Pyrogenesis dropped their annual financials last week and that immediately presented me with a reoccurring dilemma. Should I perform a review or not? The long term bulls (aka Pyro Cult) may dislike me more than any other stock (coin toss probably with Verses). But these facts don’t deter me, in fact it’s probably true that it makes me want to review them more.

My initial review of Pyro was almost three years ago to the day after their 2021 annual financial results, and it was awarded a lowly one out of five stars. Subsequent reviews have not resulted in anything more favourable.

You can plainly see how the stock has performed since that initial review, down 85% from $2.97 all the way to the 45 cents that it closed at yesterday. It’s also down 10% since they released their latest financials last week, although you could argue that has actually overperformed the market with global stocks in current turmoil.

Let’s revisit some of the CEO.ca comments from that April 2022 review:

I believe only one of these individuals above still maintains their account on the platform, and that individual may have blocked. I hope they still have the opportunity to read this review. So let’s tackle that now.

Balance Sheet:

If we remove costs and billings on uncompleted contracts (similarly how I do this regularly with deferred revenue) Pyro’s current ratio still comes in at an unflattering .93, but in fairness I have seen them in worse shape. Their balance sheet consists of $3M in cash, $9.6M in receivables, $2.5M worth of inventory and another $3M in other short term assets against $19.6M or liabilities due across their 2025 fiscal year.

What has remained a constant with the company is their lack of liquidity as their cash plus A/R is still jus shy of their A/P (which has grown 38% YoY) and that is before they pay leases, and other cash burning expense items. Their A/R in the past has also proven to be less than reliable.

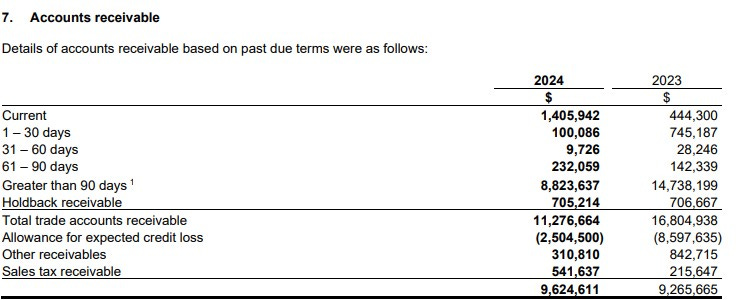

More than three quarters of the company’s A/R is very aged, over ninety days and this has been a pattern for sometime. Here is what I said about it in 2022:

Since that writing, the company has taken approximately $8.9M in accounts receivable write offs and anticipate taking an additional $2.5M this year. I can only think of one other company that has looked worse than this (A/R wise) and that company has been under a trading halt for over a year (RHT.V). Even if the company receives ALL of the $8.8M currently aged receivables, it puts tremendous strain on their cash flow, which could also explain why their A/P has grown and could potentially indicate they are also paying their vendors late.

On a more positive note, Pyro has little debt, and most of that is in the form of convertible debt including loans and debentures.

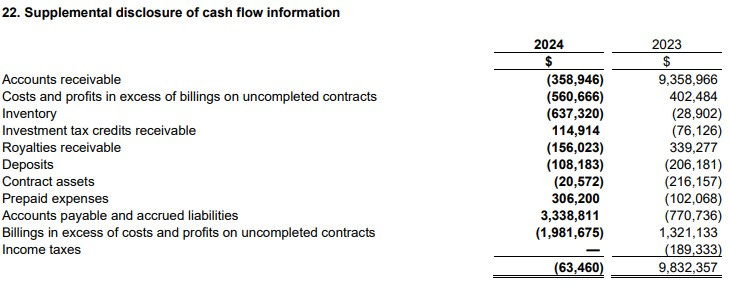

Cash Flow:

Nearly a $10M improvement in operational cash flow compared to 2023. The problem is last year was $12M, so the company still burned $2.1M during their fiscal 2024.

A lot of in and outs within their working capital adjustments in 2024 but the $3.3M growth in their A/P stands out.

Also occurring during the year was the company’s sale of their 11.4M share stake in HPQ which resulted in a $2.3M influx to the treasury. Unfortunately that also resulted in a $1.4M loss. They also had 6.8M warrants expire worthless during the year. The average sale price was 20 cents. As you can see by the chart they disposed of the shares near the lows of 2024 - evidently trading small caps is one of the many skills management lacks.

They received $2.8M in July via a private placement in July. This was well timed for the company but less so for the participants since the raise came at 80 cents which is 43% higher than where the stock trades today.

Overall, Pyrogenesis improved their cash position by 65% during the year. Given their cash burn, despite the improvement in 2024 and the state of their balance sheet, it is difficult to imagine them making it through 2025 without the need for additional capital.

Share Capital:

184.1M shares outstanding with 3% dilution during the year from their raise and options and warrants exercised

13.2M options outstanding with only 550k ITM at 43 cents. About 2.2M expected to expire worthless in 2025

11.2M warrants. Only 625k are currently ITM at 41 cents and those expire in June

42% insider ownership (per YF)

While the CEO holds approx 66M shares, the past several years have seen almost heavy regular selling of the stock through his Mellon trust. At the same time he has also been participating in private placements, convertible loans, etc. It would be really interesting to download the entire SEDI history to do an analysis of input/outputs. That’s probably a full day task however but I would be open to someone else taking on that endeavour.

In the last four years since I’ve been covering the company, they have awarded themselves over $20.7M in share based compensation while producing over $105.7M in net income losses. This includes $2.1M this past year.

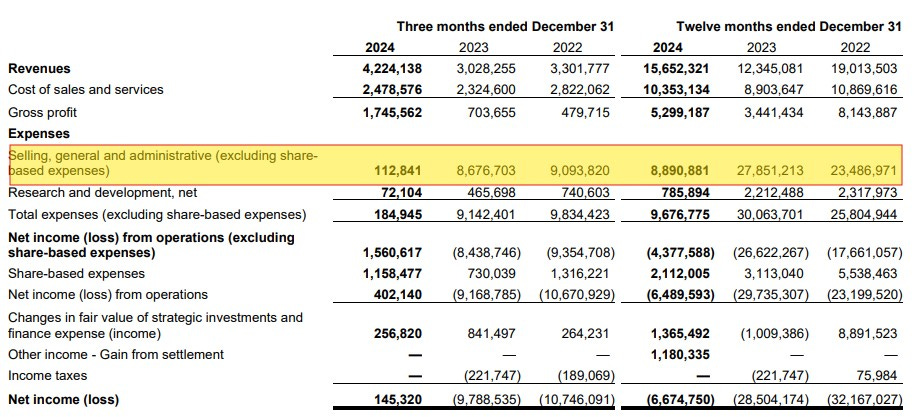

Income Statement:

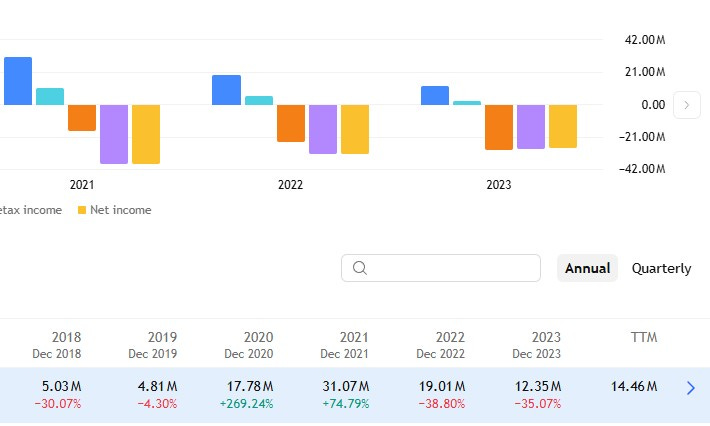

Pyrogenesis achieved a 26.7% revenue increase in 2024 rising to $15.62M vs $12.35M. In addition, they also improved margins with nearly a 600 basis point improvement in gross profit to 33.8%, therefore the dollars brought to the margin line was an increase of 54%. The company also made some dramatic improvements within their expenses year over year, down an incredible 68% from a year ago. A very large chunk of the improvements did come from one time items negatively impacting last year, and positively impacting this year. In 2024, it included a $6.9M recovery in previously written down receivables and last year included the reverse of the above, a $2.7M goodwill write down and less SBC.

Regardless of how they got there, it is a near $22M improvement in net losses, with this years total coming in at $6.67M compared to 2023’s $28.5M.

Much of that variance included occurred in Q4 and you can clearly see the impact with next to no SG&A expenses vs $8.7M recorded last year. This resulted in a profitable quarter, but given the level of adjustments, I don’t think this is something investors can expect moving forward.

Overall:

Normally a review with 27% sales growth with significant improvements in margin and expenses would be awarded the Wolf Trifecta. Not this time.

While the improvements, even with the one time items in both years are impressive, their net losses are still greater than their gross profit dollars. From a basis break even analysis this would tell you that even by doubling their revenue, maintaining their margin rate and expense dollars they would still lose money on the bottom line. The simple B/E formula suggests around $35M and that wouldn’t include the large A/R birdie received in the fourth quarter.

After two years of revenue declines, they did achieve a revenue increase in 2024 but that is still 12% less than they did in 2020.

From a valuations standpoint, they are still trading at 5.5x revenues. That would sound reasonable for a profitable, or near profitable business that is growing. I think the company does deserve a little credit for the improvements this year, but how much credit does a company get going from a “Jurassic Park” pile of shit to your average, run of the mill pile of shit?

Much better plays out their in my opinion and you’re not going to have to look that hard.

One star, which is an upgrade from last year’s 1/4 star. Congrats?

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

From Jurassic to average pile hahahahaha....got me

I remember almost investing in this back in 2020-2021. So glad I didn't.