Reklaim Ltd FINS Review (From the Archive)

2023 Annuals (2.75 / 5) *Originally posted April, 2024

Fins just dropped and at a first glance there looked like there could be something here. Market approves, up 11.1% so far this morning, but let's see if this gets my approval as well.

Balance Sheet:

An ok current ratio just shy of 1.2 that consists of $164k in cash, $1.2M of receivables against $1.23M in liabilities due over the next year. Not mind blowingly impressive, but what I am impressed by is the one year turnaround of the state of their overall balance sheet. One year ago, their balance sheet could be described as dogshit with a current ratio of just .43 and negative shareholder equity of over $2.5M. They don't have much in non-current assets, $23k which could be a couple of PC's and a depreciated Toyota Camry, but the negative equity was reduced by $1.9M. I wouldn't call their current balance sheet fantastic, but I'd no longer refer to it as dogshit either. They have $888k in long term secured debentures - secured against their A/R I would assume and those debentures were significantly reduced in 2023 as well. We'll look at these debentures more in the share capital section.

Cash Flow:

Operational cash flow generated in 2023 was $58k on the positive side of the ledger after a significant $3.33M operational burn the year prior. This years number includes a hit of $1.4M in working capital adjustments. Almost half of these adjustments come from increases in accounts receivables and the other, a big reduction in payables. About 20% of the companies A/R is overdue and they wrote of $166k in 2023 and anticipate taking another $43 in credit losses this year. Combined that's about 5% of revenue which can make a big difference on the bottom line. Their A/R aging is certainly something to look at going forward. Reklaim's A/P also decreased by $800k, but $620k of that was through issuance of shares to settle that A/P. Another deep dive for the share capital section.

Share Capital:

114.4M shares outstanding with 23% dilution in the past year and 83% over the last two

26.2M warrants, all at a dime and ITM. This will raise $2.6M to the treasury in the next two years but is another 23% dilutionary measure in the future

9.3M options outstanding, again all ITM, so we're now up to 31% nearly guaranteed dilution between options and warrants

117k RSU's issued during 2023. It's a minor amount but RSU's given where the company is at is questionable

That $620k of payables reduction was settled for issuance of 17.25M at an average of 3.6 cents a share. Pretty good looking deal for the debtors in hindsight.

CEO contributed 30% towards those debentures and received 8.33M shares in addition to "bonus shares".

Those debentures carry an interest rate of 12% and the remaining balance would result in another 6.6M shares at yesterday's close and that's prior to future interest.

35% insider ownership per company investor deck

Only 1 open market buy in the previous year by insiders

Company completed a 5:1 reverse split in 2021 under their previous name, Killi Ltd.

Income Statement:

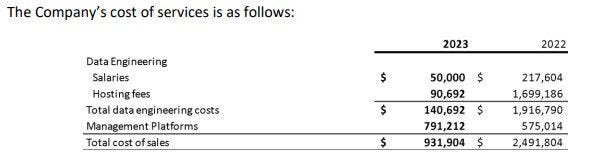

Revenue was strong with a 74% revenue increase to $4.11M. A dramatic turn of events within their gross profit going from a negative 5.5% GP to an extremely sexy 77.3%. The COGS breakdown is bizarre. The fact that they reduced their hosting fees to $90k is great, but what moron in procurement figured $1.7M was ok to sign off on in 2022 and are they still with the organization? The MD&A doesn't tell us much.

In addition to reducing their COGS by 62% on 74% growth, they also reduced operating expenses by 38%. Tack on a one time gain of $446k related to their complicated A/P story and that drove a net income of $910k, a earth shattering $5M turnaround compared to the $4.15M they lost in 2022.

Overall:

A tremendous turnaround in a lot of areas, but it's clouded by a clusterfuck of a float that has diluted by 83% in two years and set to go up by another 37% when you include warrants, options and debenture conversions. This from a company who reverse split three years ago this month, so that doesn't give me confidence in managing this much better going forward. Their net income isn't as good as it looks as half is made up of a one time gain. With that said, it's still 11% of revenue and you can't diminish the turnaround from that gag inducing 2022. They're now up to a $16M MC, so they're at 4x revenues and a 22x EV/EBITDA when you take that one time gain out, so the bargain that once was doesn't seem to be there anymore IMO. Congrats if you've been swinging this, but I don't see a lot of rope left here, as it's already trading on some futures. 2.75 initial stars.

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.