

Do I need to say more?

1.5 stars. Happy Fathers Day!

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. Never heard of this company till now. Based on your review, I'll be staying out.