I’ll be honest, I did not have Renoworks on my radar to review this morning. I was anticipating reviewing D-Box Technologies, a Wolf Seal of Approval pick from earlier this year, but their financials were not released as many had thought.

These two companies have similar characteristics, not in terms of what they actually do but instead how the two stocks have performed, each returning about 300% from their lows this year.

Renoworks currently sits just less than a double YTD, but from their April lows nearly went 5x, before falling back about 22% since.

Renoworks has been doing the discovery circuit, appearing at many microcap conferences this year and they have caught the eye of many in the community. I had the opportunity to sit through one of those in Vegas earlier this year. I clearly was not as much of a fan as some others in attendance as I currently sit holding no shares of the company.

This will be my initial coverage of Renoworks. Are they closer to the $6M market cap they were back in April or the $24M market cap they currently sit?

Balance Sheet:

Renoworks has a ridiculously clean balance sheet with $1.55M in cash, $712k of receivables and $340k in other short term assets over top of only $164k of liabilities due within the next year (deferred revenues removed) which gives them a very healthy current ratio of well over 15.

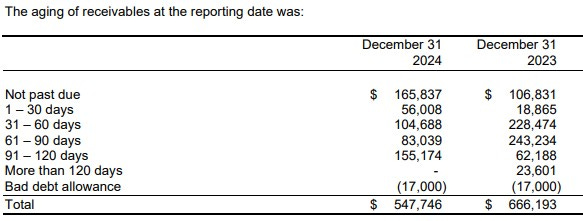

Even though company’s liquidity is strong, I would still like to see an aging report or at least more commentary within the financials regarding their A/R, particularly since the growth is about double their revenues. The company is capable of producing one as they did disclose one with their annual financials earlier this year. It looked like a dog’s breakfast to be frank with 70% of their receivables past due and that number was 85% the year prior. Do they list even terms on their invoices?

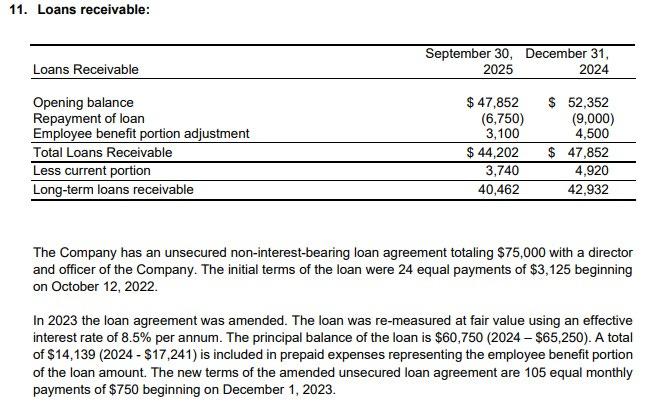

I know it’s only $75k, but loans to insiders using company funds are such an eyesore on the balance sheet. Not only that but the terms were also adjusted from 24 months to 105. Go to the bank dude.

They have no debt and no long term liabilities to speak of. We’re off to a good start despite the goofy loan.

Cash Flow:

A mere $53k of cash burn through operations in their first three quarters, a $150k bogey compared to where they were at this stage last year. Much of that bogey due to the increase in receivables mentioned above. Let’s call them cash flow neutral.

Little else occurring within the cash flow statement but the company did receive a $68k boost to the treasury from options and warrants exercised this year.

Overall, they maintain virtually the same cash position as they did to start 2025.

Share Capital:

40.8M shares outstanding in what appears to be a very well managed float with little to no significant dilution over the last two years.

No warrants outstanding post financials with 705k expiring unexercised Oct 20th

3.3M options outstanding. 760k granted this year at an avg of 34 cents - overall appears to be a well managed and shareholder friendly SBC plan historically

43% insider ownership (per company investor deck

Active buying during May-June by one director who also exercised 100k of 60 cent warrants

Income Statement:

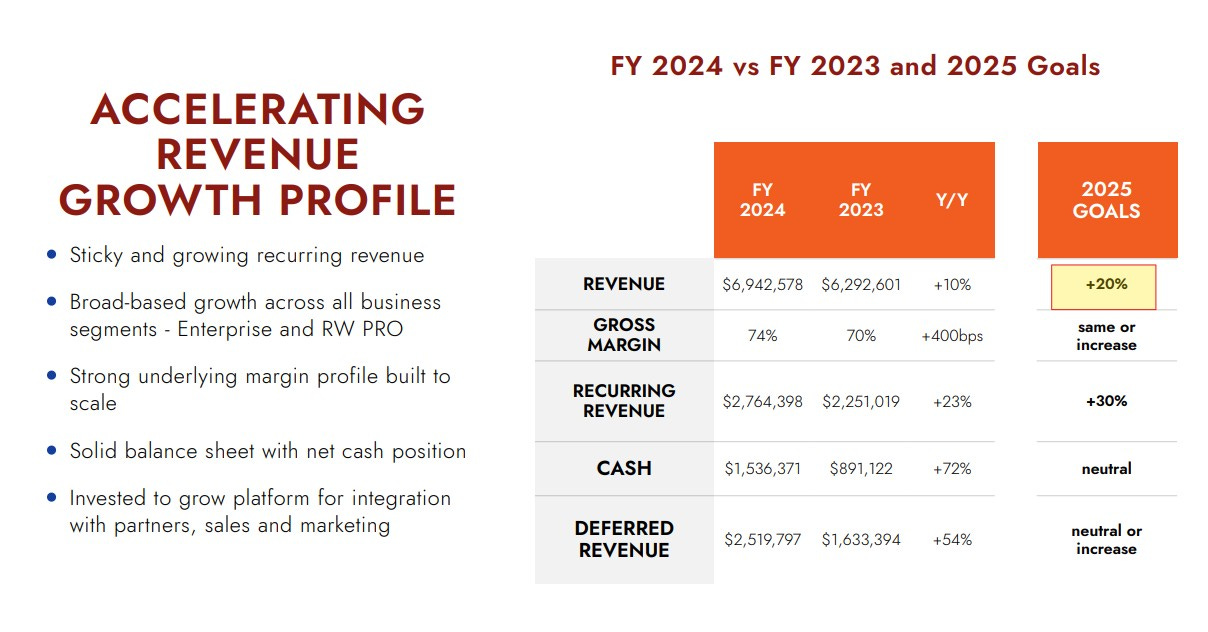

Revenues for Q3 came in just over $2M, a 5.7% increase over the same period last year. Gross margins are very attractive here at 77.5% and that’s 350 basis points more than they achieved last year which drove 10.7% more GP dollars.

Both expense buckets grew at a larger rate in the quarter than their top line however with SG&A rising by 11.7% and R&D by 20%.

Tack on a $53k bogey to last year in foreign exchange and that results in a rather pedestrian $20k of net income, 82% less than a year ago.

Through three quarters, revenues are at $6.02M, 15% higher than 2024. Margins remain very strong at 76.2% and 240 basis points better. SG&A costs YTD are up 17% outpacing revenue growth once again with R&D spending up by 8.7%. Profitability at the three quarter mark of their fiscal year is better with $113k of net income vs being virtually flat at this stage in ‘24.

Overall:

Decent financials with no major red flags despite a couple of things I didn’t care for on the balance sheet, but these results don’t scream or reflect the 4x in share appreciation in the past seven months.

On the top line, Renoworks had their softest YoY revenue increase in the mid single digits and it was actually down 8% QoQ.

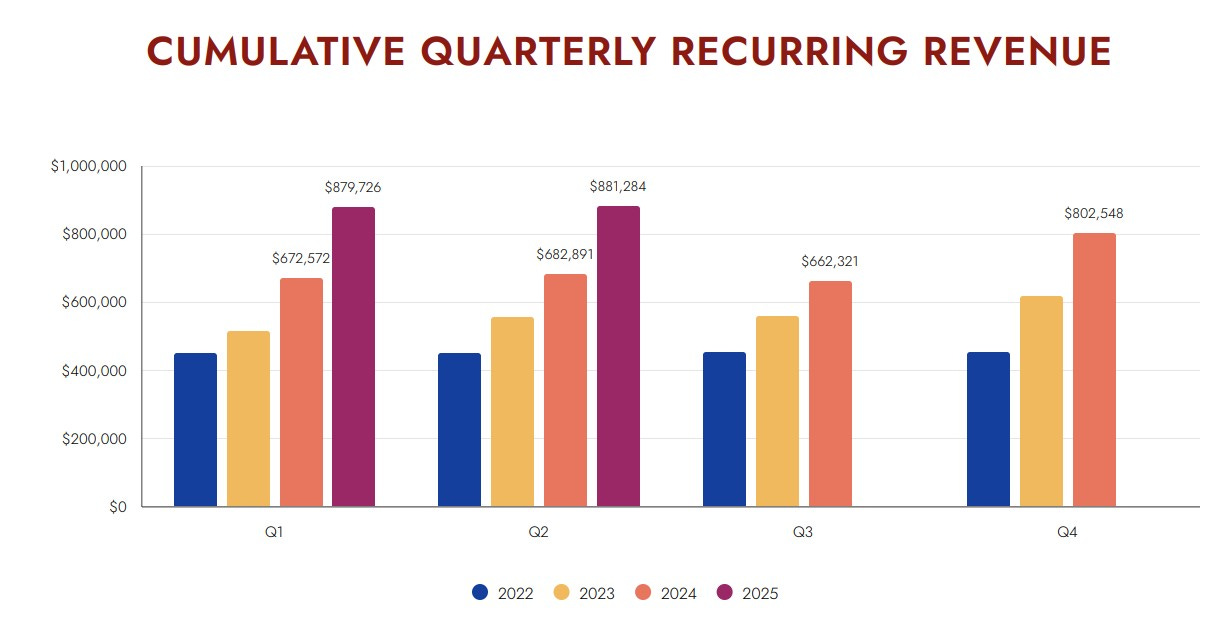

On the plus side is their Licensing and hosting revenue or their recurring revenue segment was up by 38% and this is the companies focus and that was $912k in the quarter showing some QoQ that their overall revenue results lacked. The company had excellent news flow of late giving some encouraging signs moving into 2026.

With revenues at 15% over last year, it appears they will miss their own goals which they just updated in their September investor deck, making me think internally this latest quarter was a miss. By my calculations they would have to have a Q4 with a 35% increase to achieve that goal. Given that historically Q4 has been softer than Q3 I’m not sure I like their chances.

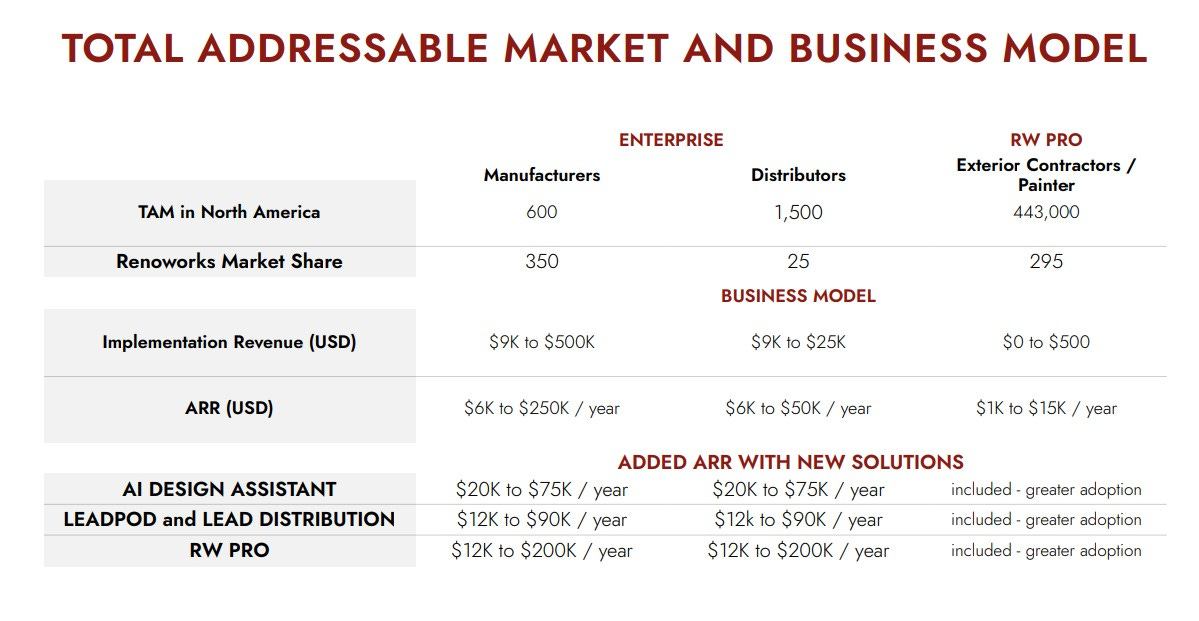

I’m not a big TAM guy but there is plenty of opportunity out there. Each new customer comes with relatively small individual revenue amount evidenced by 350 enterprise customers delivering just $8M of revenue. Therefore scaling will come down to their field teams executing extremely well. The comments within the MD&A lead me to believe they have proper incentives to get them there and that is half the battle.

Back to my valuation question at the top of the review. Are they a $6M MC or a $24M?

If I take $24M and I put a 20 P/E forward multiple on it for 2027, do I believe they can get there? That would require $1.2M of net income two years out. Their TTM currently puts them at a 97 P/E.

Let’s give them the benefit of the doubt and say they’ll achieve the 20% revenue increase this year which would put them at $8.3M and then assume 25% growth over two years. That puts them at $12M of revenue in 2027 requiring them do deliver 10% net income to meet that forward multiple. At 75% margin it’s possible if they get some operational leverage, but doesn’t that seem like a lot to achieve just to justify the current $24M market cap?

It does for me. If there’s a business case out there that suggests they can do better than that, I’d love to see it.

Solid three stars and will be monitoring their progress, but for now, I’ll be doing it from the sidelines.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.