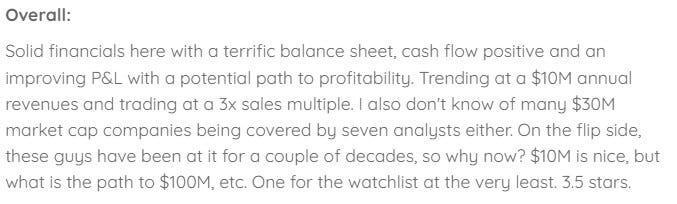

When you’ve completed so many of these financial reviews once in a while you will come across a ticker that you believe is your first deep dive, and then come to realize that you have actually reviewed them before. This is the case with Questor Technologies whom I reviewed way back in June of 2022.

What I find interesting is a 3.5 star review is a very decent initial rating, I called it watchlist worthy and yet I have zero recollection. <insert shrug emoji here>

You’ll notice in the summary above that I referred to them as a $30M market cap back then. Today, they sit at a $14M market cap and the stock is down 62% from that review which occurred over three years ago.

As recently as April of this year, they were trading as low as twenty cents, therefore up over 150% from that recent low point. If they were able to get back to a $30M market cap company, that’s over a double from here. How likely do I feel that’s a possibility? Let’s find out.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Both the current ratio and their liquidity looks strong with $4.4M in cash, $2.4M of investments (GIC’s), $1.6m in receivables and $860k in other short term assets against just $2.1M in liability commitments over the next year.

Questor has no debt and can easily cover their one year commitments with their cash on hand. The company does not provide any details surrounding their receivables such as an aging report.

Looks very solid but I should also point on the company had $15.8M in cash in my June 2022 review, with the majority of the variance coming from capital investment costs.

Cash Flow:

Questor has generated $1.9M of operational cash flow (OCF) through the first six months of the year. About a third of that amount come from working capital adjustments. It’s unusual for companies not to have a financial note listing these adjustments, but that is what we have in this case. In reviewing the variances in the balance sheet, much of that is likely due to the improved accounts receivable.

Through the first half of the year, they have spent $1.7M on their waste heat to power project. If you’re looking for the reason for the difference in cash between my last review and this one, this is it as Questor has now spent over $11.1M on this project over the past few years. This intangible asset now makes up 50% of the company’s total assets. The company also bought back $22k worth of shares and paid back $160k of government grants.

Overall their cash position has been depleted by 16% from the beginning of the year. So while the company’s liquidity can easily cover their short term commitments and they are producing operational cash flow, the amount of cash being spent on their next generation heat to power project has been depleting their funds rather significantly. According to their press release accompanying their results it appears this cash outflow for the project is coming to an end and could start generating some results.

Share Capital:

27.6M shares outstanding which is actually a couple hundred thousand less shares than my 2022 review

695k combined DSU/PSU/RSU’s outstanding

125k out of the money options at 73 cents

18% insider and 14% institutional ownership

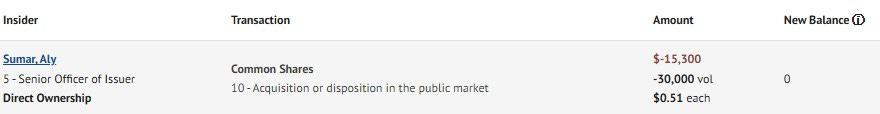

Not much to speak of in terms of insider participation on the open market. The CFO however after purchasing 30k shares over the past year sold them all last week and now holds zero shares (per SEDI filings)

Income Statement:

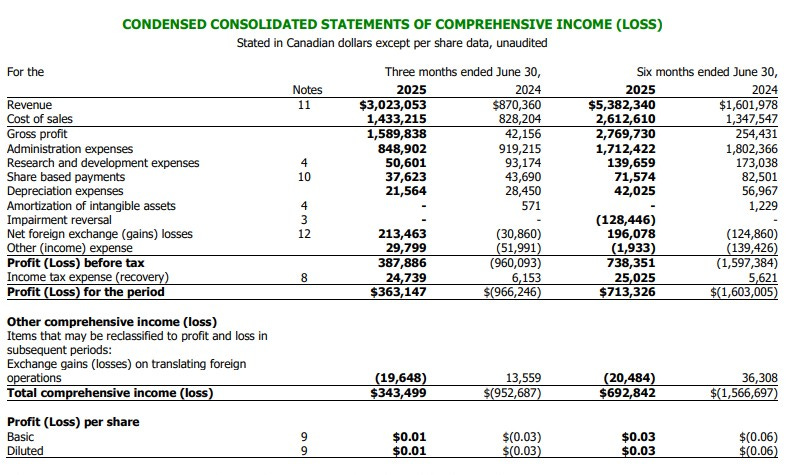

Questor has such a rough year on the top line in 2024 that using those comparisons feel rather moot. The fact they were able to generate over 50% margins and spend less within admin and R&D expenses while driving over 3x of the business last year are encouraging signs. They also delivered 13% of those revenues to the net income line.

Overall:

I’ll be honest. I don’t know what to make of these guys. What I will say is trying to do any research or perform due diligence on Questor was a painful endeavor.

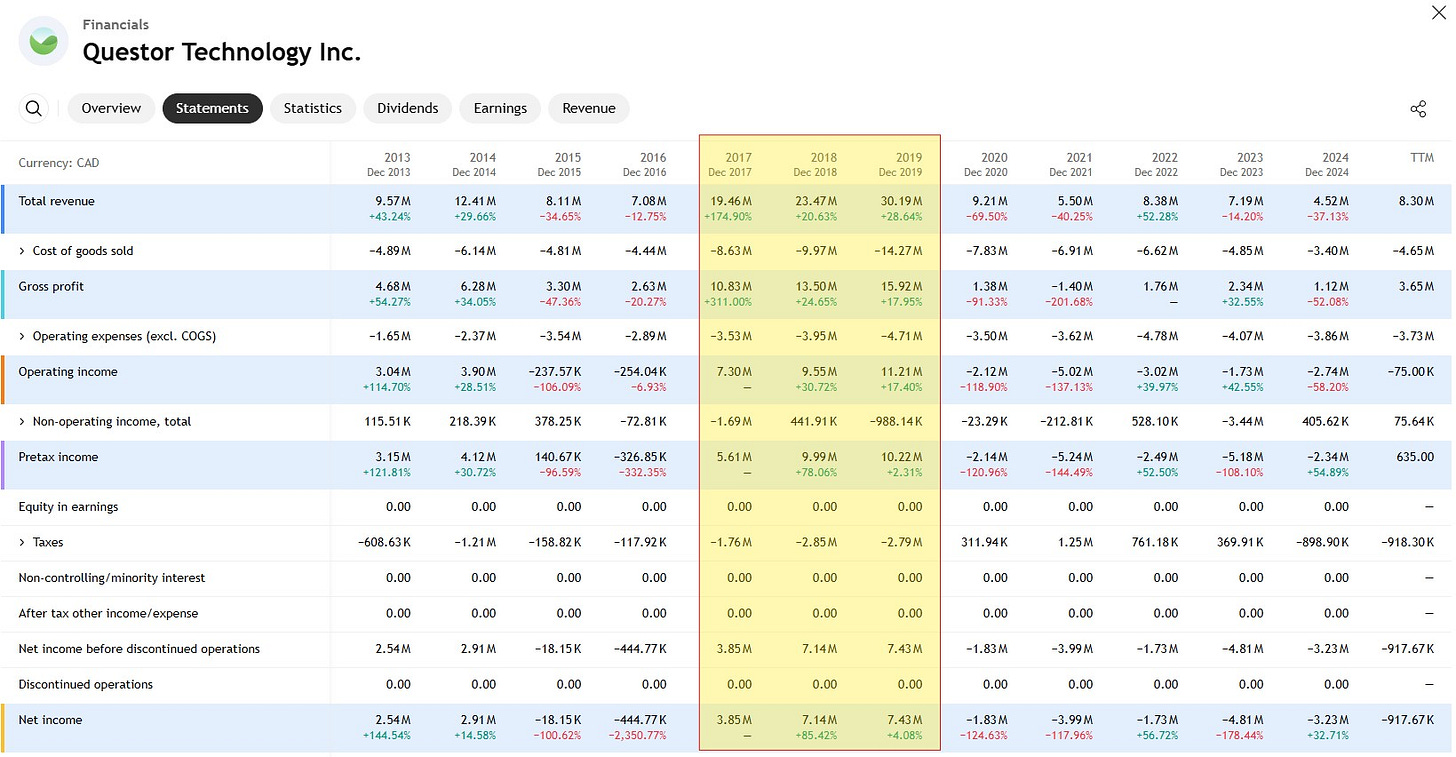

Questor once traded over $5 back in early 2020, and you can see why as they delivered over $30M in revenue with $7.4M in net income the year prior. In 2024, that revenue was all the way down to $4.5M, and that is half the revenue they produced in 2007 - the year before my 17 year old daughter was born.

As far as I can tell, the company doesn’t want you to invest in them either. It doesn’t appear that this was always the case, but when trying to get information about the company feels like pulling teeth, I become disinterested very quickly. The CFO is their IR contact, and he decided to sell all of his whopping 30k in shares last week.

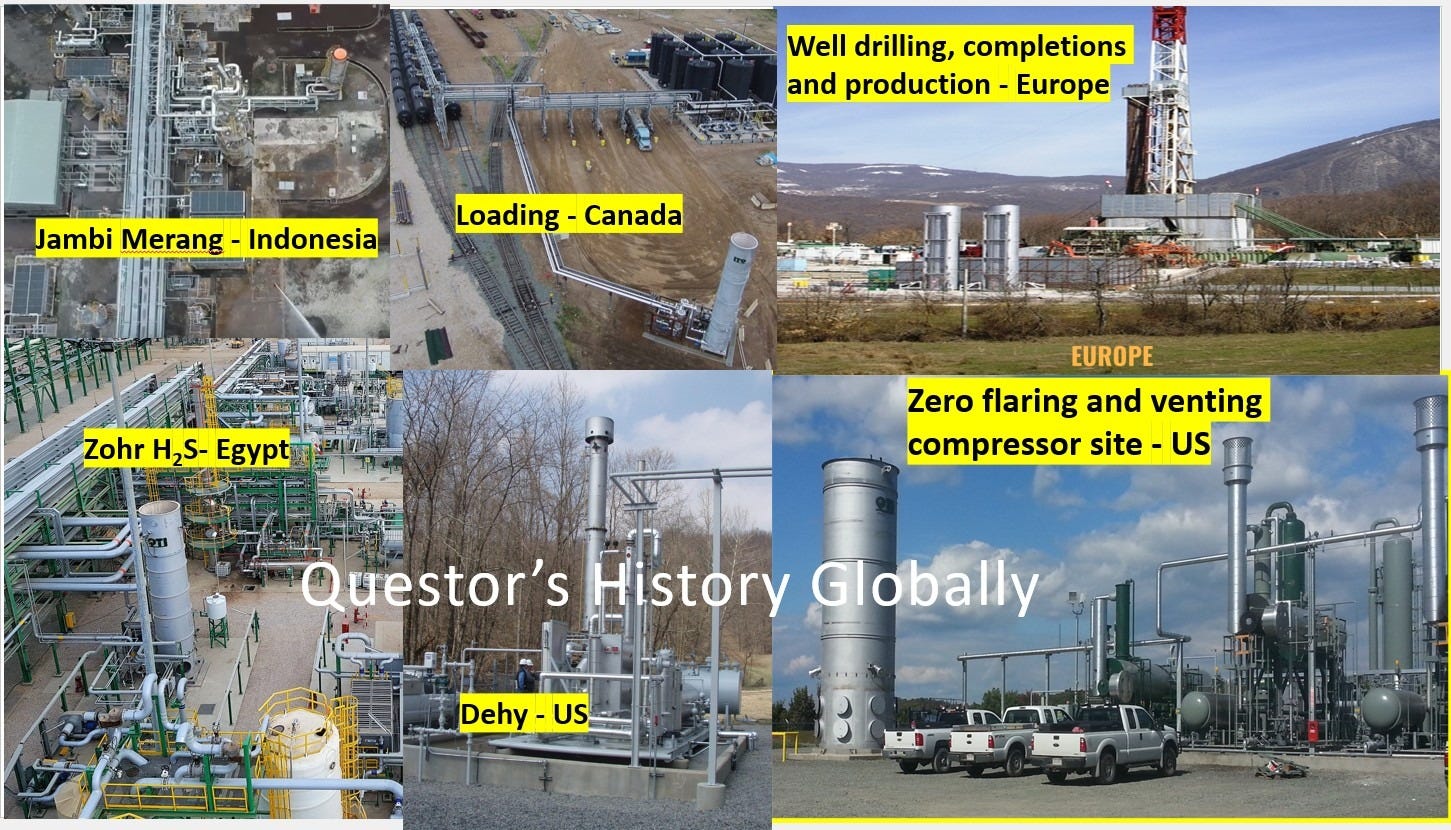

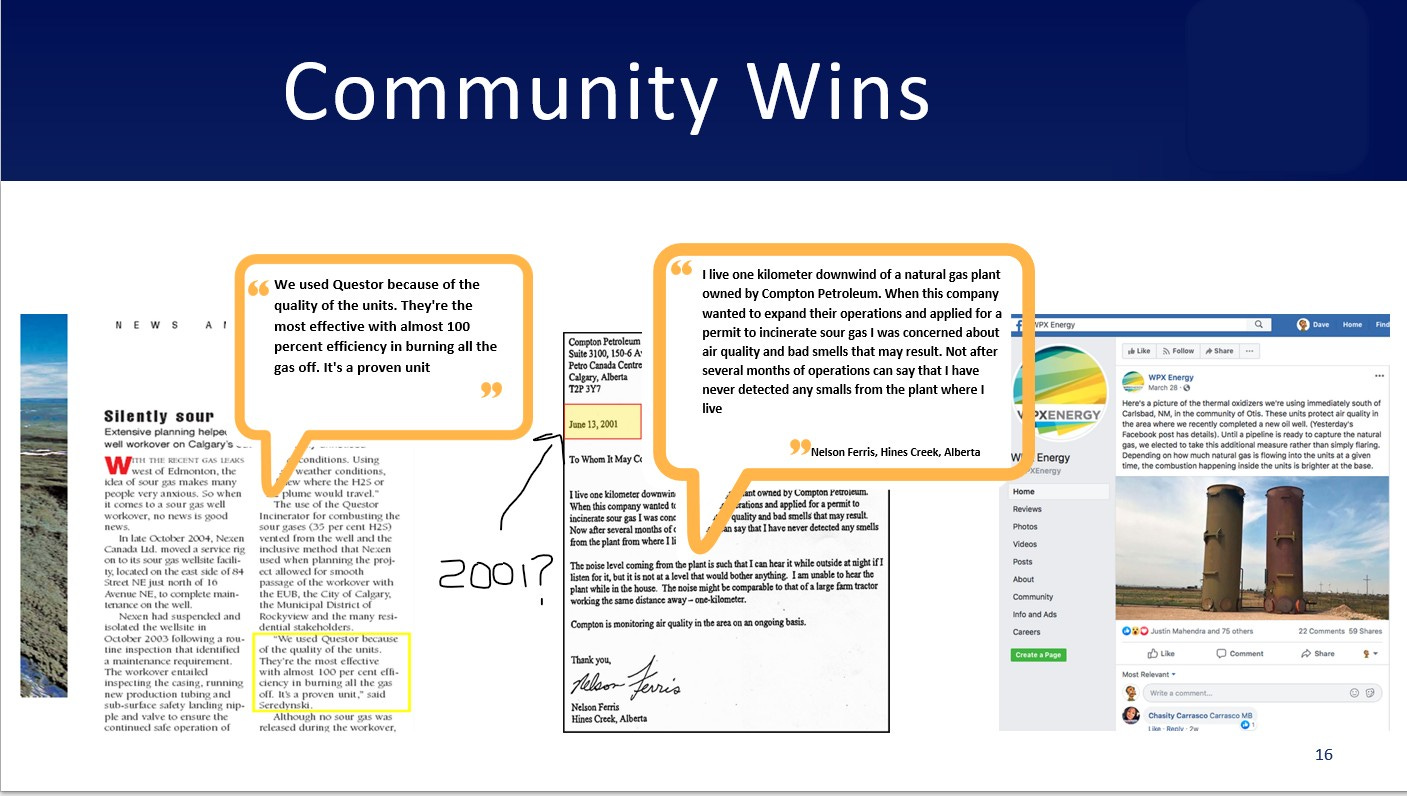

I can find very little information about the project they spent $11M on over the past few years and their investor deck is in POWERPOINT that looks like it was created by a sixth grader.

Very rarely do I ever regret starting a review. This is one of those times. I care so little about them right now, I’m not even going to go back and re-read this for editing purposes. If grammatical or spelling errors exist, so be it.

2.5 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Lol, that was a short review, which merits a short comment.