I have a sense that this review will have a bit of a different feel to it than many of my most recent reviews, but doing so partially because of a request out of the Wolf Den discord, and my own morbid curiosity.

My last review of BRED was in March of 2024 when they traded under the ticker COHO, as they were previously known as Coho Collective Kitchens. That review did not go well, receiving almost as low of a rating as a company can receive, one quarter of one star. The stock is down 85% since which includes a reverse split back in April of this year.

Receiving less that one star puts them into the same category with the likes of VSBLTY, FOBI, Pyrogenesis, Organic Garage, Empower Clinics, Tetra BioPharma, Voxtur, ODD Burger, Dynamite Blockchain, RYU Apparel, TrackX, Versus AI and Else Nutrition. Less than half of the above are still actually trading with most either delisted or currently halted for late financials. One thing they all had in common was horrendous share price performances post reviews, giving further credo to #FinsDontLie. Ironically, I made 10x on FOBI and even liked a few of those names on that list before things started to sour.

Sadly, sometimes the bad reviews are more educational than the good ones, and that’s what I aim to do first - educate retail investors who can perform DD but have trouble analyzing financial statements and a businesses health. I’m not always right on the good ones, but the track record on the bad ones is hard to argue against.

So how does Purebread look about a year and a half later? Do I think they will suffer the same fate as many of the ones mentioned above, or is there a better story on the horizon?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

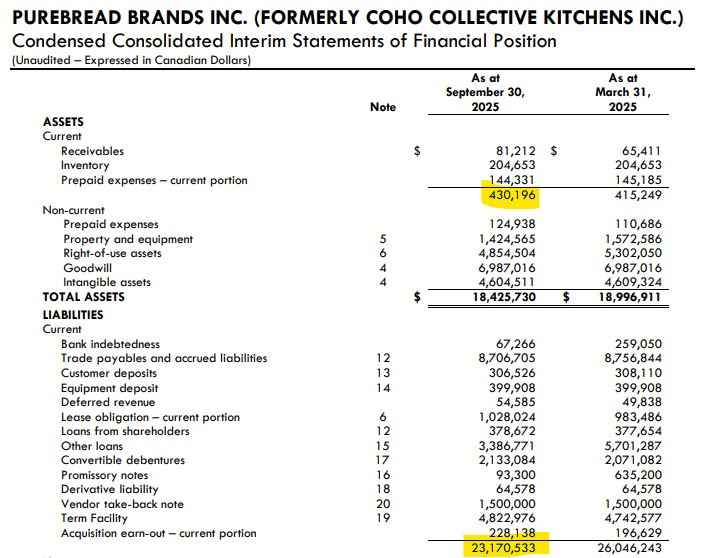

Balance Sheet:

Unfortunately, the balance sheet is the page within the financials that most retail investors ignore or understand the least. I had this to say in March of last year:

A year and a half later I’m sad to say that the one of the worst current ratio I had reviewed until that point has worsened, to a microscopic .02, including a negative cash position. Now it’s official, it is the worst I’ve EVER seen.

Normally I run through and list the company’s short assets and their current liabilities. It’s so glaringly horrific that only a picture can reflect how bad it really looks. Under $500k in total current assets overtop of over $23M of financial commitments over their next twelve months, with negative cash (yes, that’s a real thing).

After taking into account a few million in convertible debentures and potentially other short term liabilities that won’t impact cash it’s still $18.5M when you just include their A/P, debt and lease obligations.

Rough start.

Cash Flow:

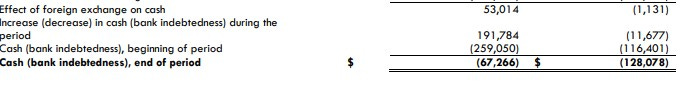

The cash flow section is certainly much better than the last time I looked with the company achieving $1M in operational cash flow, about $100k more than a year ago although last year was positively impacted by working capital adjustments while this years OCF looks more legitimate and sustaining.

No investing activities through their first six months, little differences made to their net debt situation and paid $842k in lease costs through six months. Below is what their cash position looked like at the end of Q2.

Share Capital:

26.9M shares outstanding after their 1:5 reverse split earlier this year. 16% dilutive measures mainly from shares for debt transactions

7k options, none remotely in danger of ITM

650k RSUs. IMO a company in this financial position utilizing RSU’s is an insult to retail shareholders

5.5M warrants, again none remotely close to ITM. 3.6M expire in Sept of ‘26

$1.65M of convertible debentures scheduled to convert at 75 cents next March. These are at the option of the holder and with the conversion at a 84% loss currently, you would have to assume these will get renegotiated.

$530k of other debentures expire in three weeks at an even higher price of $1.25. They don’t appear to be in the shape to pay this principal, so watch the news wires for what happens with these.

17% insider ownership (per YF)

No insider activity at all within SEDI for fifteen months.

Income Statement:

In Q2, total revenues of $4.14M, a decrease of 12% over a year ago when they achieved $4.7M.

Gross margins were relatively stable at 63.4%, although they blend their retail and rental revenue on one line with COGS only relating back to retail. Regardless, gross profit dollars decreased by a similar margin as total revenue - 12%.

Purebread was able to take out 18.4% out of their operating expenses. Unfortunately, the cash burning portion of their opex was reduced by 11%, less than their rate of revenue erosion as the bulk of their opex savings was through reduced amortization costs.

Their overall bottom line did improve, a $693k loss in the quarter compared to $1.07M in the comparable quarter.

YTD shaped up as follows:

Total revenue down 11.1% from $8.7M to $7.8M

Blended margin up 200 basis points to 64%

32% taken out of operating expenses or about $2.7M

Net loss of $720k vs $3M

Overall:

Even though there is still a net loss in both the quarter and YTD, if you solely looked at the P&L and the cash flow statement, things don’t look so bad. When you remove the non cash items from the P&L and interest costs, they’re EBITDA positive and are now generating operational flow.

The problem is you can’t ignore the balance sheet, and I’m not sure I’ve ever seen a brighter red flag in my years of covering microcaps.

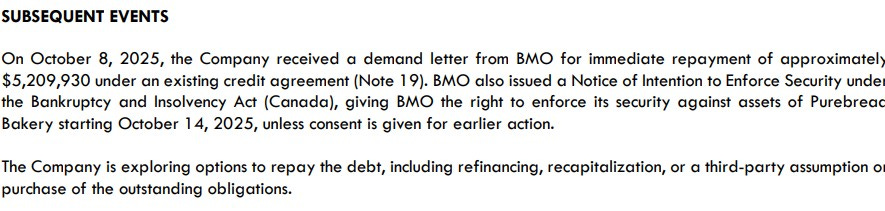

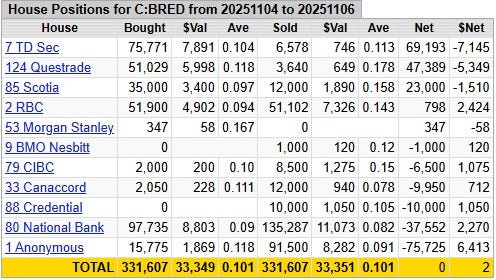

The price action over the last couple of months is beyond bizarre given the news in early October.

Now what if I told you the stock went from 5.5 cents to 19 cents over a three day period a month later, on relatively small volume. It’s retreated 37% since and that over 3x move prompted the company to issue a release saying there were no material changes to their business. Very bizarre, given the very imminent threat that BMO could force them into bankruptcy.

The company’s escape hatch options don’t look good either. First, let’s take a look at this BMO debt, currently sitting at $5.2M.

For starters, this loan wasn’t originally structured with the most faith in the business with escalating rates to 18%. These aren’t that far off the interest rates you can get down at the Bada Bing.

The company is also not in compliance with current debt covenants. It’s really difficult to imagine anyone taking on this refinancing burden here - not if they did an analysis as I just did. And even if they were able to, it surely would come with a much higher interest rate than the high rates in the teens they are looking at now. Their operational cash flow for six months was $1M. Their interest costs were $1.4M, and that’s before lease costs and then they have $9M in accounts payables, payroll and a mountain of other costs to

o.

Shares for debt I assume is a possibility. But how has that worked out for those who agreed to do it the last two times?

In March, they settled $5.6M of debt for 22.3M shares. That was pre reverse split. Those shares are now worth $535k, so they’ve already lost 90% on that debt settlement. The one done in September isn’t any better as they settled $3.9M of debt for now what amounts to 14% of a company with a $3.2M market cap.

So, which of their debtors are signing up for another round of that shitty deal? What vendors are still giving BRED credit terms - you’d have to think they are on COD (cash on delivery) for inventory and any other purchases.

In closing, this is a real shame. The company actually has very nicely looking stores and who doesn’t like fresh bread? I also know some current and past retail shareholders, so sharing this review with them sucks too.

If Purebread was my Grandma, I would have pulled the plug long ago. This is why Canada has MAID.

Zero stars & one of the best historical lessons of #FinsDontLie

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Ouch. I feel bad for retail shareholders. I've never seen a current ratio of 0.2, and interest rates so high.

LMAO what a dumpster fire. You almost need a shower.