Pyrogenesis FINS Review

Q2 2024 (0.75 / 5 stars)

I have not reviewed Pyro since their annuals where they received a lowly and rarely seen one quarter of one star. The stock has actually nearly doubled since then giving bulls something to pound their chests about. Those same bulls tend to ignore that it’s off 28% from its 52 week high, 93% from its ATH and 75% less than my initial review back in April 2022.

The headlines from this release look decent. Revenues up over last year and QoQ, and some collections from their historically problematic receivables reversing a previously incurred loss actually put them in the green in Q2. Bragging about your “third best ever Q2” is an odd flex I must say, but are the details in the numbers as encouraging as the headlines might suggest? Let’s drill in.

Balance Sheet:

It’s been a very long time since Pyrogenesis has had a strong balance sheet and they are still a long way from being able to say that. At the end of Q2, they sit with a current ratio of .67 that consisted of $3.4M in cash, $9.35M in receivables, $2.5M worth of inventory, several million across other short term assets against over $28.5M of short term liabilities due within the next year.

Their current ratio is in a similarly poor position as it was to start the year, since then adding $2.6M in current assets but also seeing their current liabilities grow by $4.8M.

Pyro’s accounts receivable aging report is in a word, horrific, with 95% of their trade receivables past due while their bouncing ball of anticipated credit losses now amounts to just over $5M. The company has a host of problems, but this one is their largest. It makes their top line performance almost irrelevant as how can any investor be confident the company will actually get paid for what they sell. This isn’t new either. Here is an excerpt from my review 28 months ago where I literally said “watch this moving forward”.

At best it creates an unpredictable environment to manages one’s cash flow. It also creates an environment where they could be letting their payables lag which could be supported by the 56% growth in their A/P and one where you need to borrow from Peter (purely coincidental) to pay Paul which could explain the $1M short term loan from the CEO.

There are no long term debt concerns here but they do have about $2.5M of convertible loans and debentures.

Post financials, they raised $2.8M via a private placement.

Cash Flow:

Operational cash flow looks the best I’ve ever seen it here with just $560k of burn against burning nearly $7.5M through six months last year. This number includes two very large anomalies however; a reversal of a $4.1M credit loss, and a $1.5M legal judgement in their favour. Obviously receiving these funds is better than not, but one cannot use these numbers to gauge the outlook of their future cash flow. With these numbers backed out, their monthly burn rate is still in excess of $1M per month so until they show differently, one would have to assume that latest raise would only get them through another quarter.

Further to that point, they received the $1M temp loan from the CEO, sold off $2.5M of their HPQ investment, had the influx of these two anomalies worth $5.6M, and yet their cash position was only $1.6M better than they started the year with.

That CEO loan was paid off post financials, but PYR still has significant spending and operational cash flow issues.

Share Capital:

Not much different from my annual review which you can read here.

As mentioned post financials they raised capital with the issuance of 3.5M shares. They also repriced 4.1M warrants at .75 and that could be a welcome $3M influx into the treasury, but at the same time may have created a share price resistance area.

Income Statement:

The good news for Pyro bulls is the long revenue slide the company has been on has reversed and Q2 was up 30% to $3.9M and YTD revenue is now up by 32% to $7.4M.

Less exciting is their gross profit dollars which was only up by 1% in the quarter on 30% more business and 14% more GP dollars YTD. This is a result of their GP rate dropping to 28.5% in the quarter compared to 36.5%, a serous drop of 800 basis points. YTD looks slightly better with a GP rate erosion of 330 basis points.

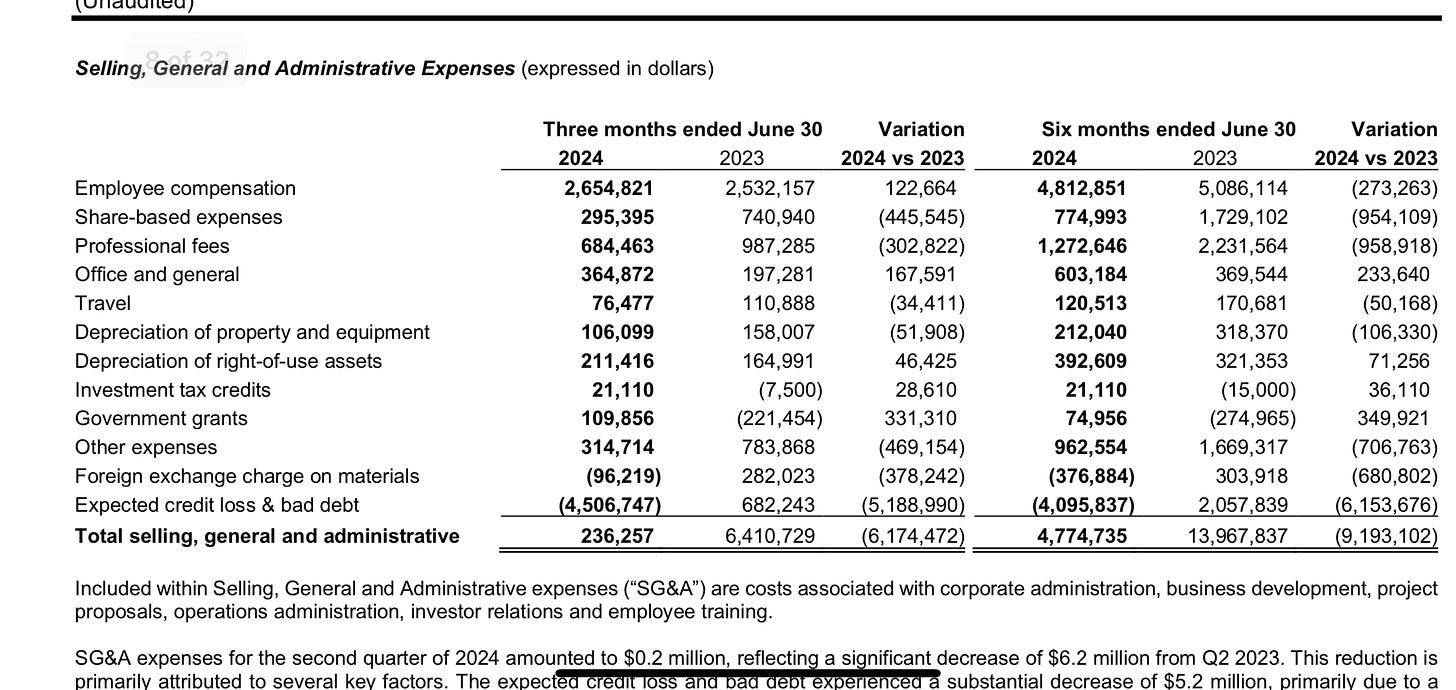

The rest of the P&L is a little deceiving showing a minuscule amount of expenses of only $500k in the quarter vs $7.15M in the comparable quarter from last year. The details within note 15 of their financial statements are basically useless and I have no idea why they feel this is adequate supplemental disclosure or how it can help investors. Thankfully it’s explained much better within their MD&A.

The small $236k amount within their SG&A expenses contains the $4.5M credit loss reversal. With this removed $4.8M of expenses is still a pretty good improvement from $6.4M last year. The problem with that is 2/3rds of that reduction from a year ago is from non cash burning expenses, grants and foreign exchange with only about $500k in what you could call actual operational efficiencies. It’s a start though, I suppose.

Below the net income line is another $1.2M birdie resulting from a legal judgement which leads to a profitable quarter of $1.4M before taxes.

Overall:

Is a profitable quarter better than an unprofitable one regardless of the circumstances? Of course, but what it is not is an indication of improved future results. With those two one time items removed, Pyro still faces some daunting challenges ahead which would have been a YTD loss of $8.7M. That results in an annualized break even point of about $68M in revenue for a company trending to do about $15M.

The backlog reaching near $30M is an improvement but it could take up to three years to recognize that revenue. They would need a 3 year backlog of $200M to cover these margins and level of spending. That is assuming they get paid, and get paid on time and that’s not the company’s strong suit.

Your due diligence would have to be at delusional proportions to simply ignore all of these warnings signs. Facts are not FUD people and these aren’t new issues, but we are dealing with an inexplicable cult like following with this one. It happens. Add in a highly questionable $142M market cap and it’s hard to see a near term upside here.

They have turned the tide after two straight years of revenue erosion and spending is minutely improved so I’ll throw a bone to the bulls with a half star upgrade to .75 stars. This is still a massive turd on the TSX and half way into today’s trading session, the market doesn’t seem very interested either. Double technical support at 76 cents with the 50MA right underneath that. Big risk underneath that.

No position short or long here.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without formal financial compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.